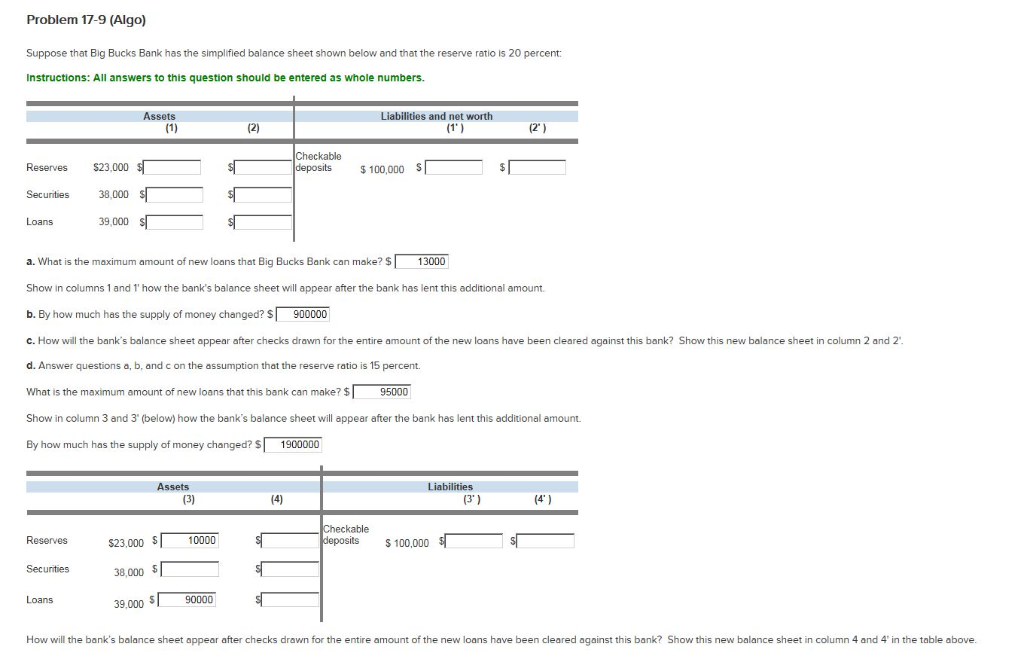

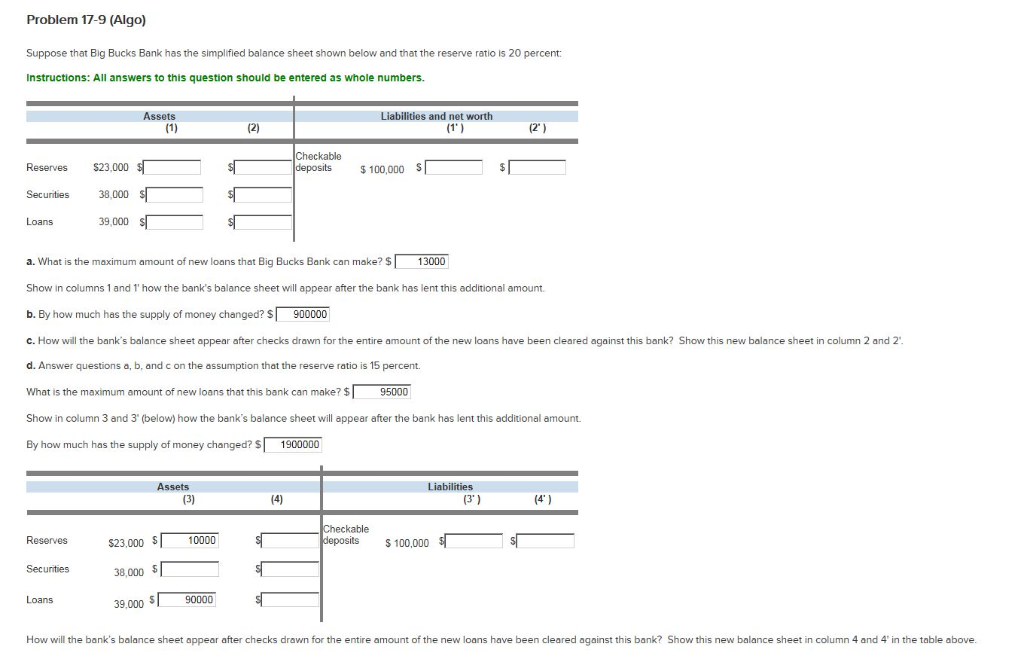

Problem 17-9 (Algo) Suppose that Big Bucks Bank has the simplified balance sheet shown below and that the reserve ratio is 20 percent: Instructions: All answers to this question should be entered as whole numbers. Assets Liabilities and net worth (1 Checkable Reserves $23,000 Securities Loans 100,000 S 38,000 39,000 a. What is the maximum amount of new loans that Big Bucks Bank can make? $13000 Show in columns 1 and 1' how the bank's balance sheet will appear after the bank has lent this additional amount. b. By how much has the supply of money changed? S 900000 c. How will the bank's balance sheet appear after checks drawn for the entire amount of the new loans have been cleared against this bank? Show this new balance sheet in column 2 and 2 d. Answer questions a, b, and c on the assumption that the reserve ratio is 15 percent. What is the maximum amount of new loans that this bank can make? $ 95000 Show in column 3 and 3(below) how the bank's balance sheet will appear after the bank has lent this additional amount. By how much has the supply of money changed? 1900000 Assets Liabilities ckable Reserves S23,000 S 38,000 39,000 S 10000 S 100,000 Securities Loans 90000 How will the bank's balance sheet appear after checks drawn for the entire amount of the new loans have been cleared against this bank? Show this new balance sheet in column 4 and 4' in the table above. Problem 17-9 (Algo) Suppose that Big Bucks Bank has the simplified balance sheet shown below and that the reserve ratio is 20 percent: Instructions: All answers to this question should be entered as whole numbers. Assets Liabilities and net worth (1 Checkable Reserves $23,000 Securities Loans 100,000 S 38,000 39,000 a. What is the maximum amount of new loans that Big Bucks Bank can make? $13000 Show in columns 1 and 1' how the bank's balance sheet will appear after the bank has lent this additional amount. b. By how much has the supply of money changed? S 900000 c. How will the bank's balance sheet appear after checks drawn for the entire amount of the new loans have been cleared against this bank? Show this new balance sheet in column 2 and 2 d. Answer questions a, b, and c on the assumption that the reserve ratio is 15 percent. What is the maximum amount of new loans that this bank can make? $ 95000 Show in column 3 and 3(below) how the bank's balance sheet will appear after the bank has lent this additional amount. By how much has the supply of money changed? 1900000 Assets Liabilities ckable Reserves S23,000 S 38,000 39,000 S 10000 S 100,000 Securities Loans 90000 How will the bank's balance sheet appear after checks drawn for the entire amount of the new loans have been cleared against this bank? Show this new balance sheet in column 4 and 4' in the table above