Problem 2: Financial Statement Analysis: (45 points)

Using The Gaps financial statements and the additional information given below, compute these ratios for the most current year shown fiscal year 2019 - which ended on February 1, 2020. Show all computations. (round to 2 decimal places; (percent 15% or .15)

Computations

- Gross Profit Rate _________

- Operating Income Rate _________

- Profit Margin Rate ________

- Asset Turnover ________________

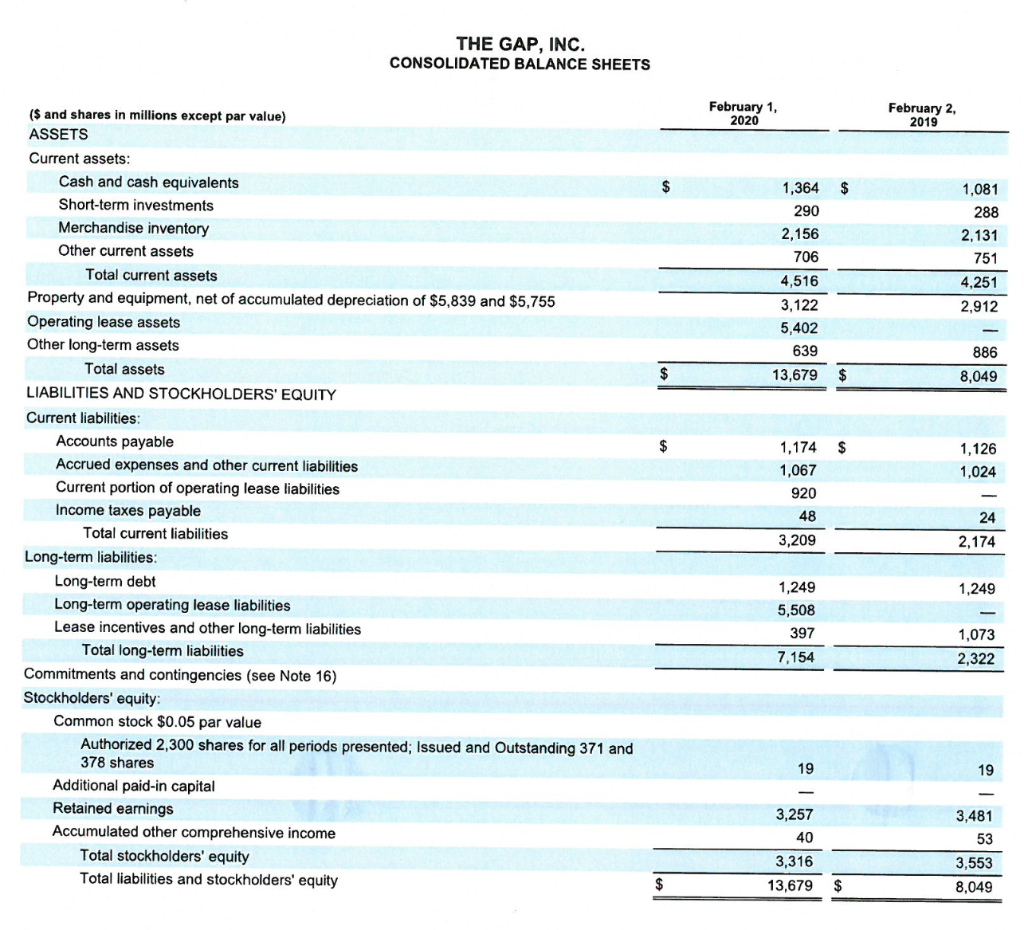

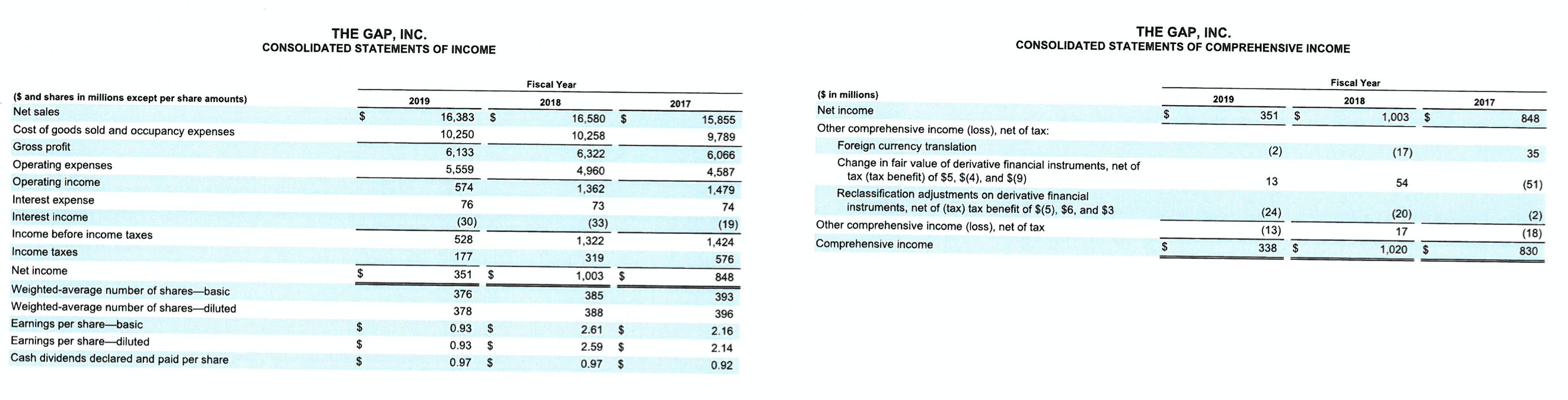

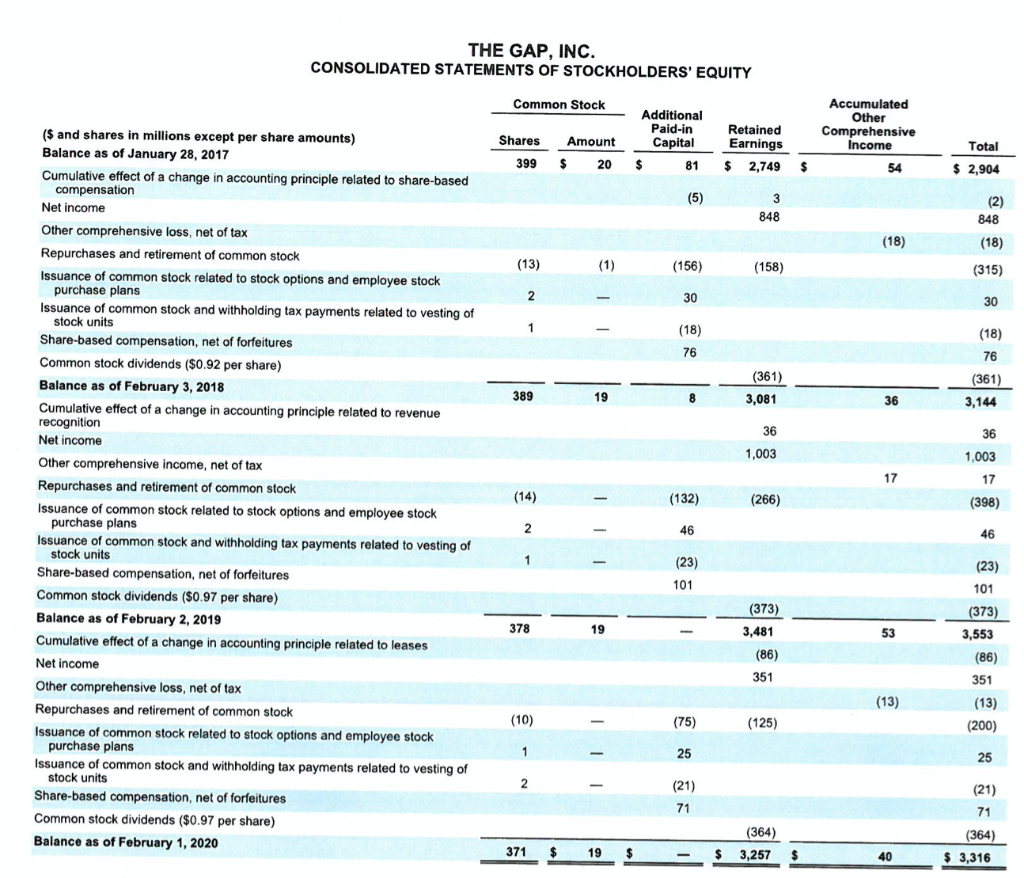

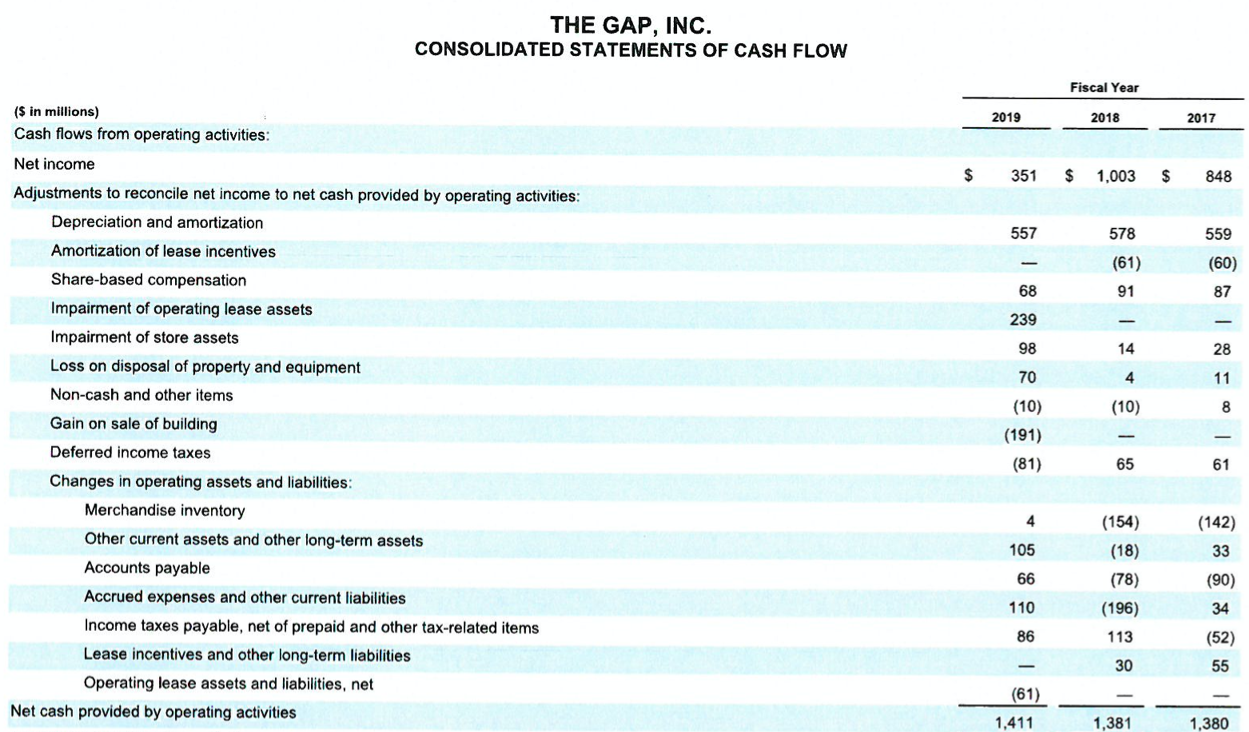

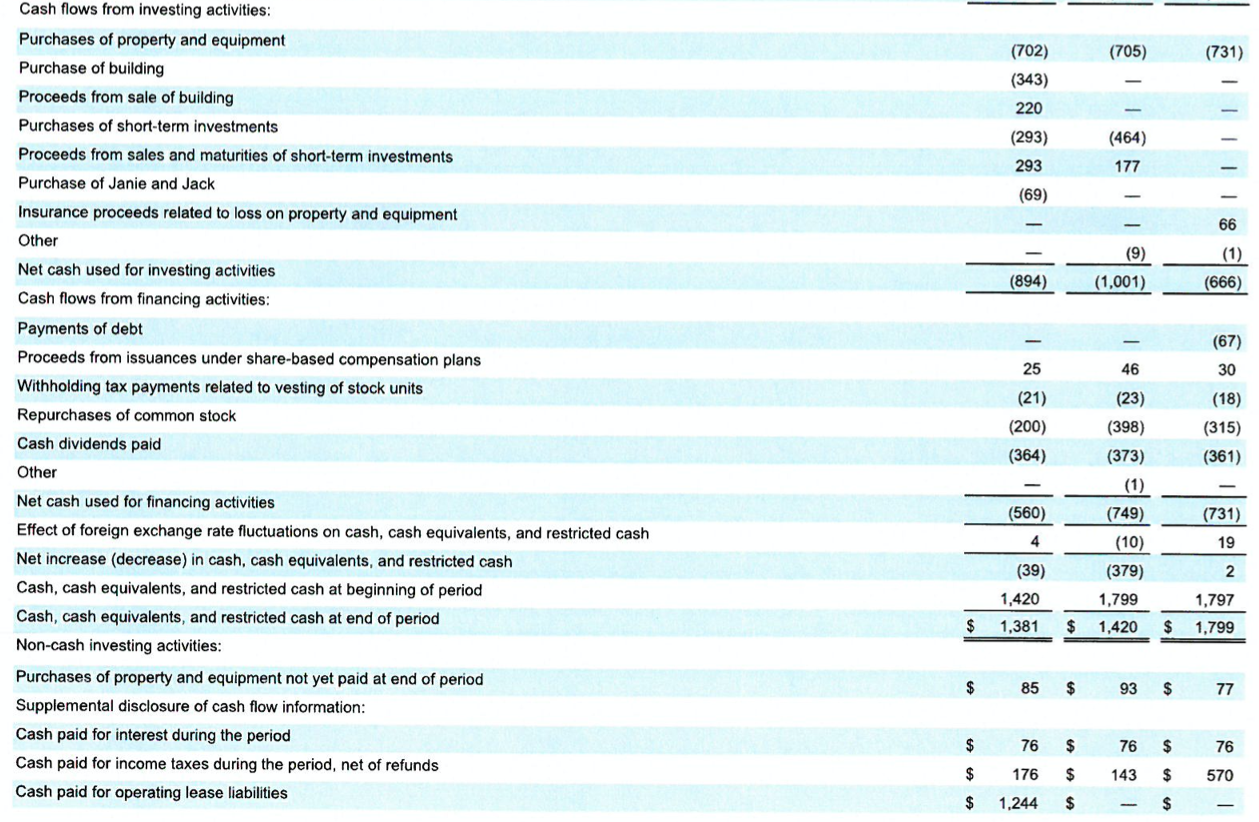

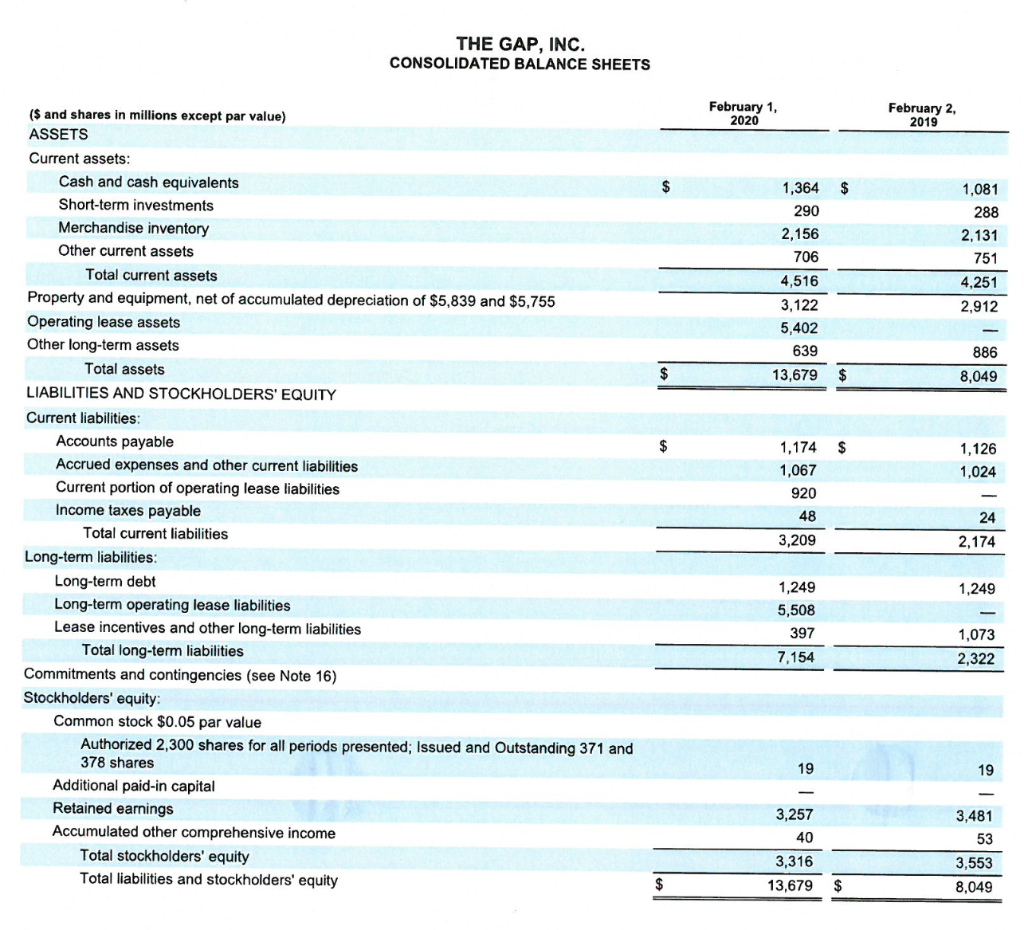

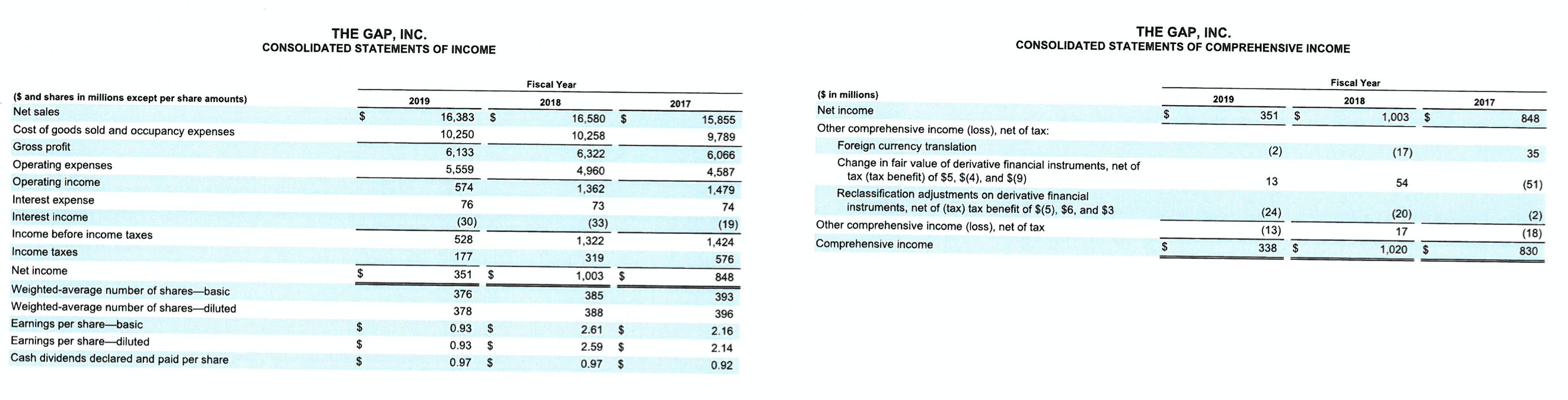

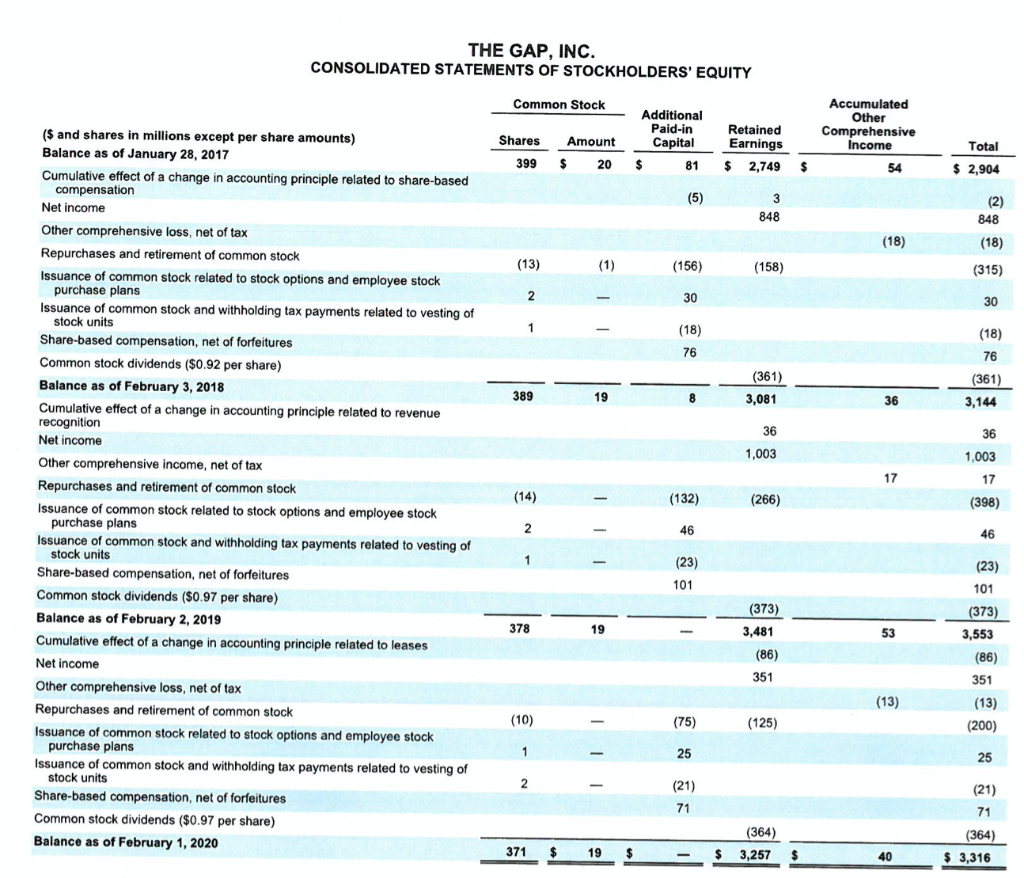

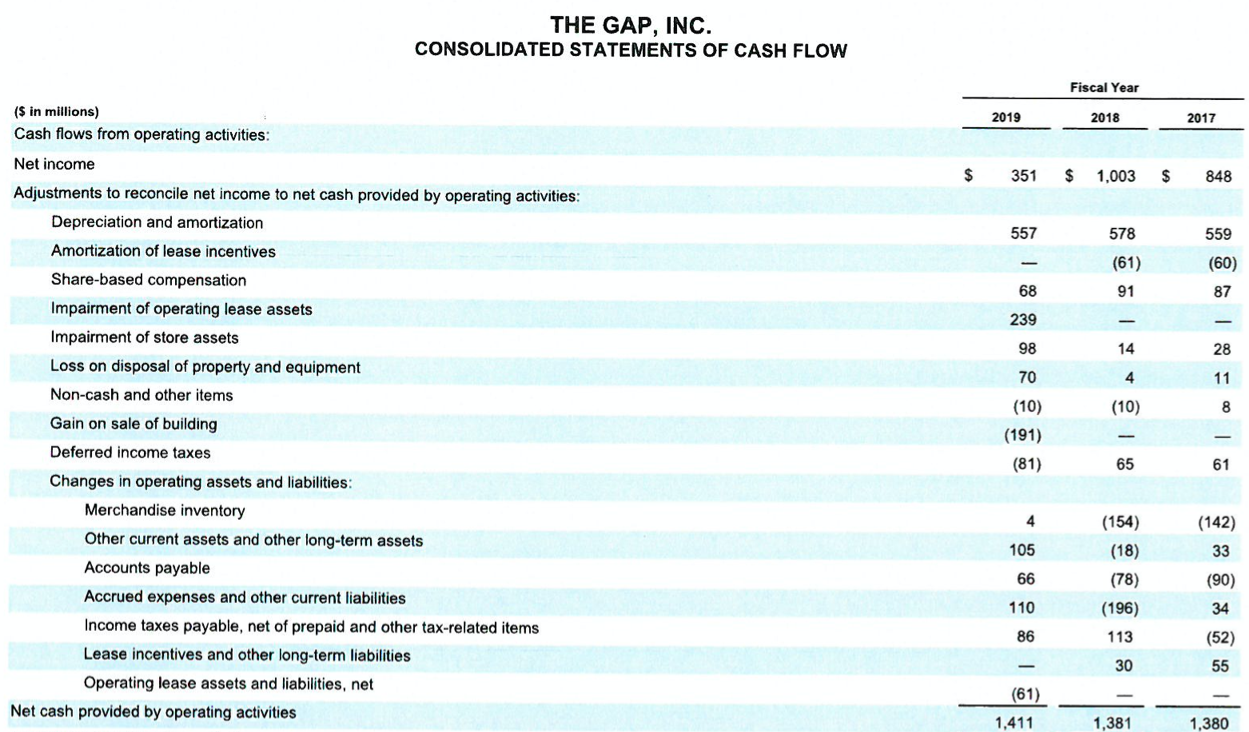

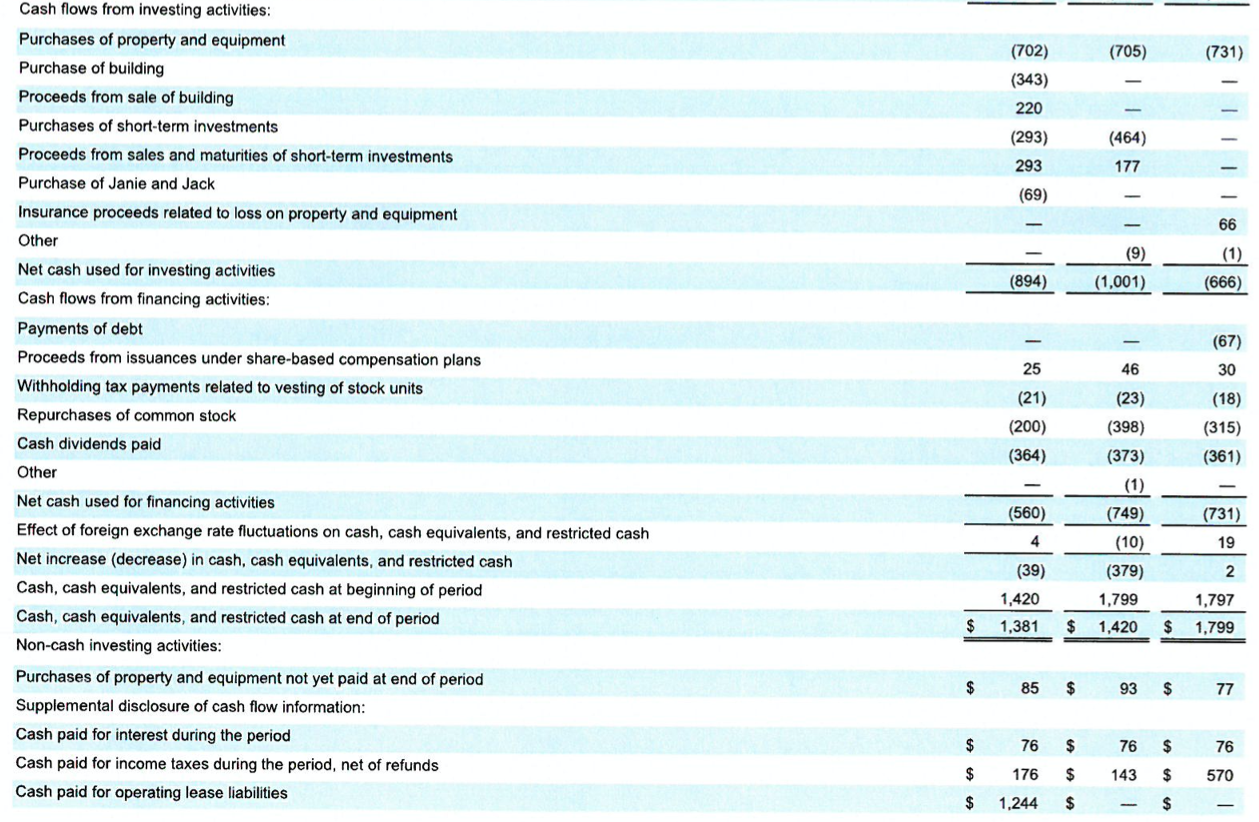

