PROBLEM 2

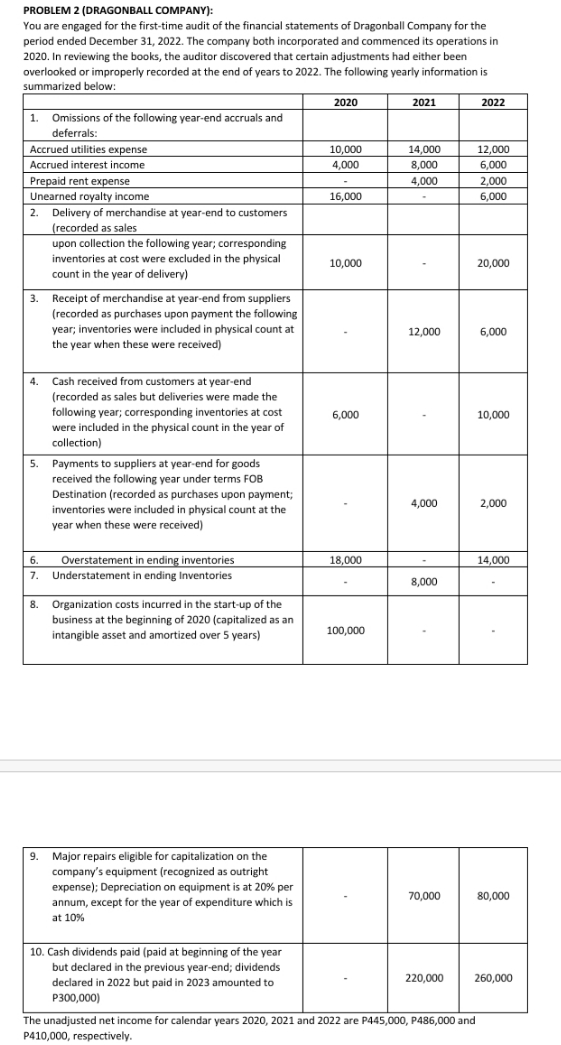

PROBLEM 2 (DRAGONBALL COMPANY): You are engaged for the first-time audit of the financial statements of Dragonball Company for the period ended December 31, 2022. The company both incorporated and commenced its operations in 2020. In reviewing the books, the auditor discovered that certain adjustments had either been overlooked or improperly recorded at the end of years to 2022. The following yearly information is summarized below: 2020 2021 2022 1. Omissions of the following year-end accruals and deferrals: Accrued utilities expense 10,000 14,000 12,000 Accrued interest income 4.000 8,000 6,000 Prepaid rent expense 4,000 2,000 Unearned royalty income 16,000 6,000 2. Delivery of merchandise at year-end to customers (recorded as sales upon collection the following year; corresponding inventories at cost were excluded in the physical 10,000 20,000 count in the year of delivery) 3. Receipt of merchandise at year-end from suppliers (recorded as purchases upon payment the following year; inventories were included in physical count at 12,000 6,000 the year when these were received) 4. Cash received from customers at year-end (recorded as sales but deliveries were made the following year; corresponding inventories at cost 6,000 10,000 were included in the physical count in the year of collection) 5. Payments to suppliers at year-end for goods received the following year under terms FOB Destination (recorded as purchases upon payment; inventories were included in physical count at the 4,000 2,000 year when these were received) 6. Overstatement in ending inventories 18,000 14,000 7. Understatement in ending Inventories 8,000 8. Organization costs incurred in the start-up of the business at the beginning of 2020 (capitalized as an intangible asset and amortized over 5 years) 100,000 9. Major repairs eligible for capitalization on the company's equipment (recognized as outright expense); Depreciation on equipment is at 20% per annum, except for the year of expenditure which is 70,000 80,000 at 10% 10. Cash dividends paid (paid at beginning of the year but declared in the previous year-end; dividends declared in 2022 but paid in 2023 amounted to 220,000 260,000 P300,000) The unadjusted net income for calendar years 2020, 2021 and 2022 are P445,000, P486,000 and P410,000, respectively