Answered step by step

Verified Expert Solution

Question

1 Approved Answer

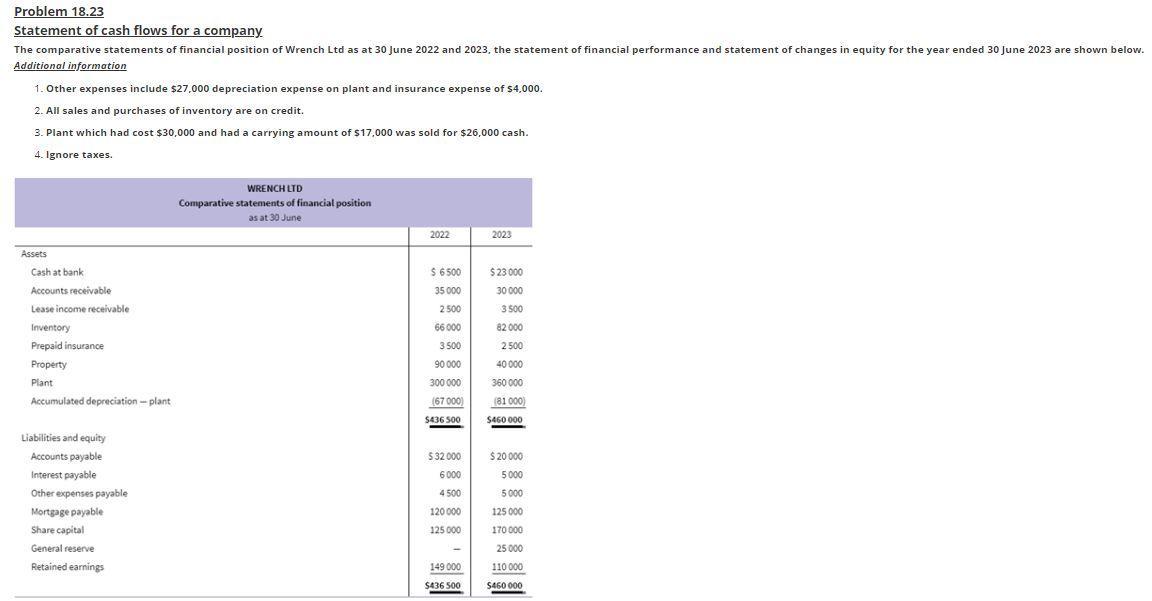

Problem 18.23 Statement of cash flows for a company The comparative statements of financial position of Wrench Ltd as at 30 June 2022 and

