Answered step by step

Verified Expert Solution

Question

1 Approved Answer

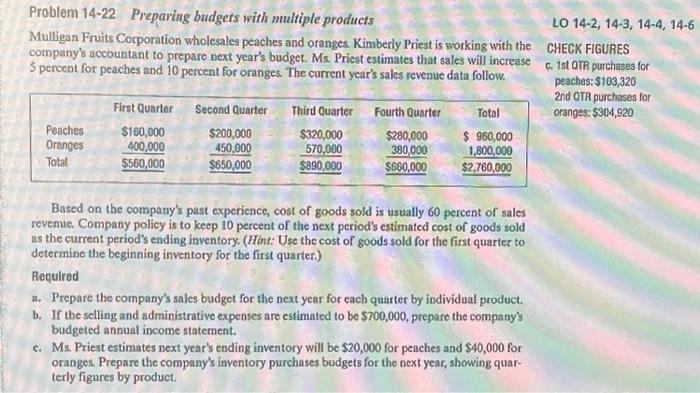

Problem 14-22 Preparing budgets with multiple products Mulligan Fruits Corporation wholesales peaches and oranges. Kimberly Priest is working with the company's accountant to prepare next

Problem 14-22 Preparing budgets with multiple products Mulligan Fruits Corporation wholesales peaches and oranges. Kimberly Priest is working with the company's accountant to prepare next year's budget. Ms. Priest estimates that sales will increase 5 percent for peaches and 10 percent for oranges. The current year's sales revenue data follow. Peaches Oranges Total First Quarter $160,000 400,000 $560,000 Second Quarter $200,000 450,000 $650,000 Third Quarter Fourth Quarter $320,000 570,000 $890,000 $280,000 380,000 $660,000 Total $ 960,000 1,800,000 $2,760,000 Based on the company's past experience, cost of goods sold is usually 60 percent of sales revenue. Company policy is to keep 10 percent of the next period's estimated cost of goods sold as the current period's ending inventory. (Hint: Use the cost of goods sold for the first quarter to determine the beginning inventory for the first quarter.) Required a. Prepare the company's sales budget for the next year for each quarter by individual product. If the selling and administrative expenses are estimated to be $700,000, prepare the company's budgeted annual income statement. b. c. Ms. Priest estimates next year's ending inventory will be $20,000 for peaches and $40,000 for oranges. Prepare the company's inventory purchases budgets for the next year, showing quar- terly figures by product. LO 14-2, 14-3, 14-4, 14-6 CHECK FIGURES c. 1st QTR purchases for peaches: $103,320 2nd QTR purchases for oranges: $304,920

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started