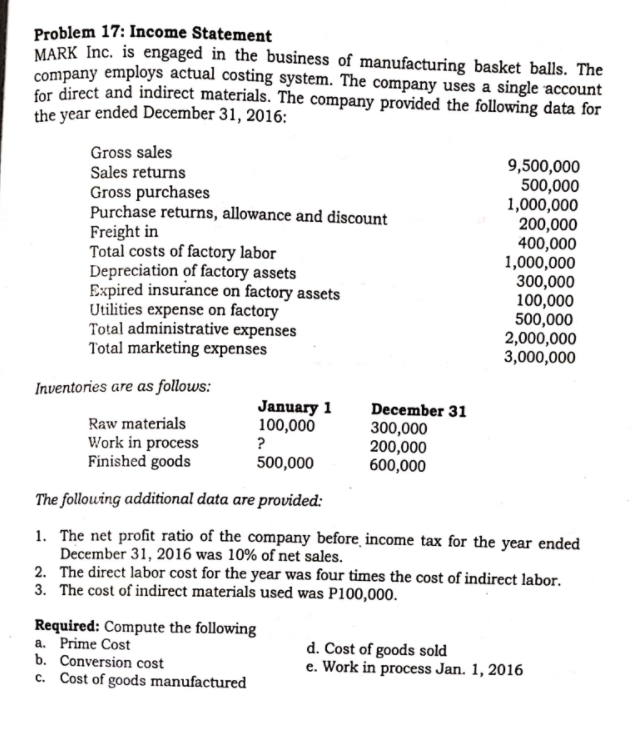

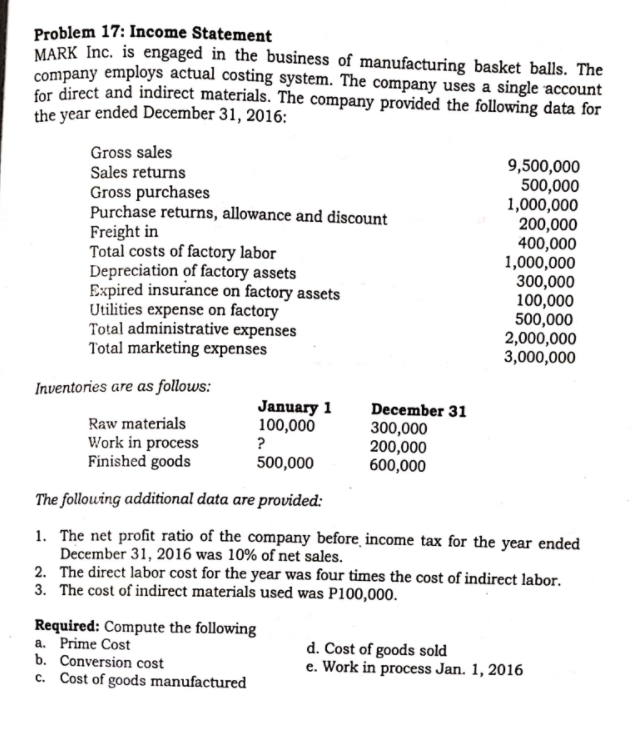

Problem 17: Income Statement MARK Inc. is engaged in the business of manufacturing basket balls. The company employs actual costing system. The company uses a single account for direct and indirect materials. The company provided the following data for the year ended December 31, 2016: Gross sales 9,500,000 Sales returns 500,000 Gross purchases 1,000,000 Purchase returns, allowance and discount 200,000 Freight in 400,000 Total costs of factory labor 1,000,000 Depreciation of factory assets 300,000 Expired insurance on factory assets 100,000 Utilities expense on factory 500,000 Total administrative expenses 2,000,000 Total marketing expenses 3,000,000 Inventories are as follows: Raw materials Work in process Finished goods January 1 100,000 ? 500,000 December 31 300,000 200,000 600,000 The following additional data are provided: 1. The net profit ratio of the company before income tax for the year ended December 31, 2016 was 10% of net sales. 2. The direct labor cost for the year was four times the cost of indirect labor. 3. The cost of indirect materials used was P100,000. Required: Compute the following a. Prime Cost d. Cost of goods sold b. Conversion cost e. Work in process Jan. 1, 2016 C. Cost of goods manufactured Problem 17: Income Statement MARK Inc. is engaged in the business of manufacturing basket balls. The company employs actual costing system. The company uses a single account for direct and indirect materials. The company provided the following data for the year ended December 31, 2016: Gross sales 9,500,000 Sales returns 500,000 Gross purchases 1,000,000 Purchase returns, allowance and discount 200,000 Freight in 400,000 Total costs of factory labor 1,000,000 Depreciation of factory assets 300,000 Expired insurance on factory assets 100,000 Utilities expense on factory 500,000 Total administrative expenses 2,000,000 Total marketing expenses 3,000,000 Inventories are as follows: Raw materials Work in process Finished goods January 1 100,000 ? 500,000 December 31 300,000 200,000 600,000 The following additional data are provided: 1. The net profit ratio of the company before income tax for the year ended December 31, 2016 was 10% of net sales. 2. The direct labor cost for the year was four times the cost of indirect labor. 3. The cost of indirect materials used was P100,000. Required: Compute the following a. Prime Cost d. Cost of goods sold b. Conversion cost e. Work in process Jan. 1, 2016 C. Cost of goods manufactured