THE GAP, INC. CONSOLIDATED BALANCE SHEETS February 1, February 2, 2020 2019 1,364 $ 290 2,156 706 4,516 3,122 5,402 639 13,679 1,081 288 2.131 751 4,251 2,912 886 8,049 $ $ $ 1,126 1,024 ($ and shares in millions except par value) ASSETS Current assets: Cash and cash equivalents Short-term investments Merchandise inventory Other current assets Total current assets Property and equipment, net of accumulated depreciation of $5,839 and $5,755 Operating lease assets Other long-term assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Accrued expenses and other current liabilities Current portion of operating lease liabilities Income taxes payable Total current liabilities Long-term liabilities: Long-term debt Long-term operating lease liabilities Lease incentives and other long-term liabilities Total long-term liabilities Commitments and contingencies (see Note 16) Stockholders' equity: Common stock $0.05 par value Authorized 2,300 shares for all periods presented; Issued and Outstanding 371 and 378 shares Additional paid-in capital Retained earnings Accumulated other comprehensive income Total stockholders' equity Total liabilities and stockholders' equity 1,174 1,067 920 48 24 3,209 2,174 1,249 1,249 5,508 397 7,154 1,073 2,322 19 19 3,257 40 3,316 13,679 3,481 53 3,553 8,049 $ $ THE GAP, INC. CONSOLIDATED STATEMENTS OF INCOME THE GAP, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Fiscal Year Fiscal Year ($ and shares in millions except per share amounts) Net sales 2019 2018 2019 2017 2018 2017 $ $ $ $ 351 $ 1,003 $ 848 (2) (17) 35 13 54 Cost of goods sold and occupancy expenses Gross profit Operating expenses Operating income Interest expense Interest income Income before income taxes Income taxes Net income ($ in millions) Net income Other comprehensive income (loss), net of tax: Foreign currency translation Change in fair value of derivative financial instruments, net of tax (tax benefit) of $5, $(4), and $(9) Reclassification adjustments on derivative financial instruments, net of (tax) tax benefit of $(5), $6, and $3 Other comprehensive income (loss), net of tax Comprehensive income 16,383 