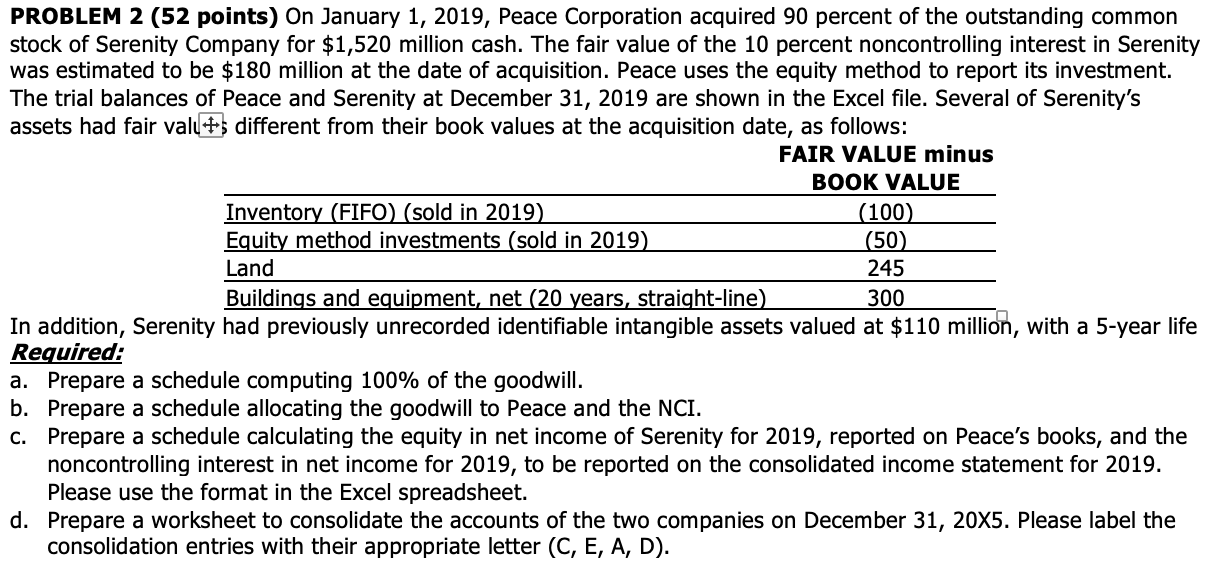

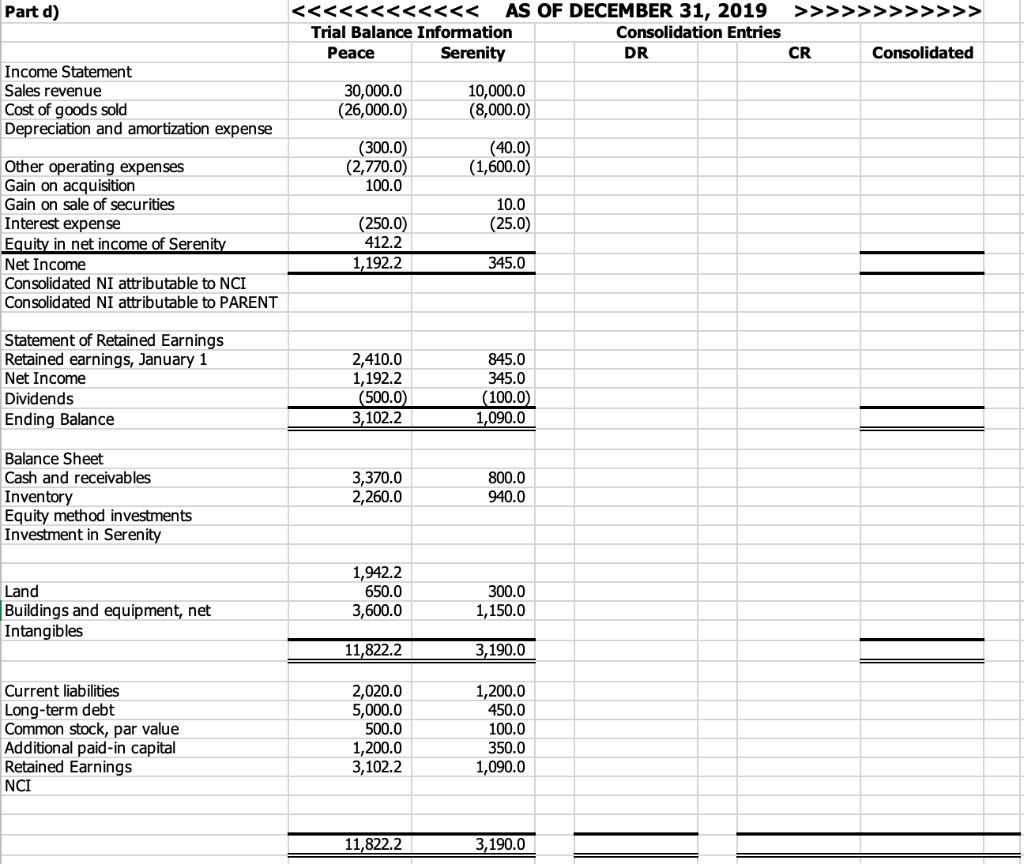

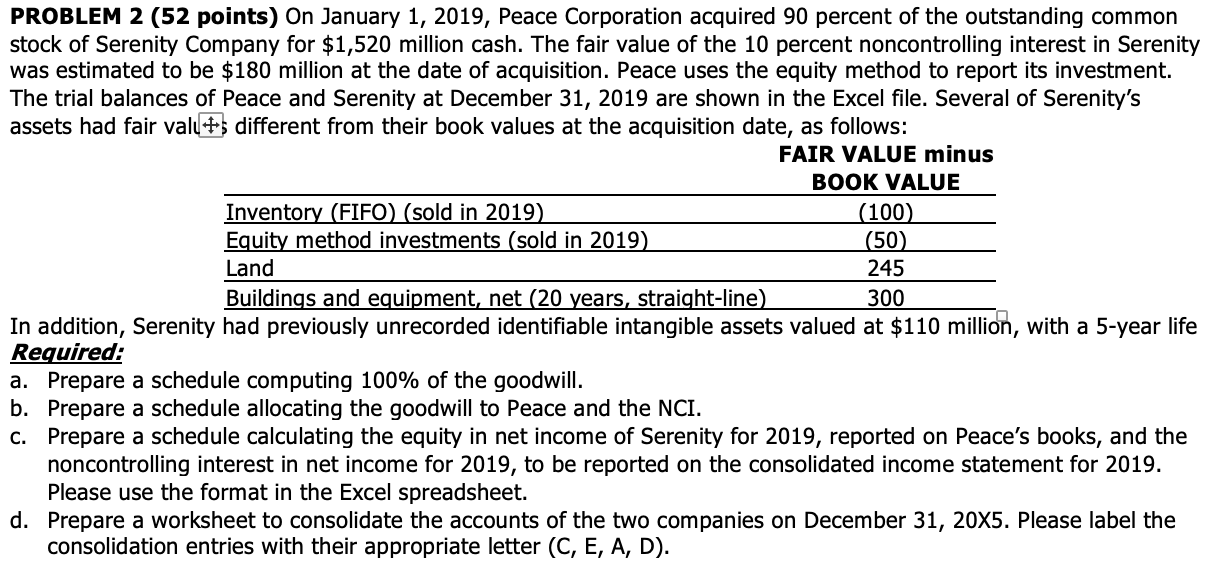

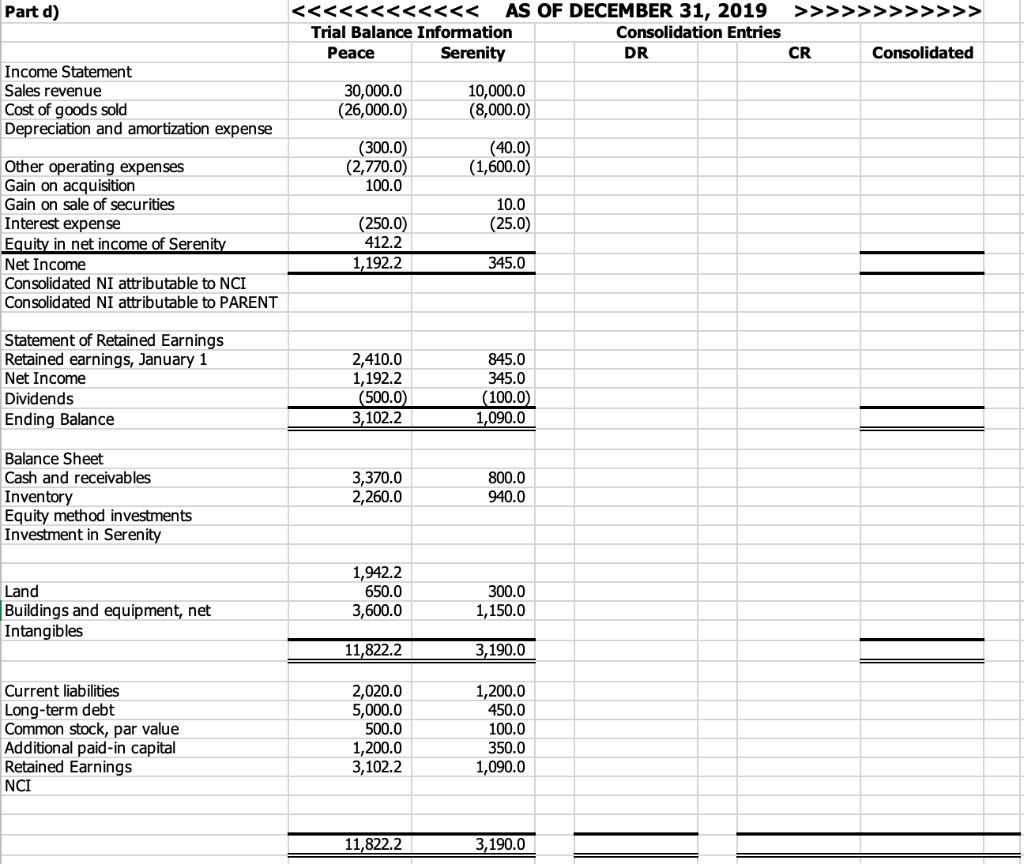

PROBLEM 2 (52 points) On January 1, 2019, Peace Corporation acquired 90 percent of the outstanding common stock of Serenity Company for $1,520 million cash. The fair value of the 10 percent noncontrolling interest in Serenity was estimated to be $180 million at the date of acquisition. Peace uses the equity method to report its investment. The trial balances of Peace and Serenity at December 31, 2019 are shown in the Excel file. Several of Serenity's assets had fair valu +5 different from their book values at the acquisition date, as follows: FAIR VALUE minus BOOK VALUE Inventory (FIFO (sold in 2019 (100) Equity method investments (sold in 2019) (50) Land 245 Buildings and equipment, net (20 years, straight-line) 300 In addition, Serenity had previously unrecorded identifiable intangible assets valued at $110 million, with a 5-year life Required: a. Prepare a schedule computing 100% of the goodwill. b. Prepare a schedule allocating the goodwill to Peace and the NCI. c. Prepare a schedule calculating the equity in net income of Serenity for 2019, reported on Peace's books, and the noncontrolling interest in net income