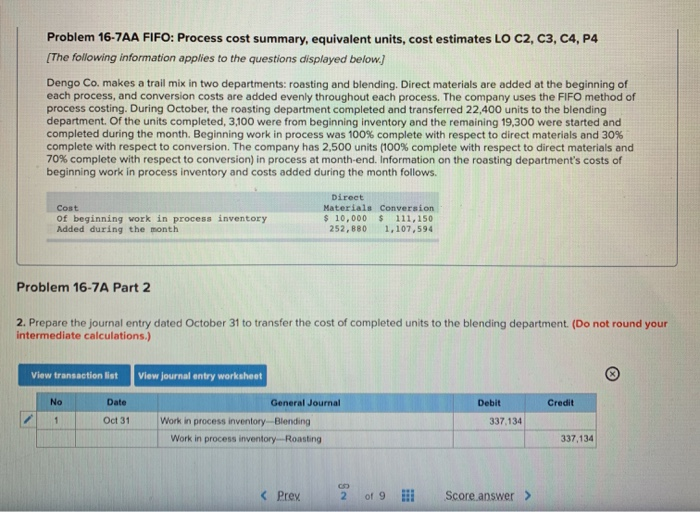

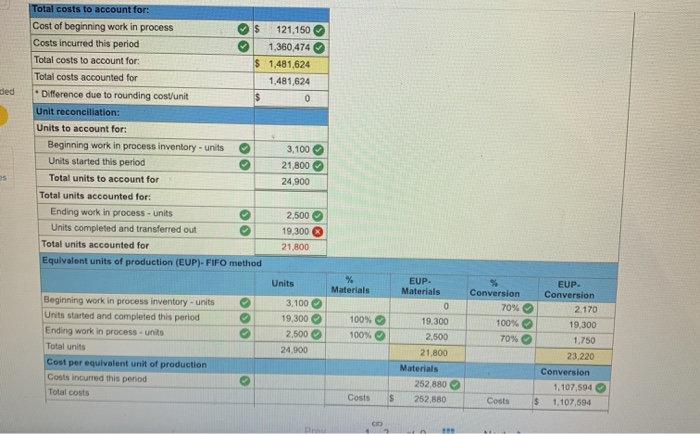

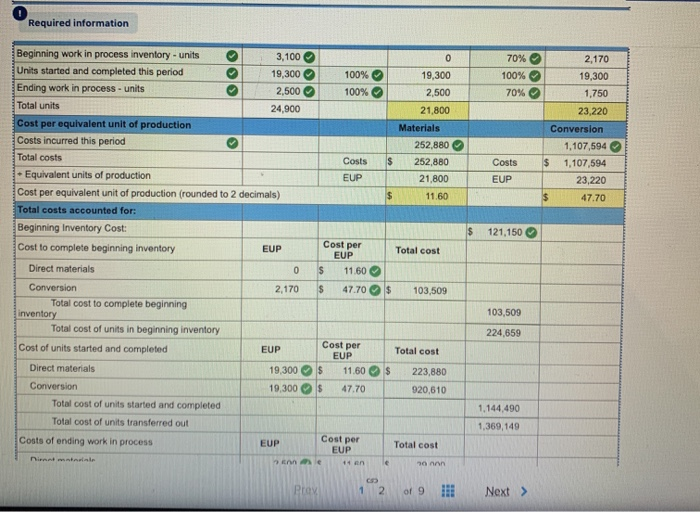

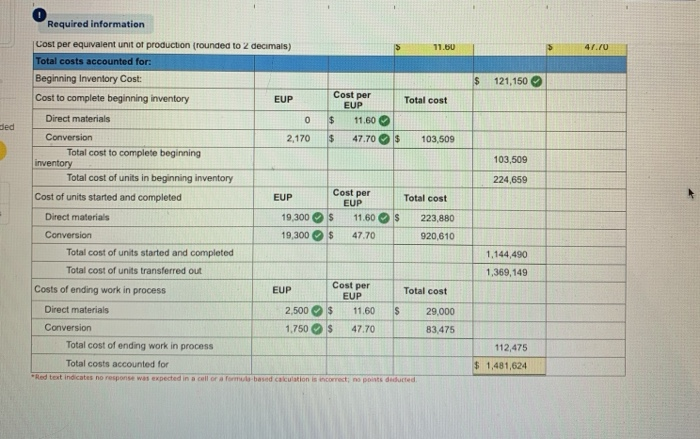

Problem 16-7AA FIFO: Process cost summary, equivalent units, cost estimates LO C2, C3, C4, P4 [The following information applies to the questions displayed below.) Dengo Co. makes a trail mix in two departments: roasting and blending Direct materials are added at the beginning of each process, and conversion costs are added evenly throughout each process. The company uses the FIFO method of process costing. During October, the roasting department completed and transferred 22,400 units to the blending department of the units completed, 3,100 were from beginning inventory and the remaining 19,300 were started and completed during the month. Beginning work in process was 100% complete with respect to direct materials and 30% complete with respect to conversion. The company has 2,500 units (100% complete with respect to direct materials and 70% complete with respect to conversion) in process at month-end. Information on the roasting department's costs of beginning work in process inventory and costs added during the month follows. Cost of beginning work in process inventory Added during the month Direct Materials Conversion $ 10,000 $ 111,150 252,880 1,107,594 Problem 16-7A Part 2 2. Prepare the journal entry dated October 31 to transfer the cost of completed units to the blending department (Do not round your intermediate calculations.) View transaction list View journal entry worksheet No Date Credit General Journal Work in process inventory-Blending Work in process inventory Roasting Debit 337,134 Oct 31 337,134 ded Total costs to account for: Cost of beginning work in process $ 121,150 Costs incurred this period 1,360,474 Total costs to account for: 1.481.624 Total costs accounted for 1,481.624 Difference due to rounding cost/unit Unit reconciliation: Units to account for: Beginning work in process inventory - units 3,100 Units started this period 21,800 Total units to account for 24.900 Total units accounted for: Ending work in process- units 2,500 Units completed and transferred out 19,300 Total units accounted for 21.800 Equivalent units of production (CUP)- FIFO method Units Units Materials Materials EUP. Materials metu pale Conversion CEUP. Conversion 