10,250 6,133 5,559 574 76 (30) 528 177 351 (51) 16,580 10,258 6,322 4,960 1,362 73 (33) 1,322 319 1,003 15,855 9,789 6,066 4,587 1,479 74 (19) 1,424 576 (24) (13) 338 (20) 17 1,020 (2) (18) 830 $ $ $ $ $ 848 376 378 385 388 Weighted-average number of shares-basic Weighted-average number of shares-diluted Earnings per share-basic Earnings per share-diluted Cash dividends declared and paid per share 393 396 2.16 $ 0.93 $ $ $ 0.93 $ 2.61 2.59 0.97 $ 2.14 $ 0.97 $ $ 0.92 THE GAP, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY Common Stock Additional Paid-in Capital $ 81 Accumulated Other Comprehensive income Retained Earnings $ 2,749 $ Shares Amount 399 $ 20 Total 54 $ 2,904 (5) 3 848 (2) 2 848 (18) (18) (13) (1) (156) (158) (315) 2 30 30 1 (18) (18) 76 76 (361) 3,081 389 (361) 3,144 19 8 36 36 36 1,003 1,003 17 17 ($ and shares in millions except per share amounts) Balance as of January 28, 2017 Cumulative effect of a change in accounting principle related to share-based - compensation Net income Other comprehensive loss, net of tax Repurchases and retirement of common stock Issuance of common stock related to stock options and employee stock purchase plans Issuance of common stock and withholding tax payments related to vesting of stock units Share-based compensation, net of forfeitures Common stock dividends ($0.92 per share) Balance as of February 3, 2018 Cumulative effect of a change in accounting principle related to revenue recognition Net income Other comprehensive income, net of tax Repurchases and retirement of common stock Issuance of common stock related to stock options and employee stock purchase plans Issuance of common stock and withholding tax payments related to vesting of stock units Share-based compensation, net of forfeitures Common stock dividends ($0.97 per share) Balance as of February 2, 2019 Cumulative effect of a change in accounting principle related to leases Net income Other comprehensive loss, net of tax Repurchases and retirement of common