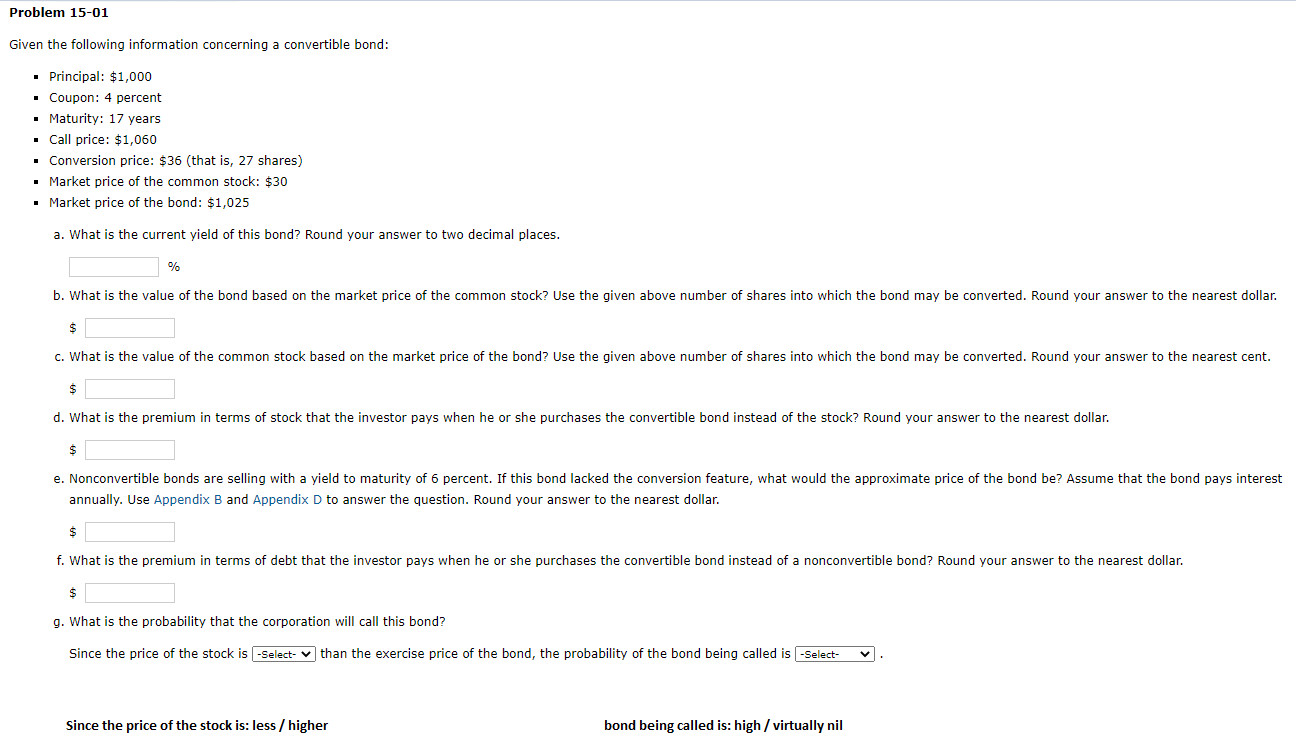

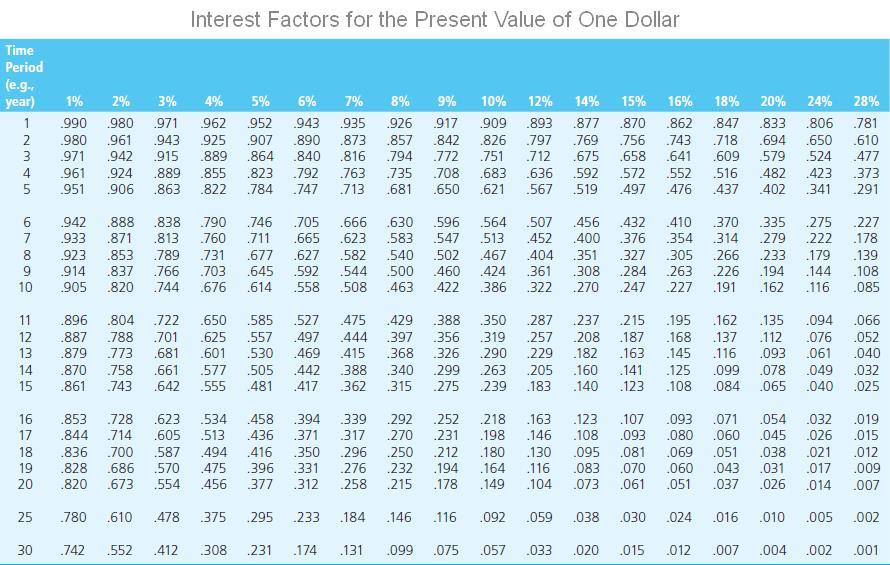

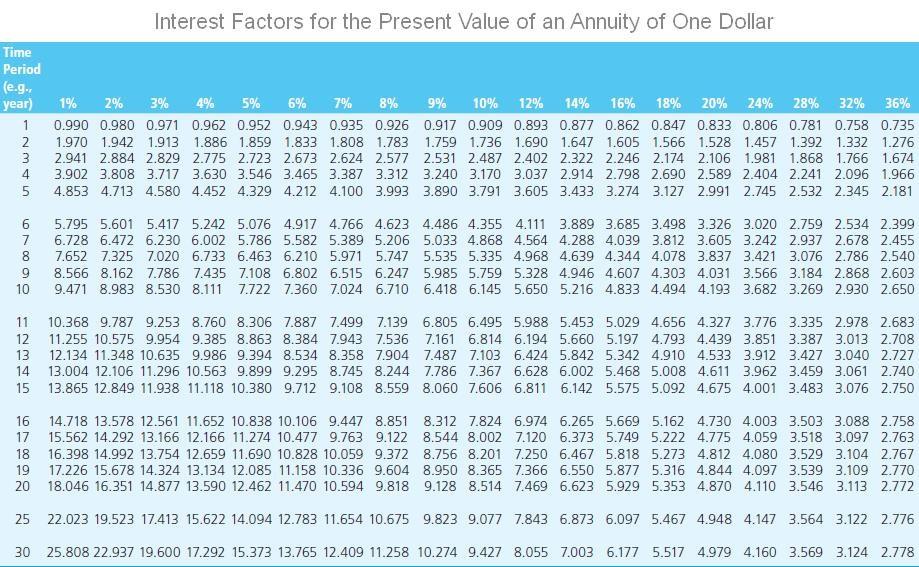

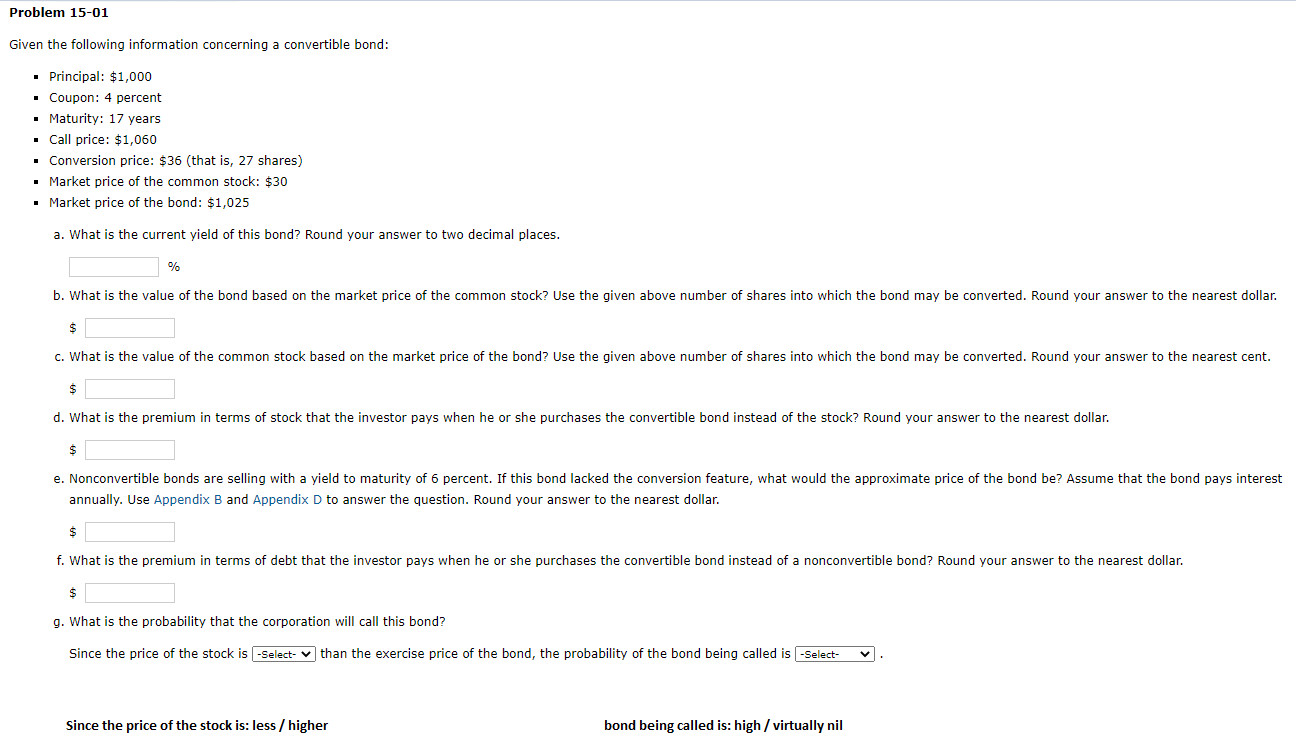

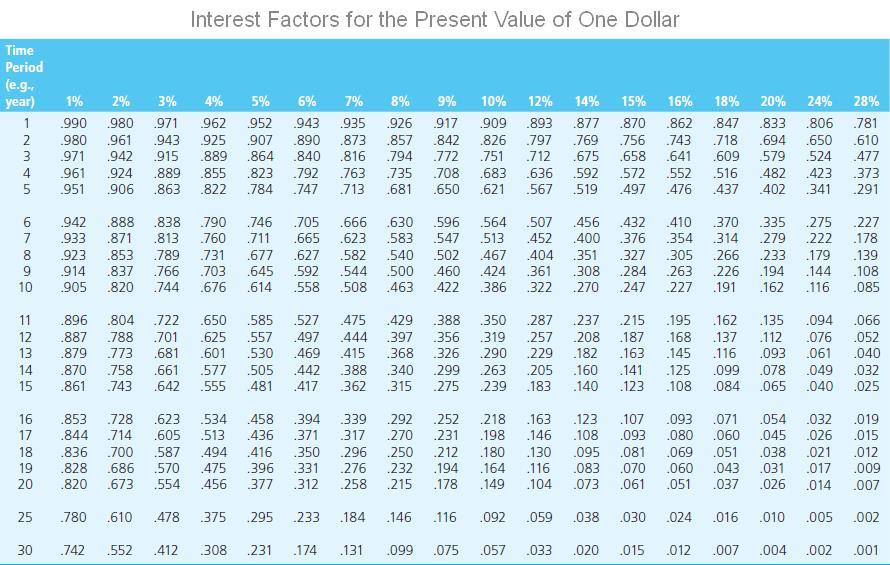

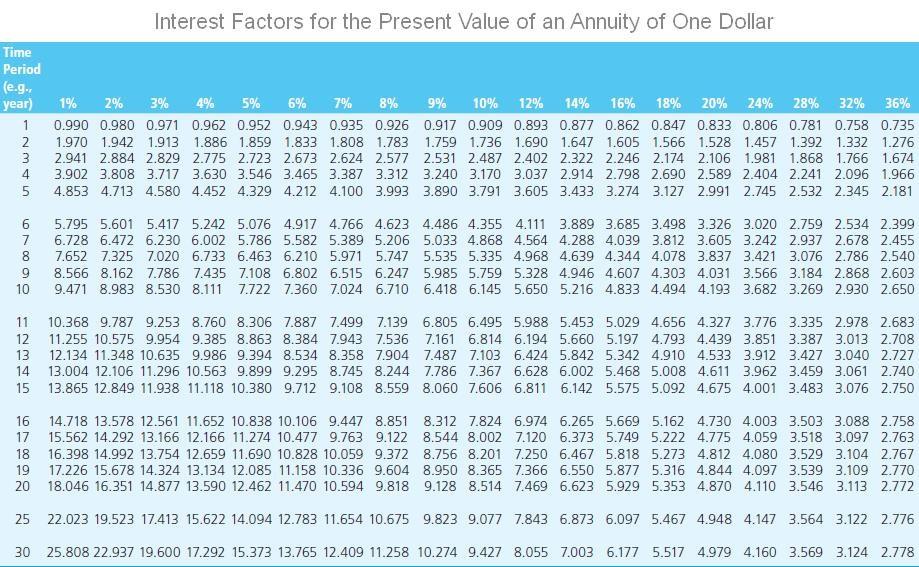

Problem 15-01 Given the following information concerning a convertible bond: Principal: $1,000 Coupon: 4 percent Maturity: 17 years . Call price: $1,060 Conversion price: $36 (that is, 27 shares) Market price of the common stock: $30 Market price of the bond: $1,025 a. What is the current yield of this bond? Round your answer to two decimal places. % b. What is the value of the bond based on the market price of the common stock? Use the given above number of shares into which the bond may be converted. Round your answer to the nearest dollar. $ c. What is the value of the common stock based on the market price of the bond? Use the given above number of shares into which the bond may be converted. Round your answer to the nearest cent. $ d. What is the premium in terms of stock that the investor pays when he or she purchases the convertible bond instead of the stock? Round your answer to the nearest dollar. e. Nonconvertible bonds are selling with a yield to maturity of 6 percent. If this bond lacked the conversion feature, what would the approximate price of the bond be? Assume that the bond pays interest annually. Use Appendix B and Appendix D to answer the question. Round your answer to the nearest dollar. $ f. What is the premium in terms of debt that the investor pays when he or she purchases the convertible bond instead of a nonconvertible bond? Round your answer to the nearest dollar. $ g. What is the probability that the corporation will call this bond? Since the price of the stock is -Select-than the exercise price of the bond, the probability of the bond being called is -Select- Since the price of the stock is: less / higher bond being called is: high / virtually nil Interest Factors for the Present Value of One Dollar Time Period (e.g. year) 1 1% 2% 7% NM 990 980 .971 961 .951 3% 4% 980 971 962 1961 .943 925 .942 .915 .889 924 889 855 .906 863 822 5% 952 907 .864 .823 .784 6% .943 .890 .840 .792 .747 935 .873 .816 .763 .713 8% .926 .857 .794 .735 .681 9% 917 .842 .772 .708 .650 10% 12% 14% 15% .909.893 .877 870 .826 .797 .769 .756 .751 .712 .675 .658 .683 .636 592 .572 .621 .567 519 497 16% .862 .743 .641 .552 476 18% .847 .718 .609 1516 437 20% .833 .694 .579 482 402 24% .806 .650 .524 423 .341 28% .781 .610 477 373 291 4 5 6 7 8 9 10 942 933 923 914 905 .888 838 790 .746 .705.666 630 .871 .813 .760 .711 .665.623 583 .853 .789 .731 677 627 582 .540 .837 .766 .703 645 592 544 .500 .820 .744 .676 614 558 508 463 596 .547 -502 460 .422 564 507 1513 452 467 .404 424 361 .386 .322 .456 .432 400 376 .351 327 .308 .284 .270 247 .410 .370 335 .354 .314 .279 .305 266 233 .263 226 .194 .227 191 .162 .275 .222 .179 .144 .116 .227 .178 .139 . 108 .085 11 12 13 14 15 .896 .887 .879 .870 .861 .804 .788 .773 .758 .743 .722 .701 .681 .661 .642 .650 .625 .601 .577 .555 .585 .557 .530 .505 .481 .527 .497 469 .442 417 475 .444 415 388 362 .429 .397 .368 .340 315 .388 .356 326 .299 .275 .350 .319 .290 .263 .239 .287 .257 .229 .205 .183 .237 .208 .182 .160 .140 .215 .187 .163 .141 .123 .195 .168 .145 .125 .108 .162 .137 .116 .099 .084 .135 .112 .093 .078 .065 .094 .076 .061 .049 .040 .066 .052 .040 .032 .025 16 17 18 19 20 .853 .844 .836 .828 .820 .728 .714 .700 .686 .673 .623 .605 .587 .570 .554 .534 .513 1494 475 456 .458 436 416 396 377 .394 .371 350 .331 .312 339 317 .296 .276 .258 .292 .270 .250 .232 .215 .252 .231 .212 .194 .178 .218 .198 .180 .164 .149 .163 .146 .130 .116 .104 .123 .107.093 071 .054 .032 .019 .108.093 .080 .060 .045 .026 .015 .095 .081 .069 .051 038 021 .012 .083 .070 ,060 .043 031 .017 .009 .073 .061 .051.037 .026 .014 .007 25 .780 .610 .478 .375 .295 .233 .184 -146 .116 .092 .059 .038 .030 .024 .016 .010 .005 .002 30 .742 .552 -412 308 .231 .174 .131 .099 .075 .057.033 .020 .015 .012 .007 .004 .002 .001 Interest Factors for the Present Value of an Annuity of One Dollar Time Period (e.g.. year) 1 2 3 4 5 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 16% 18% 20% 24% 28% 32% 36% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.862 0.847 0.833 0.806 0.781 0.758 0.735 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.690 1.647 1.605 1.566 1.528 1.457 1.392 1.332 1.276 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.322 2.246 2.174 2.106 1.981 1.868 1.766 1.674 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.798 2.690 2.589 2.404 2.241 2.096 1.966 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.274 3.127 2.991 2.745 2.532 2.345 2.181 6 5.795 5.601 5.417 5.242 5.076 4.917 4.766 4.623 4.486 4.355 4.111 3.889 3.685 3.498 3.326 3.020 2.759 2.534 2.399 7 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.039 3.812 3.605 3.242 2.937 2.678 2.455 8 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4.344 4.078 3.837 3.421 3.076 2.786 2.540 9 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.985 5.759 5.328 4.946 4.607 4.303 4.031 3.566 3.184 2.868 2.603 10 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.650 5.216 4.833 4.494 4.193 3.682 3.269 2.930 2.650 11 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.988 5.453 5.029 4.656 4.327 3.776 3.335 2.978 2.683 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.194 5.660 5.197 4.793 4.439 3.851 3.387 3.013 2.708 13 12.134 11.348 10.635 9.986 9.394 8.534 8.358 7.904 7.487 7.103 6.424 5.842 5.342 4.910 4.533 3.912 3.427 