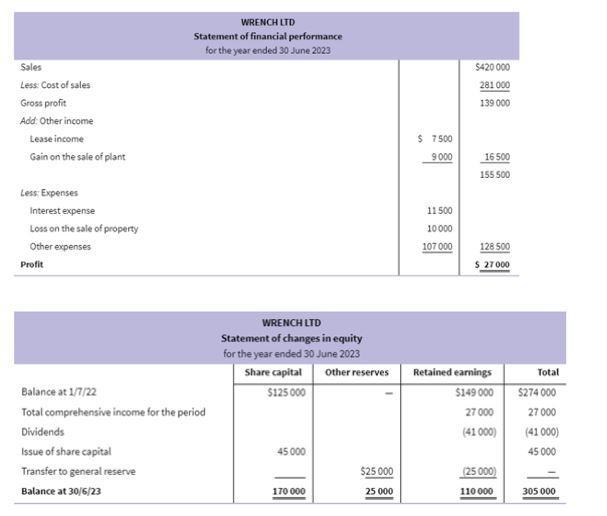

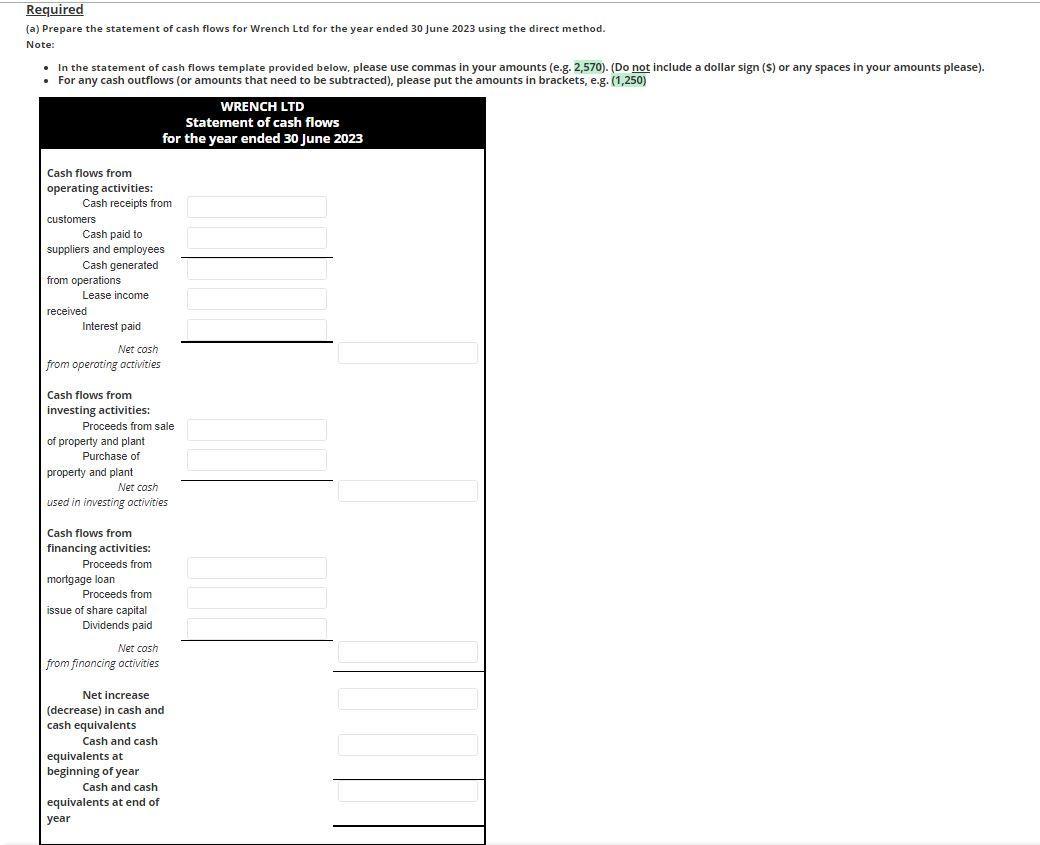

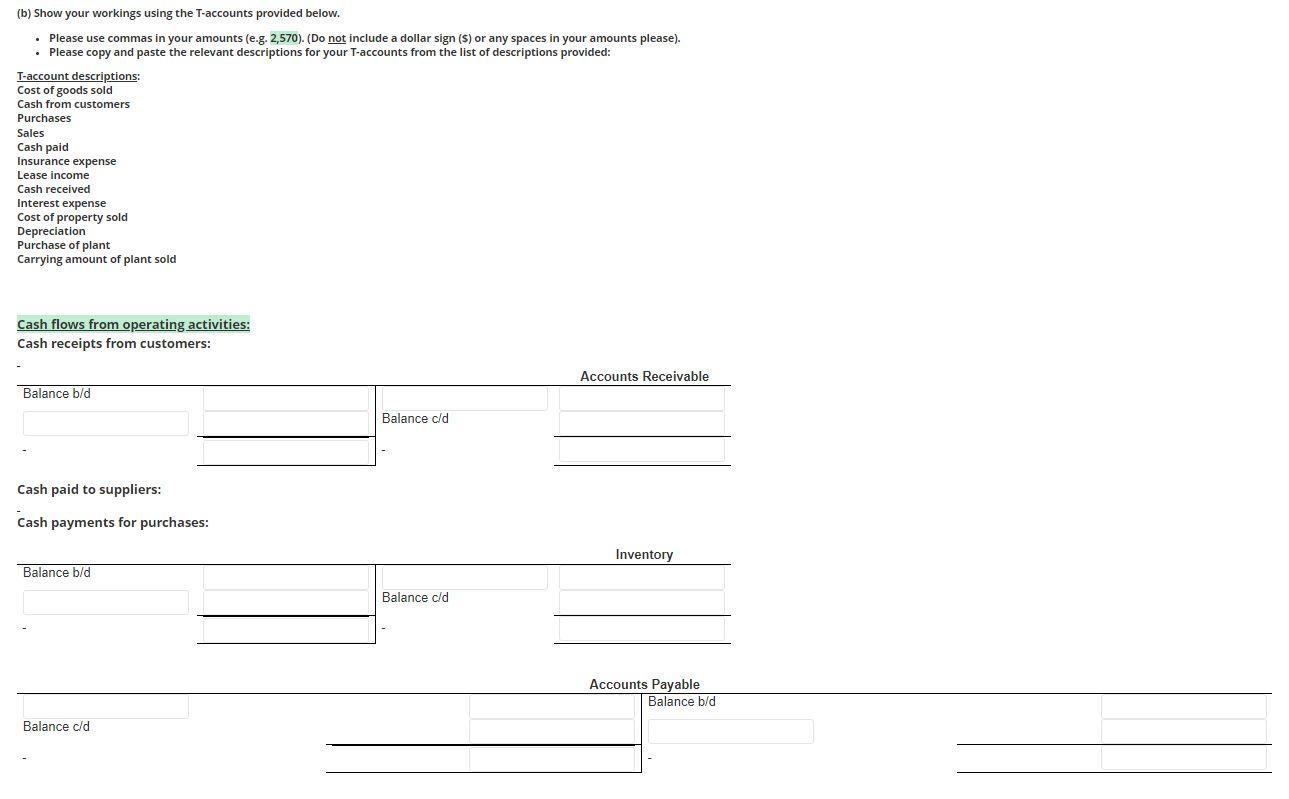

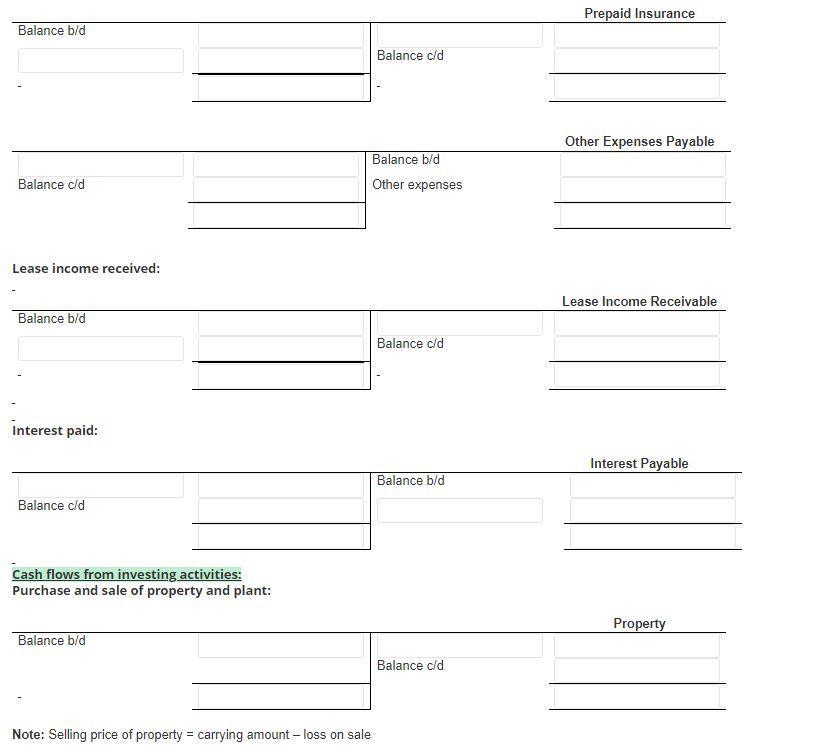

Problem 18.23 Statement of cash flows for a company The comparative statements of financial position of Wrench Ltd as at 30 June 2022 and 2023, the statement of financial performance and statement of changes in equity for the year ended 30 June 2023 are shown below. Additional information 1. Other expenses include $27,000 depreciation expense on plant and insurance expense of $4,000. 2. All sales and purchases of inventory are on credit. 3. Plant which had cost $30,000 and had a carrying amount of $17,000 was sold for $26,000 cash. 4. Ignore taxes. Assets Cash at bank Accounts receivable Lease income receivable Inventory Prepaid insurance Property Plant Accumulated depreciation-plant Liabilities and equity Accounts payable Interest payable Other expenses payable Mortgage payable Share capital General reserve Retained earnings WRENCH LTD Comparative statements of financial position as at 30 June 2022 $ 6500 35 000 2.500 66 000 3.500 90 000 300 000 (67000) $436 500 $32000 6.000 4500 120 000 125 000 149 000 $436 500 2023 $ 23000 30 000 3500 82000 2500 40 000 360 000 (81 000) $460 000 $20 000 5000 5000 125 000 170 000 25 000 110 000 $460 000 Sales Less: Cost of sales Gross profit Add: Other income Lease income Gain on the sale of plant Less: Expenses Interest expense Loss on the sale of property Other expenses Profit WRENCH LTD Statement of financial performance for the year ended 30 June 2023 Balance at 1/7/22 Total comprehensive income for the period Dividends Issue of share capital Transfer to general reserve Balance at 30/6/23 WRENCH LTD Statement of changes in equity for the year ended 30 June 2023 Share capital $125 000 45.000 170 000 Other reserves $25 000 25 000 $ 7.500 9000 11500 10 000 107 000 $420 000 281 000 139 000 16 500 155.500 128 500 $ 27000 Retained earnings $149 000 27 000 (41000) (25000) 110 000 Total $274 000 27 000 (41000) 45 000 305 000 Required (a) Prepare the statement of cash flows for Wrench