Answered step by step

Verified Expert Solution

Question

1 Approved Answer

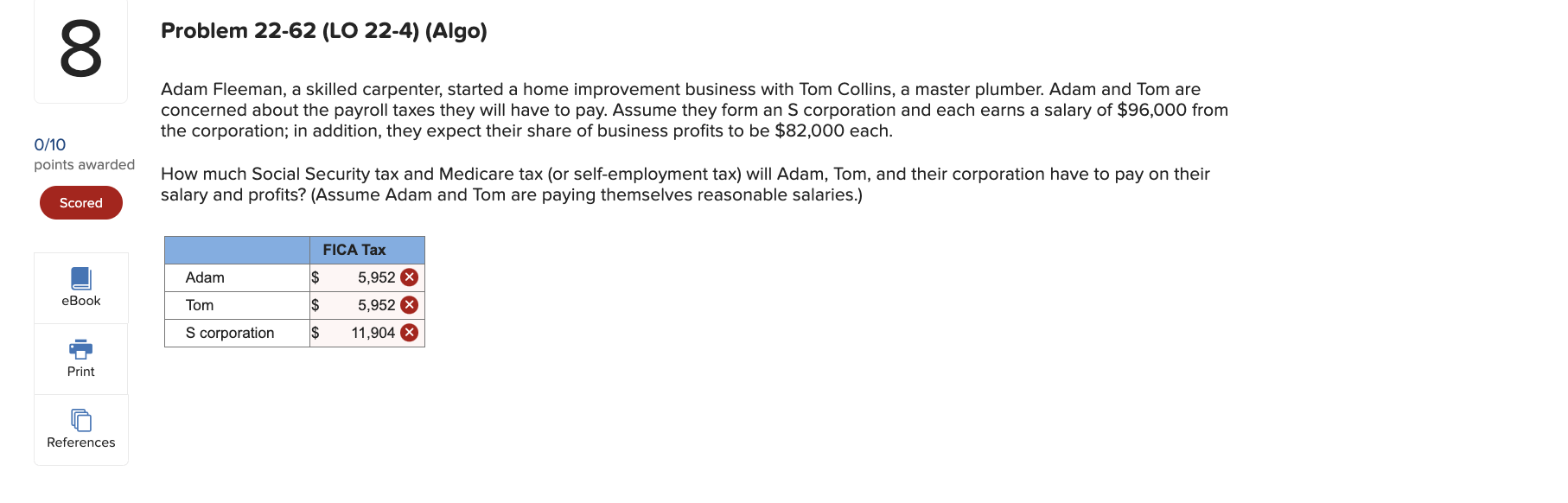

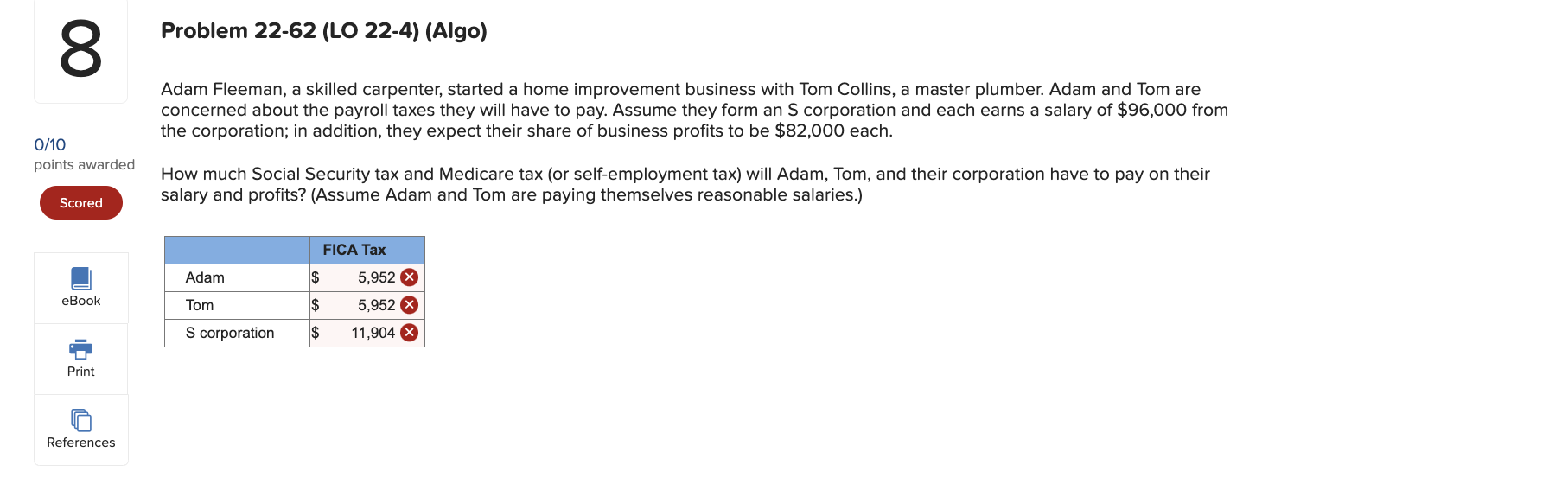

Problem 2 2 - 6 2 ( LO 2 2 - 4 ) ( Algo ) Adam Fleeman, a skilled carpenter, started a home improvement

Problem LO Algo

Adam Fleeman, a skilled carpenter, started a home improvement business with Tom Collins, a master plumber. Adam and Tom are

concerned about the payroll taxes they will have to pay. Assume they form an S corporation and each earns a salary of $ from

the corporation; in addition, they expect their share of business profits to be $ each.

How much Social Security tax and Medicare tax or selfemployment tax will Adam, Tom, and their corporation have to pay on their

salary and profits? Assume Adam and Tom are paying themselves reasonable salaries.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started