3.040 2.727 14 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.628 6.002 5.468 5.008 4.611 3.962 3.459 3.061 2.740 15 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.060 7.606 6.811 6.142 5.575 5.092 4.675 4.001 3.483 3.076 2.750 16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.312 7.824 6.974 6.265 5.669 5.162 4.730 4.003 3.503 3.088 2.758 17 5.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.002 7.120 6.373 5.749 5.22 4.775 4.059 3.518 3.097 2.763 18 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.2017.250 6.467 5.818 5.273 4.812 4.080 3.529 3.104 2.767 19 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.366 6.550 5.877 5.316 4.844 4.097 3.539 3.109 2.770 20 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.128 8.514 7.469 6.623 5.929 5.353 4.870 4.110 3.546 3.113 2.772 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 7.843 6.873 6.097 5.467 4.948 4.147 3.564 3.122 2.776 30 25.808 22.937 19.600 17.292 15.373 13.765 12.409 11.258 10.274 9.427 8.055 7.003 6.177 5.517 4.979 4.160 3.569 3.124 2.778 Problem 15-01 Given the following information concerning a convertible bond: Principal: $1,000 Coupon: 4 percent Maturity: 17 years . Call price: $1,060 Conversion price: $36 (that is, 27 shares) Market price of the common stock: $30 Market price of the bond: $1,025 a. What is the current yield of this bond? Round your answer to two decimal places. % b. What is the value of the bond based on the market price of the common stock? Use the given above number of shares into which the bond may be converted. Round your answer to the nearest dollar. $ c. What is the value of the common stock based on the market price of the bond? Use the given above number of shares into which the bond may be converted. Round your answer to the nearest cent. $ d. What is the premium in terms of stock that the investor