Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 2 1 - 2 Robust Properties is planning to go public by creating a REIT that will offer 1 , 4 9 0 ,

Problem

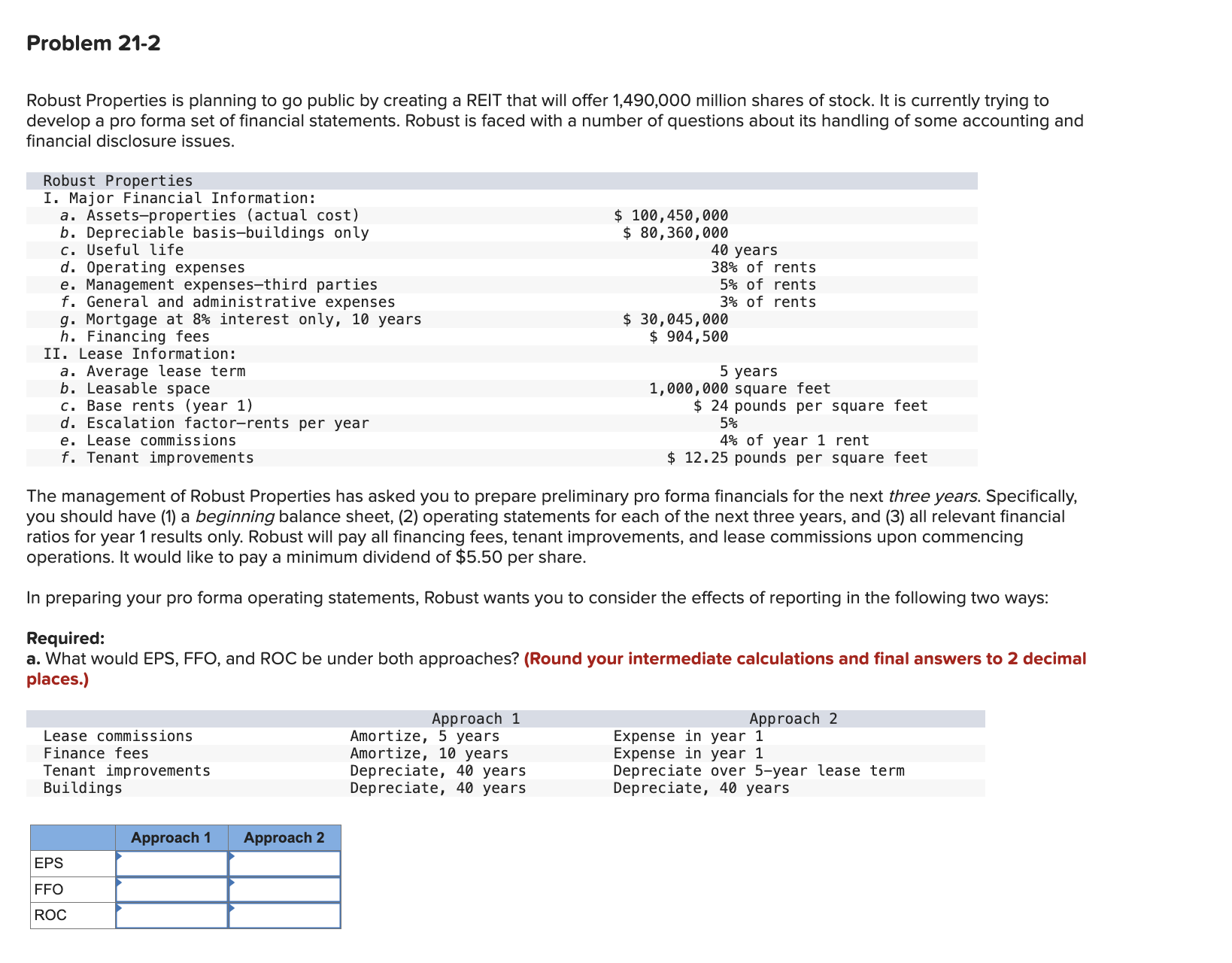

Robust Properties is planning to go public by creating a REIT that will offer million shares of stock. It is currently trying to

develop a pro forma set of financial statements. Robust is faced with a number of questions about its handling of some accounting and

financial disclosure issues.

The management of Robust Properties has asked you to prepare preliminary pro forma financials for the next three years. Specifically,

you should have a beginning balance sheet, operating statements for each of the next three years, and all relevant financial

ratios for year results only. Robust will pay all financing fees, tenant improvements, and lease commissions upon commencing

operations. It would like to pay a minimum dividend of $ per share.

In preparing your pro forma operating statements, Robust wants you to consider the effects of reporting in the following two ways:

Required:

a What would EPS, FFO, and ROC be under both approaches? Round your intermediate calculations and final answers to decimal

places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started