Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PROBLEM 2 How much is the total shareholder's equity at December 31,2019? To input answers, kindly follow the sample format below(no peso sign, with comma,

PROBLEM 2

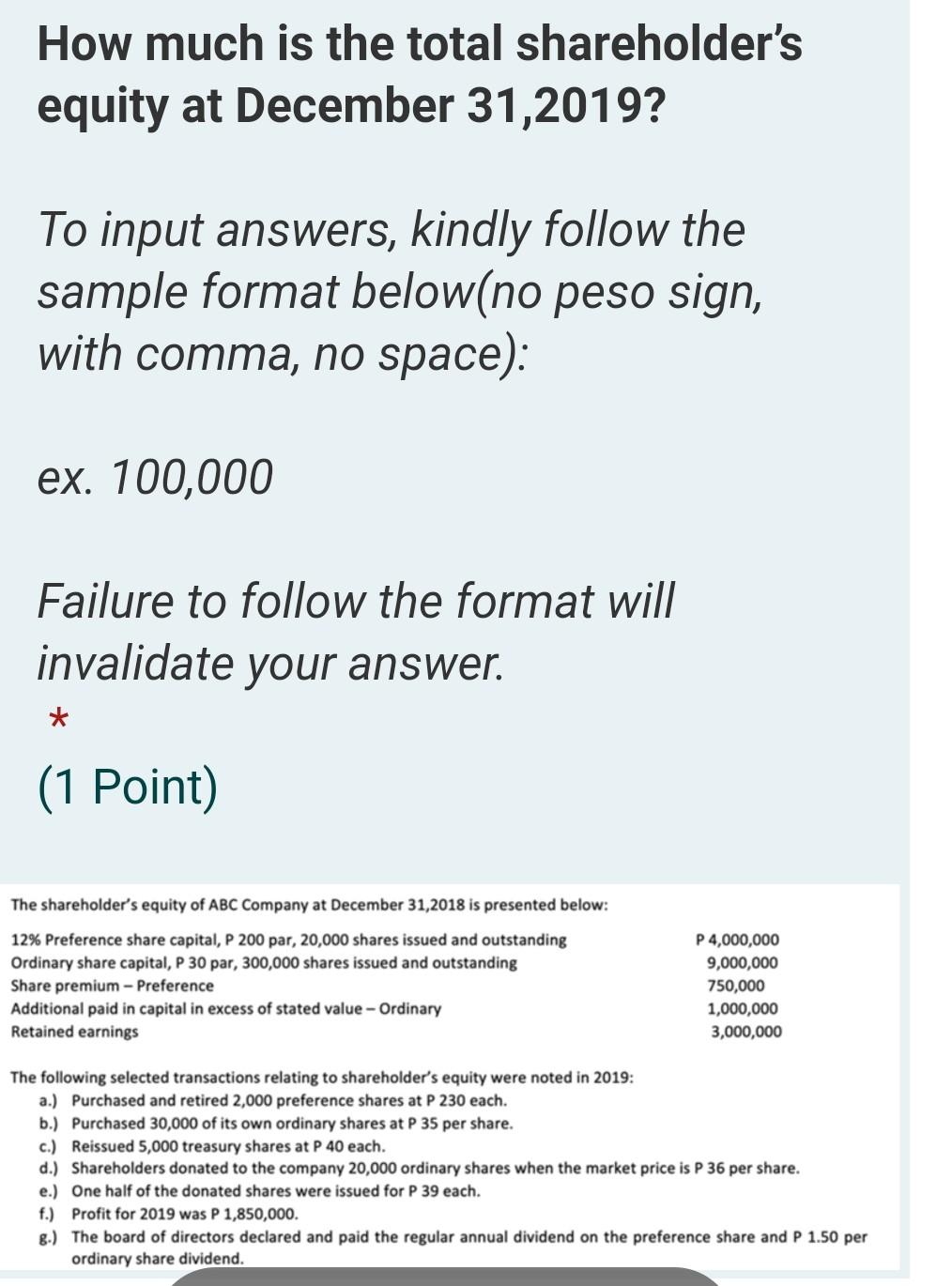

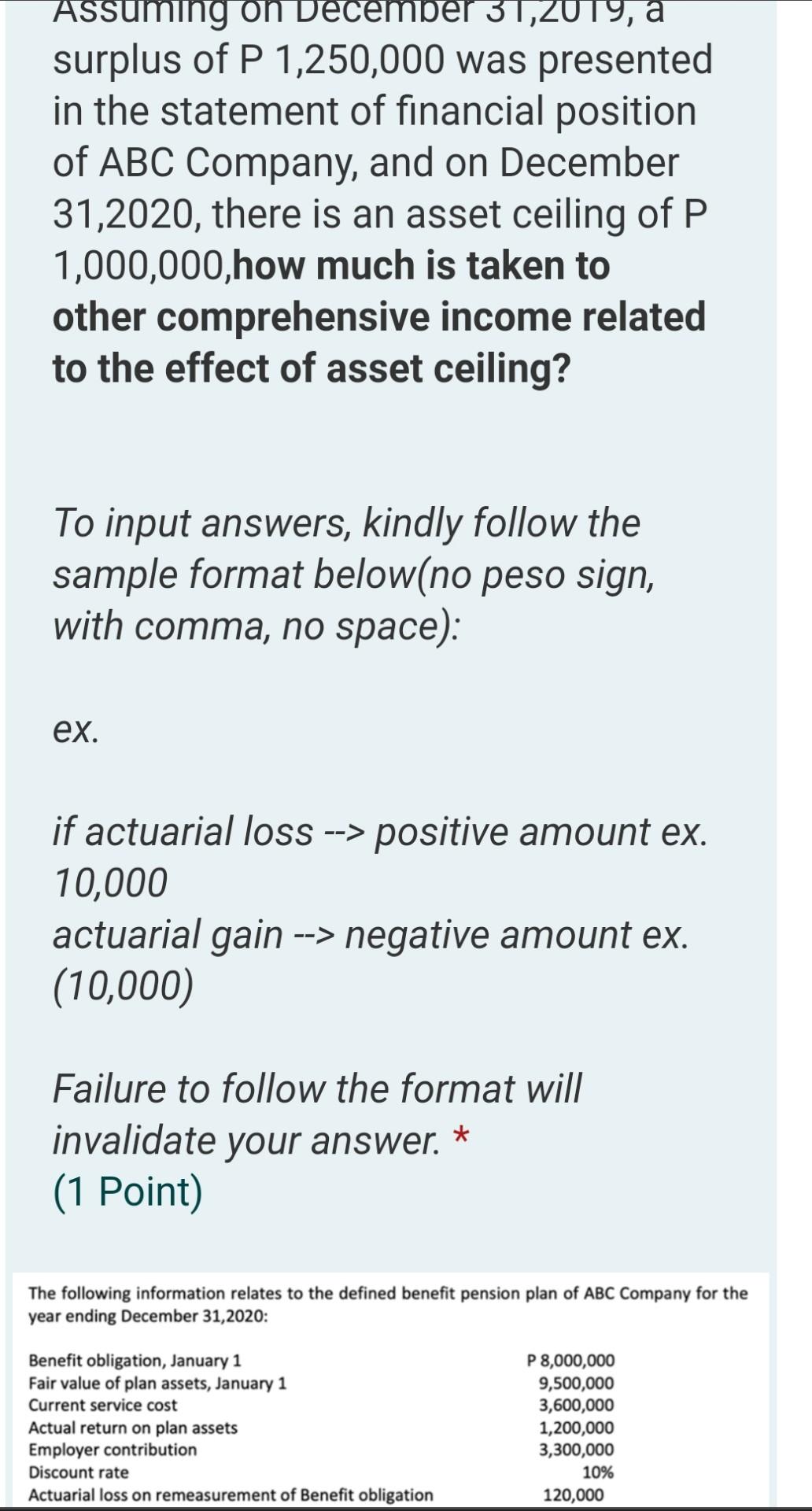

How much is the total shareholder's equity at December 31,2019? To input answers, kindly follow the sample format below(no peso sign, with comma, no space): ex. 100,000 Failure to follow the format will invalidate your answer. * (1 Point) The shareholder's equity of ABC Company at December 31,2018 is presented below: 12% Preference share capital, P 200 par, 20,000 shares issued and outstanding Ordinary share capital, P 30 par, 300,000 shares issued and outstanding Share premium - Preference Additional paid in capital in excess of stated value - Ordinary Retained earnings P 4,000,000 9,000,000 750,000 1,000,000 3,000,000 The following selected transactions relating to shareholder's equity were noted in 2019: a.) Purchased and retired 2,000 preference shares at P 230 each. b.) Purchased 30,000 of its own ordinary shares at P 35 per share. c.) Reissued 5,000 treasury shares at P 40 each. d.) Shareholders donated to the company 20,000 ordinary shares when the market price is P 36 per share. e.) One half of the donated shares were issued for P 39 each. f.) Profit for 2019 was P 1,850,000. g.) The board of directors declared and paid the regular annual dividend on the preference share and P 1.50 per ordinary share dividend. Assuming on December 31,2019, a surplus of P 1,250,000 was presented in the statement of financial position of ABC Company, and on December 31,2020, there is an asset ceiling of P 1,000,000,how much is taken to other comprehensive income related to the effect of asset ceiling? To input answers, kindly follow the sample format below(no peso sign, with comma, no space): ex. if actuarial loss --> positive amount ex. 10,000 actuarial gain --> negative amount ex. (10,000) Failure to follow the format will invalidate your answer. * (1 Point) The following information relates to the defined benefit pension plan of ABC Company for the year ending December 31,2020: Benefit obligation, January 1 Fair value of plan assets, January 1 Current service cost Actual return on plan assets Employer contribution Discount rate Actuarial loss on remeasurement of Benefit obligation P 8,000,000 9,500,000 3,600,000 1,200,000 3,300,000 10% 120,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started