pays when he or she purchases the convertible bond instead of the stock? Round your answer to the nearest dollar. e. Nonconvertible bonds are selling with a yield to maturity of 6 percent. If this bond lacked the conversion feature, what would the approximate price of the bond be? Assume that the bond pays interest annually. Use Appendix B and Appendix D to answer the question. Round your answer to the nearest dollar. $ f. What is the premium in terms of debt that the investor pays when he or she purchases the convertible bond instead of a nonconvertible bond? Round your answer to the nearest dollar. $ g. What is the probability that the corporation will call this bond? Since the price of the stock is -Select-than the exercise price of the bond, the probability of the bond being called is -Select- Since the price of the stock is: less / higher bond being called is: high / virtually nil Interest Factors for the Present Value of One Dollar Time Period (e.g. year) 1 1% 2% 7% NM 990 980 .971 961 .951 3% 4% 980 971 962 1961 .943 925 .942 .915 .889 924 889 855 .906 863 822 5% 952 907 .864 .823 .784 6% .943 .890 .840 .792 .747 935 .873 .816 .763 .713 8% .926 .857 .794 .735 .681 9% 917 .842 .772 .708 .650 10% 12% 14% 15% .909.893 .877 870 .826 .797 .769 .756 .751 .712 .675 .658 .683 .636 592 .572 .621 .567 519 497 16% .862 .743 .641 .552 476 18% .847 .718 .609 1516 437 20% .833 .694 .579 482 402 24% .806 .650 .524 423 .341 28% .781 .610 477 373 291 4 5 6 7 8 9 10 942 933 923 914 905 .888 838 790 .746 .705.666 630 .871 .813 .760 .711 .665.623 583 .853 .789 .731 677 627 582 .540 .837 .766 .703 645 592 544 .500 .820 .744 .676 614 558 508 463 596 .547 -502 460 .422 564 507 1513 452 467 .404 424 361 .386 .322 .456 .432 400 376 .351 327 .308 .284 .270 247 .410 .370 335 .354 .314 .279 .305 266 233 .263 226 .194 .227 191 .162 .275 .222 .179 .144 .116 .227 .178 .139 . 108 .085 11 12 13 14 15 .896 .887 .879 .870 .861 .804 .788 .773 .758 .743 .722 .701 .681 .661 .642 .650 .625 .601 .577 .555 .585 .557 .530 .505 .481 .527 .497 469 .442 417 475 .444 415 388 362 .429 .397 .368 .340 315 .388 .356 326 .299 .275 .350 .319 .290 .263 .239 .287 .257 .229 .205 .183 .237 .208 .182 .160 .140 .215 .187 .163 .141 .123 .195 .168 .145 .125 .108 .162 .137 .116 .099 .084 .135 .112 .093 .078 .065 .094 .076 .061 .049 .040 .066 .052 .040 .032 .025 16 17 18 19 20 .853 .844 .836 .828 .820 .728 .714 .700 .686 .673 .623 .605 .587 .570 .554 .534 .513 1494 475 456 .458 436 416 396 377 .394 .371 350 .331 .312 339 317 .296 .276 .258 .292 .270 .250 .232 .215 .252 .231 .212 .194 .178 .218 .198 .180 .164 .149 .163 .146 .130 .116 .104 .123 .107.093 071 .054 .032 .019 .108.093 .080 .060 .045 .026 .015 .095 .081 .069 .051 038 021 .012 .083 .070 ,060 .043 031 .017 .009 .073 .061 .051.037 .026 .014 .007 25 .780 .610 .478 .375 .295 .233 .184 -146 .116 .092 .059 .038 .030 .024 .016 .010 .005 .002 30 .742 .552 -412 308 .231 .174 .131 .099 .075 .057.033 .020 .015 .012 .007 .004 .002 .001 Interest Factors for the Present Value of an Annuity of One Dollar Time Period (e.g.. year) 1 2 3 4 5 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 16% 18% 20% 24% 28% 32% 36% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.862 0.847 0.833 0.806 0.781 0.758 0.735 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.690 1.647 1.605 1.566 1.528 1.457 1.392 1.332 1.276 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.322 2.246 2.174 2.106 1.981 1.868 1.766 1.674 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.798 2.690 2.589 2.404 2.241 2.096 1.966 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.274 3.127 2.991 2.745 2.532 2.345 2.181 6 5.795 5.601 5.417 5.242 5.076 4.917 4.766 4.623 4.486 