Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 15-5A (Algo) Computing and applying overhead to jobs; recording under- or overapplied overhead LO P3, P4 At the beginning of the year, Learer

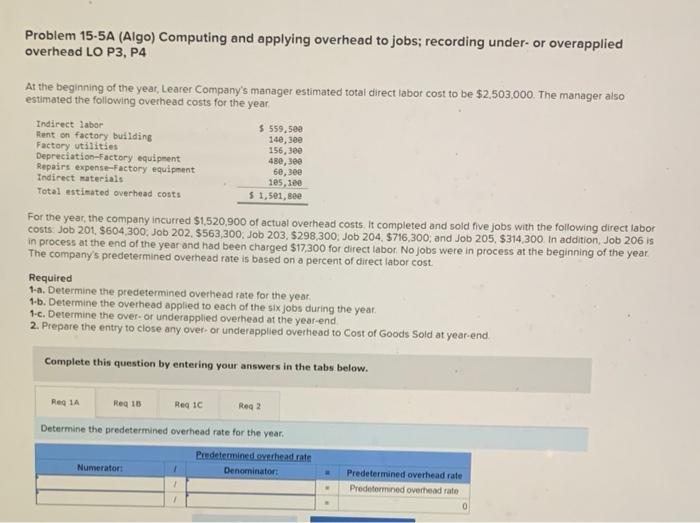

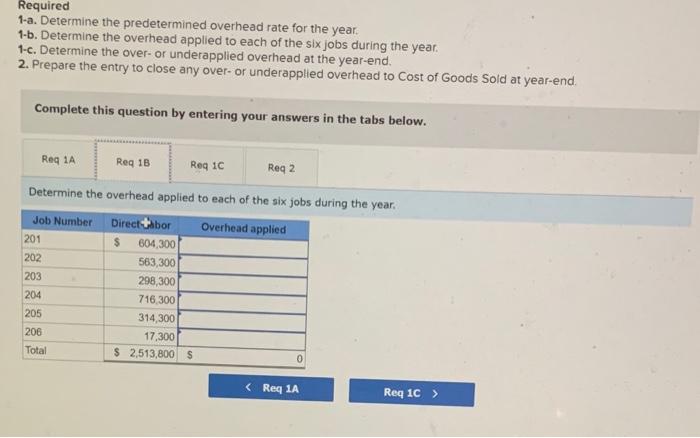

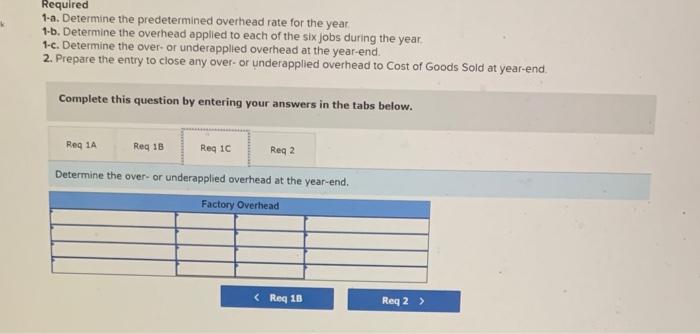

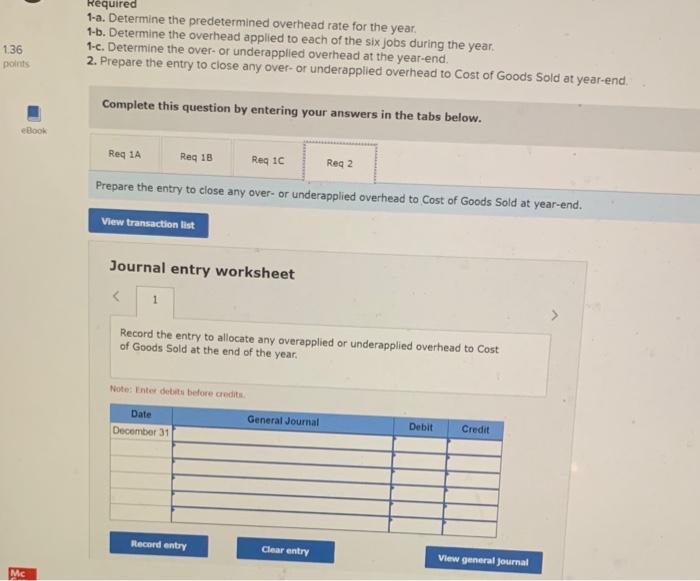

Problem 15-5A (Algo) Computing and applying overhead to jobs; recording under- or overapplied overhead LO P3, P4 At the beginning of the year, Learer Company's manager estimated total direct labor cost to be $2,503,000. The manager also estimated the following overhead costs for the year. Indirect labor Rent on factory building Factory utilities Depreciation-Factory equipment Repairs expense-Factory equipment Indirect materials Total estimated overhead costs $559,500 140,300 156,300 480, 300 60,300 105,100 $ 1,501,800 For the year, the company incurred $1,520,900 of actual overhead costs. It completed and sold five jobs with the following direct labor costs: Job 201, $604,300, Job 202, $563,300, Job 203, $298,300; Job 204, $716,300; and Job 205, $314,300. In addition, Job 206 is in process at the end of the year and had been charged $17,300 for direct labor. No jobs were in process at the beginning of the year. The company's predetermined overhead rate is based on a percent of direct labor cost Required 1-a. Determine the predetermined overhead rate for the year. 1-b. Determine the overhead applied to each of the six jobs during the year. 1-c. Determine the over- or underapplied overhead at the year-end 2. Prepare the entry to close any over- or underapplied overhead to Cost of Goods Sold at year-end. Complete this question by entering your answers in the tabs below. Req 1A Req 18 Req 1C Req 21 Determine the predetermined overhead rate for the year. Numerator: Predetermined overhead rate Denominator: Predetermined overhead rate Predetermined overhead rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started