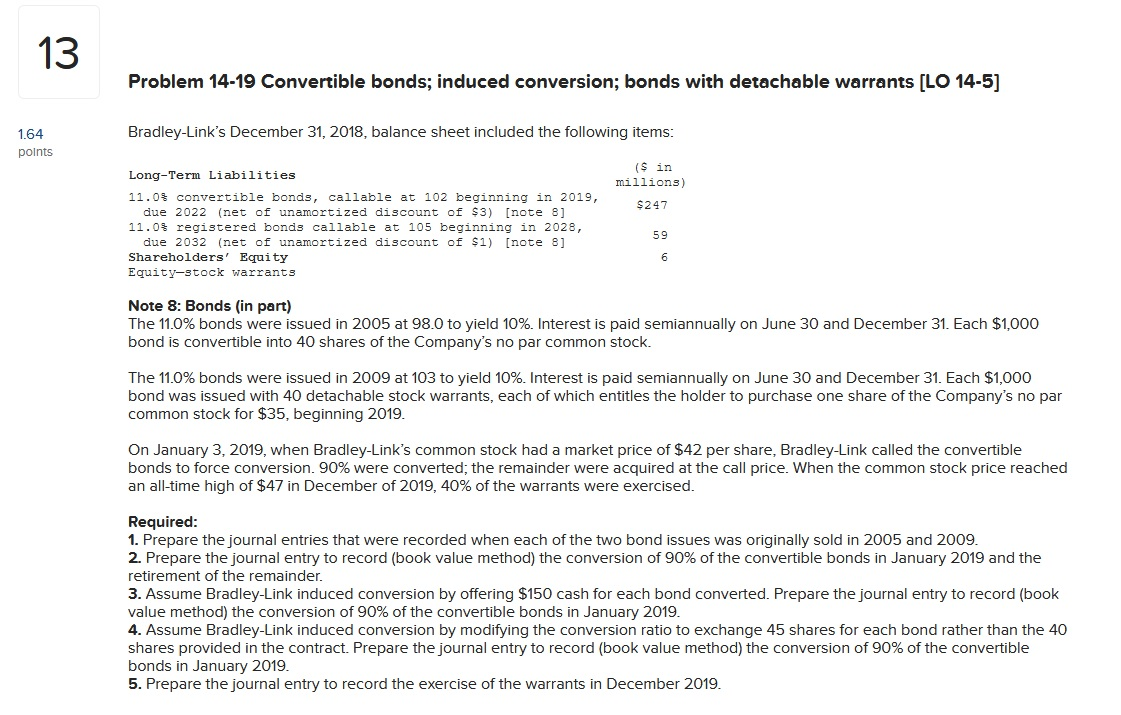

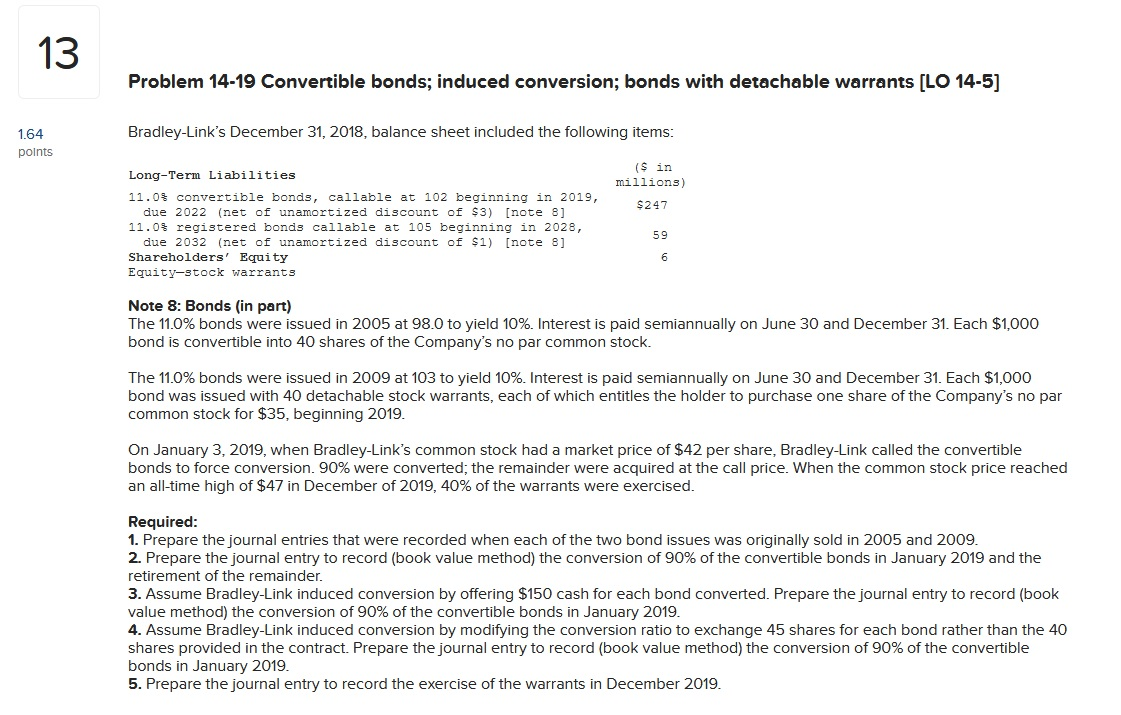

Problem 14-19 Convertible bonds; induced conversion; bonds with detachable warrants [LO 14-5]

