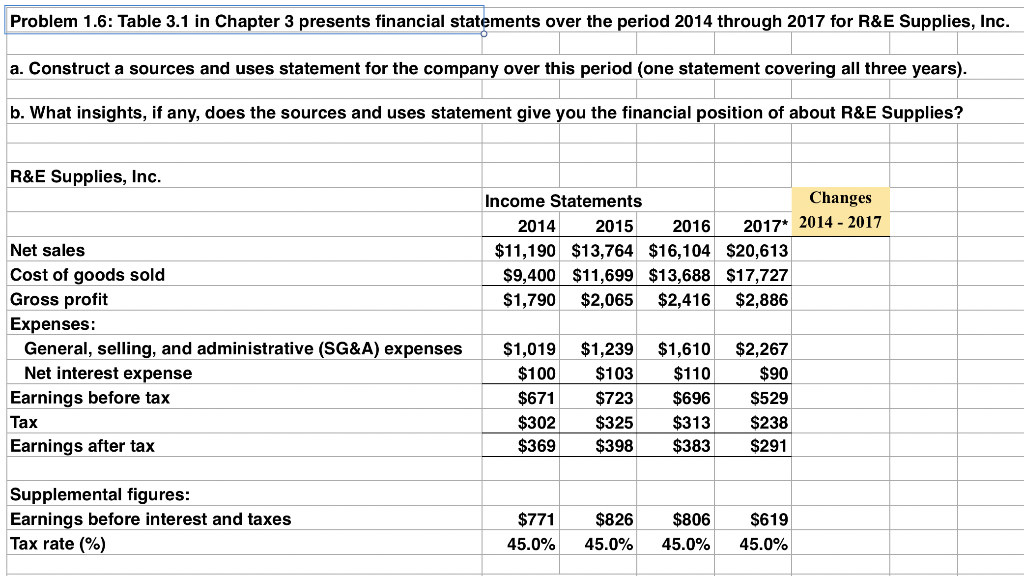

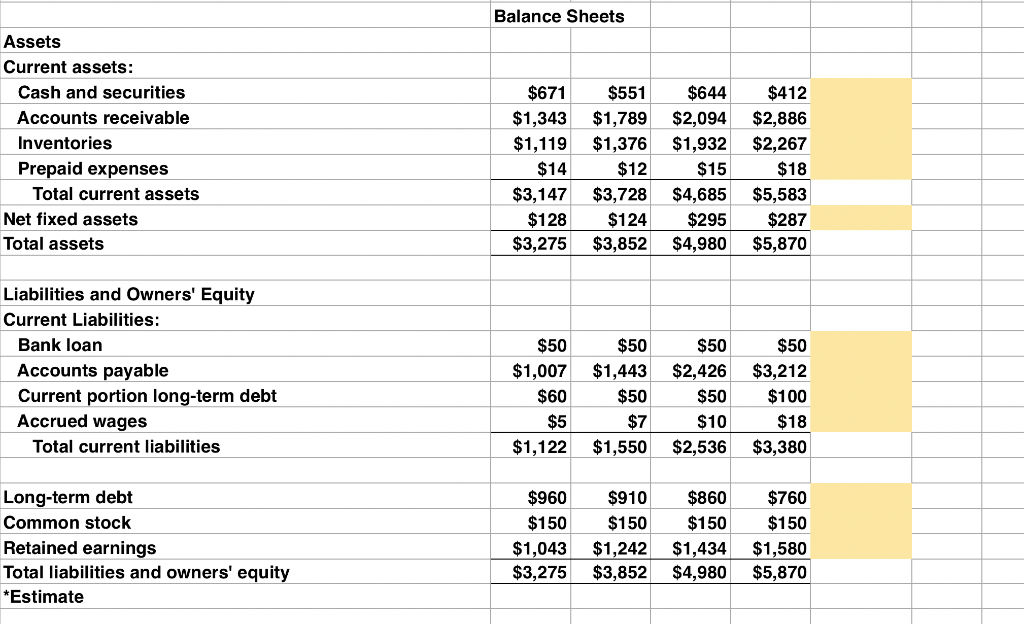

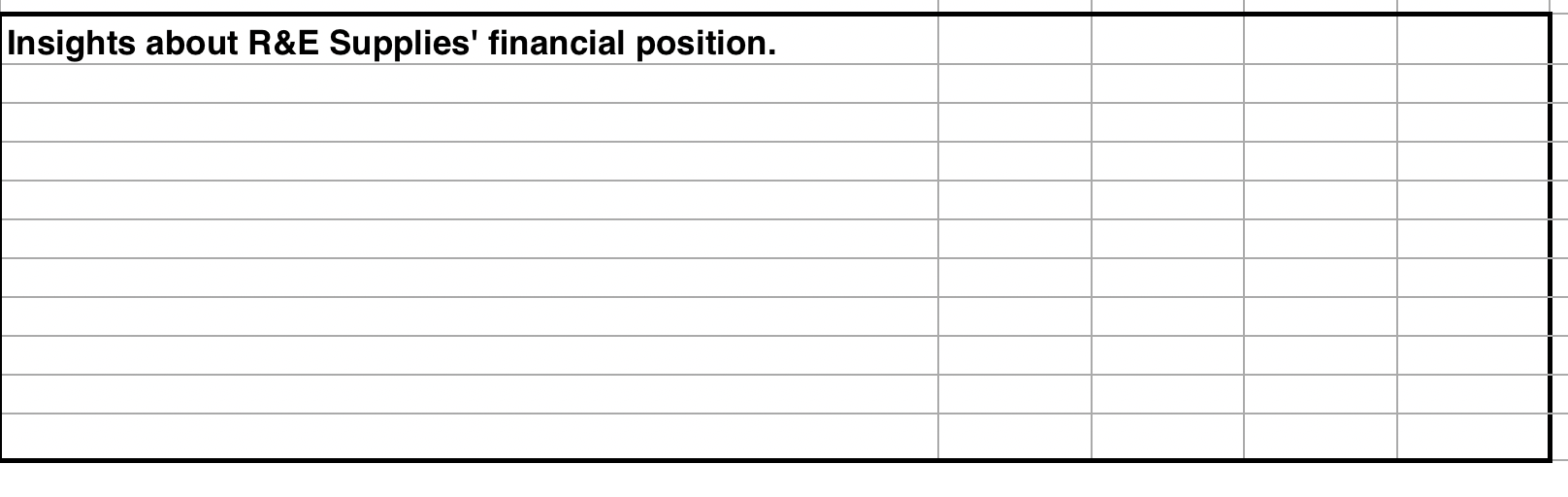

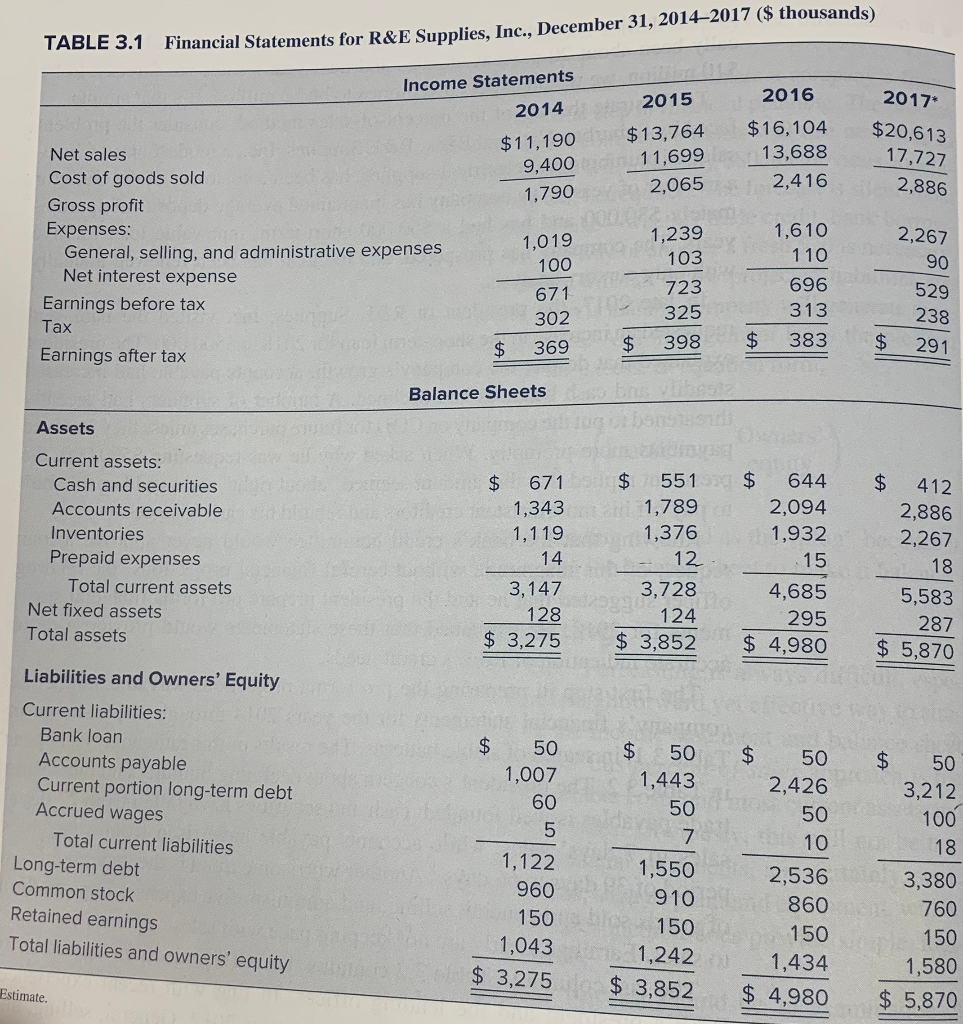

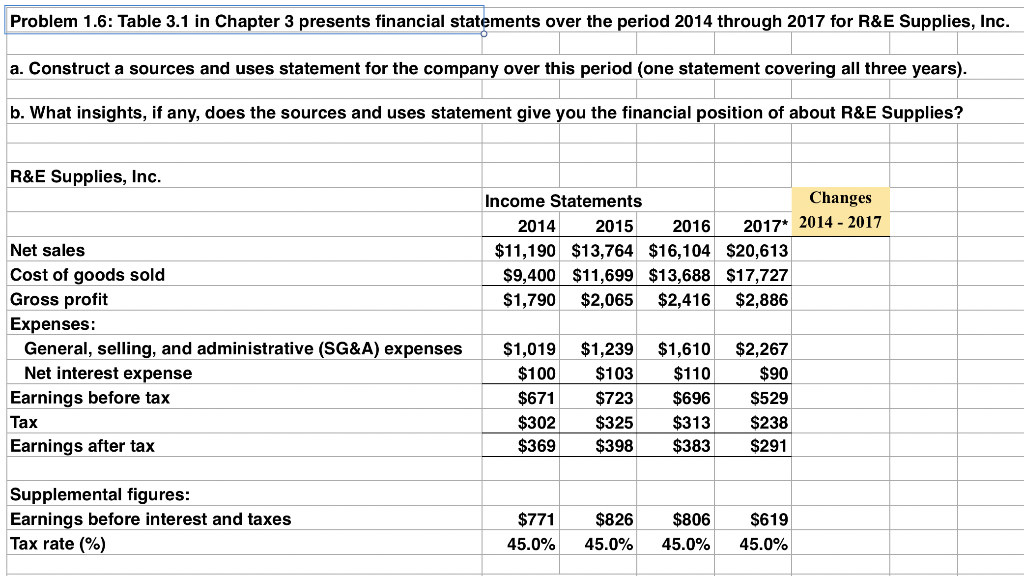

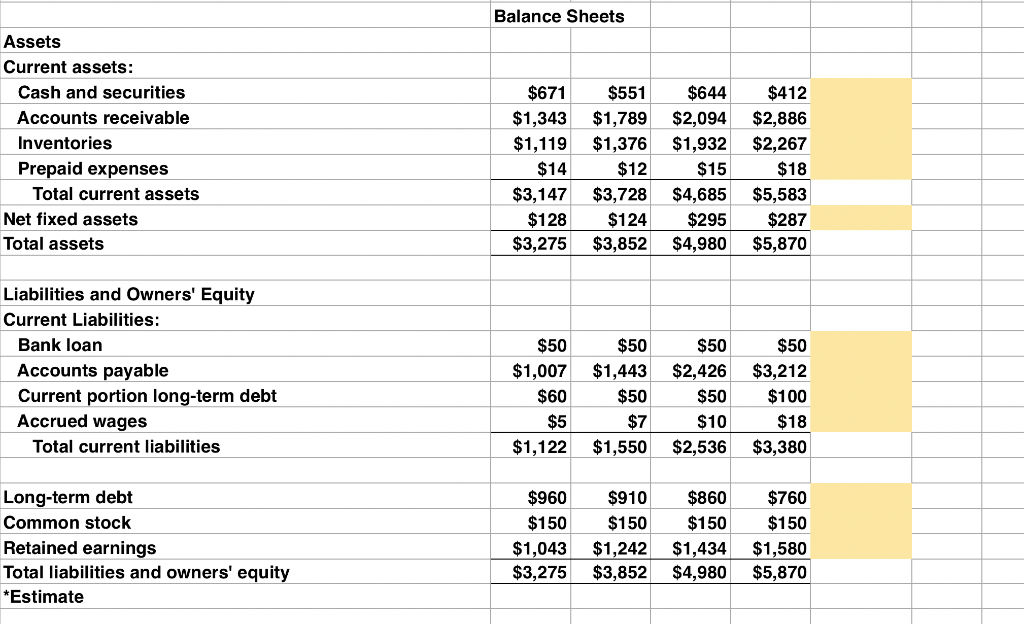

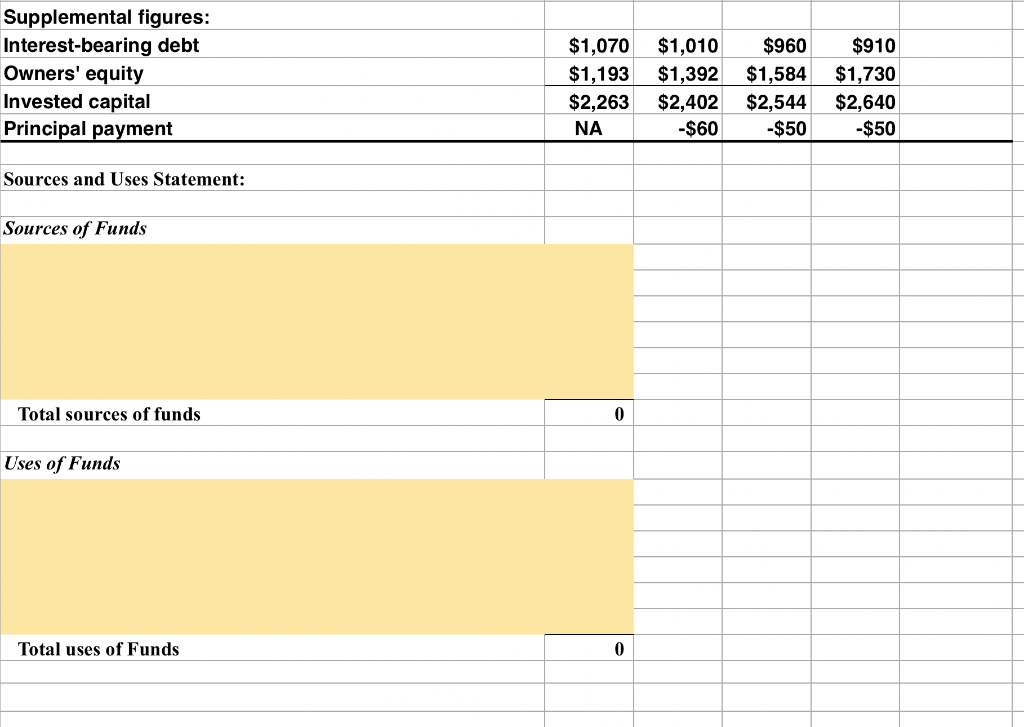

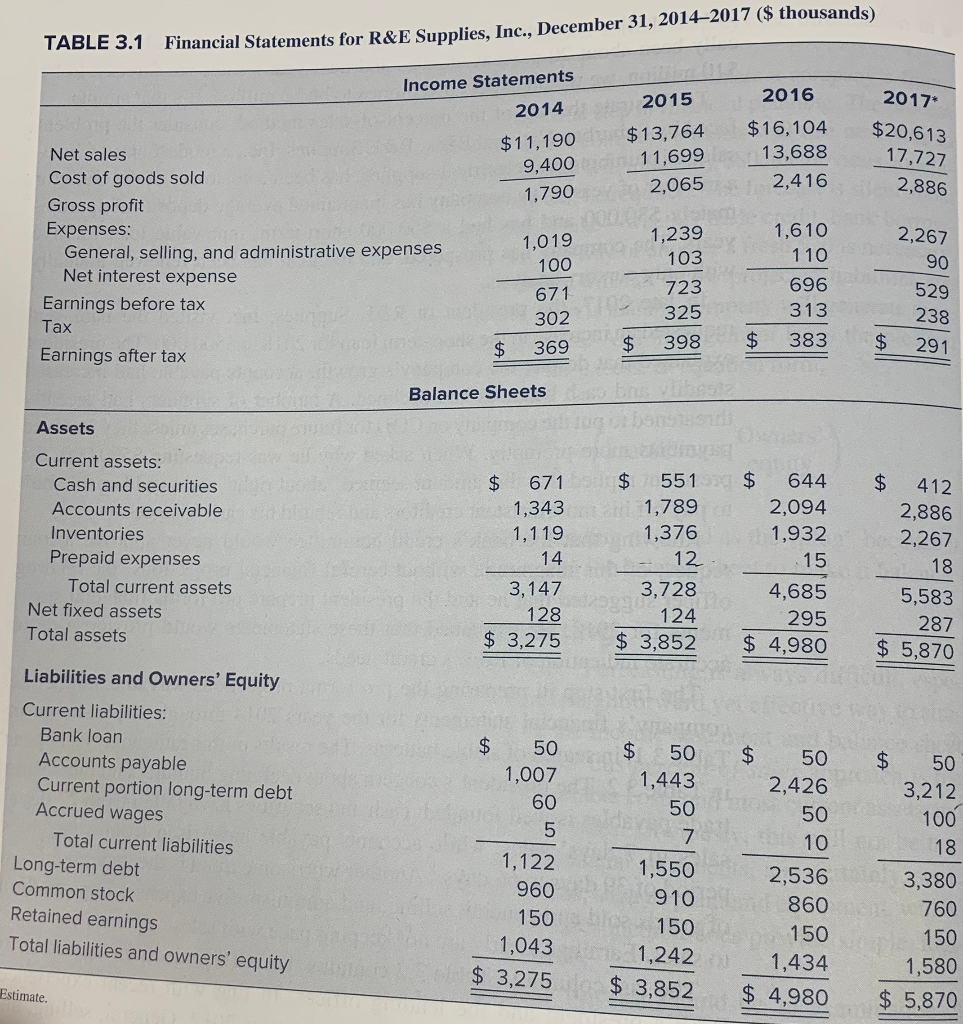

Problem 1.6: Table 3.1 in Chapter 3 presents financial statements over the period 2014 through 2017 for R&E Supplies, Inc. a. Construct a sources and uses statement for the company over this period (one statement covering all three years). b. What insights, if