Ltd for the year ended 30 June 2023 using the direct method. Note: In the statement of cash flows template provided below, please use commas in your amounts (e.g. 2,570). (Do not include a dollar sign ($) or any spaces in your amounts please). For any cash outflows (or amounts that need to be subtracted), please put the amounts in brackets, e.g. (1,250) Cash flows from operating activities: Cash receipts from customers Cash paid to suppliers and employees Cash generated from operations Lease income received Interest paid Net cosh from operating activities Cash flows from investing activities: Proceeds from sale of property and plant Purchase of property and plant Net cash used in investing activities Cash flows from financing activities: Proceeds from mortgage loan Proceeds from WRENCH LTD Statement of cash flows for the year ended 30 June 2023 issue of share capital Dividends paid Net cosh from financing activities Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year (b) Show your workings using the T-accounts provided below. Please use commas in your amounts (e.g. 2,570). (Do not include a dollar sign ($) or any spaces in your amounts please). . Please copy and paste the relevant descriptions for your T-accounts from the list of descriptions provided: T-account descriptions: Cost of goods sold Cash from customers Purchases Sales Cash paid Insurance expense Lease income Cash received Interest expense Cost of property sold Depreciation Purchase of plant Carrying amount of plant sold Cash flows from operating activities: Cash receipts from customers: Balance b/d Cash paid to suppliers: Cash payments for purchases: Balance b/d Balance c/d Balance c/d Balance c/d Accounts Receivable Inventory Accounts Payable Balance b/d Balance b/d Balance c/d Lease income received: Balance b/d Interest paid: Balance c/d Cash flows from investing activities: Purchase and sale of property and plant: Balance b/d Balance c/d Balance b/d Other expenses Note: Selling price of property = carrying amount-loss on sale Balance c/d Balance b/d Balance c/d Prepaid Insurance Other Expenses Payable Lease Income