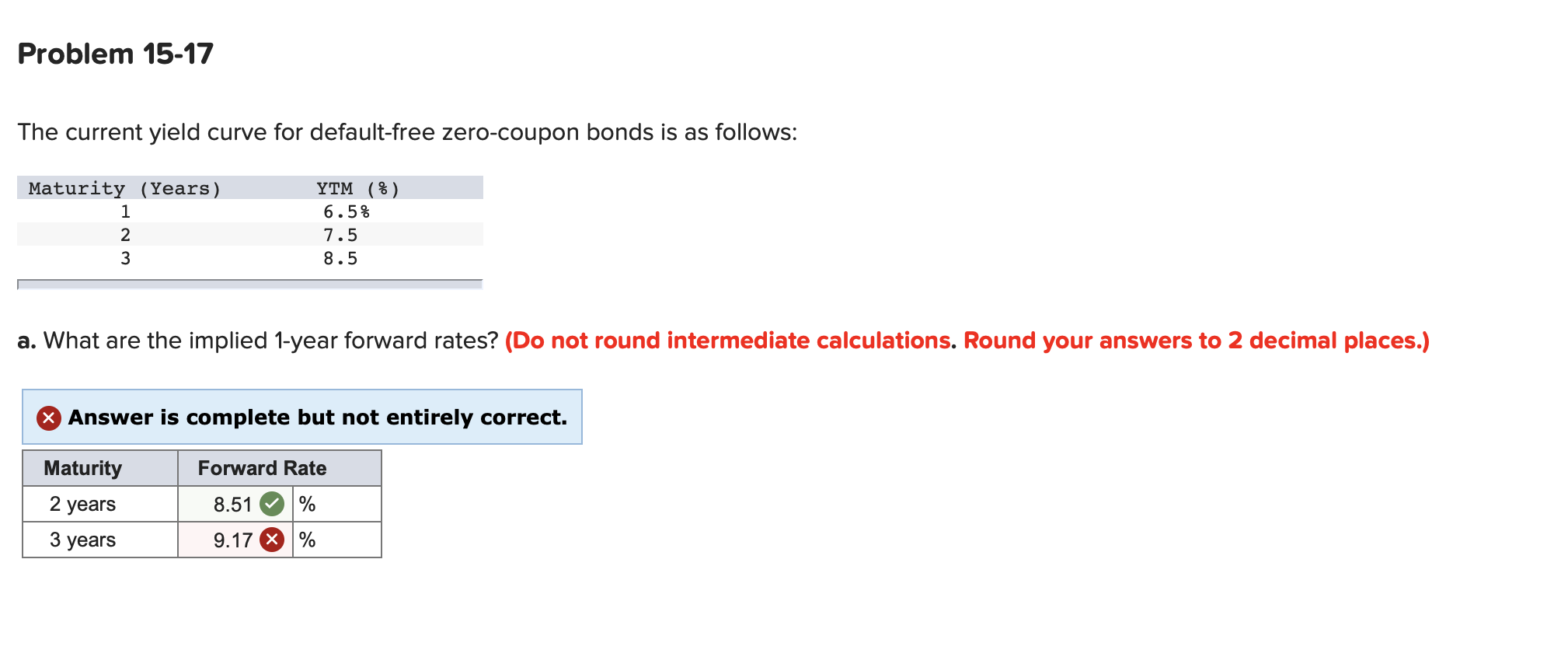

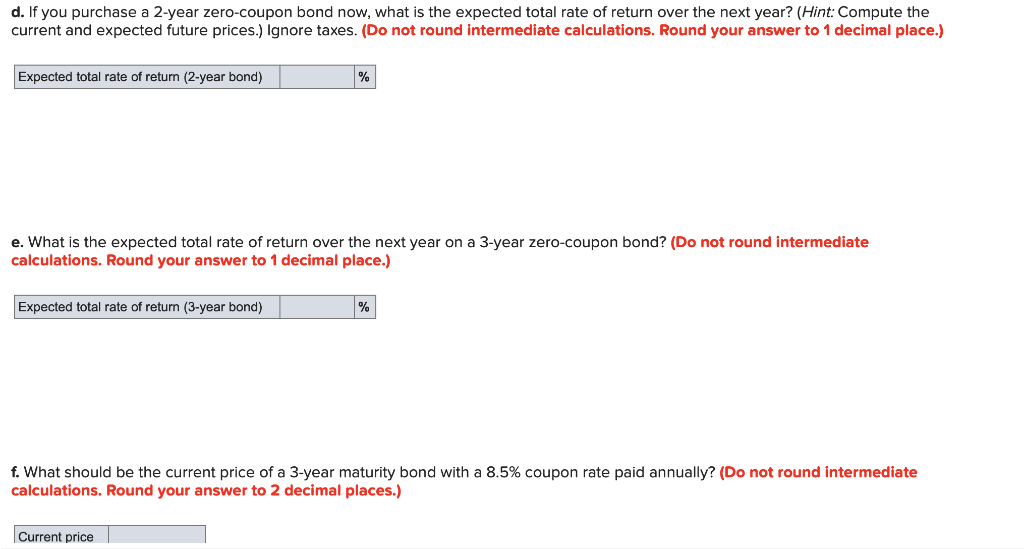

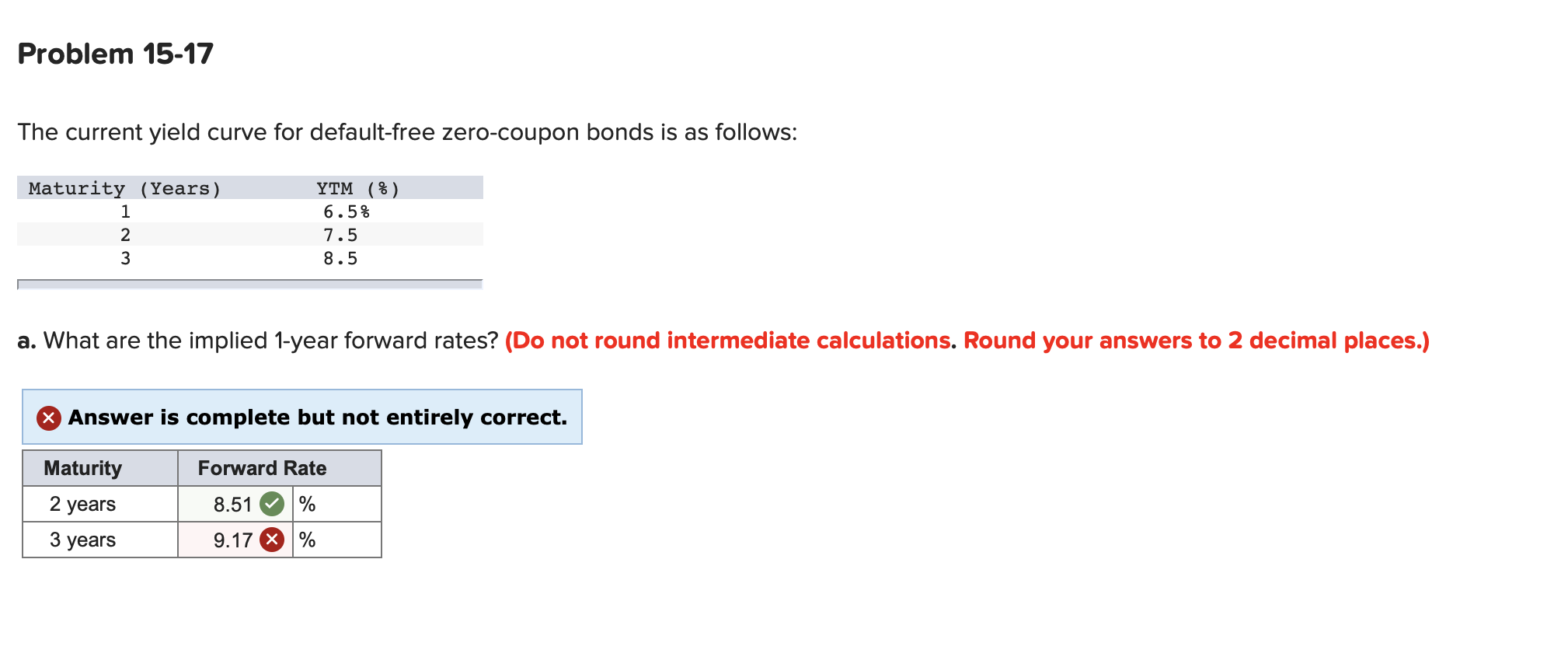

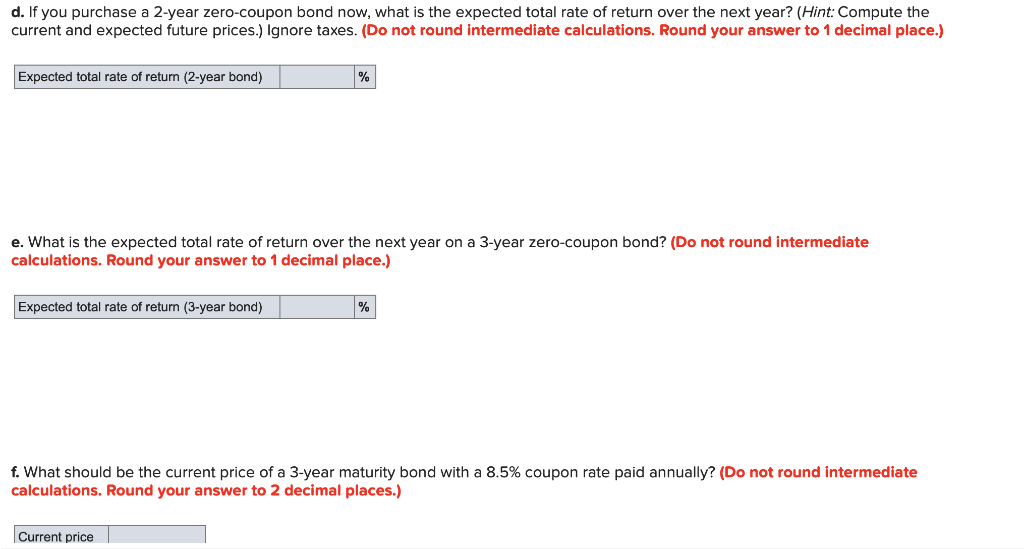

Problem 15-17 The current yield curve for default-free zero-coupon bonds is as follows: Maturity (Years) 1 2 YTM (%) 6.5% 7.5 8.5 3 a. What are the implied 1-year forward rates? (Do not round intermediate calculations. Round your answers to 2 decimal places.) X Answer is complete but not entirely correct. Forward Rate Maturity 2 years 8.51 % 3 years 9.17 X % d. If you purchase a 2-year zero-coupon bond now, what is the expected total rate of return over the next year? (Hint: Compute the current and expected future prices.) Ignore taxes. (Do not round intermediate calculations. Round