Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 16-4A (Algo) FIFO: Production cost report Required information Use the following information for the Problems below. (Algo) [The following information applies to the questions

Problem 16-4A (Algo) FIFO: Production cost report

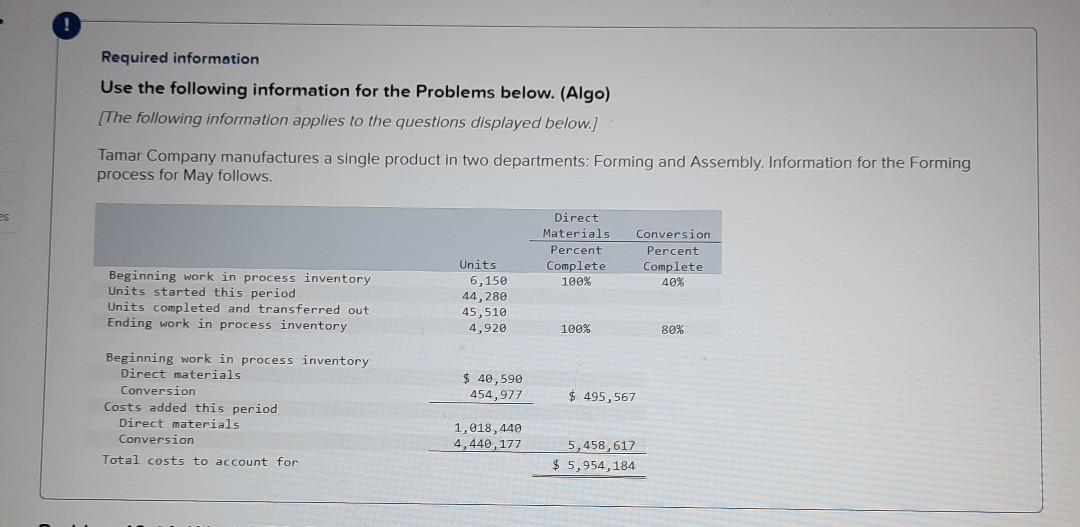

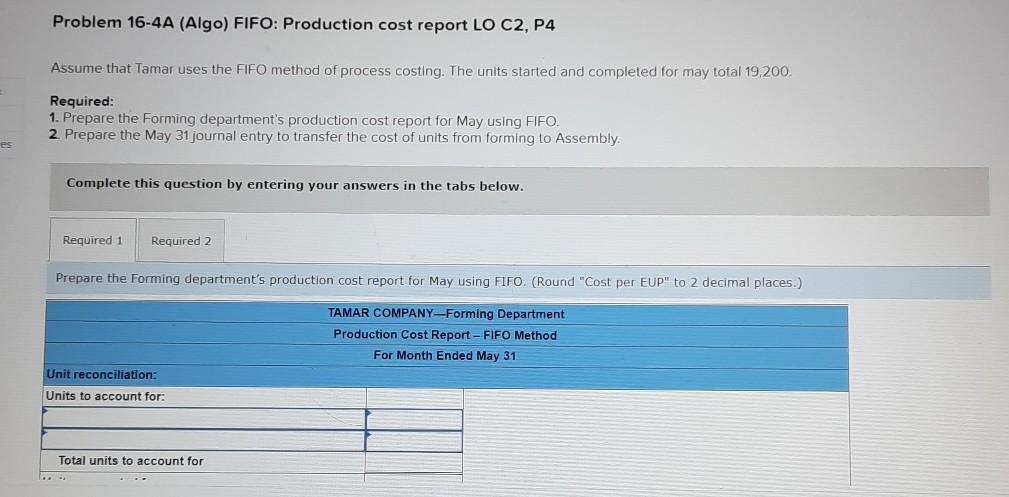

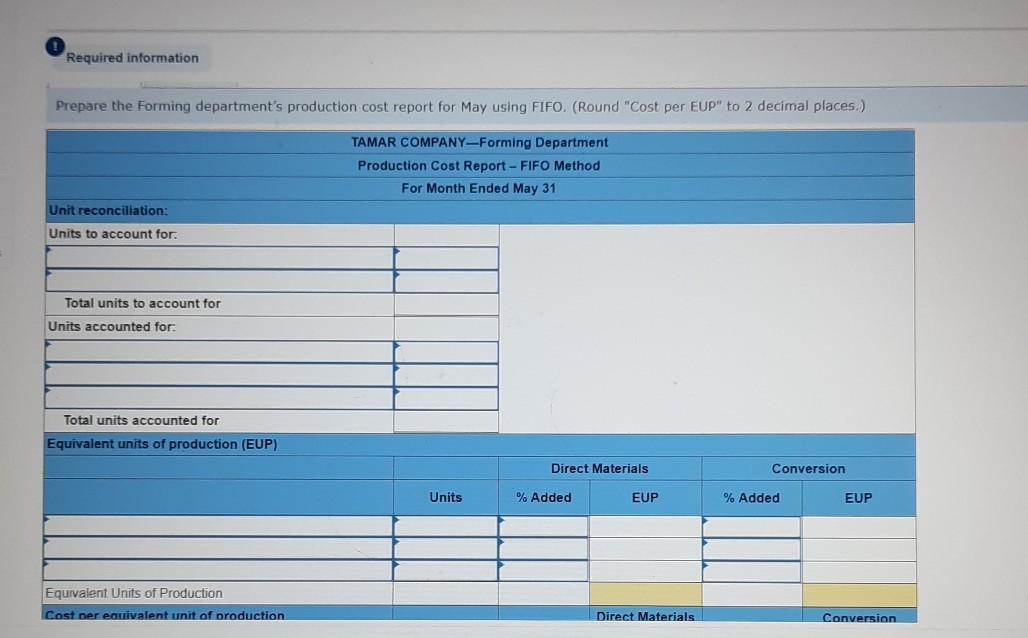

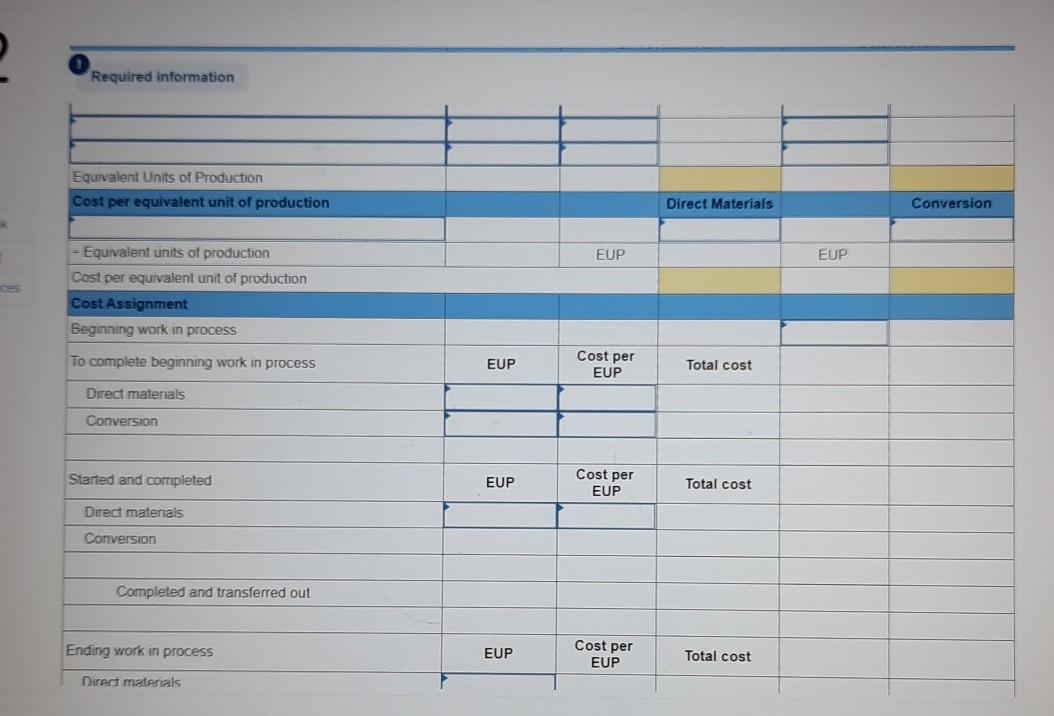

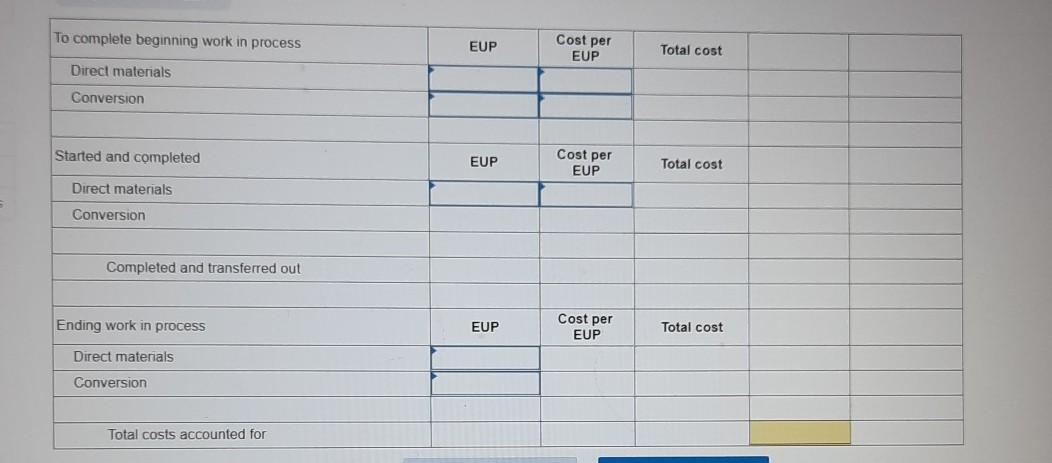

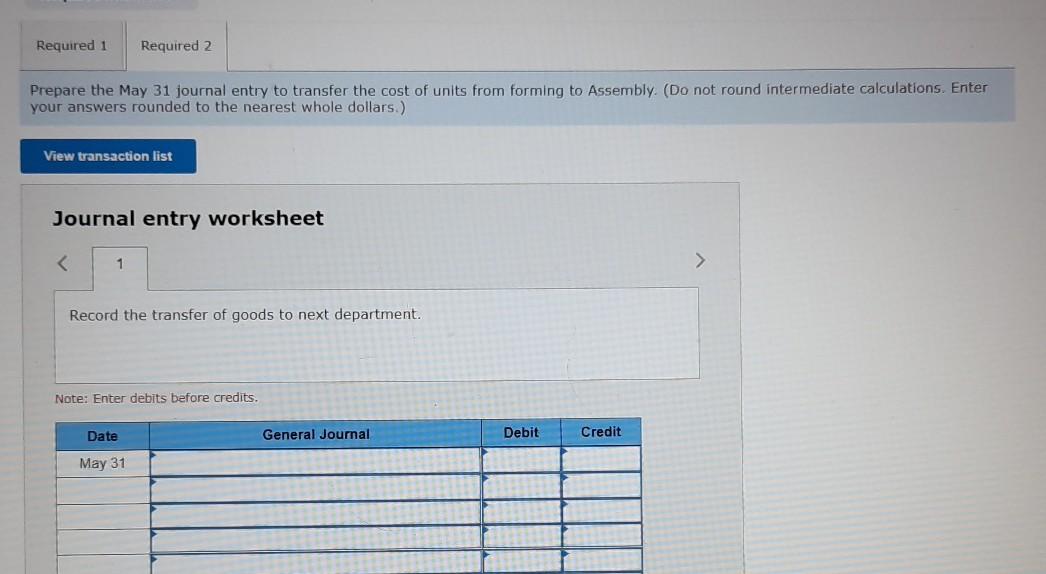

Required information Use the following information for the Problems below. (Algo) [The following information applies to the questions displayed below.) Tamar Company manufactures a single product in two departments: Forming and Assembly. Information for the Forming process for May follows. Direct Materials Percent Complete Conversion Percent Complete 40% 100% Beginning work in process inventory Units started this period Units completed and transferred out Ending work in process inventory Units 6,150 44,280 45,510 4,920 100% 80% $ 40,590 454,977 $ 495,567 Beginning work in process inventory Direct materials