Receivable Interest Payable Property Problem 18.23 Statement of cash flows for a company The comparative statements of financial position of Wrench Ltd as at 30 June 2022 and 2023, the statement of financial performance and statement of changes in equity for the year ended 30 June 2023 are shown below. Additional information 1. Other expenses include $27,000 depreciation expense on plant and insurance expense of $4,000. 2. All sales and purchases of inventory are on credit. 3. Plant which had cost $30,000 and had a carrying amount of $17,000 was sold for $26,000 cash. 4. Ignore taxes. Assets Cash at bank Accounts receivable Lease income receivable Inventory Prepaid insurance Property Plant Accumulated depreciation-plant Liabilities and equity Accounts payable Interest payable Other expenses payable Mortgage payable Share capital General reserve Retained earnings WRENCH LTD Comparative statements of financial position as at 30 June 2022 $ 6500 35 000 2.500 66 000 3.500 90 000 300 000 (67000) $436 500 $32000 6.000 4500 120 000 125 000 149 000 $436 500 2023 $ 23000 30 000 3500 82000 2500 40 000 360 000 (81 000) $460 000 $20 000 5000 5000 125 000 170 000 25 000 110 000 $460 000 Sales Less: Cost of sales Gross profit Add: Other income Lease income Gain on the sale of plant Less: Expenses Interest expense Loss on the sale of property Other expenses Profit WRENCH LTD Statement of financial performance for the year ended 30 June 2023 Balance at 1/7/22 Total comprehensive income for the period Dividends Issue of share capital Transfer to general reserve Balance at 30/6/23 WRENCH LTD Statement of changes in equity for the year ended 30 June 2023 Share capital $125 000 45.000 170 000 Other reserves $25 000 25 000 $ 7.500 9000 11500 10 000 107 000 $420 000 281 000 139 000 16 500 155.500 128 500 $ 27000 Retained earnings $149 000 27 000 (41000) (25000) 110 000 Total $274 000 27 000 (41000) 45 000 305 000 Required (a) Prepare the statement of cash flows for Wrench Ltd for the year ended 30 June 2023 using the direct method. Note: In the statement of cash flows template provided below, please