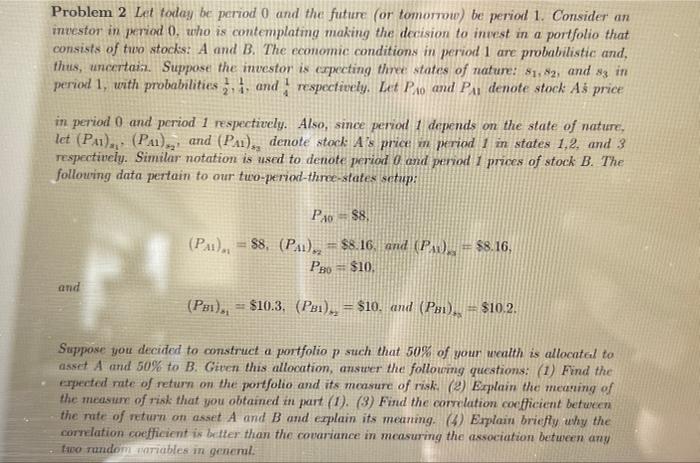

Problem 2 Let today be period 0 and the future (or tomorrow) be period 1. Consider an investor in period 0, who is contemplating making the decision to invest in a portfolio that consists of two stocks: A and B. The economic conditions in period 1 are probabilistic and, thus, uncertain. Suppose the investor is expecting three states of nature: 81, 82, and $3 in period 1, with probabilities, and respectively. Let Pro and Pa denote stock A price 11 21 in period 0 and period 1 respectively. Also, since period 1 depends on the state of nature, let (P11).,. (PA), and (PA),, denote stock A's price m period / in states 1,2, and 3 respectively. Similar notation is used to denote period 0 and period 1 prices of stock B. The following data pertain to our two-period-three-states setup: PA0 -- 88 (PAU),, = 88, (PAU)., = $8.16, and (P) = $8.16. PBP = $10. and (Pri), = $10.3. (Pol., = $10. and (Pol) == $10.2. Suppose you decided to construct a portfolio p such that 50% of your wealth is allocatel to asset A and 50% to B. Given this allocation, answer the following questions: (1) Find the erpected rate of return on the portfolio and its measure of risk. (9) Explain the meaning of the measure of risk that you obtained in part (1). (3) Find the correlation coefficient between the nite of return on asset A and B and explain its meaning. (4) Earplain briefly why the correlation coefficient is better than the covariance in measuring the association between any Tuo random variables in general. Problem 2 Let today be period 0 and the future (or tomorrow) be period 1. Consider an investor in period 0, who is contemplating making the decision to invest in a portfolio that consists of two stocks: A and B. The economic conditions in period 1 are probabilistic and, thus, uncertain. Suppose the investor is expecting three states of nature: 81, 82, and $3 in period 1, with probabilities, and respectively. Let Pro and Pa denote stock A price 11 21 in period 0 and period 1 respectively. Also, since period 1 depends on the state of nature, let (P11).,. (PA), and (PA),, denote stock A's price m period / in states 1,2, and 3 respectively. Similar notation is used to denote period 0 and period 1 prices of stock B. The following data pertain to our two-period-three-states setup: PA0 -- 88 (PAU),, = 88, (PAU)., = $8.16, and (P) = $8.16. PBP = $10. and (Pri), = $10.3. (Pol., = $10. and (Pol) == $10.2. Suppose you decided to construct a portfolio p such that 50% of your wealth is allocatel to asset A and 50% to B. Given this allocation, answer the following questions: (1) Find the erpected rate of return on the portfolio and its measure of risk. (9) Explain the meaning of the measure of risk that you obtained in part (1). (3) Find the correlation coefficient between the nite of return on asset A and B and explain its meaning. (4) Earplain briefly why the correlation coefficient is better than the covariance in measuring the association between any Tuo random variables in general