for 2019, to be reported on the consolidated income statement for 2019. Please use the format in the Excel spreadsheet. d. Prepare a worksheet to consolidate the accounts of the two companies on December 31, 20X5. Please label the consolidation entries with their appropriate letter (C, E, A, D). Part d) >>>>>>>>>>> Trial Balance Information Consolidation Entries Peace Serenity DR CR Consolidated Income Statement Sales revenue Cost of goods sold Depreciation and amortization expense 30,000.0 (26,000.0) 10,000.0 (8,000.0) (300.0) (2,770.0) 100.0 (40.0) (1,600.0) 10.0 (25.0) Other operating expenses Gain on acquisition Gain on sale of securities Interest expense Equity in net income of Serenity Net Income Consolidated NI attributable to NCI Consolidated NI attributable to PARENT (250.0) 412.2 1,192.2 345.0 Statement of Retained Earnings Retained earnings, January 1 Net Income Dividends Ending Balance 2,410.0 1,192.2 (500.0) 3,102.2 845.0 345.0 (100.0) 1,090.0 Balance Sheet Cash and receivables Inventory Equity method investments Investment in Serenity 3,370.0 2,260.0 800.0 940.0 Land Buildings and equipment, net Intangibles 1,942.2 650.0 3,600.0 300.0 1,150.0 11,822.2 3,190.0 Current liabilities Long-term debt Common stock, par value Additional paid-in capital Retained Earnings NCI 2,020.0 