Question: Problem 2 (25 points) A biotech company has an effective income tax rate of 40%. The company must choose one of the following mutually exclusive

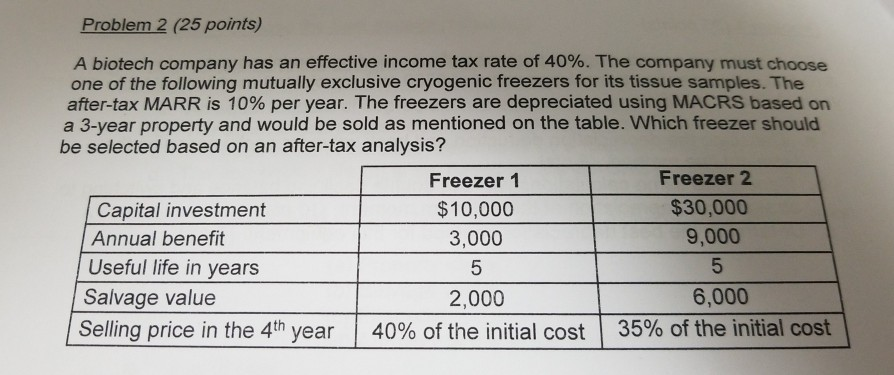

Problem 2 (25 points) A biotech company has an effective income tax rate of 40%. The company must choose one of the following mutually exclusive cryogenic freezers for its tissue samples. The after-tax MARR is 10% per year. The freezers are depreciated using MACRS based on a 3-year property and would be sold as mentioned on the table. Which freezer should be selected based on an after-tax analysis? Capital investment Annual benefit Useful life in years Salvage value Freezer 1 $10,000 3,000 5 2,000 Freezer 2 $30,000 9,000 6,000 Selling price in the 4th year | 40% of the initial cost | 35% of the initial cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts