Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 2 (17 points) Fitzhugh Investors sells, manages, and operates three mutual funds: Money Market, Blue Chip, and Fixed Income. Each fund's prospectus specifies

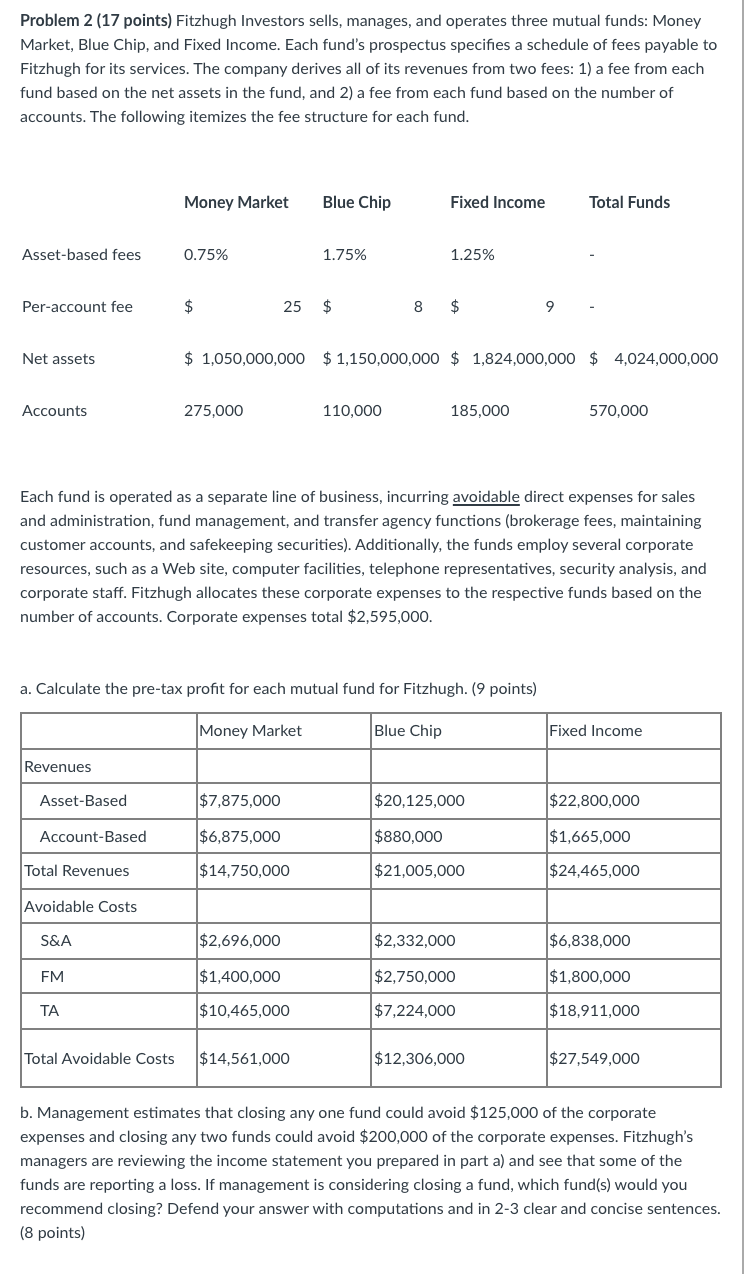

Problem 2 (17 points) Fitzhugh Investors sells, manages, and operates three mutual funds: Money Market, Blue Chip, and Fixed Income. Each fund's prospectus specifies a schedule of fees payable to Fitzhugh for its services. The company derives all of its revenues from two fees: 1) a fee from each fund based on the net assets in the fund, and 2) a fee from each fund based on the number of accounts. The following itemizes the fee structure for each fund. Money Market Blue Chip Fixed Income Total Funds Asset-based fees 0.75% 1.75% 1.25% Per-account fee $ 25 $ 8 $ 9 Net assets Accounts $ 1,050,000,000 $1,150,000,000 $ 1,824,000,000 $ 4,024,000,000 275,000 110,000 185,000 570,000 Each fund is operated as a separate line of business, incurring avoidable direct expenses for sales and administration, fund management, and transfer agency functions (brokerage fees, maintaining customer accounts, and safekeeping securities). Additionally, the funds employ several corporate resources, such as a Web site, computer facilities, telephone representatives, security analysis, and corporate staff. Fitzhugh allocates these corporate expenses to the respective funds based on the number of accounts. Corporate expenses total $2,595,000. a. Calculate the pre-tax profit for each mutual fund for Fitzhugh. (9 points) Money Market Blue Chip Fixed Income Revenues Asset-Based $7,875,000 $20,125,000 $22,800,000 Account-Based $6,875,000 $880,000 $1,665,000 Total Revenues $14,750,000 $21,005,000 $24,465,000 Avoidable Costs S&A $2,696,000 $2,332,000 $6,838,000 FM $1,400,000 $2,750,000 $1,800,000 TA $10,465,000 $7,224,000 $18,911,000 Total Avoidable Costs $14,561,000 $12,306,000 $27,549,000 b. Management estimates that closing any one fund could avoid $125,000 of the corporate expenses and closing any two funds could avoid $200,000 of the corporate expenses. Fitzhugh's managers are reviewing the income statement you prepared in part a) and see that some of the funds are reporting a loss. If management is considering closing a fund, which fund(s) would you recommend closing? Defend your answer with computations and in 2-3 clear and concise sentences. (8 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Problem 2 Fitzhugh Investors Part a PreTax Profit Calculation Money Market Revenue Assetbased 7875000 Accountbased 6875000 14750000 Costs SA 2696000 FM 1400000 TA 10465000 Corporate 683000 15244000 Pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started