Question

Problem 16-44 Net Present Value; Qualitative Issues (Section 1) (LO 16-1, 16-3) Special People Industries (SPI) is a nonprofit organization that employs only people with

Problem 16-44 Net Present Value; Qualitative Issues (Section 1) (LO 16-1, 16-3)

Special People Industries (SPI) is a nonprofit organization that employs only people with physical or mental disabilities. One of the organizations activities is to make cookies for its snack food store. Several years ago, Special People Industries purchased a special cookie-cutting machine. As of December 31, 20x0, this machine will have been used for three years. Management is considering the purchase of a newer, more efficient machine. If purchased, the new machine would be acquired on December 31, 20x0. Management expects to sell 300,000 dozen cookies in each of the next six years. The selling price of the cookies is expected to average $1.15 per dozen. Special People Industries has two options: continue to operate the old machine or sell the old machine and purchase the new machine. No trade-in was offered by the seller of the new machine. The following information has been assembled to help management decide which option is more desirable.

| Old Machine | New Machine | |||||

| Original cost of machine at acquisition | $ | 80,000 | $ | 120,000 | ||

| Remaining useful life as of December 31, 20x0 | 6 | years | 6 | years | ||

| Expected annual cash operating expenses: | ||||||

| Variable cost per dozen | $ | 0.38 | $ | 0.29 | ||

| Total fixed costs | $ | 21,000 | $ | 11,000 | ||

| Estimated cash value of machines: | ||||||

| December 31, 20x0 | $ | 40,000 | $ | 120,000 | ||

| December 31, 20x6 | $ | 7,000 | $ | 20,000 | ||

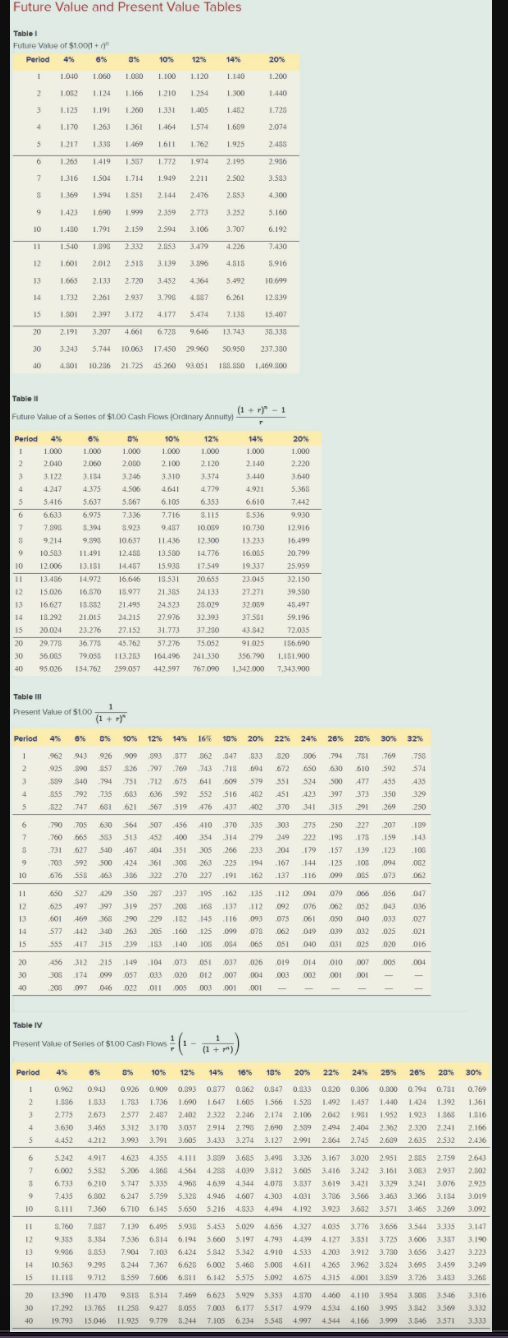

Assume that all operating revenues and expenses occur at the end of the year. Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.)

