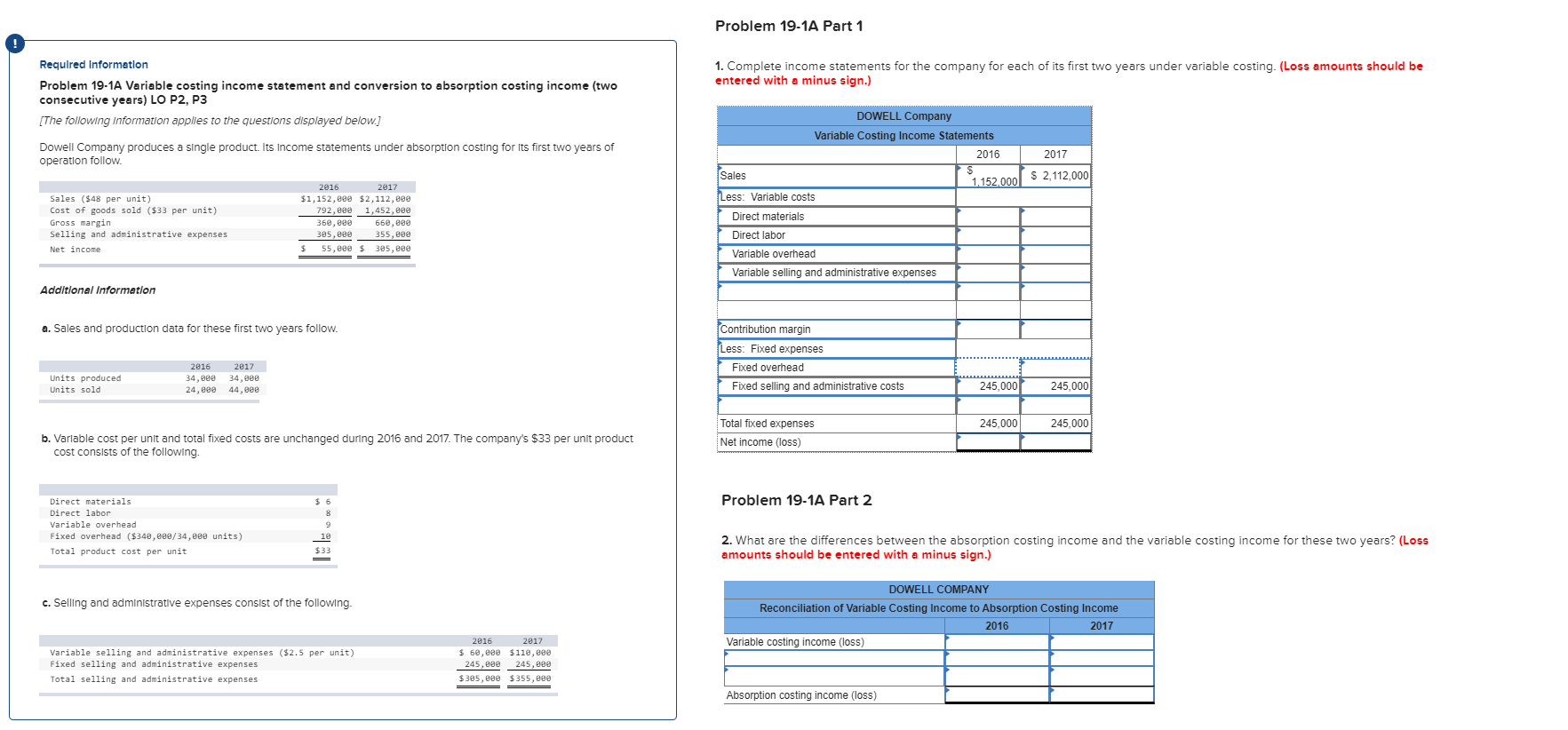

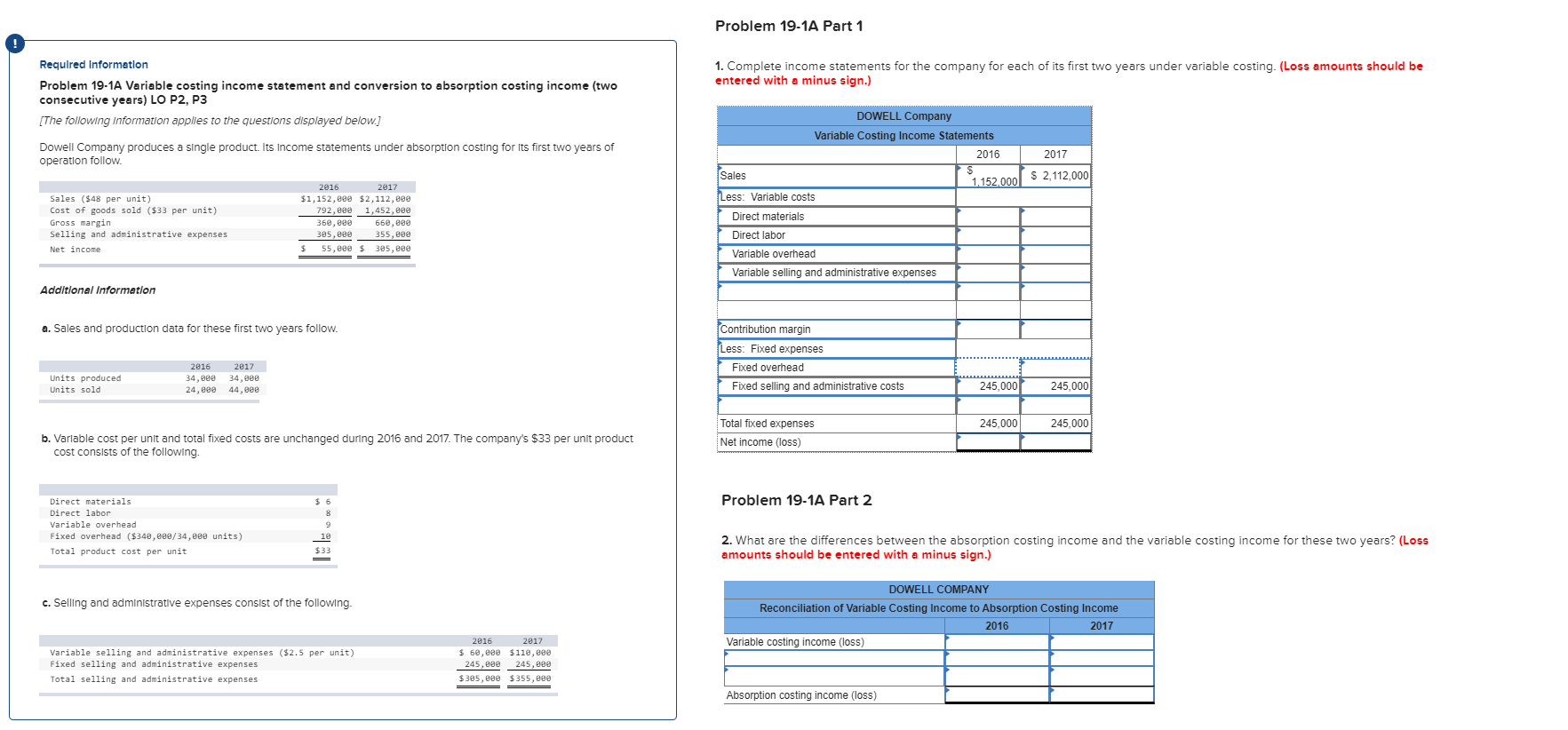

Problem 19-1A Part 1 1. Complete income statements for the company for each of its first two years under variable costing. (Loss amounts should be entered with a minus sign.) Required Information Problem 19-1A Variable costing income statement and conversion to absorption costing income (two consecutive years) LO P2, P3 [The following Information applies to the questions displayed below.] Dowell Company produces a single product. Its Income statements under absorption costing for its first two years of operation follow Sales ($48 per unit) Cost of goods sold ($33 per unit) Gross margin Selling and administrative expenses Net income 2016 2017 $1,152,800 $2,112,800 792,200 1,452,800 360,800 660,800 305,882 355,800 $ 55,200 $ 305,000 DOWELL Company Variable Costing Income Statements 2016 2017 Sales 1.152.000 $ 2,112,000 Less: Variable costs Direct materials Direct labor Variable overhead Variable selling and administrative expenses Additional Information a. Sales and production data for these first two years follow. Contribution margin Less: Fixed expenses Fixed overhead Fixed selling and administrative costs Units produced Units sold 2016 34,00 24,000 2017 34,000 44,000 245,000 245,000 245,000 245,000 b. Variable cost per unit and total fixed costs are unchanged during 2016 and 2017. The company's $33 per unit product cost consists of the following. Total fixed expenses Net income (loss) Problem 19-1A Part 2 Direct materials Direct labor Variable overhead Fixed overhead ($340,000/ 34,000 units) Total product cost per unit 2. What are the differences between the absorption costing income and the variable costing income for these two years? (Loss amounts should be entered with a minus sign.) c. Selling and administrative expenses consist of the following. DOWELL COMPANY Reconciliation of Variable Costing Income to Absorption Costing Income 2016 2017 Variable costing income (loss) Variable selling and administrative expenses ($2.5 per unit) Fixed selling and administrative expenses Total selling and administrative expenses 2016 $69.899 245,899 $305,200 2017 $110.89 245,800 $355,800 Absorption costing income (loss)