Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 2 Cost of goods sold for ZP Corporation was $2088000 during 2003. The accounts payable during the same year was $382000. What is Average

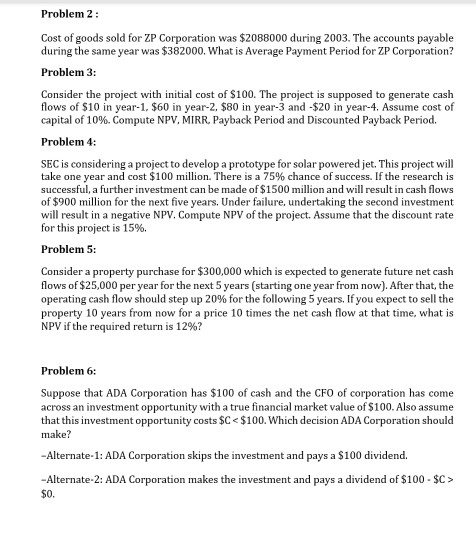

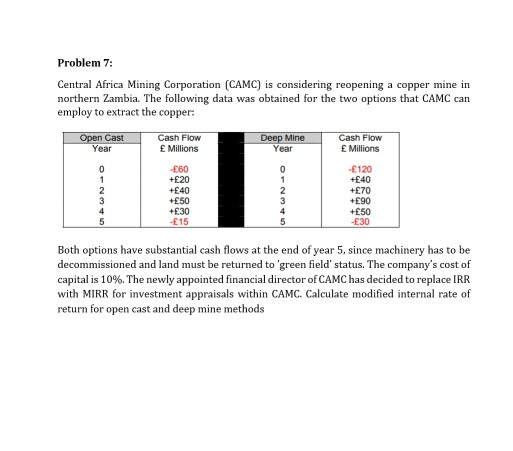

Problem 2 Cost of goods sold for ZP Corporation was $2088000 during 2003. The accounts payable during the same year was $382000. What is Average Payment Period for ZP Corporation? Problem 3: Consider the project with initial cost of $100. The project is supposed to generate cash flows of $10 in year-1, $60 in year-2, $80 in year-3 and -$20 in year-4. Assume cost of capital of 10 %. Compute NPV, MIRR, Payback Period and Discounted Payback Period. Problem 4 SEC is considering a project to develop a prototype for solar powered jet. This project will take one year and cost $100 million. There is a 75% chance of success. If the research is successful, a further investment can be made of $1500 million and will result in cash flows of $900 million for the next five years. Under failure, undertaking the second investment will result in a negative NPV. Compute NPV of the project. Assume that the discount rate for this project is 15 %. Problem 5: Consider a property purchase for $300,000 which is expected to generate future net cash flows of $25,000 per year for the next 5 years (starting one year from now). After that, the operating cash flow should step up 20% for the following 5 years. If you expect to sell the property 10 years from now for a price 10 times the net cash flow at that time, what is NPV if the required return is 12%? Problem 6 Suppose that ADA Corporation has $100 of cash and the CFO of corporation has come across an investment opportunity with a true financial market value of $100. Also assume that this investment opportunity costs $C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started