any, does the sources and uses statement give you the financial position of about R&E Supplies? R&E Supplies, Inc. Income Statements Changes 2014 2015 2016 2017* 2014 - 2017 $11,190 $13,764 $16,104 $20,613 $9,400 $11,699 $13,688 $17,727 $1,790 $2,065 $2,416 $2,886 Net sales Cost of goods sold Gross profit Expenses: General, selling, and administrative (SG&A) expenses Net interest expense Earnings before tax Tax Earnings after tax $1,019 $100 $671 $302 $369 $1,239 $103 $723 $325 $398 $1,610 $110 $696 $313 $383 $2,267 $90 $529 $238 $291 Supplemental figures: Earnings before interest and taxes Tax rate (%) $771 45.0% $826 45.0% $806 45.0% $619 45.0% Balance Sheets Assets Current assets: Cash and securities Accounts receivable Inventories Prepaid expenses Total current assets Net fixed assets Total assets $671 $1,343 $1,119 $14 $3,147 $128 $3,275 $551 $1,789 $1,376 $12 $3,728 $124 $3,852 $644 $2,094 $1,932 $15 $4,685 $295 $4,980 $412 $2,886 $2,267 $18 $5,583 $287 $5,870 Liabilities and Owners' Equity Current Liabilities: Bank loan Accounts payable Current portion long-term debt Accrued wages Total current liabilities $50 $1,007 $60 $50 $1,443 $50 $7 $1,550 $50 $2,426 $50 $10 $2,536 $50 $3,212 $100 $18 $3,380 $5 $1,122 Long-term debt Common stock Retained earnings Total liabilities and owners' equity *Estimate $960 $150 $1,043 $3,275 $910 $150 $1,242 $3,852 $860 $150 $1,434 $4,980 $760 $150 $1,580 $5,870 Supplemental figures: Interest-bearing debt Owners' equity Invested capital Principal payment $1,070 $1,193 $2,263 NA $1,010 $1,392 $2,402 -$60 $960 $1,584 $2,544 -$50 $910 $1,730 $2,640 -$50 Sources and Uses Statement: Sources of Funds Total sources of funds Uses of Funds Total uses of Funds Insights about R&E Supplies' financial position. 3.1 Financial Statements for R&E Supplies. Inc.. December 31, 2014-2017 ($ thousands) 2015 2017 $13,764 11,699 2016 $16,104 13,688 2,416 $20,613 17,727 2,886 2,065 Income Statements 2014 Net sales $11,190 Cost of goods sold 9,400 Gross profit 1,790 Expenses: General, selling, and administrative expenses Net interest expense 100 Earnings before tax 671 Tax 302 Earnings after tax 369 1,019 2,267 1,239 103 723 90 1,610 110 696 313 383 529 325 238 $ 398 291 Balance Sheets $ $ 412 551 1,789 2,886 Assets Current assets: Cash and securities Accounts receivable Inventories Prepaid expenses Total current assets Net fixed assets Total assets 1,376 2,267 $ 671 1,343 1,119 14 3,147 128 $ 3,275 $ 644 2,094 1,932 15 4,685 295 $ 4,980 12 3,728 124 $ 3,852 18 5,583 287 $ 5,870 $ $ 50 1,443 $ 50 1,007 60 $ Liabilities and Owners' Equity Current liabilities: Bank loan Accounts payable Current portion long-term debt Accrued wages Total current liabilities Long-term debt Common stock Retained earnings Total liabilities and owners' equity 50 2,426 50 50 3,212 50 100 7 10 1,122 960 150 1,043 $ 3,275 1,550 910 150 2,536 860 150 1,434 $ 4,980 18 3,380 760 150 1,580 $ 5,870 1,242 $ 3,852 Estimate