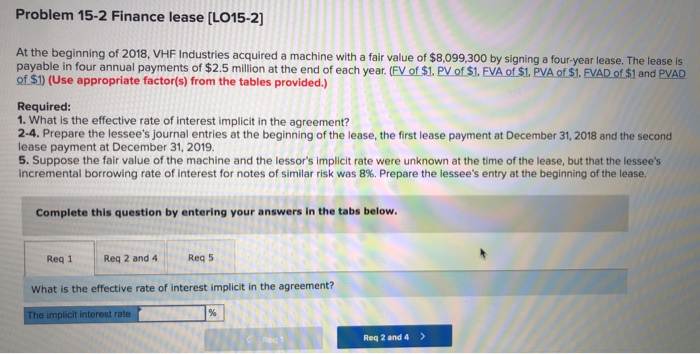

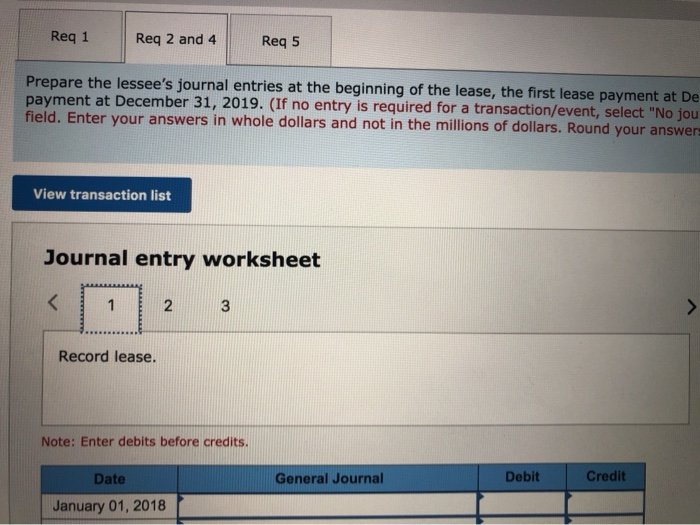

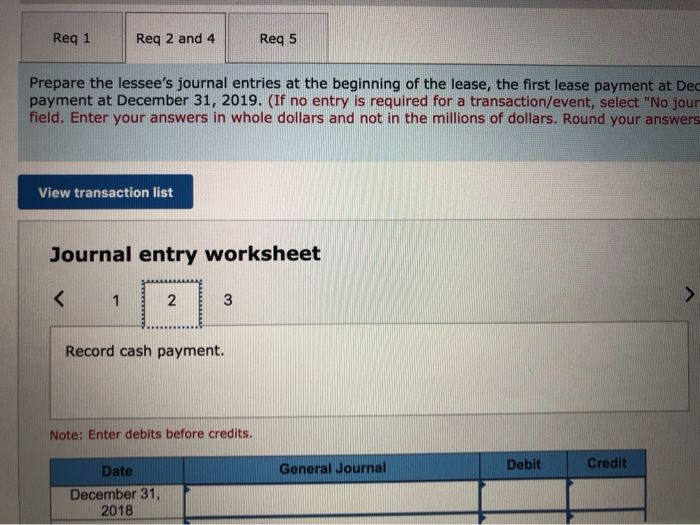

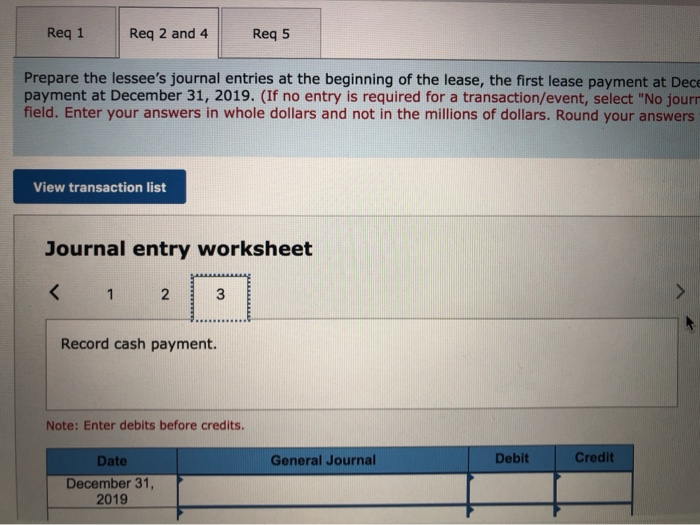

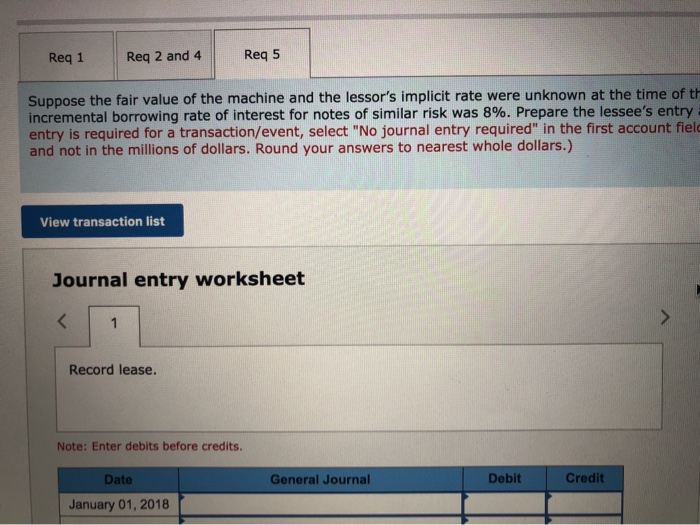

Problem 15-2 Finance lease [LO15-2 At the beginning of 2018, VHF Industries acquired a machine with a fair value of $8,099,300 by signing a four-year lease. The lease is payable in four annual payments of $2.5 million at the end of each year.(EV of S1. PV of $1. EVA of S1. PVA of S1, EVAD ot 51 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required 1. What is the effective rate of interest implicit in the agreement? 2-4. Prepare the lessee's journal entries at the beginning of the lease, the first lease payment at December 31, 2018 and the second lease payment at December 31, 2019. 5. Suppose the fair value of the machine and the lessor's implicit rate were unknown at the time of the lease, but that the lessee's incremental borrowing rate of interest for notes of similar risk was 8%. Prepare the lessee's entry at the beginning of the lease. Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 4 Req 5 What is the effective rate of interest implicit in the agreement? The implicit interest rat > Req 2 and 4 Req 2 and 4Req S Req 1 Prepare the lessee's journal entries at the beginning of the lease, the first lease payment at D payment at December 31, 2019. (If no entry is required for a trans field. Enter your answers in whole dollars and not in the millions of dollars. Round your answer action/event, select "No jou View transaction list Journal entry worksheet 2 