Answered step by step

Verified Expert Solution

Question

1 Approved Answer

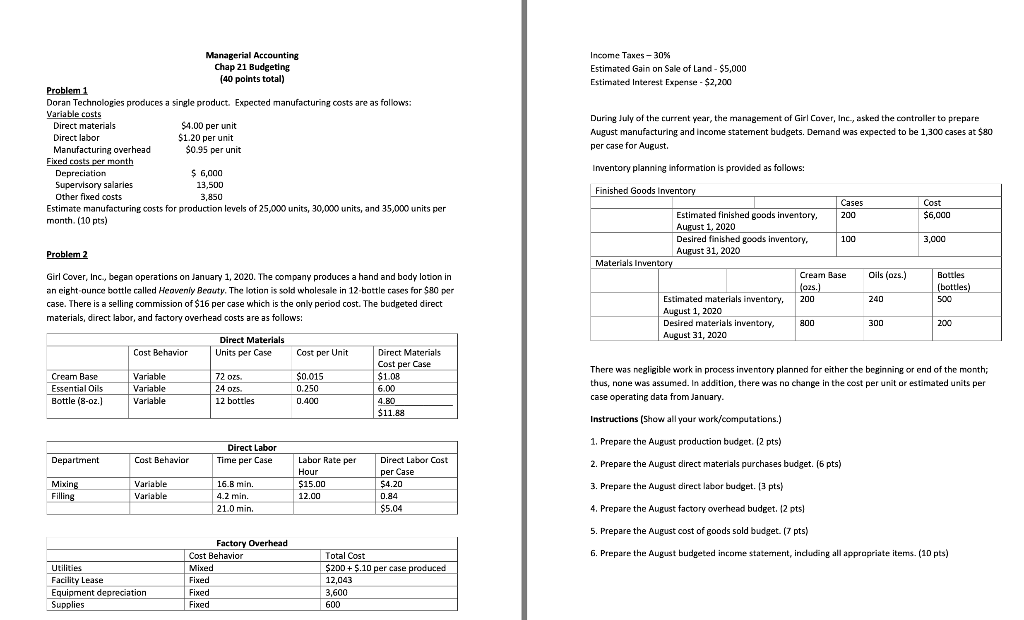

Problem 2 Only Please! Thanks!! Income Taxes -30% Estimated Gain on Sale of Land - $5,000 Estimated Interest Expense - $2,200 Managerial Accounting Chap 21

Problem 2 Only Please! Thanks!!

