Answered step by step

Verified Expert Solution

Question

1 Approved Answer

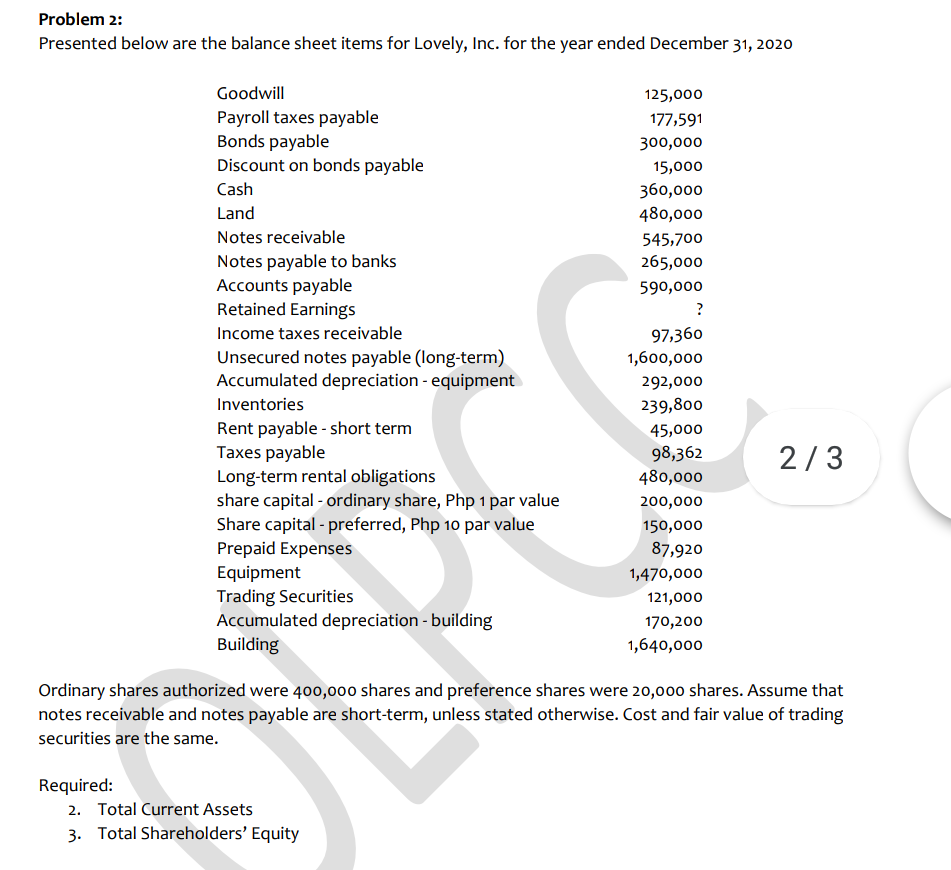

Problem 2: Presented below are the balance sheet items for Lovely, Inc. for the year ended December 31, 2020 Goodwill Payroll taxes payable Bonds payable

Problem 2: Presented below are the balance sheet items for Lovely, Inc. for the year ended December 31, 2020 Goodwill Payroll taxes payable Bonds payable Discount on bonds payable Cash Land Notes receivable Notes payable to banks Accounts payable Retained Earnings Income taxes receivable Unsecured notes payable (long-term) Accumulated depreciation - equipment Inventories Rent payable - short term Taxes payable Long-term rental obligations share capital - ordinary share, Php 1 par value Share capital - preferred, Php 10 par value Prepaid Expenses Equipment Trading Securities Accumulated depreciation - building Building 125,000 177,591 300,000 15,000 360,000 480,000 545,700 265,000 590,000 ? 97,360 1,600,000 292,000 239,800 45,000 98,362 480,000 200,000 150,000 87,920 1,470,000 121,000 170,200 1,640,000 2/3 Ordinary shares authorized were 400,000 shares and preference shares were 20,000 shares. Assume that notes receivable and notes payable are short-term, unless stated otherwise. Cost and fair value of trading securities are the same. Required: 2. Total Current Assets 3. Total Shareholders' Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started