Answered step by step

Verified Expert Solution

Question

1 Approved Answer

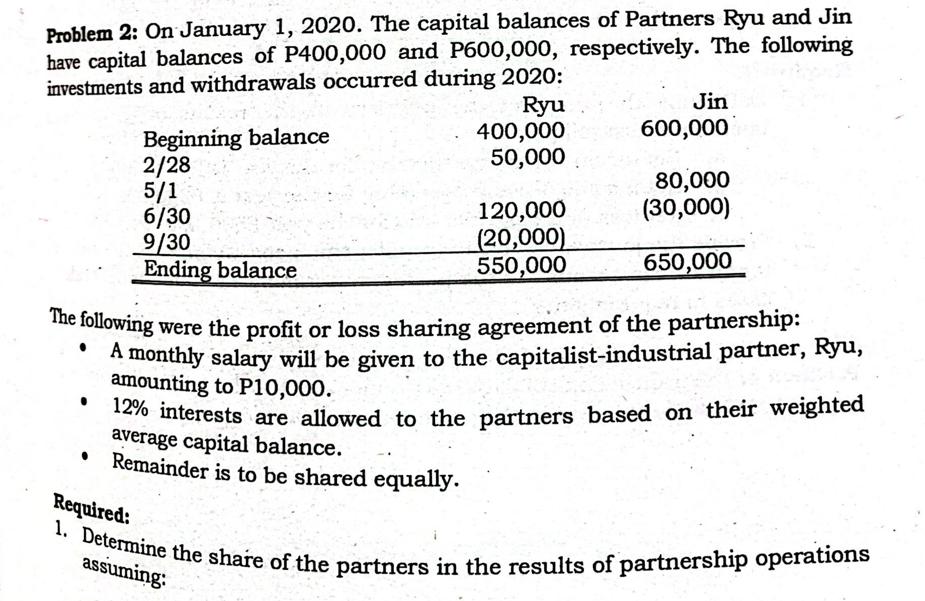

Problem 2: On January 1, 2020. The capital balances of Partners Ryu and Jin have capital balances of P400,000 and P600,000, respectively. The following

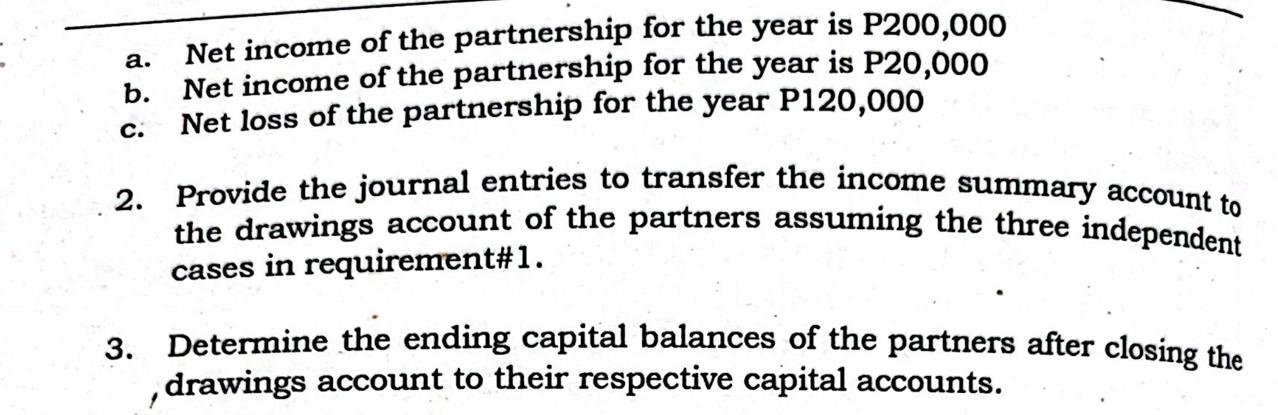

Problem 2: On January 1, 2020. The capital balances of Partners Ryu and Jin have capital balances of P400,000 and P600,000, respectively. The following investments and withdrawals occurred during 2020: Ryu Beginning balance 2/28 5/1 6/30 9/30 Ending balance 400,000 50,000 120,000 (20,000) 550,000 Jin 600,000 The following were the profit or loss sharing agreement of the partnership: A monthly salary will be given to the capitalist-industrial partner, Ryu, amounting to P10,000. 12% interests are allowed to the partners based on their weighted average capital balance. Remainder is to be shared equally. 80,000 (30,000) 650,000 Required: 1. Determine the share of the partners in the results of partnership operations assuming: a. b. C. Net income of the partnership for the year is P200,000 Net income of the partnership for the year is P20,000 Net loss of the partnership for the year P120,000 2. Provide the journal entries to transfer the income summary account to the drawings account of the partners assuming the three independent cases in requirement#1. 3. Determine the ending capital balances of the partners after closing the ,drawings account to their respective capital accounts.

Step by Step Solution

★★★★★

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Here are the solutions to the three parts of the problem 1 Share of partners in results of operation...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started