Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 15-02 Given the following information concerning a convertible bond: Coupon: 5 percent ($50 per $1,000 bond) Exercise price: $25 Maturity date: 25 years -

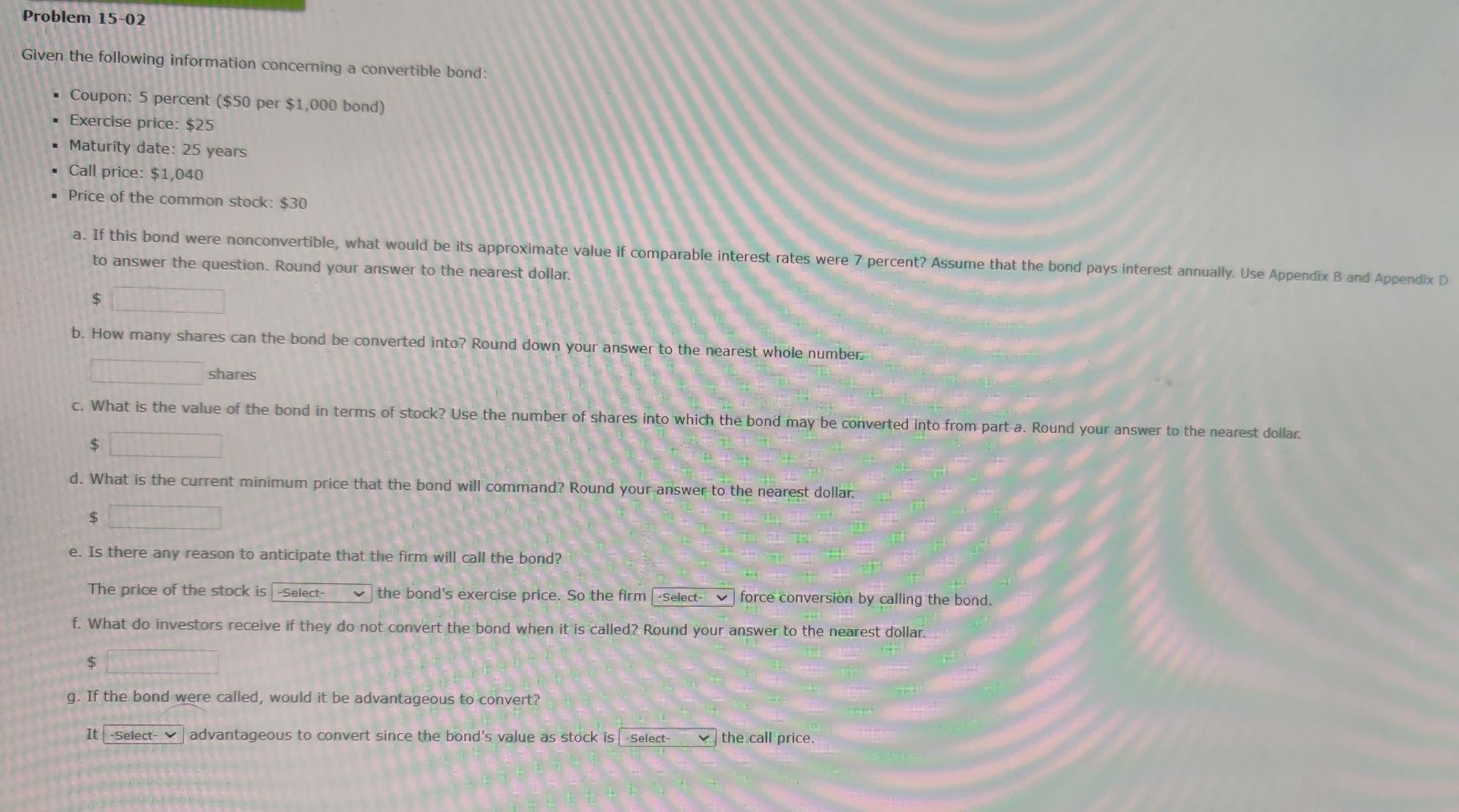

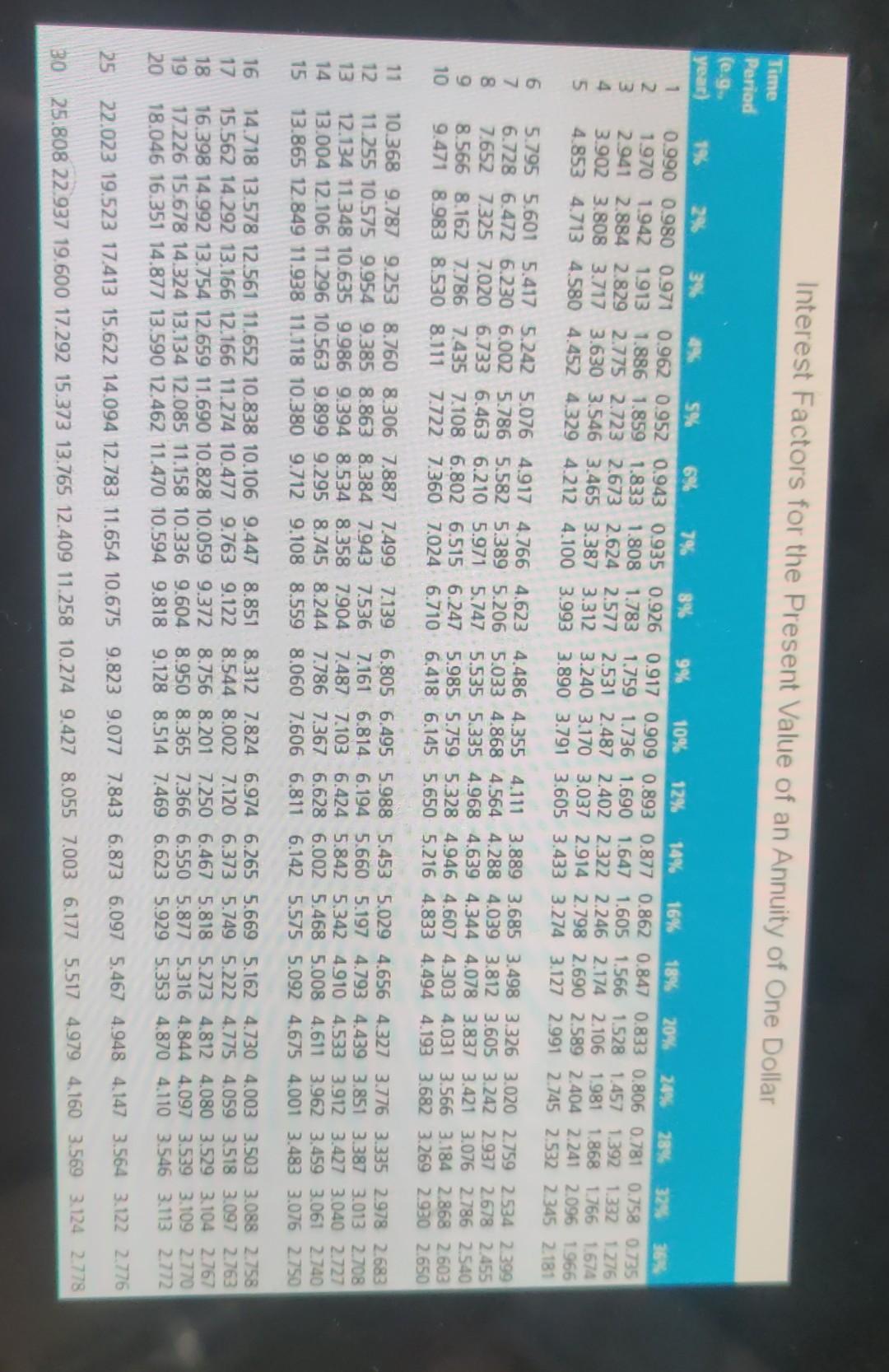

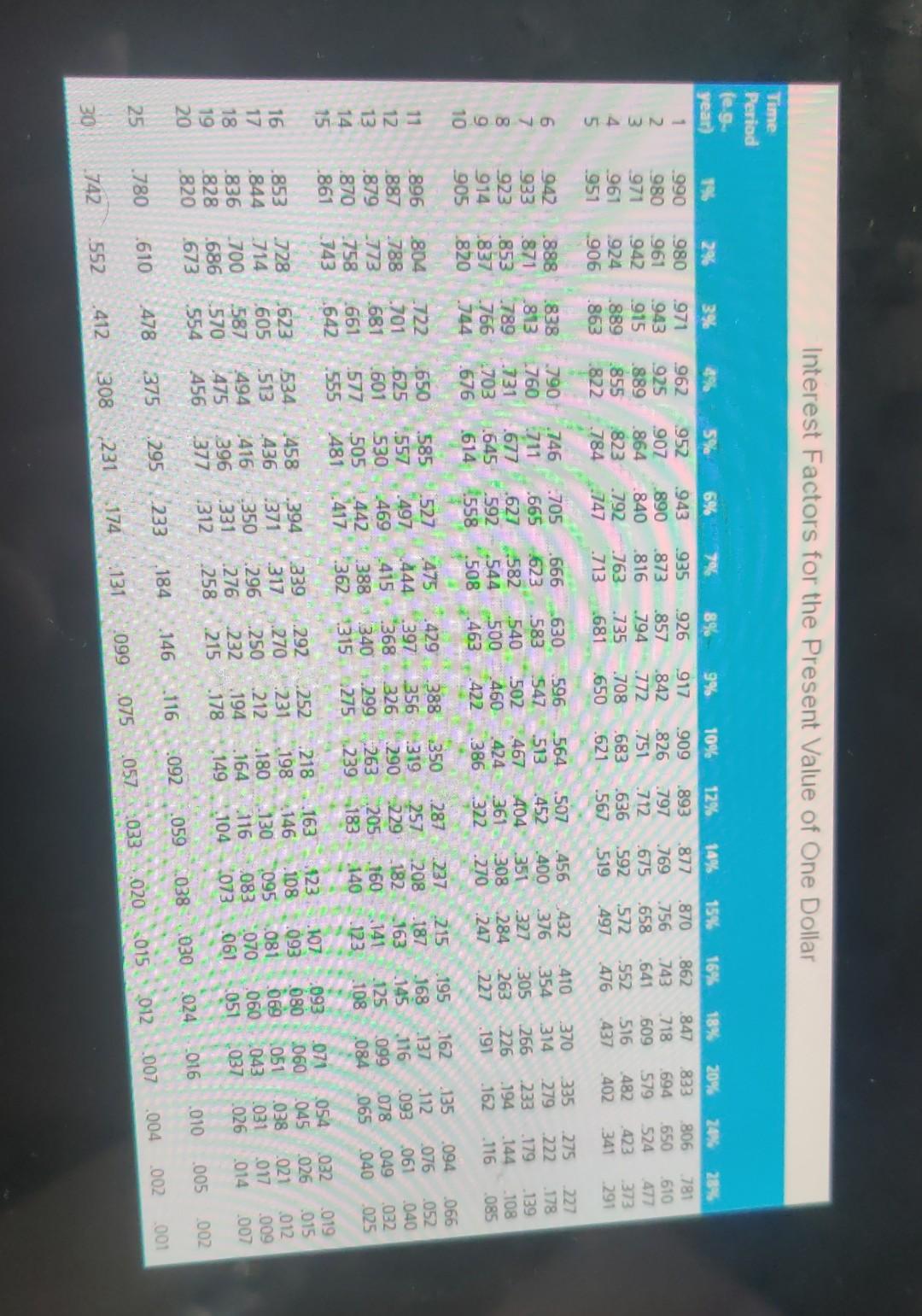

Problem 15-02 Given the following information concerning a convertible bond: Coupon: 5 percent ($50 per $1,000 bond) Exercise price: $25 Maturity date: 25 years - Call price: $1,040 Price of the common stock: $30 a. If this bond were nonconvertible, what would be its approximate value if comparable interest rates were 7 percent? Assume that the bond pays interest annually. Use Appendix B and Appendix D to answer the question. Round your answer to the nearest dollar, $ b. How many shares can the bond be converted into? Round down your answer to the nearest whole number. shares c. What is the value of the bond in terms of stock? Use the number of shares into which the bond may be converted into from part a. Round your answer to the nearest dollar. $ d. What is the current minimum price that the bond will