4.355 4.111 3.889 3.685 3.498 3.326 3.020 2.759 2.534 2.399 7 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.039 3.812 3.605 3.242 2.937 2.678 2.455 8 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4.344 4.078 3.837 3.421 3.076 2.786 2.540 9 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.985 5.759 5.328 4.946 4.607 4.303 4.031 3.566 3.184 2.868 2.603 10 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.650 5.216 4.833 4.494 4.193 3.682 3.269 2.930 2.650 11 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.988 5.453 5.029 4.656 4.327 3.776 3.335 2.978 2.683 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.194 5.660 5.197 4.793 4.439 3.851 3.387 3.013 2.708 13 12.134 11.348 10.635 9.986 9.394 8.534 8.358 7.904 7.487 7.103 6.424 5.842 5.342 4.910 4.533 3.912 3.427 3.040 2.727 14 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.628 6.002 5.468 5.008 4.611 3.962 3.459 3.061 2.740 15 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.060 7.606 6.811 6.142 5.575 5.092 4.675 4.001 3.483 3.076 2.750 16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.312 7.824 6.974 6.265 5.669 5.162 4.730 4.003 3.503 3.088 2.758 17 5.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.002 7.120 6.373 5.749 5.22 4.775 4.059 3.518 3.097 2.763 18 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.2017.250 6.467 5.818 5.273 4.812 4.080 3.529 3.104 2.767 19 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.366 6.550 5.877 5.316 4.844 4.097 3.539 3.109 2.770 20 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.128 8.514 7.469 6.623 5.929 5.353 4.870 4.110 3.546 3.113 2.772 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 7.843 6.873 6.097 5.467 4.948 4.147 3.564 3.122 2.776 30 25.808 22.937 19.600 17.292 15.373 13.765 12.409 11.258 10.274 9.427 8.055 7.003 6.177 5.517 4.979 4.160 3.569 3.124 2.778