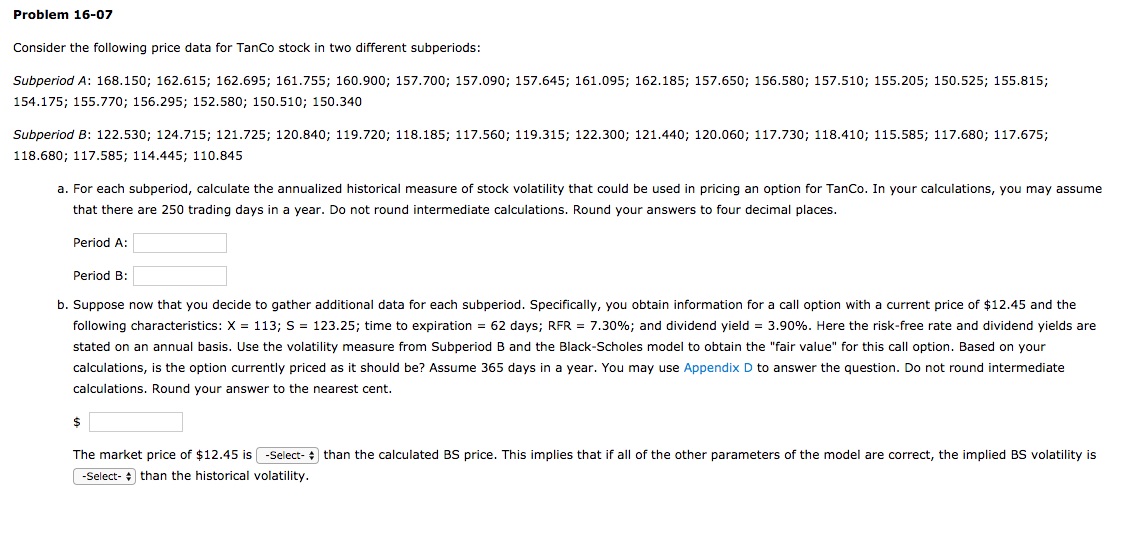

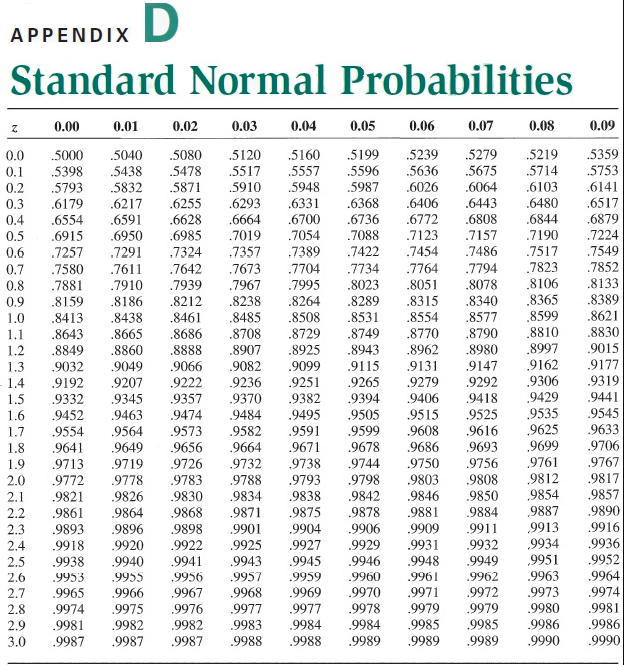

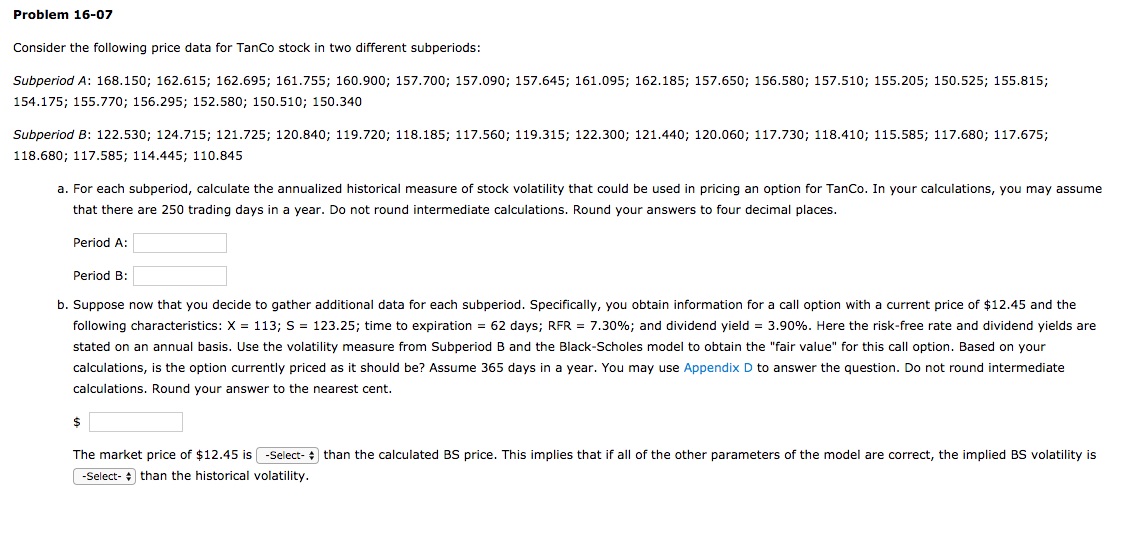

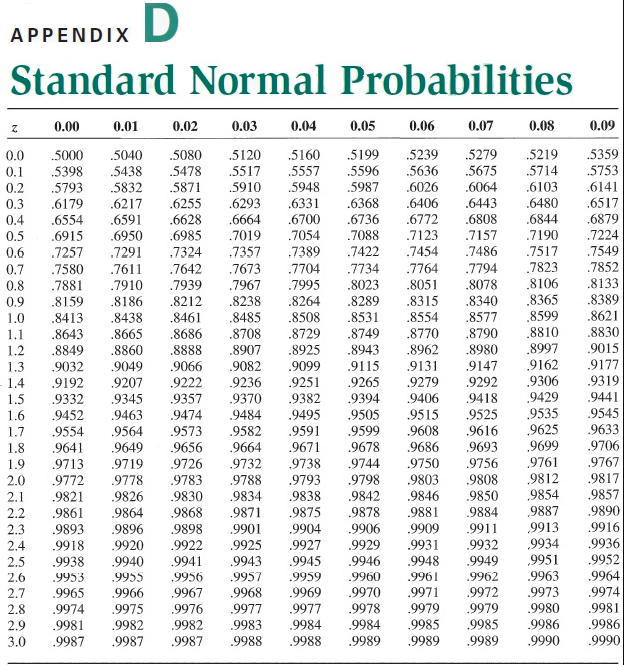

Problem 16-07 Consider the following price data for TanCo stock in two different subperiods: Subperiod A: 168.150; 162.615; 162.695; 161.755; 160.900; 157.700; 157.090; 157.645; 161.095; 162.185; 157.650; 156.580; 157.510; 155.205; 150.525; 155.815; 154.175; 155.770; 156.295; 152.580; 150.510; 150.340 Subperiod B: 122.530; 124.715; 121.725; 120.840; 119.720; 118.185; 117.560; 119.315; 122.300; 121.440; 120.060; 117.730; 118.410; 115.585; 117.680; 117.675; 118.680; 117.585; 114.445; 110.845 a. For each subperiod, calculate the annualized historical measure of stock volatility that could be used in pricing an option for TanCo. In your calculations, you may assume that there are 250 trading days in a year. Do not round intermediate calculations. Round your answers to four decimal places. Period A: Period B: b. Suppose now that you decide to gather additional data for each subperiod. Specifically, you obtain information for a call option with a current price of $12.45 and the following characteristics: X = 113; S = 123.25; time to expiration = 62 days; RFR = 7.30%; and dividend yield = 3.90%. Here the risk-free rate and dividend yields are stated on an annual basis. Use the volatility measure from Subperiod B and the Black-Scholes model to obtain the "fair value" for this call option. Based on your calculations, is the option currently priced as it should be? Assume 365 days in a year. You may use Appendix D to answer the question. Do not round intermediate calculations. Round your answer to the nearest cent. than the calculated BS price. This implies that if all of the other parameters of the model are correct, the implied BS volatility is The market price of $12.45 is -Select- -Select- than the historical volatility. APPENDIX D Standard Normal Probabilities 0.00 0.01 0.02 0.03 0.04 0.05 0.06 0.07 0.08 0.09 0.0 0.2 0.4 .6808 .8023 .7939 .8212 0.6 0.7 0.8 0.9 1.0 1.1 1.2 1.3 .8810 1.4 1.5 5000 .5040 5080 5120 .5398 5438 .5478 5478 5517 5793 58325871 5910 .6179 .6217 .6255 .6293 6554 .6591 .6628 .6664 .6915 .6950 .6985 7019 7257 .72917324 7357 .7580 .7611 .7642 .7673 .7881 .7910 .7967 .8159 .8186 .8238 .8413 .8438 .8461 .8485 .8643 .8665 .8686 .8708 .8849 .8860 .8888 .8907 .9032 .9049 .9066 .9082 9192 .9207 9222 9236 .9332 9345 9357 .9370 .9452 9463 9474 9484 9554 9564 9573 9582 .9641 .9649 9656 .9664 9713 9719 9726 9732 9772 .9778 9783 9788 9821 .9826 .9830 .9834 .9861 9864 .9868 9871 .9893 .9896 9898 9901 .9918 9920 .9922 9925 .9938 .9940 .9941 9943 9953 9955 .9956 .9957 .9965 9966 .9967 9968 9974 9975 9976 9977 9981998299829983 99879987 .99879988 5160519952395279 .5219 .5557 .5596 5636 5675 5714 .5948 5987 .6026 6103 .6331 .6368 6406 .6443 .6480 .6700 .6736 .6772 .6844 7054 .7088 .7157 .7190 7389 7422 .7454 7486 .7517 .7704 .7734 .7764 .7794 .7823 .7995 .8051 .8078 .8106 .8264 .8289 .8315 .8340 .8365 .8508 .8531 .8554 .8577 .8599 .8729 .8749 .8770 .8790 .8925 .8943 .8962 .8980 .8997 .9099 9115 .9131 .9147 9162 9251 9265 .9279 .9292 9306 .9382 .9394 9406 9418 .9429 .9495 9505 .9515 .9525 9535 .9591 .9599 .9608 .9616 9625 .9671 .9678 .9686 .9693 .9699 .9738 9744 .9750 9756 9761 9793 9798 .9803 9808 9812 9838 .9842 9846 .9850 ,9854 .9875 9878 .9881 .9884 9887 .9904 .9906 .9909 9911 9913 9927 .9929 .9931 .9932 9934 9945 9946 .9948 .9949 ,9951 .9959 .9960 9961 .9962 .9963 .9969 .9970 9971 .9972 .9973 9977 .9978 9 979 9979 9980 9984 99849985 99859986 9988 9989998999899990 .5359 .5753 .6141 .6517 .6879 .7224 .7549 .7852 .8133 .8389 .8621 .8830 .9015 9177 .9319 .9441 .9545 .9633 .9706 .9767 .9817 9857 .9890 .9916 .9936 .9952 .9964 9974 9981 9986 9990 1.7 2.0 2.1 2.4 2.7 2.8 2. 