Conversion Costs added this period Direct materials Conversion Total costs to account for 1,018, 440 4,440, 177 5,458,617 $ 5,954,184 Problem 16-4A (Algo) FIFO: Production cost report LO C2, P4 Assume that Tamar uses the FIFO method of process costing. The units started and completed for may total 19,200. Required: 1. Prepare the Forming department's production cost report for May using FIFO. 2. Prepare the May 31 journal entry to transfer the cost of units from forming to Assembly es Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the Forming department's production cost report for May using FIFO. (Round "Cost per EUP" to 2 decimal places) TAMAR COMPANY-Forming Department Production Cost Report - FIFO Method For Month Ended May 31 Unit reconciliation: Units to account for: Total units to account for Required information Prepare the Forming department's production cost report for May using FIFO. (Round "Cost per EUP" to 2 decimal places.) TAMAR COMPANY-Forming Department Production Cost Report - FIFO Method For Month Ended May 31 Unit reconciliation: Units to account for: Total units to account for Units accounted for Total units accounted for Equivalent units of production (EUP) Direct Materials Conversion Units % Added EUP % Added EUP Equivalent Units of Production Cost per equivalent unit of production Direct Materials Conversion Required information Equivalent Units of Production Cost per equivalent unit of production Direct Materials Conversion EUP EUP - Equivalent units of production Cost per equivalent unit of production Cost Assignment Beginning work in process To complete beginning work in process EUP Cost per EUP Total cost Direct materials Conversion Started and completed Cost per EUP Total cost EUP Direct materials Conversion Completed and transferred out Ending work in process Cost per EUP EUP Total cost Direct materials Required 1 Required 2 Prepare the May 31 journal entry to transfer the cost of units from forming to Assembly. (Do not round intermediate calculations. Enter your answers rounded to the nearest whole dollars.) View transaction list Journal entry worksheet Record the transfer of goods to next department. Note: Enter debits before credits. Date General Journal Debit Credit May 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started