Income Taxes -30% Estimated Gain on Sale of Land - $5,000 Estimated Interest Expense - $2,200 Managerial Accounting Chap 21 Budgeting (40 points total) Problem 1 Doran Technologies produces a single product. Expected manufacturing costs are as follows: Variable costs Direct materials $4.00 per unit Direct labor $1.20 per unit Manufacturing overhead $0.95 per unit Fixed costs per month Depreciation $ 6,000 Supervisory salaries 13,500 Other fixed costs 3,850 Estimate manufacturing costs for production levels of 25,000 units, 30,000 units, and 35,000 units per month. (10 pts) During July of the current year, the management of Girl Cover, Inc., asked the controller to prepare August manufacturing and income statement budgets. Demand was expected to be 1,300 cases at 580 per case for August Inventory planning information is provided as follows: Cost $6,000 3,000 Problem 2 Finished Goods Inventory Cases Estimated finished goods inventory. 200 August 1, 2020 Desired finished goods Inventory. 100 August 31, 2020 Materials Inventory Cream Base Oils (ozs.) fo2s.) Estimated materials inventory. 200 August 1, 2020 Desired materials inventory 300 August 31, 2020 Girl Cover, Inc, began operations on January 1, 2020. The company produces a hand and body lotion in an eight ounce bottle called Heavenly Beauty, The lotion is sold wholesale in 12 bottle cases for $80 per case. There is a selling commission of $16 per case which is the only period cost. The budgeted direct materials, direct labor, and factory overhead costs are as follows: Bottles (bottles) 500 240 800 200 Cost Behavior Direct Materials Units per Case Cost per Unit Cream Base Essential Oils Bottle (8-oz.) Variable Variable Variable 72 oz. 24 ors. 12 bottles $0,015 0.250 0.400 Direct Materials Cost per Case $1.00 6.00 4.80 $11.88 There was negligible work in process inventory planned for either the beginning or end of the month; thus, none was assumed. In addition, there was no change in the cost per unit or estimated units per case operating data from January Instructions (Show all your work/computations.) 1. Prepare the August production budget (2 pts) Direct Labor Time per Case Department Cost Behavior 2. Prepare the August direct materials purchases budget. (6 pts) Labor Rate per Hour $15.00 12.00 Mixing Filling Variable Variable Direct Labor Cost per Case $4.20 0.84 $5.04 16 8 min. 42 min. 21 0 min. 3. Prepare the August direct labor budget. (3 pts) 4. Prepare the August factory overhead budget. 12 pts 5. Prepare the August cost of goods sold budget. (7 pts) 6. Prepare the August budgeted income statement, including all appropriate items. (10 pts) Utilities Facility Lease Equipment depreciation Supplies Factory Overhead Cost Behavior Mixed Flued Fred Fixed Total Cost $200 +5.10 per case produced 12,043 3,600 600 Income Taxes -30% Estimated Gain on Sale of Land - $5,000 Estimated Interest Expense - $2,200 Managerial Accounting Chap 21 Budgeting (40 points total) Problem 1 Doran Technologies produces a single product. Expected manufacturing costs are as follows: Variable costs Direct materials $4.00 per unit Direct labor $1.20 per unit Manufacturing overhead $0.95 per unit Fixed costs per month Depreciation $ 6,000 Supervisory salaries 13,500 Other fixed costs 3,850 Estimate manufacturing costs for production levels of 25,000 units, 30,000 units, and 35,000 units per month. (10 pts) During July of the current year, the management of Girl Cover, Inc., asked the controller to prepare August manufacturing and income statement budgets. Demand was expected to be 1,300 cases at 580 per case for August Inventory planning information is provided as follows: Cost $6,000 3,000 Problem 2 Finished Goods Inventory Cases Estimated finished goods inventory. 200 August 1, 2020 Desired finished goods Inventory. 100 August 31, 2020 Materials Inventory Cream Base Oils (ozs.) fo2s.) Estimated materials inventory. 200 August 1, 2020 Desired materials inventory 300 August 31, 2020 Girl Cover, Inc, began operations on January 1, 2020. The company produces a hand and body lotion in an eight ounce bottle called Heavenly Beauty, The lotion is sold wholesale in 12 bottle cases for $80 per case. There is a selling commission of $16 per case which is the only period cost. The budgeted direct materials, direct labor, and factory overhead costs are as follows: Bottles (bottles) 500 240 800 200 Cost Behavior Direct Materials Units per Case Cost per Unit Cream Base Essential Oils Bottle (8-oz.) Variable Variable Variable 72 oz. 24 ors. 12 bottles $0,015 0.250 0.400 Direct Materials Cost per Case $1.00 6.00 4.80 $11.88 There was negligible work in process inventory planned for either the beginning or end of the month; thus, none was assumed. In addition, there was no change in the cost per unit or estimated units per case operating data from January Instructions (Show all your work/computations.) 1. Prepare the August production budget (2 pts) Direct Labor Time per Case Department Cost Behavior 2. Prepare the August direct materials purchases budget. (6 pts) Labor Rate per Hour $15.00 12.00 Mixing Filling Variable Variable Direct Labor Cost per Case $4.20 0.84 $5.04 16 8 min. 42 min. 21 0 min. 3. Prepare the August direct labor budget. (3 pts) 4. Prepare the August factory overhead budget. 12 pts 5. Prepare the August cost of goods sold budget. (7 pts) 6. Prepare the August budgeted income statement, including all appropriate items. (10 pts) Utilities Facility Lease Equipment depreciation Supplies Factory Overhead Cost Behavior Mixed Flued Fred Fixed Total Cost $200 +5.10 per case produced 12,043 3,600 600Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started