Question

Problem 2 Consider a Black-Scholes model with r = 5%, ? = 0.2, S(0) = 50 and ? = 0. Suppose you sold ten (10)

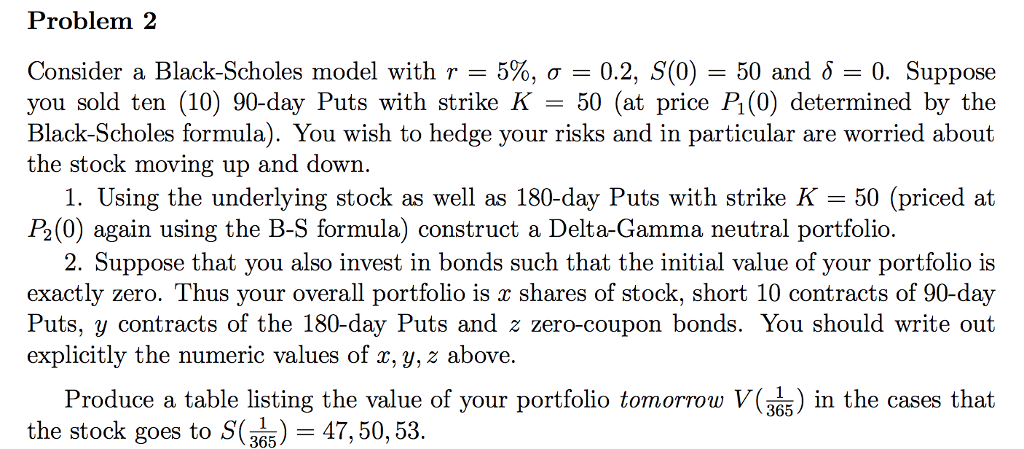

Problem 2 Consider a Black-Scholes model with r = 5%, ? = 0.2, S(0) = 50 and ? = 0. Suppose you sold ten (10) 90-day Puts with strike K = 50 (at price P1(0) determined by the Black-Scholes formula). You wish to hedge your risks and in particular are worried about the stock moving up and down. 1. Using the underlying stock as well as 180-day Puts with strike K = 50 (priced at P2(0) again using the B-S formula) construct a Delta-Gamma neutral portfolio. 2. Suppose that you also invest in bonds such that the initial value of your portfolio is exactly zero. Thus your overall portfolio is x shares of stock, short 10 contracts of 90-day Puts, y contracts of the 180-day Puts and z zero-coupon bonds. You should write out explicitly the numeric values of x, y, z above. Produce a table listing the value of your portfolio tomorrow V ( 1 365 ) in the cases that the stock goes to S( 1 365 ) = 47, 50, 53.

You can use the excel sheet we used in the lecture as a starting point, or any other tool (R, Phyton, matlab,....) or calculate by hand and hand in the result. Note that 1. and 2. have to be carried out on paper and handed in

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started