your answer to 1 decimal place.) Expected total rate of return (2-year bond) % e. What is the expected total rate of return over the next year on a 3-year zero-coupon bond? (Do not round intermediate calculations. Round your answer to 1 decimal place.) Expected total rate of return (3-year bond) % f. What should be the current price of a 3-year maturity bond with a 8.5% coupon rate paid annually? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Current price Problem 15-17 The current yield curve for default-free zero-coupon bonds is as follows: Maturity (Years) 1 2 YTM (%) 6.5% 7.5 8.5 3 a. What are the implied 1-year forward rates? (Do not round intermediate calculations. Round your answers to 2 decimal places.) X Answer is complete but not entirely correct. Forward Rate Maturity 2 years 8.51 % 3 years 9.17 X % d. If you purchase a 2-year zero-coupon bond now, what is the expected total rate of return over the next year? (Hint: Compute the current and expected future prices.) Ignore taxes. (Do not round intermediate calculations. Round your answer to 1 decimal place.) Expected total rate of return (2-year bond) % e. What is the expected total rate of return over the next year on a 3-year zero-coupon bond? (Do not round intermediate calculations. Round your answer to 1 decimal place.) Expected total rate of return (3-year bond) % f. What should be the current price of a 3-year maturity bond with a 8.5% coupon rate paid annually? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Current price