Bradley-Links December 31, 2018, balance sheet included the following items:

| Long-Term Liabilities | ($ in millions) |

| 11.0% convertible bonds, callable at 102 beginning in 2019, due 2022 (net of unamortized discount of $3) [note 8] | $247 |

| 11.0% registered bonds callable at 105 beginning in 2028, due 2032 (net of unamortized discount of $1) [note 8] | 59 |

| Shareholders Equity | 6 |

| Equitystock warrants | |

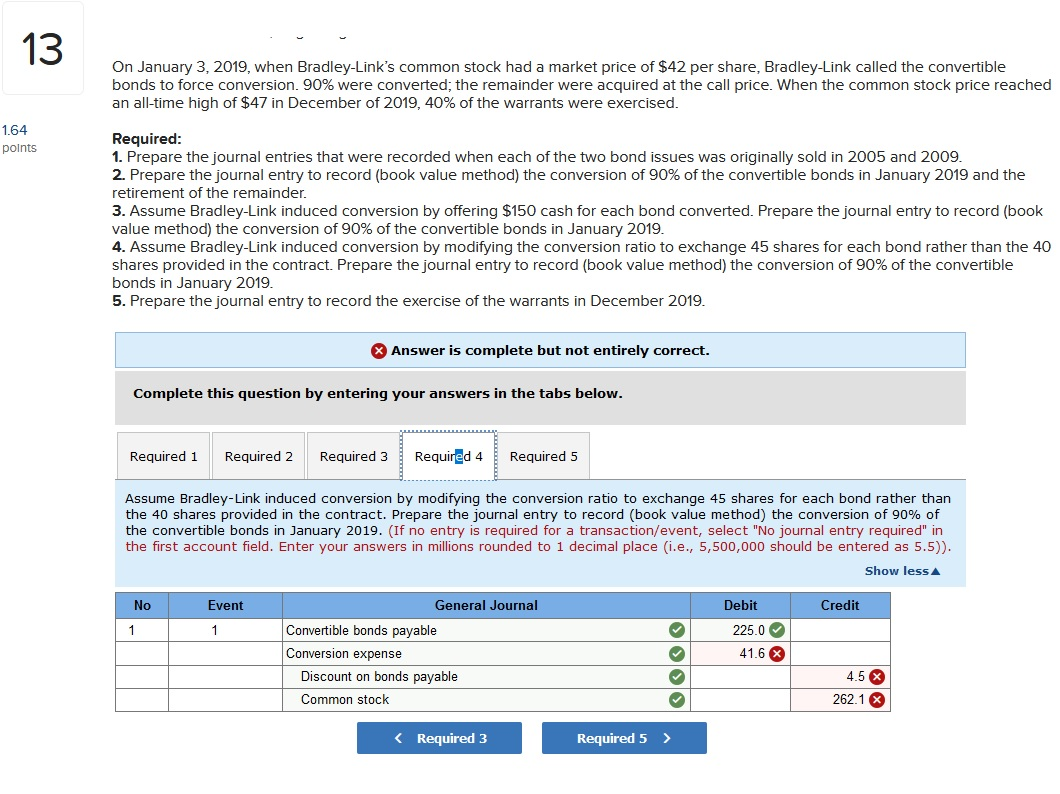

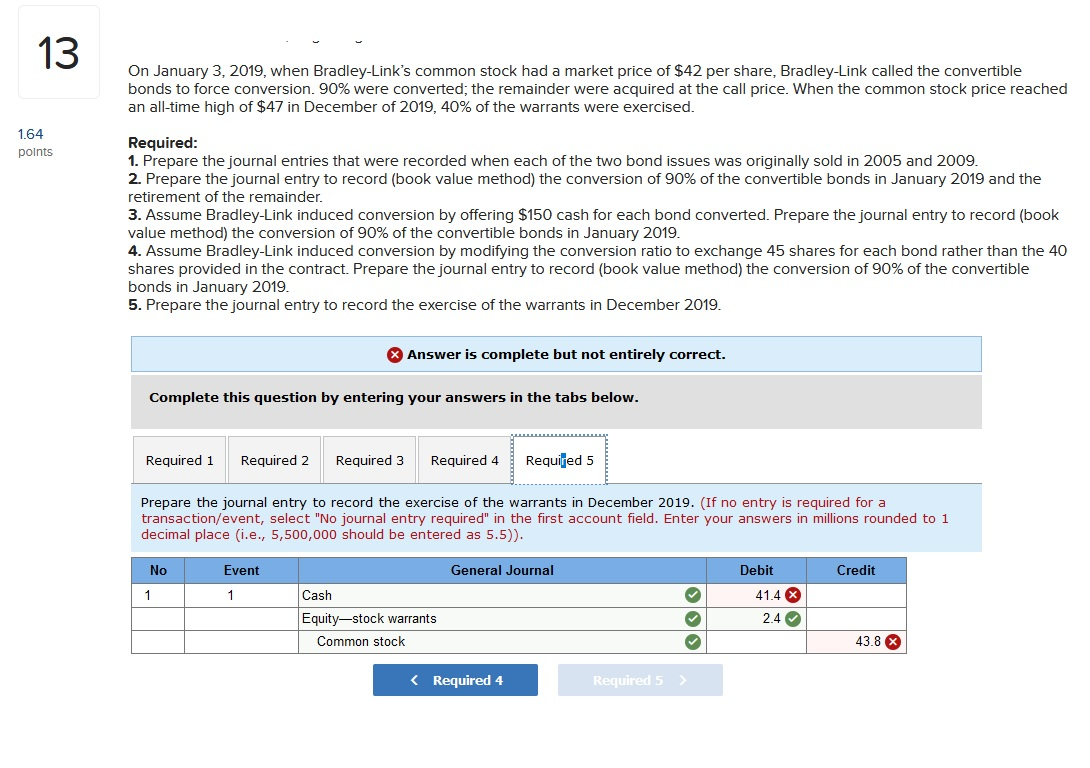

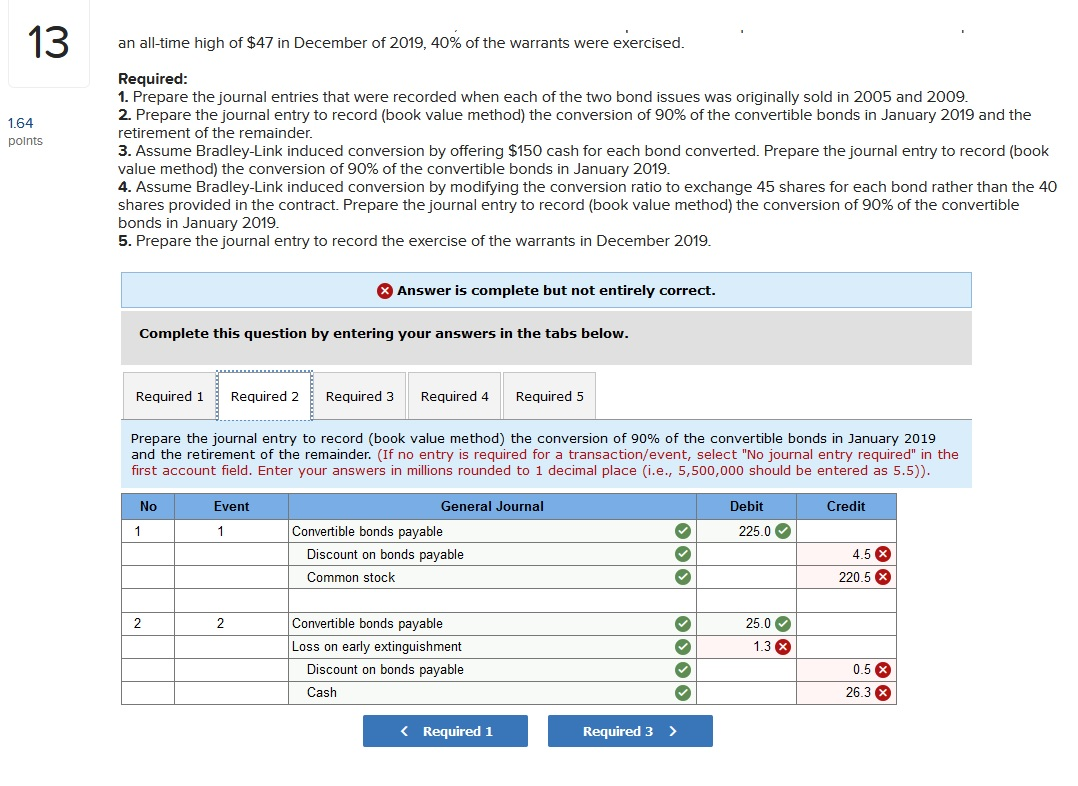

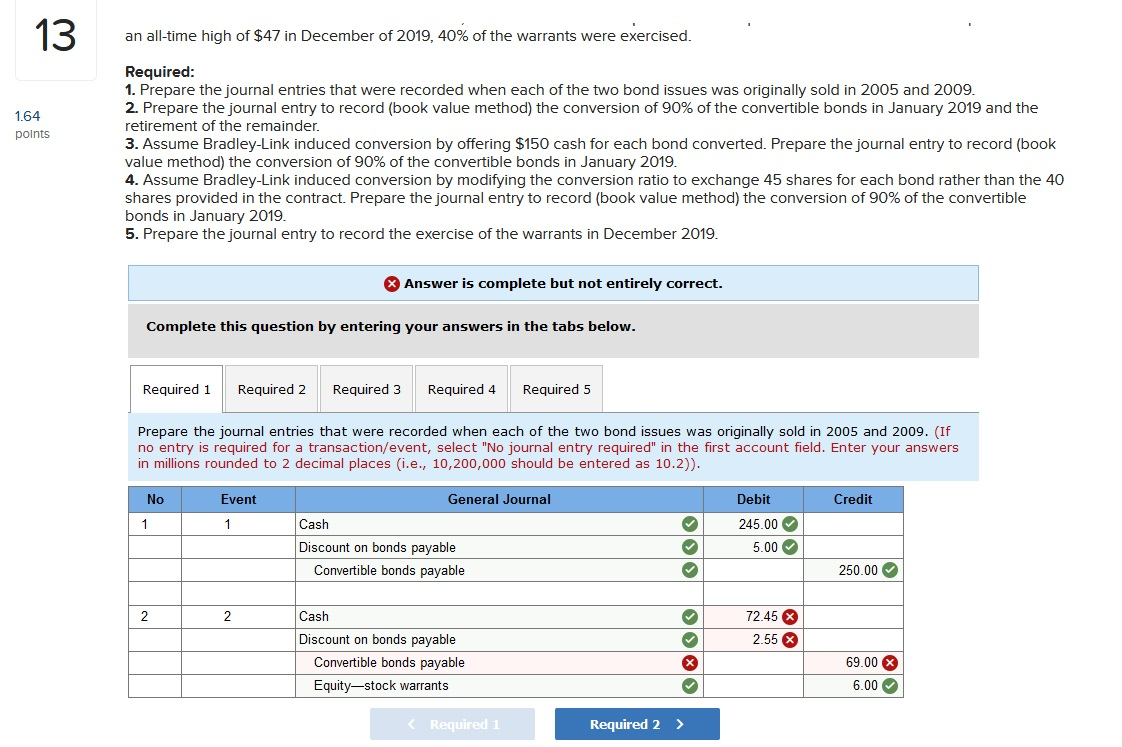

