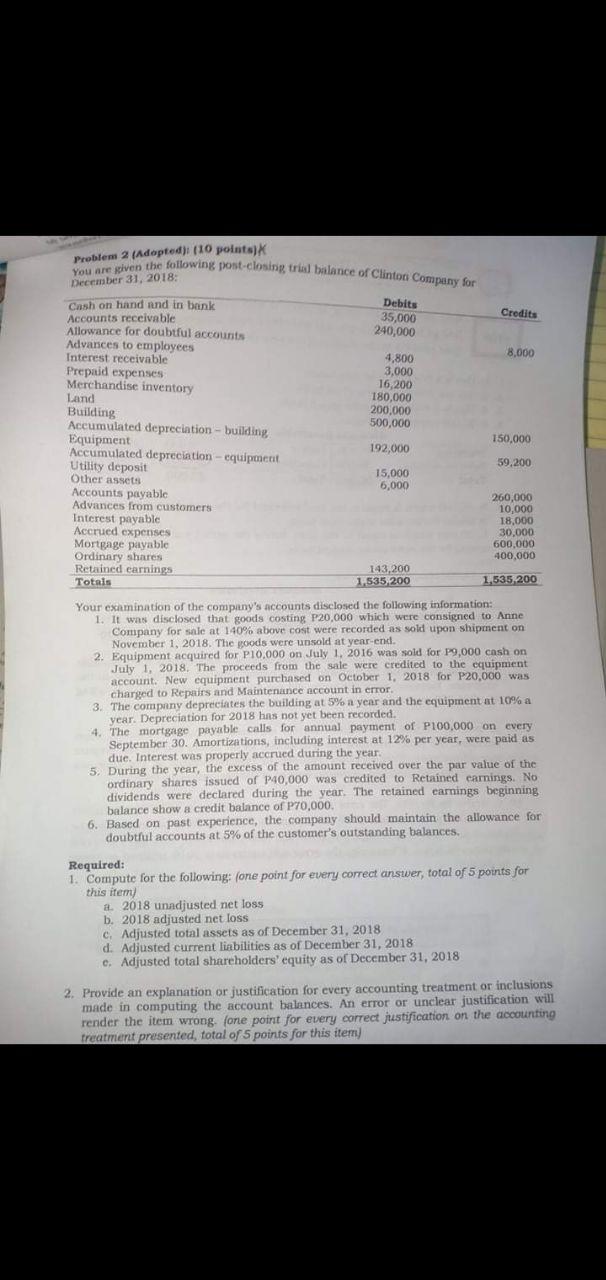

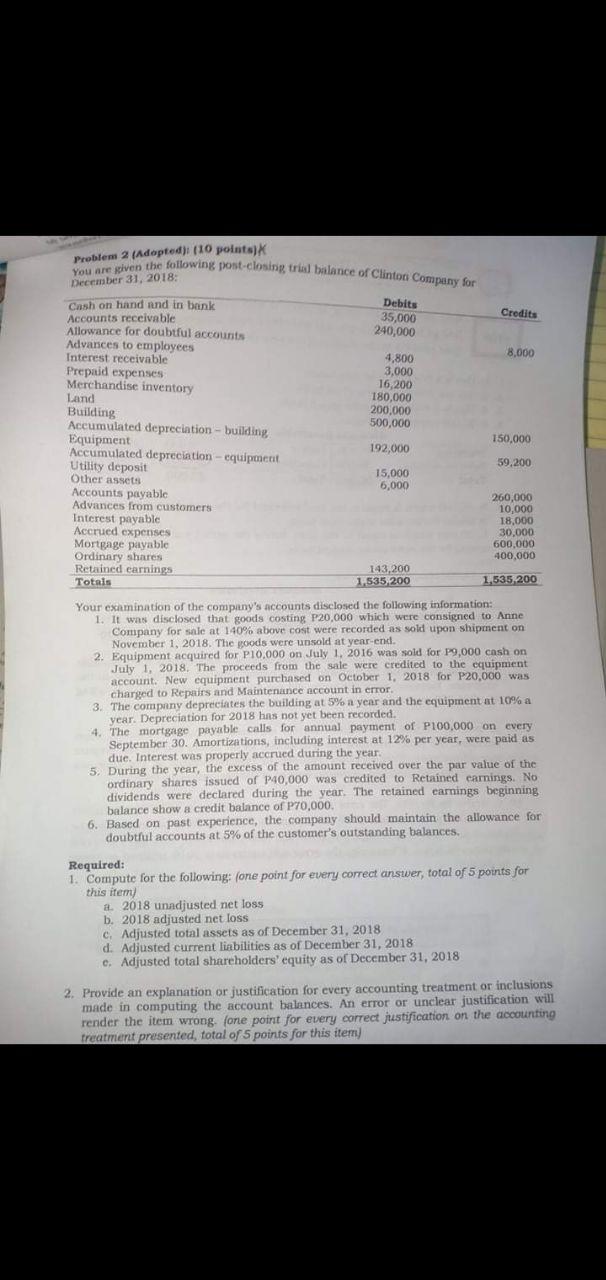

Problem 2 (Adopted): (10 points) December 31, 2018: You are given the following post-closing trial balance of Clinton Company for Debits 35,000 240,000 Credits Cash on hand and in bank Accounts receivable Allowance for doubtful accounts Advances to employees Interest receivable 8,000 4,800 Prepaid expenses 3,000 Merchandise inventory 16,200 Land 180,000 Building 200.000 Accumulated depreciation - building 500,000 Equipment 150,000 Accumulated depreciation - equipment 192,000 Utility deposit 59.200 15,000 Other assets 6,000 Accounts payable 260,000 Advances from customers 10,000 Interest payable 18,000 Accrued expenses 30,000 Mortgage payable 600.000 Ordinary shares 400,000 Retained earnings 143,200 Totais 1,535,200 1.535,200 Your examination of the company's accounts disclosed the following information: 1. It was disclosed that goods costing P20,000 which were consigned to Anne Company for sale at 140% above cost were recorded as sold upon shipment on November 1, 2018. The goods were unsold at year-end. 2. Equipment acquired for P10,000 on July 1, 2016 was sold for P9,000 cash on July 1, 2018. The proceeds from the sale were credited to the equipment account. New equipment purchased on October 1, 2018 for P20,000 was charged to Repairs and Maintenance account in error 3. The company depreciates the building at 5% a year and the equipment at 10% a year. Depreciation for 2018 has not yet been recorded. 4. The mortgage payable calls for annual payment of P100.000 on every September 30. Amortizations, including interest at 12% per year, were paid as due. Interest was properly accrued during the year. 5. During the year, the excess of the amount received over the par value of the ordinary shares issued of 140,000 was credited to Retained earnings. No dividends were declared during the year. The retained earnings beginning balance show a credit balance of P70,000 6. Based on past experience, the company should maintain the allowance for doubtful accounts at 5% of the customer's outstanding balances, Required: 1. Compute for the following: (one point for every correct answer, total of 5 points for this item) a. 2018 unadjusted net loss b. 2018 adjusted net loss c. Adjusted total assets as of December 31, 2018 d. Adjusted current liabilities as of December 31, 2018 c. Adjusted total shareholders' equity as of December 31, 2018 2. Provide an explanation or justification for every accounting treatment or inclusions made in computing the account balances. An error or unclear justification will render the item wrong. (one point for every correct justification on the accounting treatment