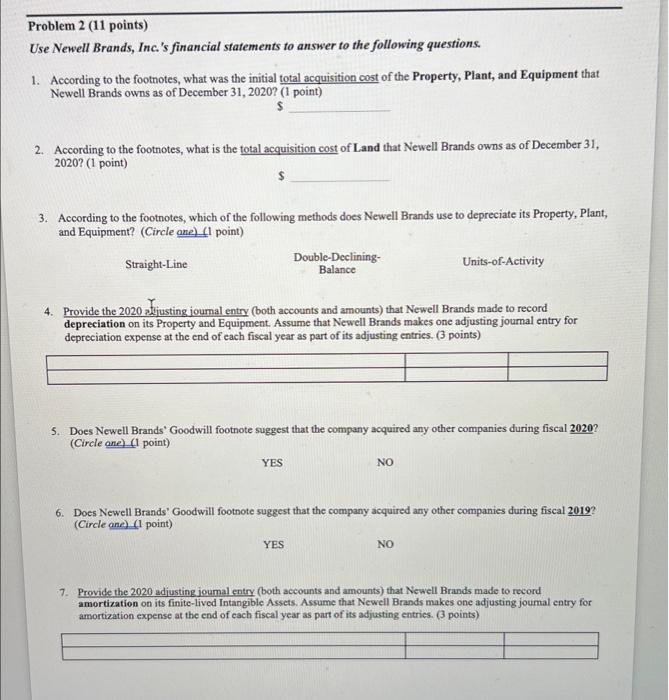

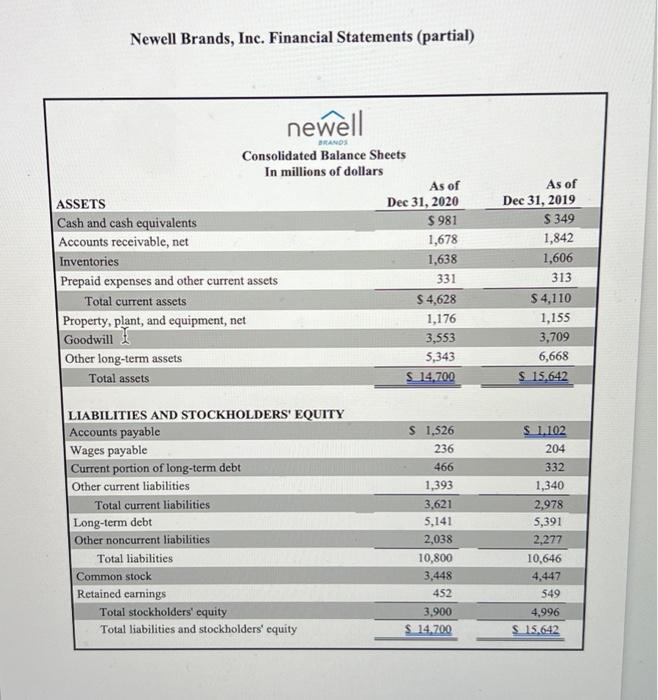

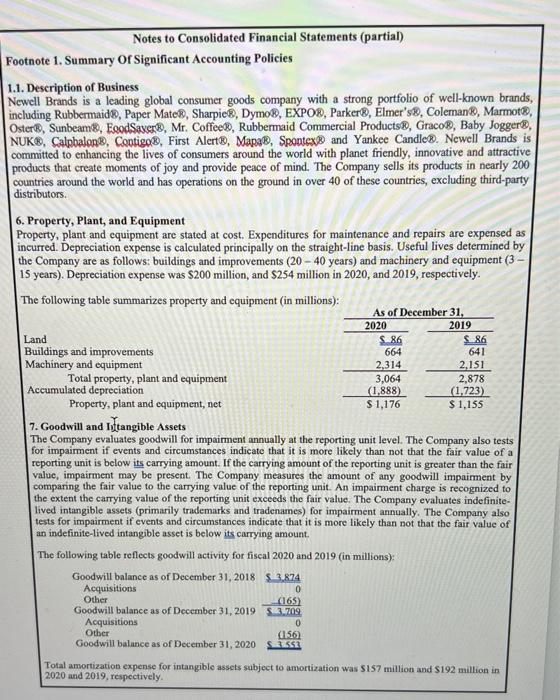

Problem 2 (11 points) Use Newell Brands, Inc.'s financial statements to answer to the following questions. 1. According to the footnotes, what was the initial total acquisition cost of the Property, Plant, and Equipment that Newell Brands owns as of December 31, 2020? (1 point) 2. According to the footnotes, what is the total acquisition cost of Land that Newell Brands owns as of December 31, 2020? (1 point) 3. According to the footnotes, which of the following methods does Newell Brands use to depreciate its Property, Plant, and Equipment? (Circle ane). 1 point) Straight-Line Double-Declining- Balance Units-of-Activity 4. Provide the 2020 pljusting journal entry (both accounts and amounts) that Newell Brands made to record depreciation on its Property and Equipment. Assume that Newell Brands makes one adjusting journal entry for depreciation expense at the end of cach fiscal year as part of its adjusting entries. (3 points) 5. Does Newell Brands Goodwill footnote suggest that the company acquired any other companies during fiscal 2020? (Circle ane) 0 point) YES NO 6. Does Newell Brands Goodwill footnote suggest that the company acquired any other companies during fiscal 2019? (Circle ane) (1 point) YES NO 7. Provide the 2020 adjusting joumal entry (both accounts and amounts) that Newell Brands made to record amortization on its finite-lived Intangible Assets. Assume that Newell Brands makes one adjusting joumal entry for amortization expense at the end of each fiscal year as part of its adjusting entries. (3 points) Newell Brands, Inc. Financial Statements (partial) newell BRANDS Consolidated Balance Sheets In millions of dollars As of ASSETS Dec 31, 2020 Cash and cash equivalents $ 981 Accounts receivable, net 1,678 Inventories 1,638 Prepaid expenses and other current assets 331 Total current assets $ 4,628 Property, plant, and equipment, net 1,176 Goodwill I 3,553 Other long-term assets 5,343 Total assets S 14,700 As of Dec 31, 2019 $ 349 1,842 1,606 313 $ 4,110 1,155 3,709 6,668 S 15.642 LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable Wages payable Current portion of long-term debt Other current liabilities Total current liabilities Long-term debt Other noncurrent liabilities Total liabilities Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 1,526 236 466 1,393 3,621 5,141 2,038 10,800 3,448 452 3,900 S 14.700 $ 1.102 204 332 1,340 2,978 5,391 2,277 10.646 4,447 549 4,996 S 15.642 Notes to Consolidated Financial Statements (partial) Footnote 1. Summary or Significant Accounting Policies 1.1. Description of Business Newell Brands is a leading global consumer goods company with a strong portfolio of