5,000.0 500.0 1,200.0 3,102.2 1,200.0 450.0 100.0 350.0 1,090.0 11,822.2 3,190.0 PROBLEM 2 (52 points) On January 1, 2019, Peace Corporation acquired 90 percent of the outstanding common stock of Serenity Company for $1,520 million cash. The fair value of the 10 percent noncontrolling interest in Serenity was estimated to be $180 million at the date of acquisition. Peace uses the equity method to report its investment. The trial balances of Peace and Serenity at December 31, 2019 are shown in the Excel file. Several of Serenity's assets had fair valu +5 different from their book values at the acquisition date, as follows: FAIR VALUE minus BOOK VALUE Inventory (FIFO (sold in 2019 (100) Equity method investments (sold in 2019) (50) Land 245 Buildings and equipment, net (20 years, straight-line) 300 In addition, Serenity had previously unrecorded identifiable intangible assets valued at $110 million, with a 5-year life Required: a. Prepare a schedule computing 100% of the goodwill. b. Prepare a schedule allocating the goodwill to Peace and the NCI. c. Prepare a schedule calculating the equity in net income of Serenity for 2019, reported on Peace's books, and the noncontrolling interest in net income for 2019, to be reported on the consolidated income statement for 2019. Please use the format in the Excel spreadsheet. d. Prepare a worksheet to consolidate the accounts of the two companies on December 31, 20X5. Please label the consolidation entries with their appropriate letter (C, E, A, D). Part d) >>>>>>>>>>> Trial Balance Information Consolidation Entries Peace Serenity DR CR Consolidated Income Statement Sales revenue Cost of goods sold Depreciation and amortization expense 30,000.0 (26,000.0) 10,000.0 (8,000.0) (300.0) (2,770.0) 100.0 (40.0) (1,600.0) 10.0 (25.0) Other operating expenses Gain on acquisition Gain on sale of securities Interest expense Equity in net income of Serenity Net Income Consolidated NI attributable to NCI Consolidated NI attributable to PARENT (250.0) 412.2 1,192.2 345.0 Statement of Retained Earnings Retained earnings, January 1 Net Income Dividends Ending Balance 2,410.0 1,192.2 (500.0) 3,102.2 845.0 345.0 (100.0) 1,090.0 Balance Sheet Cash and receivables Inventory Equity method investments Investment in Serenity 3,370.0 2,260.0 800.0 940.0 Land Buildings and equipment, net Intangibles 1,942.2 650.0 3,600.0 300.0 1,150.0 11,822.2 3,190.0 Current liabilities Long-term debt Common stock, par value Additional paid-in capital Retained Earnings NCI 2,020.0 5,000.0 500.0 1,200.0 3,102.2 1,200.0 450.0 100.0 350.0 1,090.0 11,822.2 3,190.0