9 3.0 Problem 16-07 Consider the following price data for TanCo stock in two different subperiods: Subperiod A: 168.150; 162.615; 162.695; 161.755; 160.900; 157.700; 157.090; 157.645; 161.095; 162.185; 157.650; 156.580; 157.510; 155.205; 150.525; 155.815; 154.175; 155.770; 156.295; 152.580; 150.510; 150.340 Subperiod B: 122.530; 124.715; 121.725; 120.840; 119.720; 118.185; 117.560; 119.315; 122.300; 121.440; 120.060; 117.730; 118.410; 115.585; 117.680; 117.675; 118.680; 117.585; 114.445; 110.845 a. For each subperiod, calculate the annualized historical measure of stock volatility that could be used in pricing an option for TanCo. In your calculations, you may assume that there are 250 trading days in a year. Do not round intermediate calculations. Round your answers to four decimal places. Period A: Period B: b. Suppose now that you decide to gather additional data for each subperiod. Specifically, you obtain information for a call option with a current price of $12.45 and the following characteristics: X = 113; S = 123.25; time to expiration = 62 days; RFR = 7.30%; and dividend yield = 3.90%. Here the risk-free rate and dividend yields are stated on an annual basis. Use the volatility measure from Subperiod B and the Black-Scholes model to obtain the "fair value" for this call option. Based on your calculations, is the option currently priced as it should be? Assume 365 days in a year. You may use Appendix D to answer the question. Do not round intermediate calculations. Round your answer to the nearest cent. than the calculated BS price. This implies that if all of the other parameters of the model are correct, the implied BS volatility is The market price of $12.45 is -Select- -Select- than the historical volatility. APPENDIX D Standard Normal