Answered step by step

Verified Expert Solution

Question

1 Approved Answer

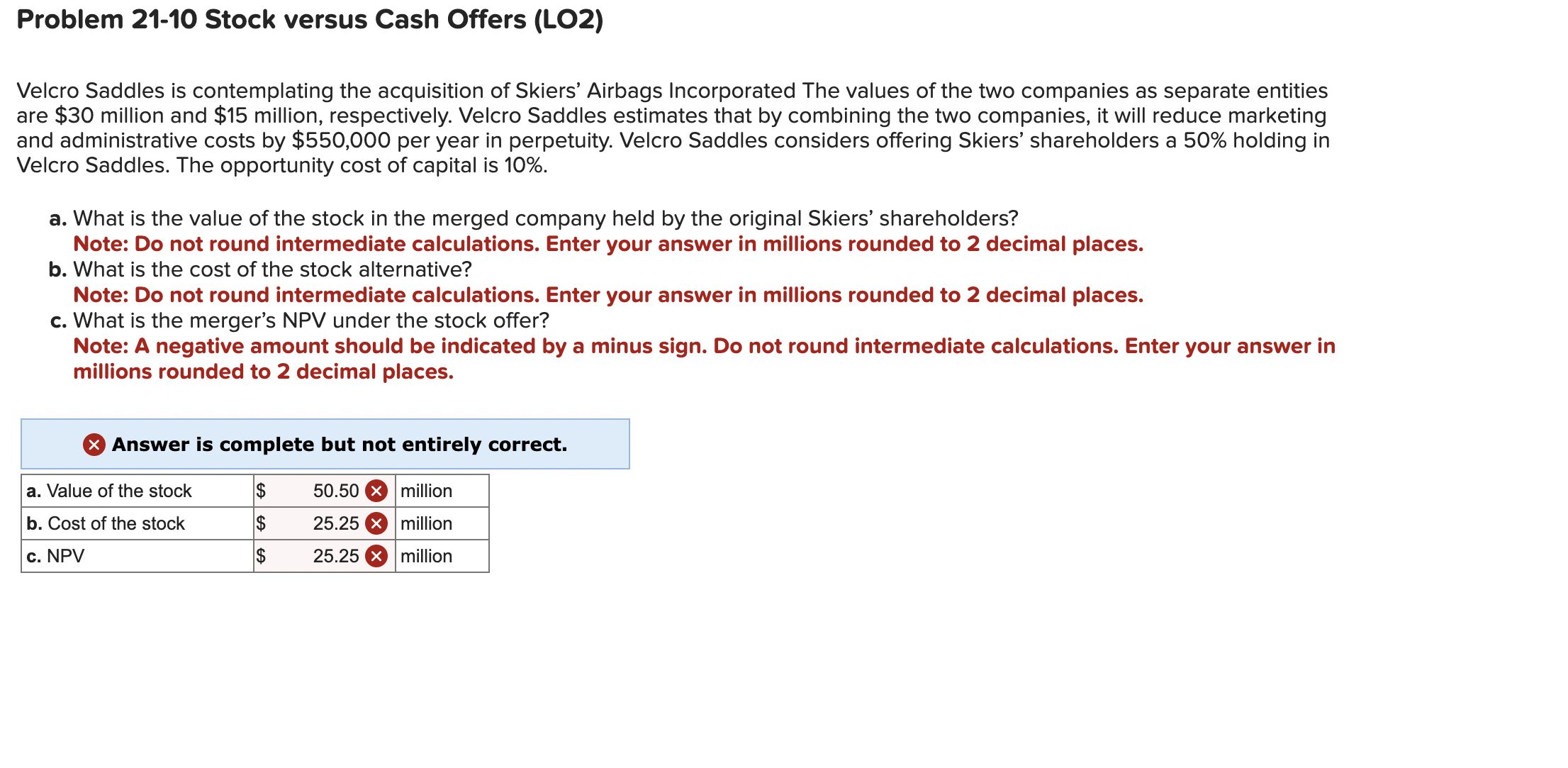

Problem 2 1 - 1 0 Stock versus Cash Offers ( LO 2 ) Velcro Saddles is contemplating the acquisition of Skiers' Airbags Incorporated The

Problem Stock versus Cash Offers LO

Velcro Saddles is contemplating the acquisition of Skiers' Airbags Incorporated The values of the two companies as separate entities

are $ million and $ million, respectively. Velcro Saddles estimates that by combining the two companies, it will reduce marketing

and administrative costs by $ per year in perpetuity. Velcro Saddles considers offering Skiers' shareholders a holding in

Velcro Saddles. The opportunity cost of capital is

a What is the value of the stock in the merged company held by the original Skiers' shareholders?

Note: Do not round intermediate calculations. Enter your answer in millions rounded to decimal places.

b What is the cost of the stock alternative?

Note: Do not round intermediate calculations. Enter your answer in millions rounded to decimal places.

c What is the merger's NPV under the stock offer?

Note: A negative amount should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer in

millions rounded to decimal places.

Answer is complete but not entirely correct.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started