70% EUP Conversion 2.170 19,300 19 300 100% 3,100 19,300 2,500 24,900 100% 100% 2.500 70% Beginning work in process inventory - units Units started and completed this period Ending work in process units Total units Cost per equivalent unit of production Costs incurred this period Total costs 1.750 21.800 23.220 Materials 252 880 Conversion 1.107.594 Costs 252 BO Costs $ 1.107,594 Required information 100% 100% 70% 100% 70% 2,170 19,300 1,750 23,220 0 19,300 2,500 21,800 Materials 252,880 252,880 21,800 11.60 Conversion Costs $ $ Costs EUP 1,107,594 1,107,594 23,220 47.70 EUP $ 121,150 Beginning work in process inventory - units 3,100 Units started and completed this period 19,300 Ending work in process - units 2,500 Total units 24.900 Cost per equivalent unit of production Costs incurred this period Total costs - Equivalent units of production Cost per equivalent unit of production (rounded to 2 decimals) Total costs accounted for: Beginning Inventory Cost: Cost to complete beginning inventory EUP Direct materials O Conversion 2,170 Total cost to complete beginning inventory Total cost of units in beginning inventory Cost of units started and completed EUP Direct materials 19.300 Conversion 19,300 Total cost of units started and completed Total cost of units transferred out Costs of ending work in process EUP Cost per EUP Total cost $ $ 11.60 47.70 $ 103,509 103,509 224,659 Cost per Total cost EUP $ $ $ 11.60 47.70 223,880 920,610 1.144.490 1,369,149 Cost per EUP Total cost 1 2 of 9 !!! Next > $ 121,150 Cost per EUP Total cost 11.60 Sed $ 47.70 $ 103,509 Required information Cost per equivalent unit of production (rounded to 2 decimals) Total costs accounted for: Beginning Inventory Cost: Cost to complete beginning inventory Direct materials Conversion 2,170 Total cost to complete beginning inventory Total cost of units in beginning inventory Cost of units started and completed EUP Direct materials 19,300 Conversion 19,300 Total cost of units started and completed Total cost of units transferred out 103,509 224,659 Cost per EUP $ $ 11.60S 47.70 Total cost 223,880 920,610 1.144,490 1,369,149 Costs of ending work in process EUP 2,500 1.750 Cost per EUP $ 11.60 $ 47.70 A7 20 Total cost $ 29,000 3 475 Direct materials Conversion Total cost of ending work in process Total costs accounted for 112,475 $ 1,481,624 incorrect: ne pos ted