presented, total of 5 points for this item) Problem 2 (Adopted): (10 points) December 31, 2018: You are given the following post-closing trial balance of Clinton Company for Debits 35,000 240,000 Credits Cash on hand and in bank Accounts receivable Allowance for doubtful accounts Advances to employees Interest receivable 8,000 4,800 Prepaid expenses 3,000 Merchandise inventory 16,200 Land 180,000 Building 200.000 Accumulated depreciation - building 500,000 Equipment 150,000 Accumulated depreciation - equipment 192,000 Utility deposit 59.200 15,000 Other assets 6,000 Accounts payable 260,000 Advances from customers 10,000 Interest payable 18,000 Accrued expenses 30,000 Mortgage payable 600.000 Ordinary shares 400,000 Retained earnings 143,200 Totais 1,535,200 1.535,200 Your examination of the company's accounts disclosed the following information: 1. It was disclosed that goods costing P20,000 which were consigned to Anne Company for sale at 140% above cost were recorded as sold upon shipment on November 1, 2018. The goods were unsold at year-end. 2. Equipment acquired for P10,000 on July 1, 2016 was sold for P9,000 cash on July 1, 2018. The proceeds from the sale were credited to the equipment account. New equipment purchased on October 1, 2018 for P20,000 was charged to Repairs and Maintenance account in error 3. The company depreciates the building at 5% a year and the equipment at 10% a year. Depreciation for 2018 has not yet been recorded. 4. The mortgage payable calls for annual payment of P100.000 on every September 30. Amortizations, including interest at 12% per year, were paid as due. Interest was properly accrued during the year. 5. During the year, the excess of the amount received over the par value of the ordinary shares issued of 140,000 was credited to Retained earnings. No dividends were declared during the year. The retained earnings beginning balance show a credit balance of P70,000 6. Based on past experience, the company should maintain the allowance for doubtful accounts at 5% of the customer's outstanding balances, Required: 1. Compute for the following: (one point for every correct answer, total of 5 points for this item) a. 2018 unadjusted net loss b. 2018 adjusted net loss c. Adjusted total assets as of December 31, 2018 d. Adjusted current liabilities as of December 31, 2018 c. Adjusted total shareholders' equity as of December 31, 2018 2. Provide an explanation or justification for every accounting treatment or inclusions made in computing the account balances. An error or unclear justification will render the item wrong. (one point for every correct justification on the accounting treatment presented, total of 5 points for this item)