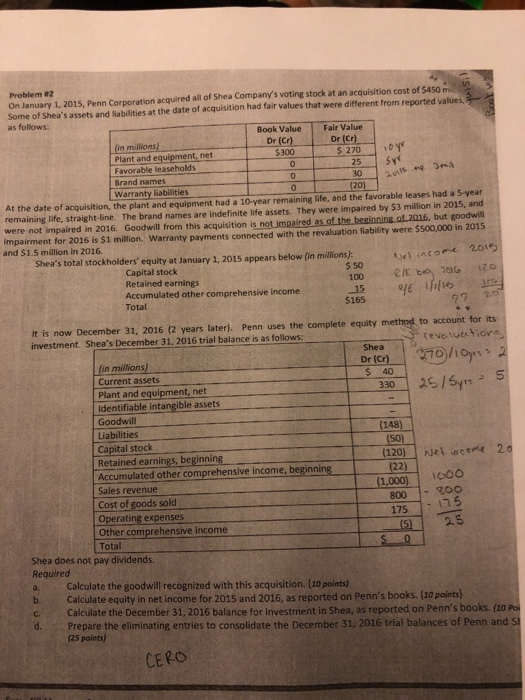

Problem #2 On lanuary 1, 2015, Penn Corporation acquired all of Shea Company's voting stock at an acquisition cost of $450 Some of Shea's assets and liabilities at the date of acquisition had fair values that were different from reported values. as follows: Book Value Fair Value Dr 270y 25 SY $300 Plant and equipment, net Favorable leaseholds Brand names LWarranty lEabilities At the date of acquisition, the plant and equipment had a 10-year remaining life, and the favorable leases had a 5-year remaining life, straight-line. The brand names are indefinite life assets. They were impaired by $3 milion in 2015, and were not impaired in 2016. Goodwill from this acquisition is not impaired as of the beginning ol 2016, but goodwill impairment for 2016 is $1 million, Warranty payments connected with the revaluation fiability were $500,000 in 2015 and $1.5 million in 2016 Shea's total stockholders' equity at January 1, 2015 appears below (in millions) Capital stock Retained earnings Accumulated other comprehensive income 5 so Total It is now December 31, 2016 (2 years later). Penn uses the complete equity investment. Shea's December 31, 2016 trial balance is as follows: to account for its Shea fin milions 40 330 Current assets Plant and equipment, net dentifiable intangible assets Goodwill Liabilities Capital stock Retained earnings, beginning Accumulated other comprehensive income, beginning Sales revenue Cost of goods sold (148) (50) 800200 175 175 Other comprehensive income Total Shea does not pay dividends. Required b. Calculate equity in net income for 2015 and 2016, as reported on Penn's books. (10 points) d. Prepare the eliminating entries to consolidate the December 31, 2016 trial balances of Penn and s Calculate the goodwill recognized with this acquisition. (10 points) Calculate the December 31, 2016 balance for Investment in Shea, as reported on Penn's books. (10 Po (25 points) CERO Problem #2 On lanuary 1, 2015, Penn Corporation acquired all of Shea Company's voting stock at an acquisition cost of $450 Some of Shea's assets and liabilities at the date of acquisition had fair values that were different from reported values. as follows: Book Value Fair Value Dr 270y 25 SY $300 Plant and equipment, net Favorable leaseholds Brand names LWarranty lEabilities At the date of acquisition, the plant and equipment had a 10-year remaining life, and the favorable leases had a 5-year remaining life, straight-line. The brand names are indefinite life assets. They were impaired by $3 milion in 2015, and were not impaired in 2016. Goodwill from this acquisition is not impaired as of the beginning ol 2016, but goodwill impairment for 2016 is $1 million, Warranty payments connected with the revaluation fiability were $500,000 in 2015 and $1.5 million in 2016 Shea's total stockholders' equity at January 1, 2015 appears below (in millions) Capital stock Retained earnings Accumulated other comprehensive income 5 so Total It is now December 31, 2016 (2 years later). Penn uses the complete equity investment. Shea's December 31, 2016 trial balance is as follows: to account for its Shea fin milions 40 330 Current assets Plant and equipment, net dentifiable intangible assets Goodwill Liabilities Capital stock Retained earnings, beginning Accumulated other comprehensive income, beginning Sales revenue Cost of goods sold (148) (50) 800200 175 175 Other comprehensive income Total Shea does not pay dividends. Required b. Calculate equity in net income for 2015 and 2016, as reported on Penn's books. (10 points) d. Prepare the eliminating entries to consolidate the December 31, 2016 trial balances of Penn and s Calculate the goodwill recognized with this acquisition. (10 points) Calculate the December 31, 2016 balance for Investment in Shea, as reported on Penn's books. (10 Po (25 points) CERO