Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 18-112 (Algo) DJG Corporation purchased land in order to... DJG Corporation purchased land in order to build new corporate headquarters for a purchase

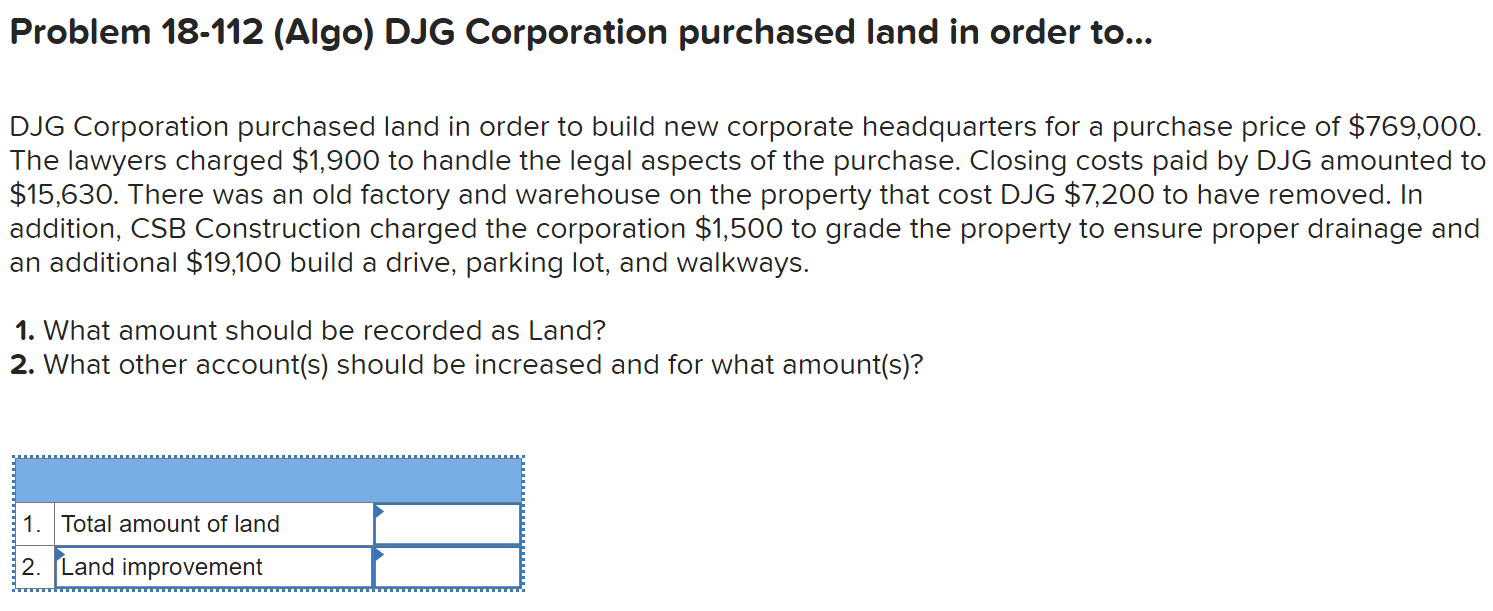

Problem 18-112 (Algo) DJG Corporation purchased land in order to... DJG Corporation purchased land in order to build new corporate headquarters for a purchase price of $769,000. The lawyers charged $1,900 to handle the legal aspects of the purchase. Closing costs paid by DJG amounted to $15,630. There was an old factory and warehouse on the property that cost DJG $7,200 to have removed. In addition, CSB Construction charged the corporation $1,500 to grade the property to ensure proper drainage and an additional $19,100 build a drive, parking lot, and walkways. 1. What amount should be recorded as Land? 2. What other account(s) should be increased and for what amount(s)? 1. Total amount of land 2. Land improvement

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 The amount that should be recorded as Land is the purchase price of th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started