Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem #2: Manufacturing Analysis at TechGadget, Inc. TechGadget, Inc., renowned for its innovative electronic devices, operates under a standard cost system to maintain financial

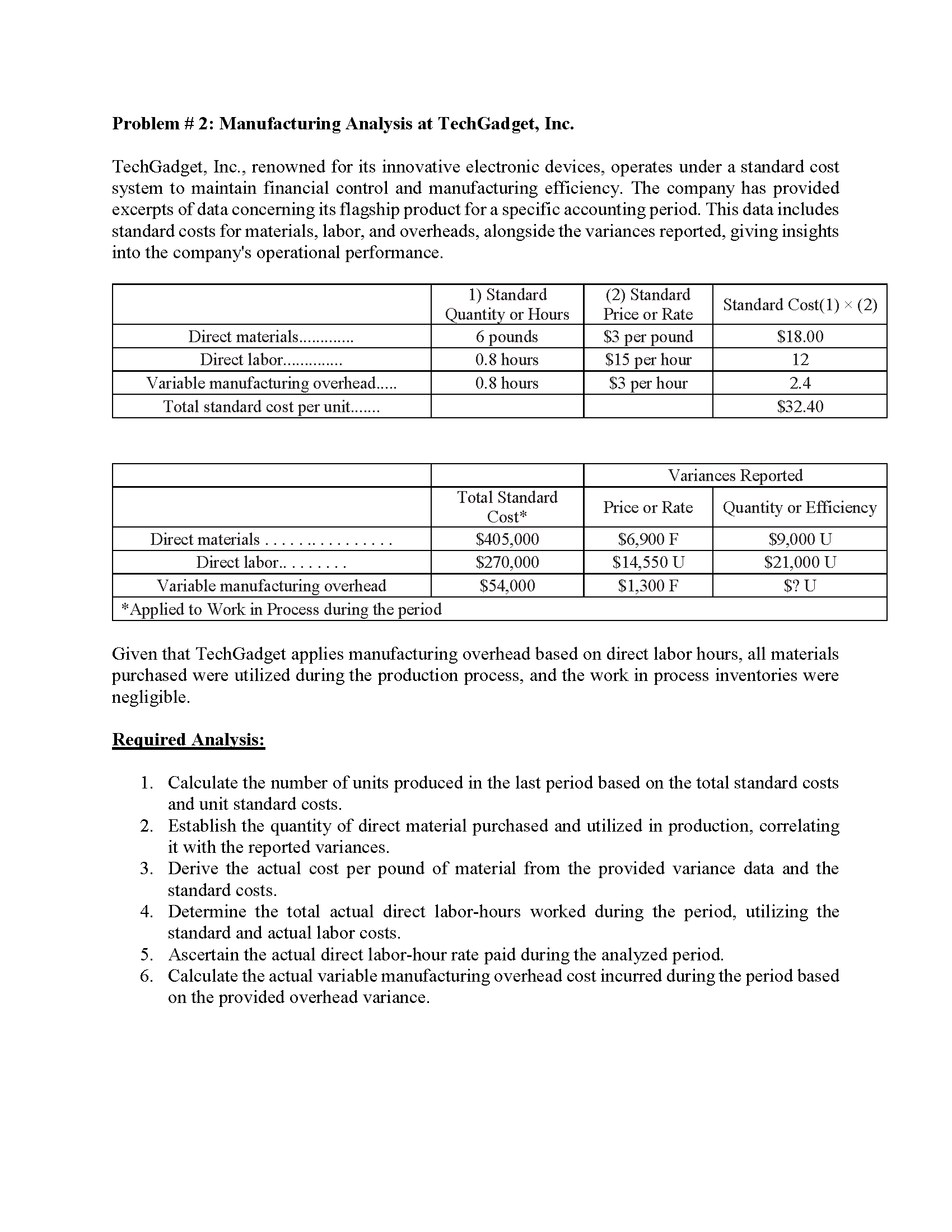

Problem #2: Manufacturing Analysis at TechGadget, Inc. TechGadget, Inc., renowned for its innovative electronic devices, operates under a standard cost system to maintain financial control and manufacturing efficiency. The company has provided excerpts of data concerning its flagship product for a specific accounting period. This data includes standard costs for materials, labor, and overheads, alongside the variances reported, giving insights into the company's operational performance. Direct materials.......... Direct labor.. Variable manufacturing overhead..... Total standard cost per unit...... 1) Standard Quantity or Hours (2) Standard Price or Rate Standard Cost(1) (2) 6 pounds $3 per pound $18.00 0.8 hours $15 per hour 12 0.8 hours $3 per hour 2.4 $32.40 Direct materials Direct labor... Variable manufacturing overhead *Applied to Work in Process during the period Variances Reported Total Standard Price or Rate Cost* Quantity or Efficiency $405,000 $6,900 F $9,000 U $270,000 $14,550 U $21,000 U $54,000 $1,300 F $? U Given that TechGadget applies manufacturing overhead based on direct labor hours, all materials purchased were utilized during the production process, and the work in process inventories were negligible. Required Analysis: 1. Calculate the number of units produced in the last period based on the total standard costs and unit standard costs. 2. Establish the quantity of direct material purchased and utilized in production, correlating it with the reported variances. 3. Derive the actual cost per pound of material from the provided variance data and the standard costs. 4. Determine the total actual direct labor-hours worked during the period, utilizing the standard and actual labor costs. 5. Ascertain the actual direct labor-hour rate paid during the analyzed period. 6. Calculate the actual variable manufacturing overhead cost incurred during the period based on the provided overhead variance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started