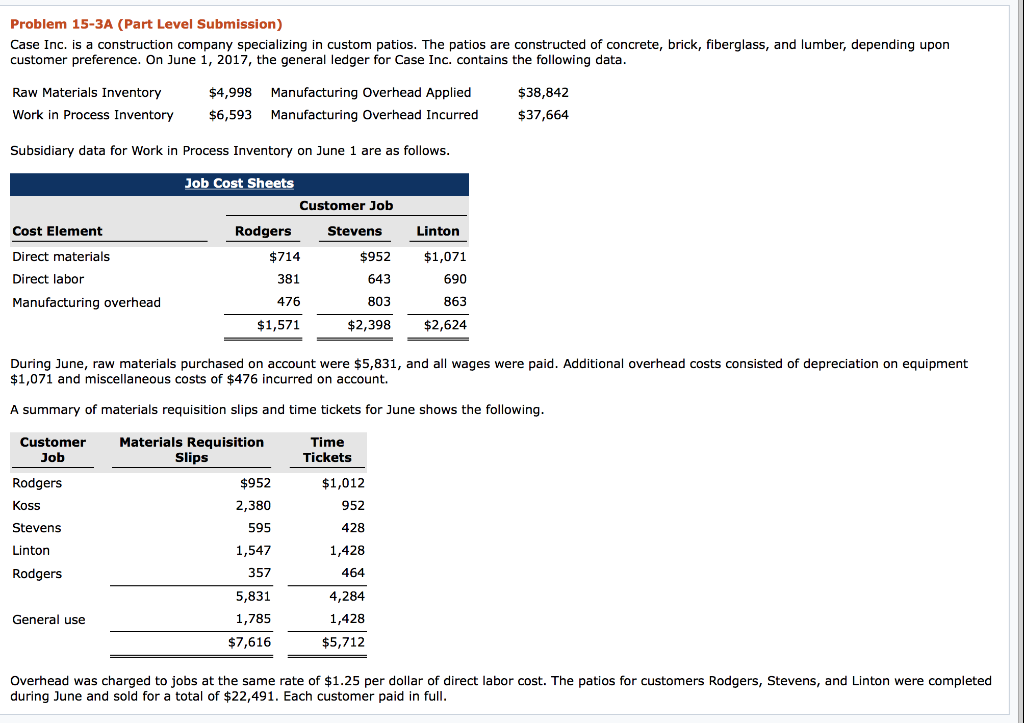

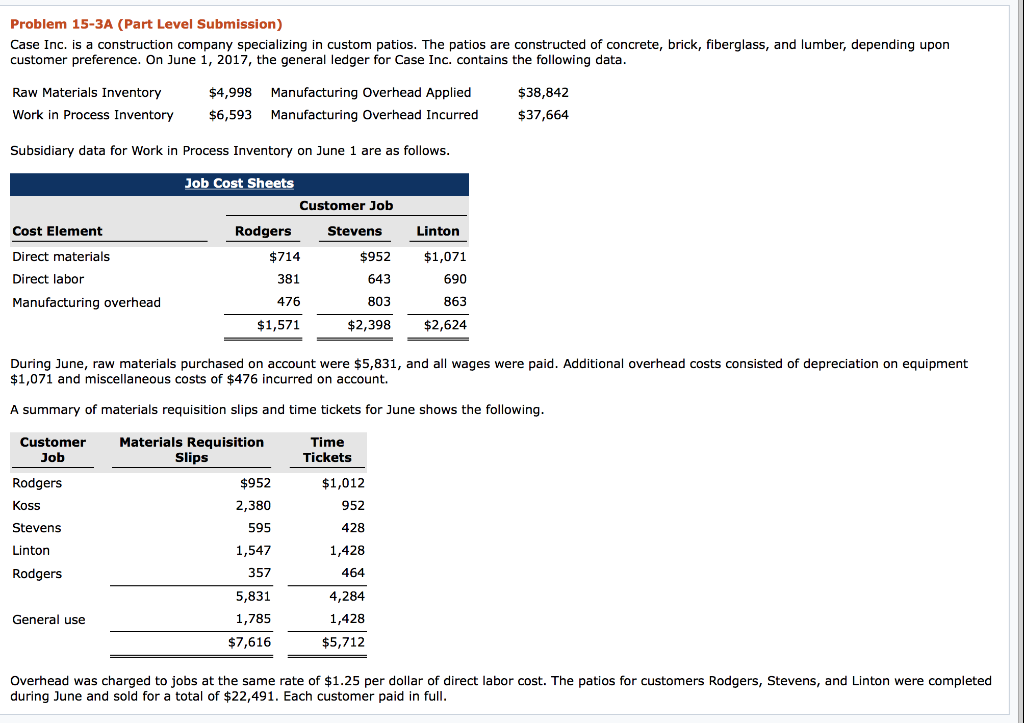

Problem 15-3A (Part Level Submission) Case Inc. is a construction company specializing in custom patios. The patios are constructed of concrete, brick, fiberglass, and lumber, depending upon customer preference. On June 1, 2017, the general ledger for Case Inc. contains the following data. Raw Materials Inventory Work in Process Inventory $4,998 $6,593 Manufacturing Overhead Applied Manufacturing Overhead Incurred $38,842 $37,664 Subsidiary data for Work in Process Inventory on June 1 are as follows. Job Cost Sheets Customer Job Rodgers Stevens Cost Element Direct materials Direct labor Manufacturing overhead $714 381 476 $1,571 $952 643 803 $2,398 Linton $1,071 690 863 $2,624 During June, raw materials purchased on account were $5,831, and all wages were paid. Additional overhead costs consisted of depreciation on equipment $1,071 and miscellaneous costs of $476 incurred on account. A summary of materials requisition slips and time tickets for June shows the following. Customer Job Materials Requisition Slips Time Tickets $952 2,380 Rodgers Koss Stevens Linton Rodgers 595 1,547 $1,012 952 428 1,428 464 4,284 1,428 $5,712 357 5,831 1,785 $7,616 General use Overhead was charged to jobs at the same rate of $1.25 per dollar of direct labor cost. The patios for customers Rodgers, Stevens, and Linton were completed during June and sold for a total of $22,491. Each customer paid in full. Problem 15-3A (Part Level Submission) Case Inc. is a construction company specializing in custom patios. The patios are constructed of concrete, brick, fiberglass, and lumber, depending upon customer preference. On June 1, 2017, the general ledger for Case Inc. contains the following data. Raw Materials Inventory Work in Process Inventory $4,998 $6,593 Manufacturing Overhead Applied Manufacturing Overhead Incurred $38,842 $37,664 Subsidiary data for Work in Process Inventory on June 1 are as follows. Job Cost Sheets Customer Job Rodgers Stevens Cost Element Direct materials Direct labor Manufacturing overhead $714 381 476 $1,571 $952 643 803 $2,398 Linton $1,071 690 863 $2,624 During June, raw materials purchased on account were $5,831, and all wages were paid. Additional overhead costs consisted of depreciation on equipment $1,071 and miscellaneous costs of $476 incurred on account. A summary of materials requisition slips and time tickets for June shows the following. Customer Job Materials Requisition Slips Time Tickets $952 2,380 Rodgers Koss Stevens Linton Rodgers 595 1,547 $1,012 952 428 1,428 464 4,284 1,428 $5,712 357 5,831 1,785 $7,616 General use Overhead was charged to jobs at the same rate of $1.25 per dollar of direct labor cost. The patios for customers Rodgers, Stevens, and Linton were completed during June and sold for a total of $22,491. Each customer paid in full