stock Issuance of common stock related to stock options and employee stock purchase plans Issuance of common stock and withholding tax payments related to vesting of stock units Share-based compensation, net of forfeitures Common stock dividends ($0.97 per share) Balance as of February 1, 2020 (14) (132) (266) (398) 2 46 46 1 (23) 101 (23) 101 (373) 378 19 53 (373) 3,481 (86) 351 3,553 (86) 351 (13) (200) (13) (10) (75) (125) 1 25 25 2 (21) 71 (21) 71 (364) $ 3,316 (364) 371 19 $ - $ 3,257 40 THE GAP, INC. CONSOLIDATED STATEMENTS OF CASH FLOW Fiscal Year 2019 2018 2017 ($ in millions) Cash flows from operating activities: Net income $ 351 $ 1,003 $ 848 557 578 559 (61) (60) 68 91 87 239 98 14 28 70 4 11 (10) 8 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization Amortization of lease incentives Share-based compensation Impairment of operating lease assets Impairment of store assets Loss on disposal of property and equipment Non-cash and other items Gain on sale of building Deferred income taxes Changes in operating assets and liabilities: Merchandise inventory Other current assets and other long-term assets Accounts payable Accrued expenses and other current liabilities Income taxes payable, net of prepaid and other tax-related items Lease incentives and other long-term liabilities Operating lease assets and liabilities, net Net cash provided by operating activities (10) (191) (81) 65 61 4 (142) 105 33 66 (154) (18) (78) (196) 113 (90) 110 34 86 (52) 30 55 (61) 1,411 1,381 1,380 (705) (731) (702) (343) 220 (464) (293) 293 177 (69) 66 (9) (1) (666) (894) (1,001) 25 46 Cash flows from investing activities: Purchases of property and equipment Purchase of building Proceeds from sale of building Purchases of short-term investments Proceeds from sales and maturities of short-term investments Purchase of Janie and Jack Insurance proceeds related to loss on property and equipment Other Net cash used for investing activities Cash flows from financing activities: Payments of debt Proceeds from issuances under share-based compensation plans Withholding tax payments related to vesting of stock units Repurchases of common stock Cash dividends paid Other Net cash used for financing activities Effect of foreign exchange rate fluctuations on cash, cash equivalents, and restricted cash Net increase (decrease) in cash, cash equivalents, and restricted cash Cash, cash equivalents, and restricted cash at beginning of period Cash, cash equivalents, and restricted cash at end of period Non-cash investing activities: Purchases of property and equipment not yet paid at end of period Supplemental disclosure of cash flow information: Cash paid for interest during the period Cash paid for income taxes during the period, net of refunds Cash paid for operating lease liabilities (23) (21) (200) (364) (67) 30 (18) (315) (361) (398) (373) (1) (560) (749) (731) 19 4 (10) (39) 2 (379) 1,799 1,420 1,381 1,797 1,799 $ $ 1,420 $ $ 85 $ 93 $ 77 $ 76 $ 76 $ 76 $ 176 $ 143 $ 570 $ 1.244 $