Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 15-2A Recording, adjusting, and reporting available-for-sale debt securities P3 Mead Inc. began operations in Year 1. Following is a series of transactions and events

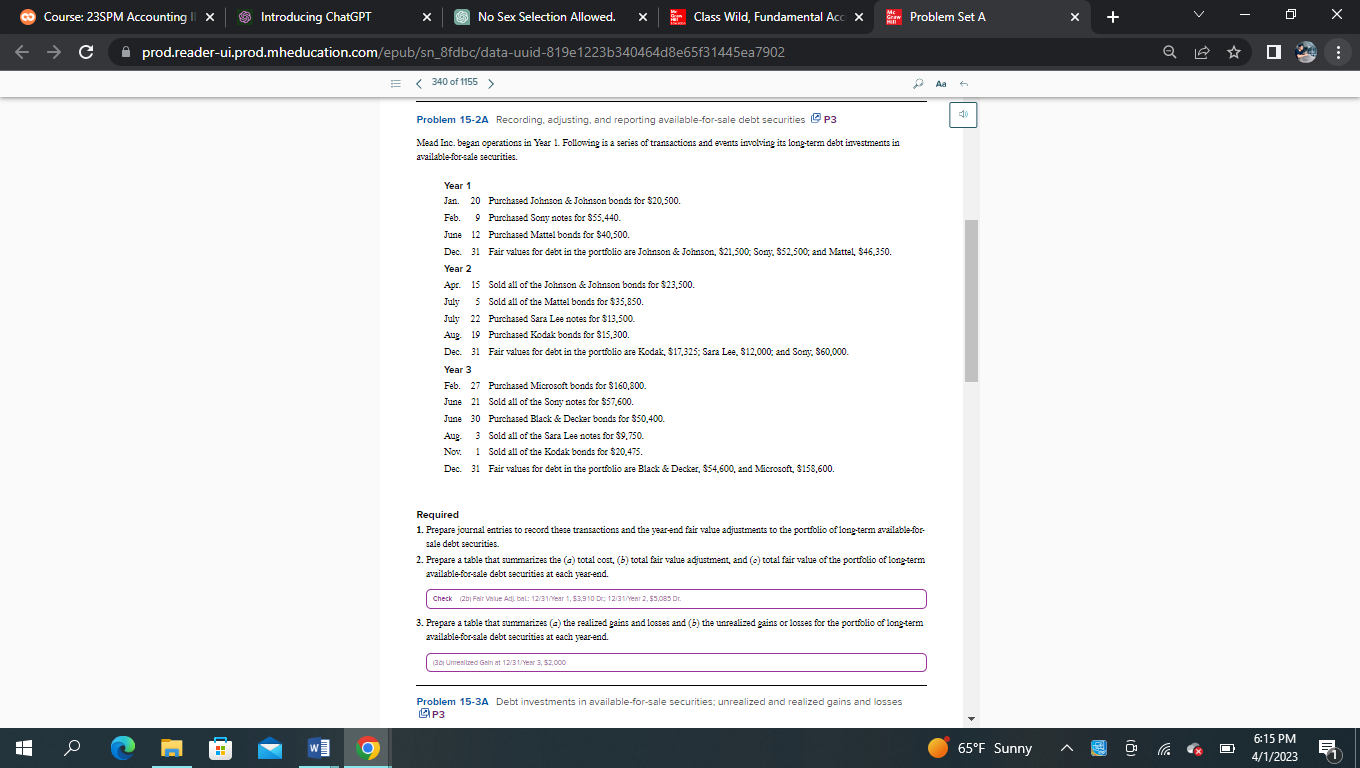

Problem 15-2A Recording, adjusting, and reporting available-for-sale debt securities P3 Mead Inc. began operations in Year 1. Following is a series of transactions and events involving its long-term debt inestments in available-for-sale securities. Year 1 Jan. 20 Purchased Johnson \& Johnson bonds for $20,500. Feb. 9 Purchased Sony notes for $55,440. June 12 Purchased Mattel bonds for $40,500. Dec. 31 Fair values for debt in the portfolio are Johnson \& Johnson, \$21,500; Sony, 852,500; and Mattel, \$46,350. Year 2 Apr. 15 Sold all of the Johnson \& Johnson bonds for $23,500. July 5 Sold all of the Mattel bonds for $35,850. July 22 Purchased Sara Lee notes for $13,500. Aug. 19 Purchased Kodak bonds for 515,300 . Dec. 31 Fair values for debt in the portfolio are Kodak; $17,325; Sara Lee, \$12,000; and Sony, $60,000. Year 3 Feb. 27 Purchased Microsoft bonds for $160,800. June 21 Sold all of the Sony notes for $57,600. June 30 Purchased Black \& Decler bonds for 550,400 . Aug. 3 Sold all of the Sara Lee notes for $9,750. Nov. 1 Sold all of the Kodak bonds for $20,475. Dec. 31 Fair values for debt in the portfolio are Black \& Decker, $54,600, and Microcoft, $158,600. Required 1. Prepare journal entries to record these transactions and the yearend fair value adjustments to the portiolio of long-term available-forsale debt securities. 2. Prepare a table that summarizes the (a) total cost, (b) total fair value adjustment, and (o) total fair value of the portfolio of longterm available-for-sale debt securities at each year-end. Check (2b) Fair Value Adb. baL: 12/31near 1, \$3,910 Dr: 1231Year 2, \$5,085 Dr. 3. Prepare a table that summarizes (a) the realized gains and losses and (b) the unrealized gains or losses for the portfolio of longterm available-for-sale debt securities at each year-end. (3b) Unremlned Gein at 12/31/Yem 3, 32,000 Problem 15-2A Recording, adjusting, and reporting available-for-sale debt securities P3 Mead Inc. began operations in Year 1. Following is a series of transactions and events involving its long-term debt inestments in available-for-sale securities. Year 1 Jan. 20 Purchased Johnson \& Johnson bonds for $20,500. Feb. 9 Purchased Sony notes for $55,440. June 12 Purchased Mattel bonds for $40,500. Dec. 31 Fair values for debt in the portfolio are Johnson \& Johnson, \$21,500; Sony, 852,500; and Mattel, \$46,350. Year 2 Apr. 15 Sold all of the Johnson \& Johnson bonds for $23,500. July 5 Sold all of the Mattel bonds for $35,850. July 22 Purchased Sara Lee notes for $13,500. Aug. 19 Purchased Kodak bonds for 515,300 . Dec. 31 Fair values for debt in the portfolio are Kodak; $17,325; Sara Lee, \$12,000; and Sony, $60,000. Year 3 Feb. 27 Purchased Microsoft bonds for $160,800. June 21 Sold all of the Sony notes for $57,600. June 30 Purchased Black \& Decler bonds for 550,400 . Aug. 3 Sold all of the Sara Lee notes for $9,750. Nov. 1 Sold all of the Kodak bonds for $20,475. Dec. 31 Fair values for debt in the portfolio are Black \& Decker, $54,600, and Microcoft, $158,600. Required 1. Prepare journal entries to record these transactions and the yearend fair value adjustments to the portiolio of long-term available-forsale debt securities. 2. Prepare a table that summarizes the (a) total cost, (b) total fair value adjustment, and (o) total fair value of the portfolio of longterm available-for-sale debt securities at each year-end. Check (2b) Fair Value Adb. baL: 12/31near 1, \$3,910 Dr: 1231Year 2, \$5,085 Dr. 3. Prepare a table that summarizes (a) the realized gains and losses and (b) the unrealized gains or losses for the portfolio of longterm available-for-sale debt securities at each year-end. (3b) Unremlned Gein at 12/31/Yem 3, 32,000

Problem 15-2A Recording, adjusting, and reporting available-for-sale debt securities P3 Mead Inc. began operations in Year 1. Following is a series of transactions and events involving its long-term debt inestments in available-for-sale securities. Year 1 Jan. 20 Purchased Johnson \& Johnson bonds for $20,500. Feb. 9 Purchased Sony notes for $55,440. June 12 Purchased Mattel bonds for $40,500. Dec. 31 Fair values for debt in the portfolio are Johnson \& Johnson, \$21,500; Sony, 852,500; and Mattel, \$46,350. Year 2 Apr. 15 Sold all of the Johnson \& Johnson bonds for $23,500. July 5 Sold all of the Mattel bonds for $35,850. July 22 Purchased Sara Lee notes for $13,500. Aug. 19 Purchased Kodak bonds for 515,300 . Dec. 31 Fair values for debt in the portfolio are Kodak; $17,325; Sara Lee, \$12,000; and Sony, $60,000. Year 3 Feb. 27 Purchased Microsoft bonds for $160,800. June 21 Sold all of the Sony notes for $57,600. June 30 Purchased Black \& Decler bonds for 550,400 . Aug. 3 Sold all of the Sara Lee notes for $9,750. Nov. 1 Sold all of the Kodak bonds for $20,475. Dec. 31 Fair values for debt in the portfolio are Black \& Decker, $54,600, and Microcoft, $158,600. Required 1. Prepare journal entries to record these transactions and the yearend fair value adjustments to the portiolio of long-term available-forsale debt securities. 