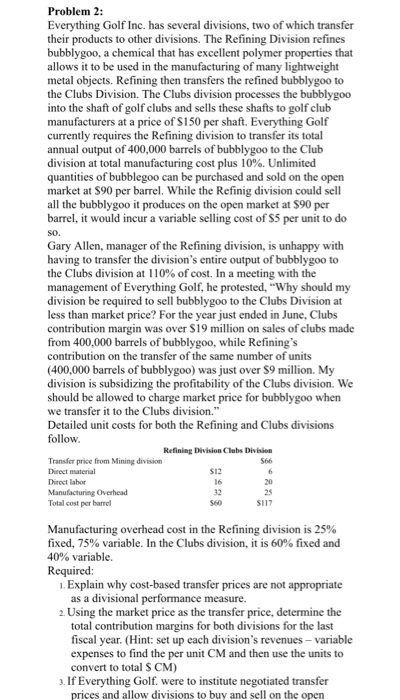

Problem 2: Everything Golf Inc. has several divisions, two of which transfer their products to other divisions. The Refining Division refines bubblygoo, a chemical that has excellent polymer properties that allows it to be used in the manufacturing of many lightweight metal objects. Refining then transfers the refined bubblygoo to the Clubs Division. The Clubs division processes the bubblygoo into the shaft of golf clubs and sells these shafts to golf club manufacturers at a price of S150 per shaft. Everything Golf currently requires the Refining division to transfer its total annual output of 400,000 barrels of bubblygoo to the Club division at total manufacturing cost plus 10%. Unlimited quantities of bubblegoo can be purchased and sold on the open market at $90 per barrel. While the Refinig division could sell all the bubblygoo it produces on the open market at S90 per barrel, SO. would incur a variable selling cost of S5 per unit to do Gary Allen, manager of the Refining division, is unhappy with having to transfer the division's entire output of bubblygoo to the Clubs division at l 10% of cost. In a meeting with the management of Everything Golf, he protested, "Why should my division be required to sell bubblygoo to the Clubs Division at less than market price? For the year just ended in June, Clubs contribution margin was over S19 million on sales of clubs made from 400,000 barrels of bubblygoo, while Refining's contribution on the transfer of the same number of units (400,000 barrels of bubblygoo) was just over S9 million. My division is subsidizing the profitability of the Clubs division. We should be allowed to charge market price for bubblygoo when we transfer it to the Clubs division." Detailed unit costs for both the Refining and Clubs divisions follow Refining Division Clubs Divisien Transfer price from Mining division Direct material Diroct labor Manufacturing Overhead Total cost per barrel S66 S12 16 S117 Manufacturing overhead cost in the Refining division is 25% fixed, 75% variable. In the Clubs division, it is 60% fixed and 40% variable. Required: . Explain why cost-based transfer prices are not appropriate as a divisional performance measure. 2 Using the market price as the transfer price, determine the total contribution fiscal year. (Hint: set up each division's revenues-variable expenses to find the per unit CM and then use the units to convert to total S CM) margins for both divisions for the last . If Everything Golf. were to institute negotiated transfer prices and allow divisions to buy and sell on the open