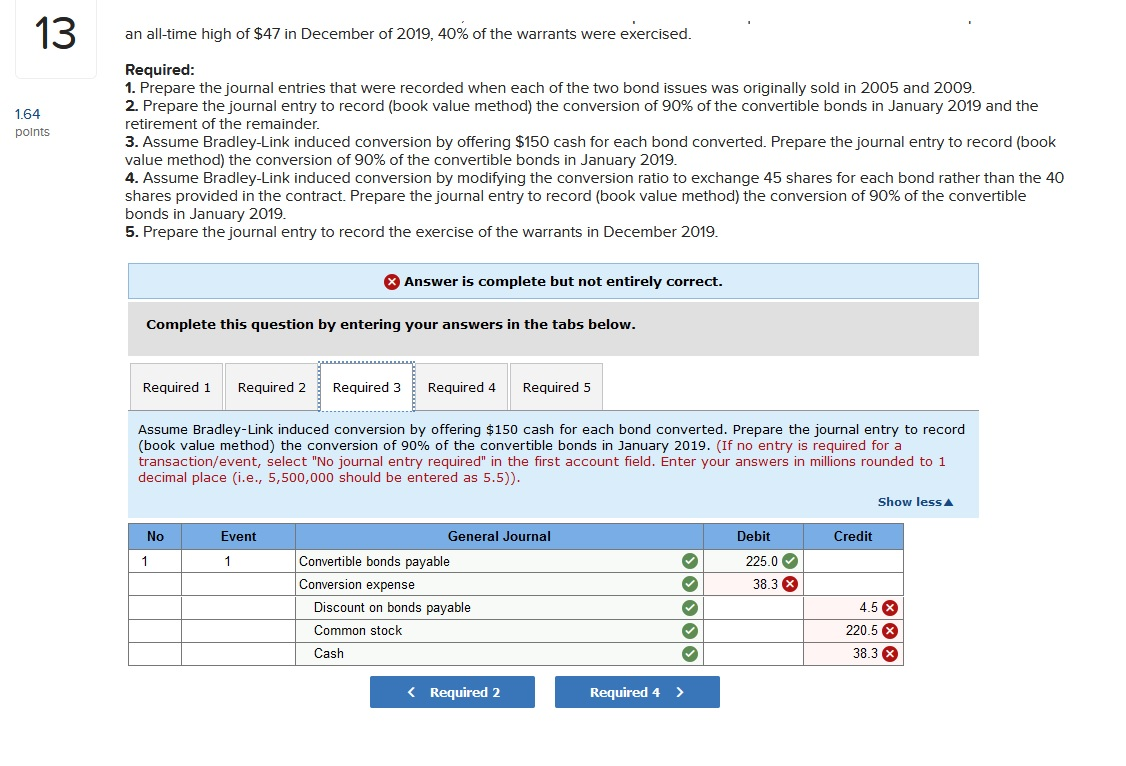

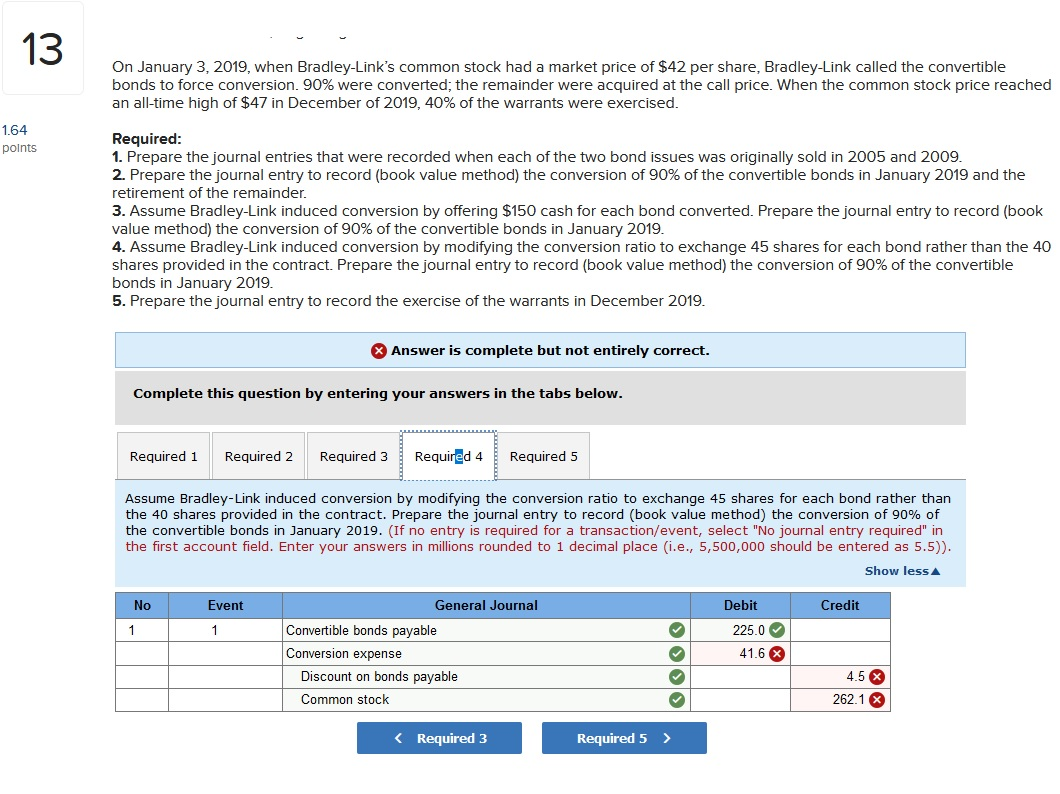

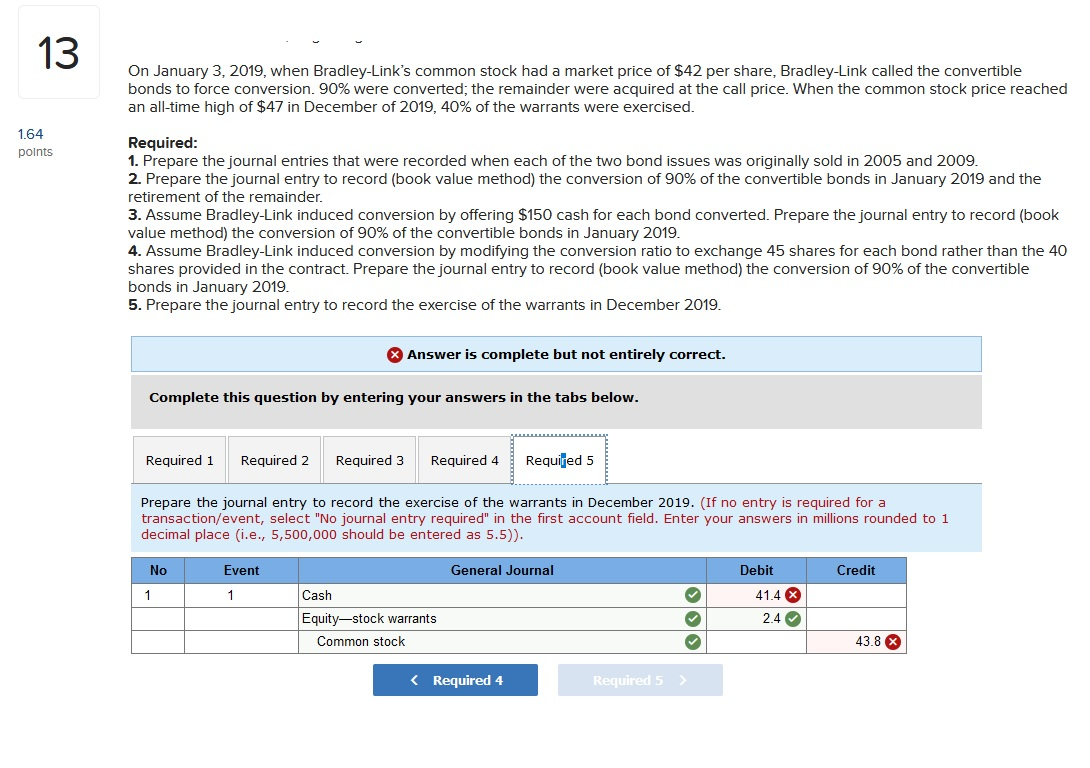

Note 8: Bonds (in part) The 11.0% bonds were issued in 2005 at 98.0 to yield 10%. Interest is paid semiannually on June 30 and December 31. Each $1,000 bond is convertible into 40 shares of the Companys no par common stock. The 11.0% bonds were issued in 2009 at 103 to yield 10%. Interest is paid semiannually on June 30 and December 31. Each $1,000 bond was issued with 40 detachable stock warrants, each of which entitles the holder to purchase one share of the Companys no par common stock for $35, beginning 2019. On January 3, 2019, when Bradley-Links common stock had a market price of $42 per share, Bradley-Link called the convertible bonds to force conversion. 90% were converted; the remainder were acquired at the call price. When the common stock price reached an all-time high of $47 in December of 2019, 40% of the warrants were exercised. Required: 1. Prepare the journal entries that were recorded when each of the two bond issues was originally sold in 2005 and 2009. 2. Prepare the journal entry to record (book value method) the conversion of 90% of the convertible bonds in January 2019 and the retirement of the remainder. 3. Assume Bradley-Link induced conversion by offering $150 cash for each bond converted. Prepare the journal entry to record (book value method) the conversion of 90% of the convertible bonds in January 2019. 4. Assume Bradley-Link induced conversion by modifying the conversion ratio to exchange 45 shares for each bond rather than the 40 shares provided in the contract. Prepare the journal entry to record (book value method) the conversion of 90% of the convertible bonds in January 2019. 5. Prepare the journal entry to record the exercise of the warrants in December 2019.