Probabilities 0.00 0.01 0.02 0.03 0.04 0.05 0.06 0.07 0.08 0.09 0.0 0.2 0.4 .6808 .8023 .7939 .8212 0.6 0.7 0.8 0.9 1.0 1.1 1.2 1.3 .8810 1.4 1.5 5000 .5040 5080 5120 .5398 5438 .5478 5478 5517 5793 58325871 5910 .6179 .6217 .6255 .6293 6554 .6591 .6628 .6664 .6915 .6950 .6985 7019 7257 .72917324 7357 .7580 .7611 .7642 .7673 .7881 .7910 .7967 .8159 .8186 .8238 .8413 .8438 .8461 .8485 .8643 .8665 .8686 .8708 .8849 .8860 .8888 .8907 .9032 .9049 .9066 .9082 9192 .9207 9222 9236 .9332 9345 9357 .9370 .9452 9463 9474 9484 9554 9564 9573 9582 .9641 .9649 9656 .9664 9713 9719 9726 9732 9772 .9778 9783 9788 9821 .9826 .9830 .9834 .9861 9864 .9868 9871 .9893 .9896 9898 9901 .9918 9920 .9922 9925 .9938 .9940 .9941 9943 9953 9955 .9956 .9957 .9965 9966 .9967 9968 9974 9975 9976 9977 9981998299829983 99879987 .99879988 5160519952395279 .5219 .5557 .5596 5636 5675 5714 .5948 5987 .6026 6103 .6331 .6368 6406 .6443 .6480 .6700 .6736 .6772 .6844 7054 .7088 .7157 .7190 7389 7422 .7454 7486 .7517 .7704 .7734 .7764 .7794 .7823 .7995 .8051 .8078 .8106 .8264 .8289 .8315 .8340 .8365 .8508 .8531 .8554 .8577 .8599 .8729 .8749 .8770 .8790 .8925 .8943 .8962 .8980 .8997 .9099 9115 .9131 .9147 9162 9251 9265 .9279 .9292 9306 .9382 .9394 9406 9418 .9429 .9495 9505 .9515 .9525 9535 .9591 .9599 .9608 .9616 9625 .9671 .9678 .9686 .9693 .9699 .9738 9744 .9750 9756 9761 9793 9798 .9803 9808 9812 9838 .9842 9846 .9850 ,9854 .9875 9878 .9881 .9884 9887 .9904 .9906 .9909 9911 9913 9927 .9929 .9931 .9932 9934 9945 9946 .9948 .9949 ,9951 .9959 .9960 9961 .9962 .9963 .9969 .9970 9971 .9972 .9973 9977 .9978 9 979 9979 9980 9984 99849985 99859986 9988 9989998999899990 .5359 .5753 .6141 .6517 .6879 .7224 .7549 .7852 .8133 .8389 .8621 .8830 .9015 9177 .9319 .9441 .9545 .9633 .9706 .9767 .9817 9857 .9890 .9916 .9936 .9952 .9964 9974 9981 9986 9990 1.7 2.0 2.1 2.4 2.7 2.8 2. 9 3.0