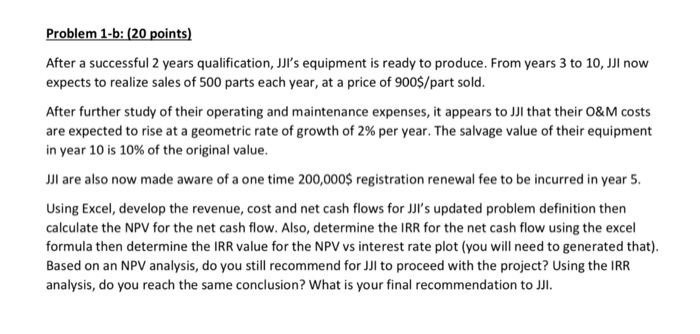

Problem 1-b: (20 points) After a successful 2 years qualification, JJI's equipment is ready to produce. From years 3 to 10, JJI now expects to realize sales of 500 parts each year, at a price of 900$/part sold. After further study of their operating and maintenance expenses, it appears to Jl that their O&M costs are expected to rise at a geometric rate of growth of 2% per year. The salvage value of their equipment in year 10 is 10% of the original value. JJI are also now made aware of a one time 200,000$ registration renewal fee to be incurred in year 5. Using Excel, develop the revenue, cost and net cash flows for Jl's updated problem definition then calculate the NPV for the net cash flow. Also, determine the IRR for the net cash flow using the excel formula then determine the IRR value for the NPV vs interest rate plot (you will need to generated that). Based on an NPV analysis, do you still recommend for JJl to proceed with the project? Using the IRR analysis, do you reach the same conclusion? What is your final recommendation to JJI. Problem 1-b: (20 points) After a successful 2 years qualification, JJI's equipment is ready to produce. From years 3 to 10, JJI now expects to realize sales of 500 parts each year, at a price of 900$/part sold. After further study of their operating and maintenance expenses, it appears to Jl that their O&M costs are expected to rise at a geometric rate of growth of 2% per year. The salvage value of their equipment in year 10 is 10% of the original value. JJI are also now made aware of a one time 200,000$ registration renewal fee to be incurred in year 5. Using Excel, develop the revenue, cost and net cash flows for Jl's updated problem definition then calculate the NPV for the net cash flow. Also, determine the IRR for the net cash flow using the excel formula then determine the IRR value for the NPV vs interest rate plot (you will need to generated that). Based on an NPV analysis, do you still recommend for JJl to proceed with the project? Using the IRR analysis, do you reach the same conclusion? What is your final recommendation to JJI