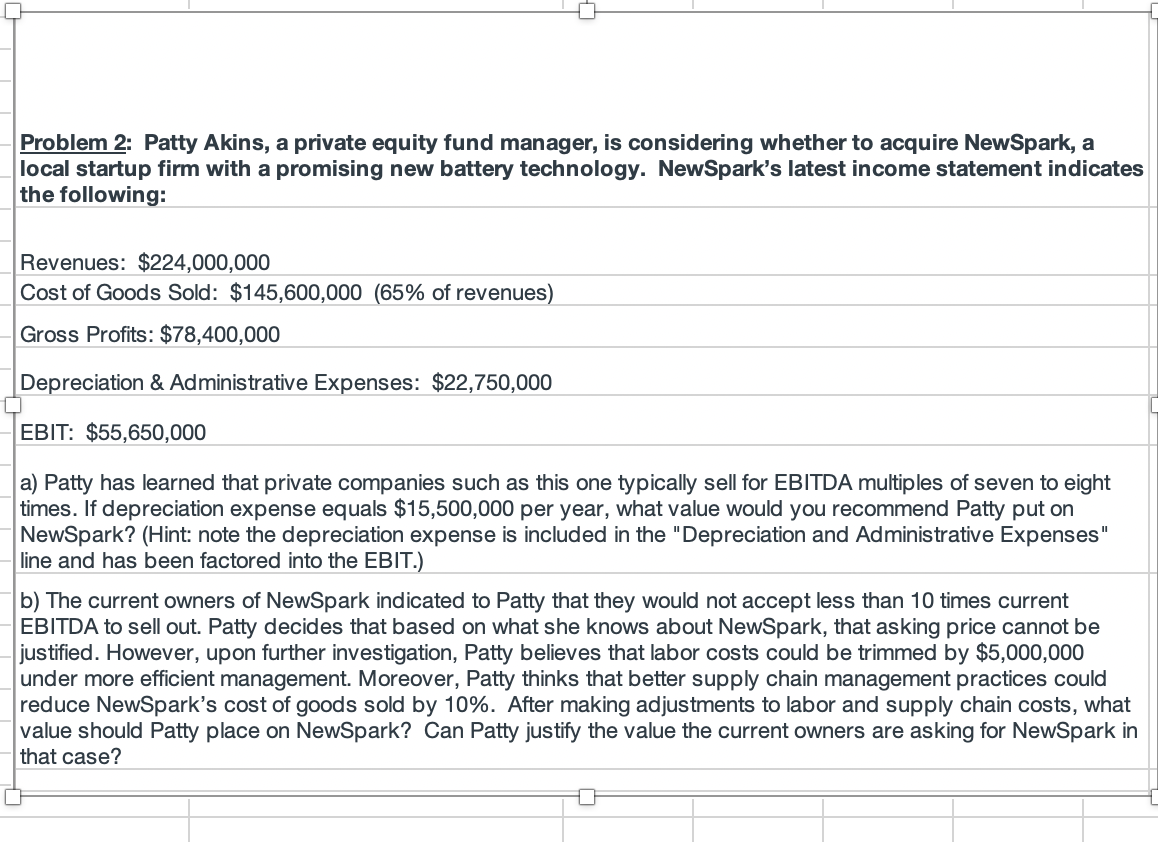

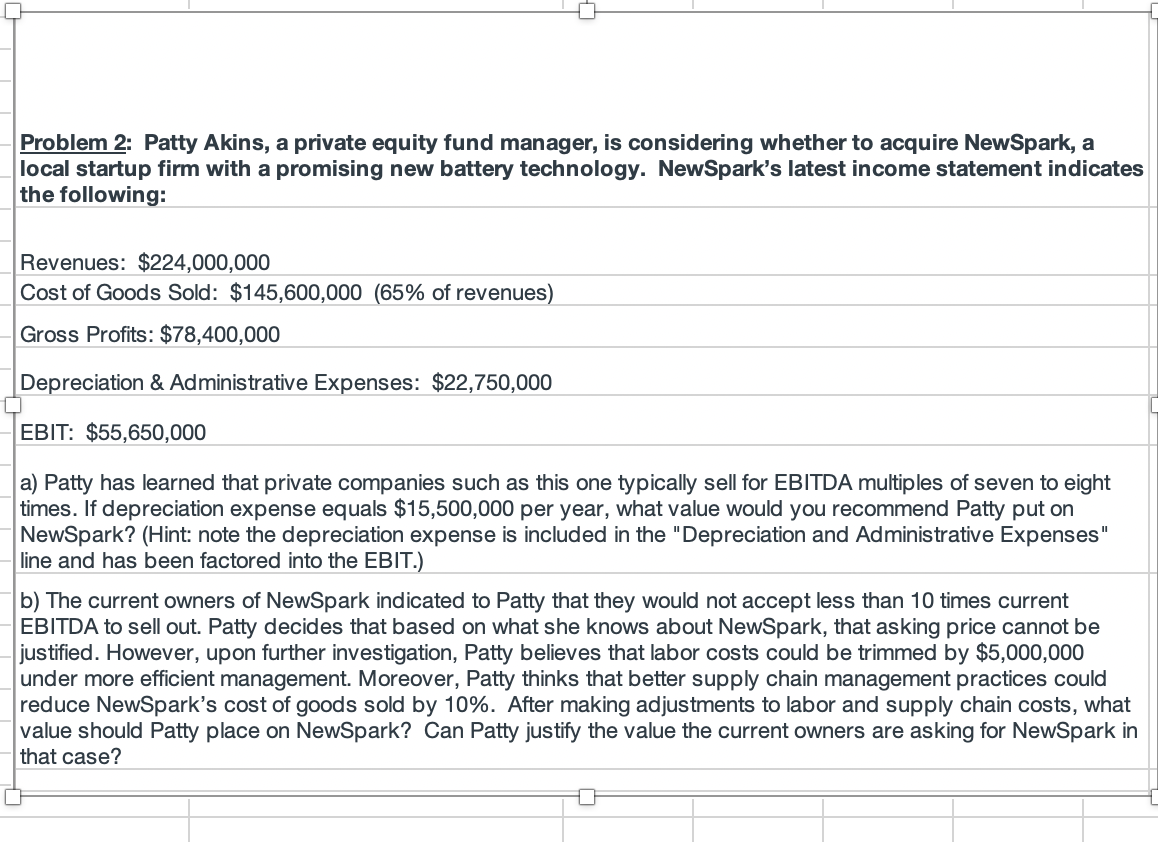

Problem 2: Patty Akins, a private equity fund manager, is considering whether to acquire NewSpark, a local startup firm with a promising new battery technology. NewSpark's latest income statement indicates the following: Revenues: $224,000,000 Cost of Goods Sold: $145,600,000 (65% of revenues) Gross Profits: $78,400,000 Depreciation & Administrative Expenses: $22,750,000 EBIT: $55,650,000 a) Patty has learned that private companies such as this one typically sell for EBITDA multiples of seven to eight times. If depreciation expense equals $15,500,000 per year, what value would you recommend Patty put on NewSpark? (Hint: note the depreciation expense is included in the "Depreciation and Administrative Expenses" line and has been factored into the EBIT.) b) The current owners of NewSpark indicated to Patty that they would not accept less than 10 times current EBITDA to sell out. Patty decides that based on what she knows about NewSpark, that asking price cannot be justified. However, upon further investigation, Patty believes that labor costs could be trimmed by $5,000,000 under more efficient management. Moreover, Patty thinks that better supply chain management practices could reduce NewSpark's cost of goods sold by 10%. After making adjustments to labor and supply chain costs, what value should Patty place on NewSpark? Can Patty justify the value the current owners are asking for NewSpark in that case? Problem 2: Patty Akins, a private equity fund manager, is considering whether to acquire NewSpark, a local startup firm with a promising new battery technology. NewSpark's latest income statement indicates the following: Revenues: $224,000,000 Cost of Goods Sold: $145,600,000 (65% of revenues) Gross Profits: $78,400,000 Depreciation & Administrative Expenses: $22,750,000 EBIT: $55,650,000 a) Patty has learned that private companies such as this one typically sell for EBITDA multiples of seven to eight times. If depreciation expense equals $15,500,000 per year, what value would you recommend Patty put on NewSpark? (Hint: note the depreciation expense is included in the "Depreciation and Administrative Expenses" line and has been factored into the EBIT.) b) The current owners of NewSpark indicated to Patty that they would not accept less than 10 times current EBITDA to sell out. Patty decides that based on what she knows about NewSpark, that asking price cannot be justified. However, upon further investigation, Patty believes that labor costs could be trimmed by $5,000,000 under more efficient management. Moreover, Patty thinks that better supply chain management practices could reduce NewSpark's cost of goods sold by 10%. After making adjustments to labor and supply chain costs, what value should Patty place on NewSpark? Can Patty justify the value the current owners are asking for NewSpark in that case