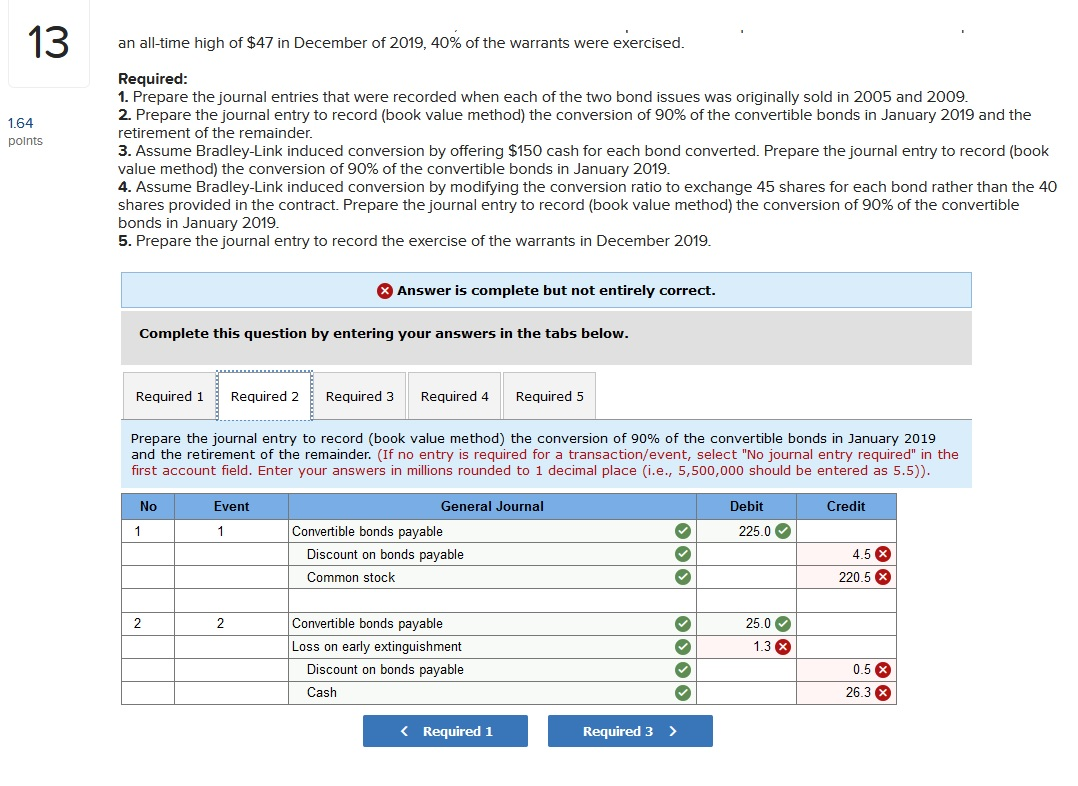

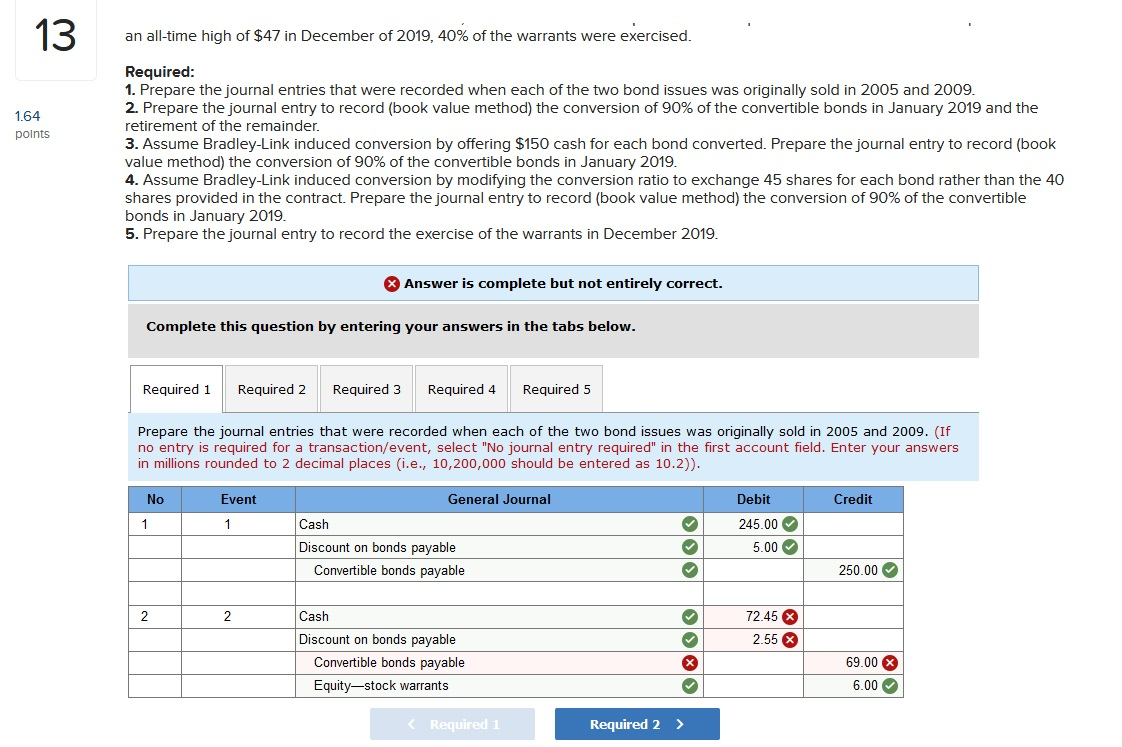

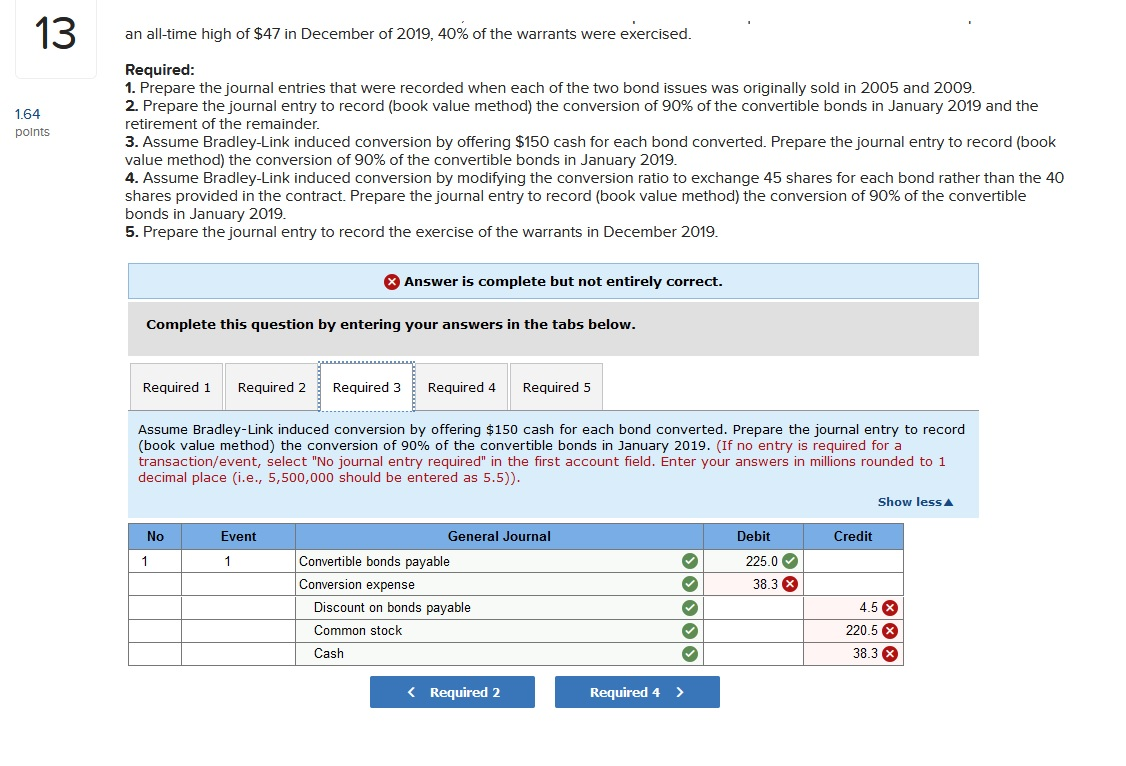

Problem 14-19 Convertible bonds; induced conversion; bonds with detachable warrants [LO 14-5] Bradley-Link's December 31, 2018, balance sheet included the following items: 1.64 points ($ in millions) Long-Term Liabilities 11.0% convertible bonds, callable at 102 beginning in 2019, due 2022 (net of unamortized discount of $3) (note 8] 11.03 registered bonds callable at 105 beginning in 2028, due 2032 (net of unamortized discount of $1) (note 8] Shareholders' Equity Equity-stock warrants 0 Note 8: Bonds (in part) The 11.0% bonds were issued in 2005 at 98.0 to yield 10%. Interest is paid semiannually on June 30 and December 31. Each $1,000 bond is convertible into 40 shares of the Company's no par common stock. The 11.0% bonds were issued in 2009 at 103 to yield 10%. Interest is paid semiannually on June 30 and December 31. Each $1.000 bond was issued with 40 detachable stock warrants, each of which entitles the holder to purchase one share of the Company's no par common stock for $35, beginning 2019. On January 3, 2019, when Bradley-Link's common stock had a market price of $42 per share, Bradley-Link called the convertible bonds to force conversion. 90% were converted; the remainder were acquired at the call price. When the common stock price reached an all-time high of $47 in December of 2019, 40% of the warrants were exercised. Required: 1. Prepare the journal entries that were recorded when each of the two bond issues was originally sold in 2005 and 2009. 2. Prepare the journal entry to record (book value method) the conversion of 90% of the convertible bonds in January 2019 and the retirement of the remainder. 3. Assume Bradley-Link induced conversion by offering $150 cash for each bond converted. Prepare the journal entry to record (book value method) the conversion of 90% of the convertible bonds in January 2019. 4. Assume Bradley-Link induced conversion by modifying the conversion ratio to exchange 45 shares for each bond rather than the 40 shares provided in the contract. Prepare the journal entry to record (book value method) the conversion of 90% of the convertible bonds in January 2019. 5. Prepare the journal entry to record the exercise of the warrants in December 2019. 13 an all-time high of $47 in December of 2019, 40% of the warrants were exercised. 1.64 points Required: 1. Prepare the journal entries that were recorded when each of the two bond issues was originally sold in 2005 and 2009. 2. Prepare the journal entry to record (book value method) the conversion of 90% of the convertible bonds in January 2019 and the retirement of the remainder. 3. Assume Bradley-Link induced conversion by offering $150 cash for each bond converted. Prepare the journal entry to record (book value method) the conversion of 90% of the convertible bonds in January 2019. 4. Assume Bradley-Link induced conversion by modifying the conversion ratio to exchange 45 shares for each bond rather than the 40 shares provided in the contract. Prepare the journal entry to record (book value method) the conversion of 90% of the convertible bonds in January 2019. 5. Prepare the journal entry to record the exercise of the warrants in December 2019. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Prepare the journal entry to record (book value method) the conversion of 90% of the convertible bonds in January 2019 and the retirement of the remainder. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5)). No Event Credit Debit 225.0 General Journal Convertible bonds payable Discount on bonds payable Common stock 4.5 X 220.5 2 25.0 1.3 X Convertible bonds payable Loss on early extinguishment Discount on bonds payable Cash 0.5 X 26.3 X Required 1 Required 3 > 13 an all-time high of $47 in December of 2019, 40% of the warrants were exercised. 1.64 points Required: 1. Prepare the journal entries that were recorded when each of the two bond issues was originally sold in 2005 and 2009. 2. Prepare the journal entry to record (book value method) the conversion of 90% of the convertible bonds in January 2019 and the retirement of the remainder. 3. Assume Bradley-Link induced conversion by offering $150 cash for each bond converted. Prepare the journal entry to record (book value method) the conversion of 90% of the convertible bonds in January 2019. 4. Assume Bradley-Link induced conversion by modifying the conversion ratio to exchange 45 shares for each bond rather than the 40 shares provided in the contract. Prepare the journal entry to record (book value method) the conversion of 90% of the convertible bonds in January 2019. 5. Prepare the journal entry to record the exercise of the warrants in December 2019. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Prepare the journal entries that were recorded when each of the two bond issues was originally sold in 2005 and 2009. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 2 decimal places (i.e., 10,200,000 should be entered as 10.2)). No Event General Journal Credit Cash Discount on bonds payable Convertible bonds payable Debit 245.00 5.00 250.00 2 2 72.45 2.55 X Cash Discount on bonds payable Convertible bonds payable Equity-stock warrants 69.00 6.00 13 an all-time high of $47 in December of 2019, 40% of the warrants were exercised. 1.64 points Required: 1. Prepare the journal entries that were recorded when each of the two bond issues was originally sold in 2005 and 2009. 2. Prepare the journal entry to record (book value method) the conversion of 90% of the convertible bonds in January 2019 and the retirement of the remainder. 3. Assume Bradley-Link induced conversion by offering $150 cash for each bond converted. Prepare the journal entry to record (book value method) the conversion of 90% of the convertible bonds in January 2019. 4. Assume Bradley-Link induced conversion by modifying the conversion ratio to exchange 45 shares for each bond rather than the 40 shares provided in the contract. Prepare the journal entry to record (book value method) the conversion of 90% of the convertible bonds in January 2019. 5. Prepare the journal entry to record the exercise of the warrants in December 2019. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Assume Bradley-Link induced conversion by offering $150 cash for each bond converted. Prepare the journal entry to record (book value method) the conversion of 90% of the convertible bonds in January 2019. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5)). Show less No Event Credit 1 Cor Debit 225.0 38.3 X General Journal Convertible bonds payable Conversion expense Discount on bonds payable Common stock Cash 4.5 % 220.5 38.3 Required 2 Required 4 > 13 On January 3, 2019, when Bradley-Link's common stock had a market price of $42 per share, Bradley-Link called the convertible bonds to force conversion. 90% were converted; the remainder were acquired at the call price. When the common stock price reached an all-time high of $47 in December of 2019, 40% of the warrants were exercised. 1.64 points Required: 1. Prepare the journal entries that were recorded when each of the two bond issues was originally sold in 2005 and 2009. 2. Prepare the journal entry to record (book value method) the conversion of 90% of the convertible bonds in January 2019 and the retirement of the remainder. 3. Assume Bradley-Link induced conversion by offering $150 cash for each bond converted. Prepare the journal entry to record (book value method) the conversion of 90% of the convertible bonds in January 2019. 4. Assume Bradley-Link induced conversion by modifying the conversion ratio to exchange 45 shares for each bond rather than the 40 shares provided in the contract. Prepare the journal entry to record (book value method) the conversion of 90% of the convertible bonds in January 2019. 5. Prepare the journal entry to record the exercise of the warrants in December 2019. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Assume Bradley-Link induced conversion by modifying the conversion ratio to exchange 45 shares for each bond rather than the 40 shares provided in the contract. Prepare the journal entry to record (book value method) the conversion of 90% of the convertible bonds in January 2019. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5)). Show less No Event Credit General Journal Convertible bonds payable Conversion expense Discount on bonds payable Common stock Debit 225.0 41.6 4.5 X 262.1 x Required 3 Required 5 > 13 On January 3, 2019, when Bradley-Link's common stock had a market price of $42 per share, Bradley-Link called the convertible bonds to force conversion. 90% were converted; the remainder were acquired at the call price. When the common stock price reached an all-time high of $47 in December of 2019, 40% of the warrants were exercised. 1.64 points Required: 1. Prepare the journal entries that were recorded when each of the two bond issues was originally sold in 2005 and 2009. 2. Prepare the journal entry to record (book value method) the conversion of 90% of the convertible bonds in January 2019 and the retirement of the remainder. 3. Assume Bradley-Link induced conversion by offering $150 cash for each bond converted. Prepare the journal entry to record (book value method) the conversion of 90% of the convertible bonds in January 2019. 4. Assume Bradley-Link induced conversion by modifying the conversion ratio to exchange 45 shares for each bond rather than the 40 shares provided in the contract. Prepare the journal entry to record (book value method) the conversion of 90% of the convertible bonds in January 2019. 5. Prepare the journal entry to record the exercise of the warrants in December 2019. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Prepare the journal entry to record the exercise of the warrants in December 2019. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5)). No Event General Journal Credit Cash Equity-stock warrants Common stock Debit 41.4 24 43.8 X