use commas in your amounts (e.g. 2,570). (Do not include a dollar sign ($) or any spaces in your amounts please). For any cash outflows (or amounts that need to be subtracted), please put the amounts in brackets, e.g. (1,250) Cash flows from operating activities: Cash receipts from customers Cash paid to suppliers and employees Cash generated from operations Lease income received Interest paid Net cosh from operating activities Cash flows from investing activities: Proceeds from sale of property and plant Purchase of property and plant Net cash used in investing activities Cash flows from financing activities: Proceeds from mortgage loan Proceeds from WRENCH LTD Statement of cash flows for the year ended 30 June 2023 issue of share capital Dividends paid Net cosh from financing activities Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year (b) Show your workings using the T-accounts provided below. Please use commas in your amounts (e.g. 2,570). (Do not include a dollar sign ($) or any spaces in your amounts please). . Please copy and paste the relevant descriptions for your T-accounts from the list of descriptions provided: T-account descriptions: Cost of goods sold Cash from customers Purchases Sales Cash paid Insurance expense Lease income Cash received Interest expense Cost of property sold Depreciation Purchase of plant Carrying amount of plant sold Cash flows from operating activities: Cash receipts from customers: Balance b/d Cash paid to suppliers: Cash payments for purchases: Balance b/d Balance c/d Balance c/d Balance c/d Accounts Receivable Inventory Accounts Payable Balance b/d Balance b/d Balance c/d Lease income received: Balance b/d Interest paid: Balance c/d Cash flows from investing activities: Purchase and sale of property and plant: Balance b/d Balance c/d Balance b/d Other expenses Note: Selling price of property = carrying amount-loss on sale Balance c/d Balance b/d Balance c/d Prepaid Insurance Other Expenses Payable Lease Income Receivable Interest Payable Property

Step by Step Solution

★★★★★

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started