2. Prepare a table that summarizes the (a) total cost, (b) total fair value adjustment, and (o) total fair value of the portfolio of longterm available-for-sale debt securities at each year-end. Check (2b) Fair Value Adb. baL: 12/31near 1, \$3,910 Dr: 1231Year 2, \$5,085 Dr. 3. Prepare a table that summarizes (a) the realized gains and losses and (b) the unrealized gains or losses for the portfolio of longterm available-for-sale debt securities at each year-end. (3b) Unremlned Gein at 12/31/Yem 3, 32,000 Problem 15-2A Recording, adjusting, and reporting available-for-sale debt securities P3 Mead Inc. began operations in Year 1. Following is a series of transactions and events involving its long-term debt inestments in available-for-sale securities. Year 1 Jan. 20 Purchased Johnson \& Johnson bonds for $20,500. Feb. 9 Purchased Sony notes for $55,440. June 12 Purchased Mattel bonds for $40,500. Dec. 31 Fair values for debt in the portfolio are Johnson \& Johnson, \$21,500; Sony, 852,500; and Mattel, \$46,350. Year 2 Apr. 15 Sold all of the Johnson \& Johnson bonds for $23,500. July 5 Sold all of the Mattel bonds for $35,850. July 22 Purchased Sara Lee notes for $13,500. Aug. 19 Purchased Kodak bonds for 515,300 . Dec. 31 Fair values for debt in the portfolio are Kodak; $17,325; Sara Lee, \$12,000; and Sony, $60,000. Year 3 Feb. 27 Purchased Microsoft bonds for $160,800. June 21 Sold all of the Sony notes for $57,600. June 30 Purchased Black \& Decler bonds for 550,400 . Aug. 3 Sold all of the Sara Lee notes for $9,750. Nov. 1 Sold all of the Kodak bonds for $20,475. Dec. 31 Fair values for debt in the portfolio are Black \& Decker, $54,600, and Microcoft, $158,600. Required 1. Prepare journal entries to record these transactions and the yearend fair value adjustments to the portiolio of long-term available-forsale debt securities. 2. Prepare a table that summarizes the (a) total cost, (b) total fair value adjustment, and (o) total fair value of the portfolio of longterm available-for-sale debt securities at each year-end. Check (2b) Fair Value Adb. baL: 12/31near 1, \$3,910 Dr: 1231Year 2, \$5,085 Dr. 3. Prepare a table that summarizes (a) the realized gains and losses and (b) the unrealized gains or losses for the portfolio of longterm available-for-sale debt securities at each year-end. (3b) Unremlned Gein at 12/31/Yem 3, 32,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started