Answered step by step

Verified Expert Solution

Question

1 Approved Answer

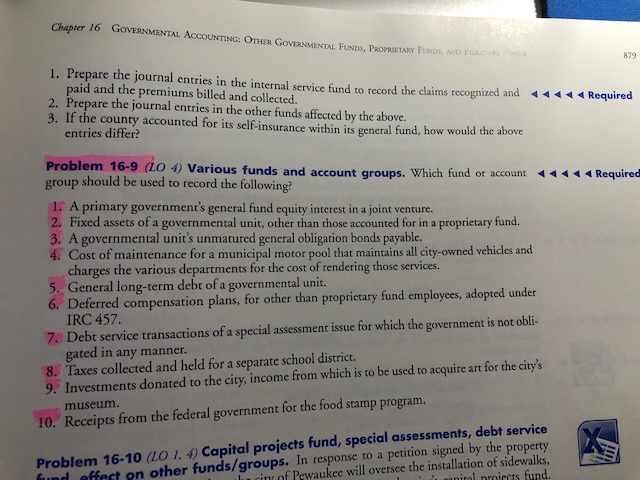

Problem 16-9 Chapter 16 GOVERNMENTAL ACCOUNTING: OUR GOVERNMENTAL OS PROPLETARY FUNDS, ORDEA 879 Required 1. Prepare the journal entries in the internal service found to

Problem 16-9

Chapter 16 GOVERNMENTAL ACCOUNTING: OUR GOVERNMENTAL OS PROPLETARY FUNDS, ORDEA 879 Required 1. Prepare the journal entries in the internal service found to record the claims recognized and paid and the premiums billed and collected 2. Prepare the journal entries in the other funds affected by the above. 3. If the county accounted for its self-insurance within its general fund, how would the above entries differ? Required Problem 16-9 (LO ) Various funds and account groups. Which fund or account group should be used to record the following? 1. A primary government's general fund equity interest in a joint venture. 2. Fixed assets of a governmental unit, other than those accounted for in a proprietary fund 3. A governmental unit's unmatured general obligation bonds payable. 4. Cost of maintenance for a municipal motor pool that maintains all city-owned vehicles and charges the various departments for the cost of rendering those services. 5. General long-term debt of a governmental unit. 6. Deferred compensation plans, for other than proprietary fund employees, adopted under IRC 457. 7. Debt service transactions of a special assessment issue for which the government is not obli- gated in any manner. 8. Taxes collected and held for a separate school district. 9. Investments donated to the city, income from which is to be used to acquire art for the city's museum. 10. Receipts from the federal government for the food stamp program. Problem 16-10 (LO 1.4) Capital projects fund, special assessments, debt service fund effect on other funds/groups. In response to a petition signed by the property L ine of Pewaukee will oversee the installation of sidewalks, capital proiects fund. Chapter 16 GOVERNMENTAL ACCOUNTING: OUR GOVERNMENTAL OS PROPLETARY FUNDS, ORDEA 879 Required 1. Prepare the journal entries in the internal service found to record the claims recognized and paid and the premiums billed and collected 2. Prepare the journal entries in the other funds affected by the above. 3. If the county accounted for its self-insurance within its general fund, how would the above entries differ? Required Problem 16-9 (LO ) Various funds and account groups. Which fund or account group should be used to record the following? 1. A primary government's general fund equity interest in a joint venture. 2. Fixed assets of a governmental unit, other than those accounted for in a proprietary fund 3. A governmental unit's unmatured general obligation bonds payable. 4. Cost of maintenance for a municipal motor pool that maintains all city-owned vehicles and charges the various departments for the cost of rendering those services. 5. General long-term debt of a governmental unit. 6. Deferred compensation plans, for other than proprietary fund employees, adopted under IRC 457. 7. Debt service transactions of a special assessment issue for which the government is not obli- gated in any manner. 8. Taxes collected and held for a separate school district. 9. Investments donated to the city, income from which is to be used to acquire art for the city's museum. 10. Receipts from the federal government for the food stamp program. Problem 16-10 (LO 1.4) Capital projects fund, special assessments, debt service fund effect on other funds/groups. In response to a petition signed by the property L ine of Pewaukee will oversee the installation of sidewalks, capital proiects fundStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started