Answered step by step

Verified Expert Solution

Question

1 Approved Answer

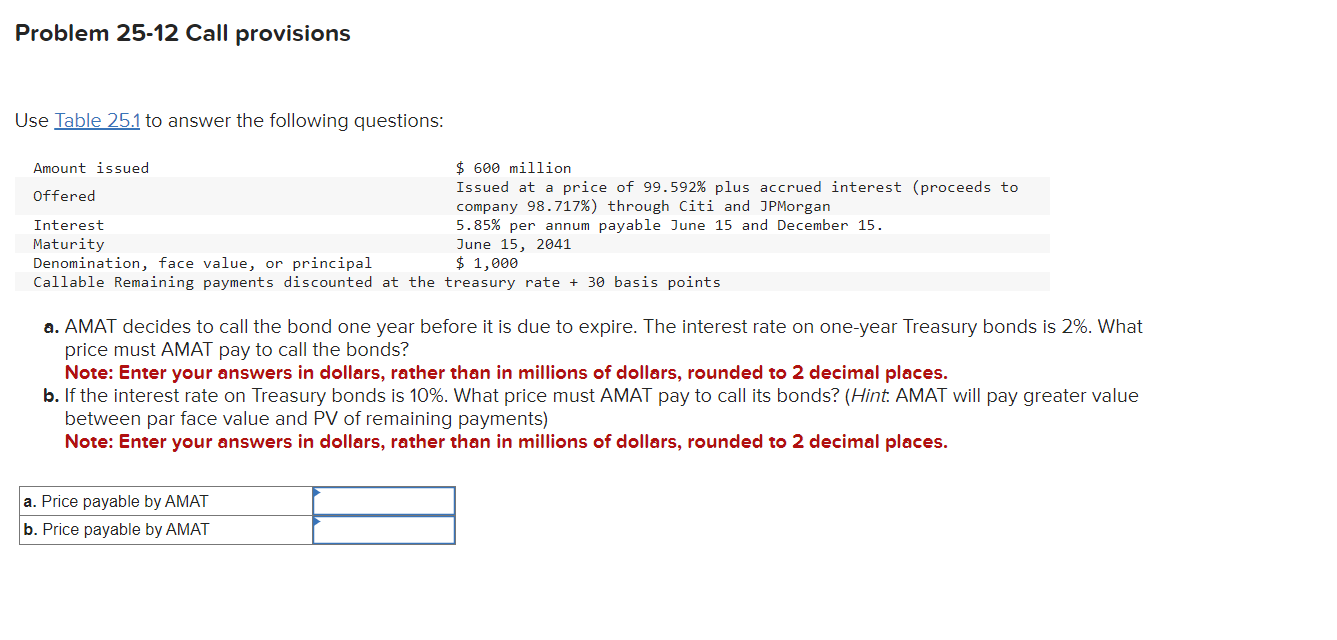

Problem 2 5 - 1 2 Call provisions Use Table 2 5 . 1 to answer the following questions: Amount issued $ 6 0 0

Problem Call provisions

Use Table to answer the following questions:

Amount issued $ million

Offered Issued at a price of plus accrued interest proceeds to company through Citi and JPMorgan

Interest per annum payable June and December

Maturity June

Denomination, face value, or principal $

Callable Remaining payments discounted at the treasury rate basis points

AMAT decides to call the bond one year before it is due to expire. The interest rate on oneyear Treasury bonds is What price must AMAT pay to call the bonds?

Note: Enter your answers in dollars, rather than in millions of dollars, rounded to decimal places.

If the interest rate on Treasury bonds is What price must AMAT pay to call its bonds? Hint: AMAT will pay greater value between par face value and PV of remaining payments

Note: Enter your answers in dollars, rather than in millions of dollars, rounded to decimal places.Problem Call provisions

Use Table to answer the following questions:

a AMAT decides to call the bond one year before it is due to expire. The interest rate on oneyear Treasury bonds is What

price must AMAT pay to call the bonds?

Note: Enter your answers in dollars, rather than in millions of dollars, rounded to decimal places.

b If the interest rate on Treasury bonds is What price must AMAT pay to call its bonds? Hint AMAT will pay greater value

between par face value and PV of remaining payments

Note: Enter your answers in dollars, rather than in millions of dollars, rounded to decimal places.

a Price payable by AMAT

b Price payable by AMAT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started