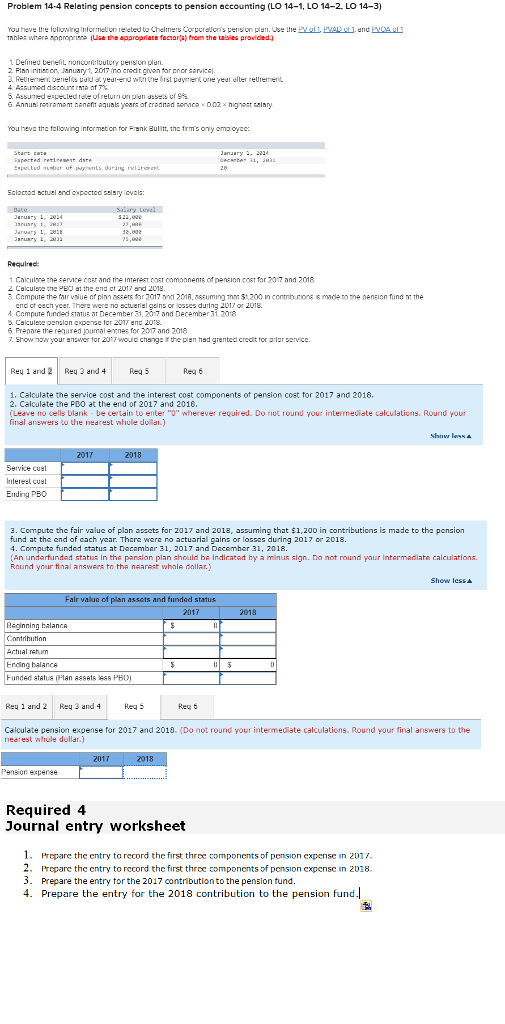

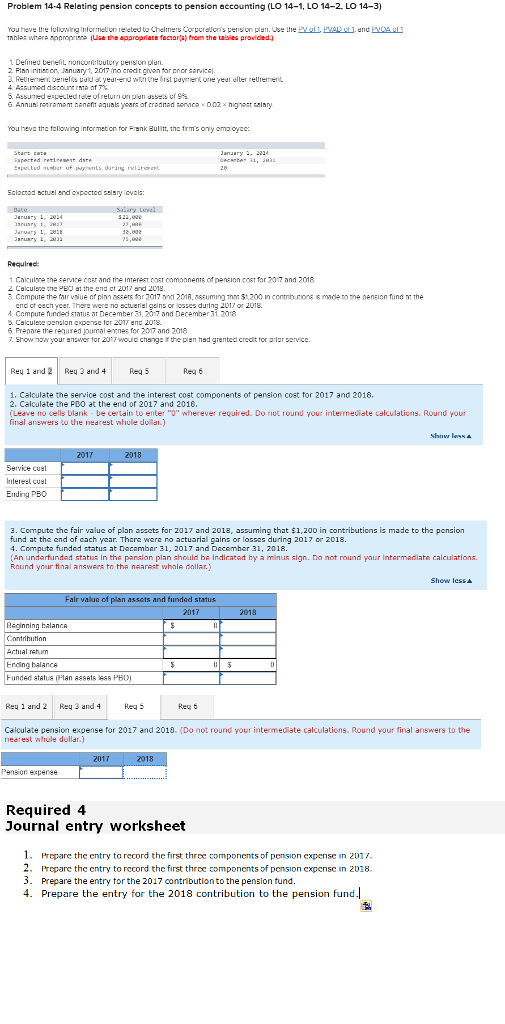

Problem 14-4 Relating pension concepts to pension accounting (LO 14-1, LO 14-2. LO 14-3) rou heve the lull wring informeton reeted to Chelmes Corporations penson plan. Use the ol L A et . dnd Pyre. 2 Flan nitien on, January1, 2017 no crodt gon or pnor sarvica Asaumed dscoure rso af Annua rramam bene qunle yoars af cradnad D02x higat lar You heve the following infermet on for Frank Eulitt, the frms ony ema oyc Scloctad actuel and cxpectdelary lova: Requred 1 Cakulre the servce cosr and the intereet cost comoonente ofpenion cot for 20-17 and 2018 3 Compute the fair value of plyn assers tor 2017 ynd 2018sesuming Tror $1,200 n contnt.rm8 g mde to me oenson fund The end ct cech yeer. Ther werE no actueriel geins or osses during 2013 or 2018. Computefunded stOTUE ot December 31. 207 and Decemer31 208 and 201s 6 Prepare the requred oumalemnes for 2017 and 2018 . Show haw your answer for 20T wouid change Ir the plen had grented creait for priar srvice Reu 1 and 2 Req 3 anReq 5 Req 6 1. Calculate the service cost and the interest cost components of pension cost tor 2017 and 2018. 2. Calculate the P0O at the end or 2017 and 2018 Leave no cells blank be certain to enter "O" wherever required. Do not round your interrmediate calculations. Round your final answers to the nedrest whole dolar) Service coet Intereet cusl Ending PBC 3. Compute the fair value of plan azzets for 2017 and 2018, assuming that $1,200 in contributions is made to the pension fund at the end of cach year. There were no actuarial gains or losses during 2017 or 2018. 4. Computa funded status at Dacambar 31, 2017 and Dacemher 31, 2018. (An undrfunded statu, in the pension plan should b Indicated by a minus sign. Do not round your intermadlate calculations. Rnund your final answers to tha naarest whale dollar.) ir value of plan assets and f 017 019 Reginning balanca Contnbutinn Actial ehum Ending balance Funded status Plan assets legg PBO) Req 1 and 2 Req 3 and 4 Req 5 Req 5 Calculate pension expense for 2017 and 2018. (Do not round your intermediate calculations. Round your final answers to the nearest whole dollar Pension expenee Required 4 Journal entry worksheet 1. repe the entry to record the first three components of pension expense in 2017 2. Prepare the entry to record the first threc components of pension expensc in 2018 3. Prepare the entry tor the 2017 contribution to the pension tund. 4. Prepare the entry for the 2018 contribution to the pension fund Problem 14-4 Relating pension concepts to pension accounting (LO 14-1, LO 14-2. LO 14-3) rou heve the lull wring informeton reeted to Chelmes Corporations penson plan. Use the ol L A et . dnd Pyre. 2 Flan nitien on, January1, 2017 no crodt gon or pnor sarvica Asaumed dscoure rso af Annua rramam bene qunle yoars af cradnad D02x higat lar You heve the following infermet on for Frank Eulitt, the frms ony ema oyc Scloctad actuel and cxpectdelary lova: Requred 1 Cakulre the servce cosr and the intereet cost comoonente ofpenion cot for 20-17 and 2018 3 Compute the fair value of plyn assers tor 2017 ynd 2018sesuming Tror $1,200 n contnt.rm8 g mde to me oenson fund The end ct cech yeer. Ther werE no actueriel geins or osses during 2013 or 2018. Computefunded stOTUE ot December 31. 207 and Decemer31 208 and 201s 6 Prepare the requred oumalemnes for 2017 and 2018 . Show haw your answer for 20T wouid change Ir the plen had grented creait for priar srvice Reu 1 and 2 Req 3 anReq 5 Req 6 1. Calculate the service cost and the interest cost components of pension cost tor 2017 and 2018. 2. Calculate the P0O at the end or 2017 and 2018 Leave no cells blank be certain to enter "O" wherever required. Do not round your interrmediate calculations. Round your final answers to the nedrest whole dolar) Service coet Intereet cusl Ending PBC 3. Compute the fair value of plan azzets for 2017 and 2018, assuming that $1,200 in contributions is made to the pension fund at the end of cach year. There were no actuarial gains or losses during 2017 or 2018. 4. Computa funded status at Dacambar 31, 2017 and Dacemher 31, 2018. (An undrfunded statu, in the pension plan should b Indicated by a minus sign. Do not round your intermadlate calculations. Rnund your final answers to tha naarest whale dollar.) ir value of plan assets and f 017 019 Reginning balanca Contnbutinn Actial ehum Ending balance Funded status Plan assets legg PBO) Req 1 and 2 Req 3 and 4 Req 5 Req 5 Calculate pension expense for 2017 and 2018. (Do not round your intermediate calculations. Round your final answers to the nearest whole dollar Pension expenee Required 4 Journal entry worksheet 1. repe the entry to record the first three components of pension expense in 2017 2. Prepare the entry to record the first threc components of pension expensc in 2018 3. Prepare the entry tor the 2017 contribution to the pension tund. 4. Prepare the entry for the 2018 contribution to the pension fund