Required: 1-a. Use the net-present-value method to compute the net-present-value for the old machine and the new machine. The organization's hurdle rate is 16 percent. 1-b. Determine whether Special People Industries should retain the old machine or acquire the new machine.

Required: 1-a. Use the net-present-value method to compute the net-present-value for the old machine and the new machine. The organization's hurdle rate is 16 percent. 1-b. Determine whether Special People Industries should retain the old machine or acquire the new machine.

Use the net-present-value method to compute the net-present-value for the old machine and the new machine. The organization's hurdle rate is 16 percent. (Negative amounts should be indicated by minus sign.)

|

Determine whether Special People Industries should retain the old machine or acquire the new machine.

| |||||

Future Value and Present Value Tables Table 1 Future Value of $1.00+ Period 4% 0% 35 10% 12% 14% 20% 1 1.040 1.060 1.000 1.100 1.120 1.140 1.200 2 10 1.124 16 1.210 1254 1.300 1.440 3 1.125 1.191 1.250 1.331 1405 1.482 1.728 4 1.170 1.263 1.361 1464 1.574 1.609 2.074 5 1217 1.333 1.469 1611 1.762 1.925 2.455 6 1200 1419 1557 1.772 1914 2.193 2.956 7 1.316 1.504 1.714 1.949 2.211 2.502 3.500 S 1.360 1.594 I SSI 2.144 2.476 2.553 4.300 9 1.422 1.690 1.999 2.359 2.773 3.252 5.160 10 1.430 1.791 2.159 2.594 3.106 2.707 6.192 11 1.5.10 1.998 2.853 4236 7.430 12 1.00 2.012 SIS 139 3.596 4.818 S 916 13 1.665 2.133 2.720 3.452 4364 5.492 10.699 14 1.732 2.261 2.937 3.790 4.587 6.261 12.939 15 1.30 2.397 3.172 4.177 5.414 713 15.407 20 2.191 3.207 +661 6.725 966 13.143 33.333 30 3143 5.744 10.063 17450 29.960 50 950 237.330 10 4.SI 10.236 21.75 21.725 45.260 03051 188 DO 1,100 300 Table i (1 + )" - 1 Future Value of a series of $1.00 Cash Flows Ordinary Annuity () Period 4 89 05 104 12% 14% 20% 1 1.000 1.000 1.000 1.000 1.000 1.000 1.000 2 2010 2.050 2.100 2.120 2.1.40 2.220 3 3.122 3.154 3310 3.374 3.440 3.640 4.247 +375 4.500 4.641 4.779 4.921 5.368 5 5 416 5.637 5.567 6.105 6.353 6.610 7.442 6 6633 6.975 7326 7.716 SUS S.536 9.930 7 7.90 1 8.933 9487 10.00 10.730 12.910 3 9.214 10.637 11.436 12.300 1323 16,499 9 10.583 11.491 12.458 13.500 14.776 16.055 20.799 10 12.006 13.151 14457 15.938 17.549 19.337 25.950 32.150 11 13.406 14.972 16.646 13.531 20.655 23.015 12 15.000 16 570 18.977 21.385 24.133 27.271 39.550 13 16.627 15.552 21.495 24.523 43.497 25.029 32.393 14 13.292 21.013 24.215 27.976 37.551 59.196 15 20.004 23.276 27.152 31.773 37.250 43.842 72,035 20 29.775 36.773 45.762 57.226 75.052 9105 156.690 30 56.065 79.05 113.253 164.496 241330 356.790 1.151.900 40 95.026 154.762 259.057 442 597 767.000 1.442.000 7.343.900 Table Present Value of $100 (1 + 1 Period 4% O% 10% 12% 14% 16 10% 20% 22% 24% 20% 20% 20% 30% 