well-known brands, including Rubbermaid, Paper Mato, Sharpie, Dymo8, EXPOB, Parker, Elmer's, Coleman, Marmot, Oster, Sunbeam, FoodSaver, Mr. Coffee, Rubbermaid Commercial Products, Graco, Baby Jogger, NUK, Calpbalone, Contigo, First Alert, Mapa, Spontex and Yankee Candle. Newell Brands is committed to enhancing the lives of consumers around the world with planet friendly, innovative and attractive products that create moments of joy and provide peace of mind. The Company sells its products in nearly 200 countries around the world and has operations on the ground in over 40 of these countries, excluding third-party distributors 6. Property, Plant, and Equipment Property, plant and equipment are stated at cost. Expenditures for maintenance and repairs are expensed as incurred. Depreciation expense is calculated principally on the straight-line basis. Useful lives determined by the Company are as follows: buildings and improvements (20 - 40 years) and machinery and equipment (3 15 years). Depreciation expense was $200 million, and $254 million in 2020, and 2019, respectively. The following table summarizes property and equipment (in millions): As of December 31, 2020 2019 Land 86 S 86 Buildings and improvements 664 641 Machinery and equipment 2,314 2,151 Total property, plant and equipment 3,064 2,878 Accumulated depreciation (1,888) (1.723) Property, plant and equipment, net $ 1,176 $ 1,155 7. Goodwill and Intangible Assets The Company evaluates goodwill for impairment annually at the reporting unit level. The Company also tests for impairment if events and circumstances indicate that it is more likely than not that the fair value of a reporting unit is below its carrying amount. If the carrying amount of the reporting unit is greater than the fair valuc, impairment may be present. The Company measures the amount of any goodwill impairment by comparing the fair value to the carrying value of the reporting unit. An impairment charge is recognized to the extent the carrying value of the reporting unit exceeds the fair value. The Company evaluates indefinite- lived intangible assets (primarily trademarks and tradenames) for impairment annually. The Company also tests for impairment if events and circumstances indicate that it is more likely than not that the fair value of an indefinite-lived intangible asset is below its carrying amount The following table reflects goodwill activity for fiscal 2020 and 2019 (in millions): Goodwill balance as of December 31, 2018 $ 3.874 Acquisitions 0 (165) Goodwill balance as of December 31, 2019 3.709 Acquisitions Other (156) sodwill balance as of December 31, 2020 S Other 0 Total amortization expense for intangible assets subject to amortization was $157 million and S192 million in 2020 and 2019, respectively