Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 2: A Company's capital structure consists of the following: Equity shares of Rs. 10 each Rs. 500000 Retained earnings Rs. 250000 9% Preference

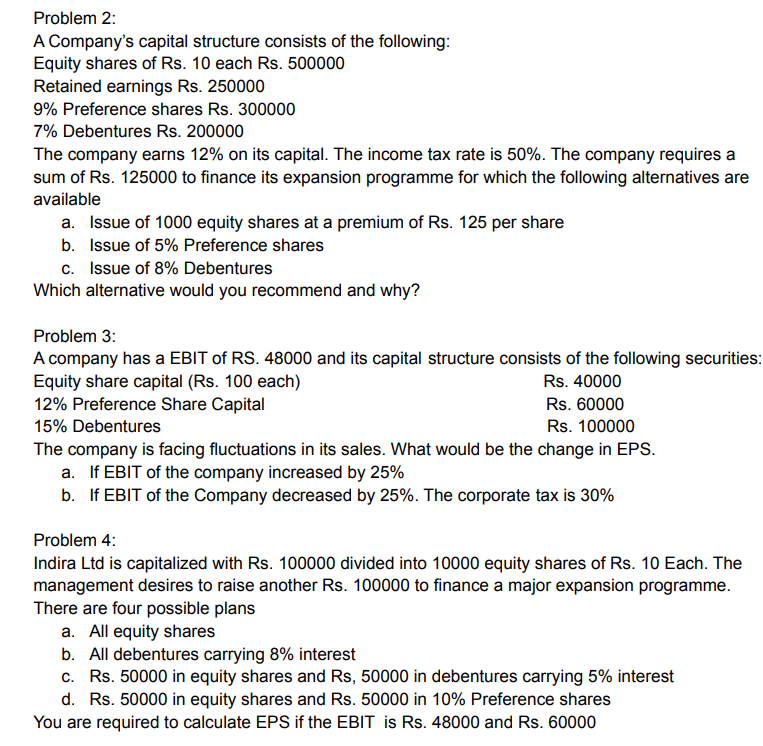

Problem 2: A Company's capital structure consists of the following: Equity shares of Rs. 10 each Rs. 500000 Retained earnings Rs. 250000 9% Preference shares Rs. 300000 7% Debentures Rs. 200000 The company earns 12% on its capital. The income tax rate is 50%. The company requires a sum of Rs. 125000 to finance its expansion programme for which the following alternatives are available a. Issue of 1000 equity shares at a premium of Rs. 125 per share b. Issue of 5% Preference shares c. Issue of 8% Debentures Which alternative would you recommend and why? Problem 3: A company has a EBIT of RS. 48000 and its capital structure consists of the following securities: Equity share capital (Rs. 100 each) 12% Preference Share Capital 15% Debentures Rs. 40000 Rs. 60000 Rs. 100000 The company is facing fluctuations in its sales. What would be the change in EPS. a. If EBIT of the company increased by 25% b. If EBIT of the Company decreased by 25%. The corporate tax is 30% Problem 4: Indira Ltd is capitalized with Rs. 100000 divided into 10000 equity shares of Rs. 10 Each. The management desires to raise another Rs. 100000 to finance a major expansion programme. There are four possible plans a. All equity shares b. All debentures carrying 8% interest c. Rs. 50000 in equity shares and Rs, 50000 in debentures carrying 5% interest d. Rs. 50000 in equity shares and Rs. 50000 in 10% Preference shares You are required to calculate EPS if the EBIT is Rs. 48000 and Rs. 60000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Problem 2 To determine which alternative to recommend for financing the expansion program we need to calculate the EPS Earnings Per Share under each alternative and then compare them Given data ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started