32% 1 96 943 926 893 377 362 147 333 $20 306 794 751 769 750 2 935 39057 26 797 760 743 .718 604 672 000 630 610 .392 524 3 540 794 SI 712 .675 641 609 579 551 524 500 477 453 435 .855.792 735 683 636 59 552 510 482 451 397 .350 .329 5 322 747 661 621 567 519 476 437 402 370 441 315 291 264 250 6 790 .705630564 SOY 456 410 370 335 303 275 250 227 .207 199 7 760 663 583 513 400 354 314 279 198 175 159 S 731 540 461 404 .351 305 .200 204 179 .157 1.39 123 100 9 703 592 500 424 361 300 263 225 194 167 14 125 100 094 002 10 676 55 463 356 302 270 227 101 162 137 110 099 .073 002 11 650 429350 287 237 105 .162 135 112 0790 050 017 12 497 397 319257 205 165 137 112 09 076 062 052 043 036 13 601 469 366 290 229 182 145 116 093 075 050010 03 027 14 572 442 340 263 205 160 125.099 079 062 019 0.39 02 .025 021 15 555 417 315 239183140106 064 065 051 010 031 015 020 016 20 456 312 215 144 104 OT OSI 07 026 019 014 010 001 .00 004 30 174 090 057 033 020 012 .007 004 003 002 ,001 001 40 205 097 046 021 011 005 000 001 001 Table IV Present Value of series of $100 Cash Flows Period 4% 8% 3% 10% 12% 18% 13% 20% 22% 24% 25% 26% 20% 30% 1 0.962 0.943 0.926 0.909 0.9930877 0.877 0.862 0.362 0.347 0.833 0.820 0.306 0.000 0.794 0.751 0.760 2 1.556 BU 1.78 1.736 690 1617 1.605 1.566 1.525 1492 1452 1.440 1424 1.392 1161 3 2.775 2673 257 2.487 2.02 2322 2.246 2.174 2.106 2042 1981 1.05 1.923 1.365 1.816 4 3.630 3465 3.312 3.170 3.037 2914 2.795 2.690 2599 2.494 2.404 2.362 2.320 2.241 2.100 5 4.452 4.212 3.993 3.791 3.605 3.433 3.274 3.127 2.99 2.364 2.745 2.604 2.605 2.532 2.4.36 6 5.242 4917 4621 4.355 3.599 3.685 3.498 3.326 3.167 3.020 3.02005 2.951 2.555 2.759 2.60) 2 6,002 5.52 5.206 4.868 4.56 1.030 3.812 3.605 3.416 3.242 3.2423.161 3083 2.937 2.502 3 6.733 6210 3.747 3.335 4.965 461 4.344 4.078 3337 3.619 3.421 3.329 3.741 3.076 2.925 9 7.435 6.302 6.247 5.759 5.328 4.946 4.601 4.303 4,031 2.780 3.566 3:46 3.366 3.134 3.019 10 7.360 6.710 6.145 5.650 5.216 4.833 4.494 4.1923.923 3.632 3.571 3.465 3.269 3.092 11 8.760 787 7.130 6.495 5.935 3.000 4.656 4327 4015 3.776 3.656 3.544 3335 3.1.47 5.453 5 12 9.335 314 7.536 6,514 6.814 6.194 5.197 4.793 4.4.194.127 3.351 3.72 3606 3357 3.190 13 9936 31853 7904 7.103 6.424 5.842 S 4.910 1533 4200 3.9123.750 3.656 3.427 3 10.563 9.295 3.244 7.367 6,625 6002 5.466 5.000 4611 4.265 3.962 3.324 3.695 3.459 4.001 3 3.859 3.726 3.453 15 9.712 8.550 7.606 6.11 6.142 5.575 5.575 5.092 1675 4.315 3.260 20 13.590 11470 9. SIS 3.514 7469 7.469 6623 5929 5 929 5.353 4.570 4.460 4.110 3.954 3.546 3.316 30 17,292 13.765 11.2589,427 5.055 7.003 6.177 5.517 1979 4.534 4.160 3.995 3.342 3.560 3.332 40 19.793 15.046 11.925 9.779 5.244 5.244 7.105 6.234 5.543 4.997 4.544 4.166 3.999 3.546 3571 3.330

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started