Answered step by step

Verified Expert Solution

Question

1 Approved Answer

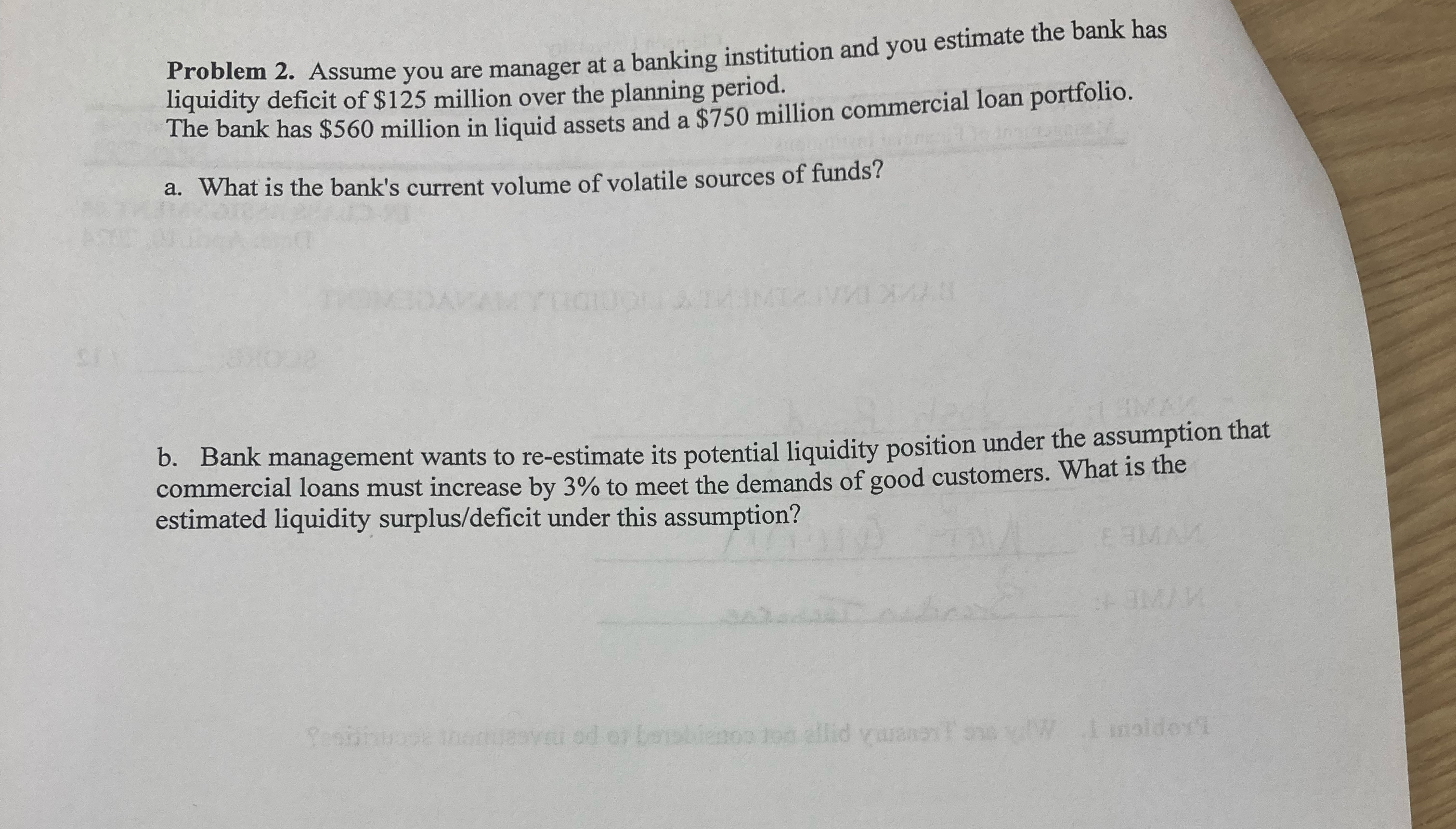

Problem 2 . Assume you are manager at a banking institution and you estimate the bank has liquidity deficit of $ 1 2 5 million

Problem Assume you are manager at a banking institution and you estimate the bank has liquidity deficit of $ million over the planning period.

The bank has $ million in liquid assets and a $ million commercial loan portfolio.

a What is the bank's current volume of volatile sources of funds?

b Bank management wants to reestimate its potential liquidity position under the assumption that commercial loans must increase by to meet the demands of good customers. What is the estimated liquidity surplusdeficit under this assumption?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started