Record lease. Note: Enter debits before credits. Debit Credit Date General Journal January 01, 2018 Req 1Req 2 and 4 Req 5 Prepare the lessee's journal entries at the beginning of the lease, the first lease payment at Dec payment at December 31, 2019. (If no entry is required for a transaction/event, select "No jour field. Enter your answers in whole dollars and not in the millions of dollars. Round your answers View transaction list Journal entry worksheet Record cash payment. Note: Enter debits before credits. Credit Debit General Journal Date December 31 2018 Req 1 Req 2 and 4Req 5 Prepare the lessee's journal entries at the beginning of the lease, the first lease payment at Dece payment at December 31, 2019. (If no entry is required for a transaction/event, select "No jourr field. Enter your answers in whole dollars and not in the millions of dollars. Round your answers View transaction list Journal entry worksheet 2 3 Record cash payment. Note: Enter debits before credits. Debit Credit General Journal Date December 31, 2019 Req 1 Re 2 and 4 Req s Suppose the fair value of the machine and the lessor's implicit rate were unknown at the time of th incremental borrowing rate of interest for notes of similar risk was 8%. Prepare the lessee's entry entry is required for a transaction/event, select "No journal entry required" in the first account fiel and not in the millions of dollars. Round your answers to nearest whole dollars.) View transaction list Journal entry worksheet Record lease. Note: Enter debits before credits. Credit Date General Journal Debit January 01, 2018