Answered step by step

Verified Expert Solution

Question

1 Approved Answer

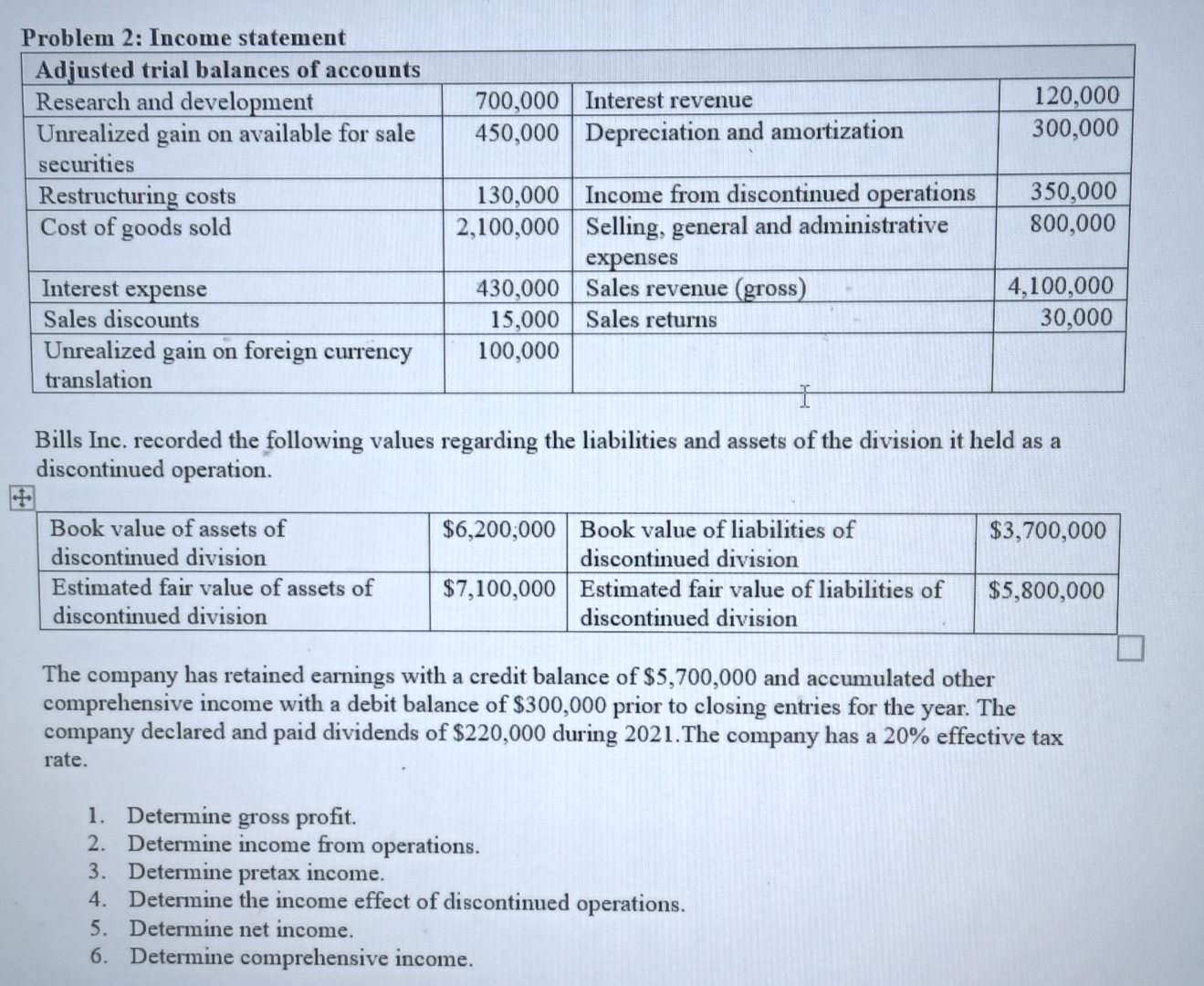

Problem 2: Income statement Adjusted trial balances of accounts Research and development Unrealized gain on available for sale securities Restructuring costs Cost of goods

Problem 2: Income statement Adjusted trial balances of accounts Research and development Unrealized gain on available for sale securities Restructuring costs Cost of goods sold 700,000 Interest revenue 120,000 450,000 Depreciation and amortization 300,000 130,000 Income from discontinued operations 350,000 2,100,000 Selling, general and administrative 800,000 expenses 430,000 Sales revenue (gross) 15,000 Sales returns 4,100,000 30,000 Interest expense Sales discounts Unrealized gain on foreign currency translation 100,000 I Bills Inc. recorded the following values regarding the liabilities and assets of the division it held as a discontinued operation. Book value of assets of discontinued division $6,200,000 Book value of liabilities of $3,700,000 discontinued division Estimated fair value of assets of discontinued division $7,100,000 Estimated fair value of liabilities of discontinued division $5,800,000 The company has retained earnings with a credit balance of $5,700,000 and accumulated other comprehensive income with a debit balance of $300,000 prior to closing entries for the year. The company declared and paid dividends of $220,000 during 2021. The company has a 20% effective tax rate. 1. Determine gross profit. 2. Determine income from operations. 3. Determine pretax income. 4. Determine the income effect of discontinued operations. 5. Determine net income. 6. Determine comprehensive income.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Gross Profit Gross Profit Sales Revenue Gross Cost of Goods Sold 4100000 2100000 2000000 2 Income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642e45e7438b_973282.pdf

180 KBs PDF File

6642e45e7438b_973282.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started