Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 2: A Co. acquired 60% of the outstanding ordinary shares of B Co. on January 1, 2014. A Co. acquired it at book

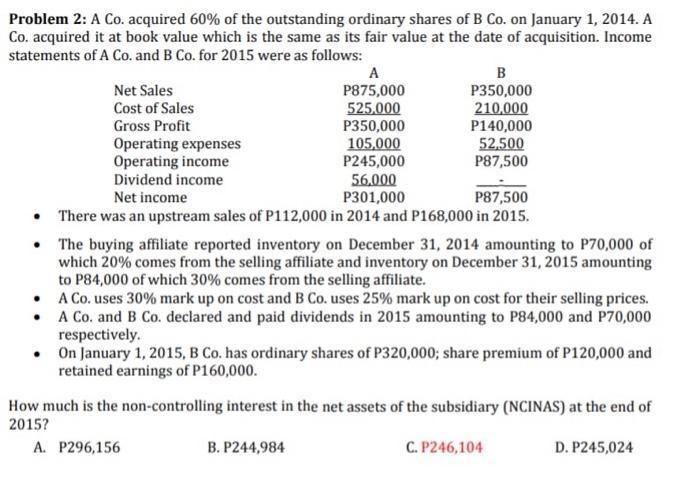

Problem 2: A Co. acquired 60% of the outstanding ordinary shares of B Co. on January 1, 2014. A Co. acquired it at book value which is the same as its fair value at the date of acquisition. Income statements of A Co. and B Co. for 2015 were as follows: B A P875,000 Net Sales P350,000 Cost of Sales 525,000 210,000 Gross Profit P350,000 P140,000 Operating expenses 105,000 52,500 Operating income P245,000 P87,500 Dividend income 56,000 P301,000 Net income P87,500 There was an upstream sales of P112,000 in 2014 and P168,000 in 2015. The buying affiliate reported inventory on December 31, 2014 amounting to P70,000 of which 20% comes from the selling affiliate and inventory on December 31, 2015 amounting to P84,000 of which 30% comes from the selling affiliate. A Co. uses 30% mark up on cost and B Co. uses 25% mark up on cost for their selling prices. A Co. and B Co. declared and paid dividends in 2015 amounting to P84,000 and P70,000 respectively. On January 1, 2015, B Co. has ordinary shares of P320,000; share premium of P120,000 and retained earnings of P160,000. How much is the non-controlling interest in the net assets of the subsidiary (NCINAS) at the end of 2015? A. P296,156 B. P244,984 C. P246,104 D. P245,024

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer Note Non Controlling Interest Computed on Subsidary equity so A co Parent I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started