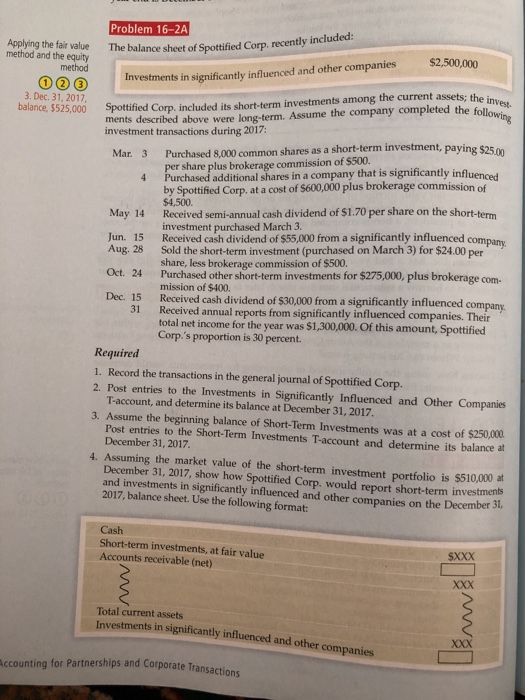

Problem 16-2A Applying the fair value method and the equity The balance sheet of Spottified Corp. recently included: $2,500,000 method Investments in significantly influenced and other companies Spottified Corp. included its short-term investments among the current assets; the invest- ments described above were long-term. Assume the company completed the following 3. Dec. 31, 2017 balance, $525,000 investment transactions during 2017: Purchased 8,000 common shares as a short-term investment, paying $25.00 Mar. 3 per share plus brokerage commission of $500 4 Purchased additional shares in a company that is significantly influenced by Spottified Corp. at a cost of $600,000 plus brokerage commission of $4,500. Received semi-annual cash dividend of $1.70 per share on the short-term. investment purchased March 3. May 14 Received cash dividend of $55,000 from a significantly influenced company Jun. 15 Sold the short-term investment (purchased on March 3) for $24.00 per share, less brokerage commission of $500. Purchased other short-term investments for $275,000, plus brokerage mission of $400. Received cash dividend of $30,000 from a significantly influenced company, Received annual reports from significantly influenced companies. Their total net income for the year was $1,300,000. Of this amount, Spottified Corp.'s proportion is 30 percent. Aug. 28 Oct. 24 com- Dec. 15 31 Required 1. Record the transactions in the general journal of Spottified Corp. 2. Post entries to the Investments in Significantly Influenced and Other Companies T-account, and determine its balance at December 31, 2017. 3. Assume the beginning balance of Short-Term Investments was at a cost of $250,000 Post entries to the Short-Term Investments T-account and determine its balance at December 31, 2017. 4. Assuming the market value of the short-term investment portfolio is $510,000 at December 31, 2017, show how Spottified Corp, would report short-term investments and investments in significantly influenced and other companies on the December 31, 2017, balance sheet. Use the following format Cash Short-term investments, at fair value Accounts receivable (net) $XXX XXX Total current assets Investments in significantly influenced and other companies XXX accounting for Partnerships and Corporate Transactions