command? Round your answer to the nearest dollar. $ e. Is there any reason to anticipate that the firm will call the bond? The price of the stock is -Select- the bond's exercise price. So the firm -Select-force conversion by calling the bond. f. What do investors receive if they do not convert the bond when it is called? Round your answer to the nearest dollar. $ g. If the bond were called, would it be advantageous to convert? It -Select- advantageous to convert since the bond's value as stock is select- the call price. Interest Factors for the Present Value of an Annuity of One Dollar Time Period (e.g. year) WN 2 3 4 5 1% 28 3% 5% 6% 7% 8% 9% 10% 12% 14% 16% 18% 20% 24% 28% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.862 0.847 0.833 0.806 0.781 0.758 0.735 1.970 1.942 1913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.690 1.647 1.605 1.566 1.528 1.457 1.392 1.332 1276 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.322 2.246 2.174 2.106 1.981 1.868 1766 1674 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.798 2.690 2.589 2.404 2.241 2.096 1966 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.274 3.127 2.991 2.745 2.532 2.345 2.181 0 6 7 8 9 10 5.795 5.601 5.417 5.242 5.076 4.917 4.766 4.623 4.486 4.355 4.111 3.889 3.685 3.498 3.326 3.020 2.759 2.534 2399 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.039 3.812 3.605 3.242 2.937 2678 2.455 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4.344 4.078 3.837 3.421 3.076 2.786 2.540 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.985 5.759 5.328 4.946 4.607 4.303 4.031 3.566 3.184 2.868 2.603 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.650 5.216 4.833 4.494 4.193 3.682 3.269 2.930 2.650 11 12 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.988 5.453 5.029 4.656 4.327 3.776 3.335 2.978 2.683 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.194 5.660 5.197 4.793 4.439 3.851 3.387 3.013 2.708 12.134 11.348 10.635 9.986 9.394 8.534 8.358 7.904 7487 7.103 6.424 5.842 5.342 4910 4.533 3.912 3.427 3.040 2.727 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.628 6.002 5.468 5.008 4.611 3.962 3.459 3.061 2.740 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.060 7.606 6.811 6.142 5.575 5.092 4.675 4.001 3.483 3.076 2.750 14 15 =2ub BDB9 16 17 18 19 20 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.312 7.824 6.974 6.265 5.669 5.162 4.730 4.003 3.503 3.088 2.758 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.002 7.120 6.373 5.749 5.222 4.775 4.059 3.518 3.097 2.763 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.2017.250 6.467 5.818 5.273 4.812 4.080 3.529 3.104 2.767 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.366 6.550 5.877 5.316 4.844 4.0973.539 3.109 2.770 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.128 8.514 7.469 6.623 5.929 5.353 4.870 4.110 3.546 3.113 2.772 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 7.843 6.873 6.097 5.467 4.948 4.147 3.564 3.122 2.776 30 25.808 22.937 19.600 17.292 15.373 13.765 12.409 11.258 10.274 9.427 8.055 7.003 6.177 5.517 4.979 4.160 3.569 3.124 2.778 Interest Factors for the Present Value of One Dollar Time Period 15% 24% year 870 756 244 2% 980 961 942 924 906 6% 943 890 .840 .792 .747 70% 935 873 .816 763 713 20% 833 694 579 482 402 806 .650 524 423 341 666 622 6789p n2BHNB98 ,wwwww S,www wwww .005 030 ,004 002 .610 LL) m 552

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started