Answered step by step

Verified Expert Solution

Question

1 Approved Answer

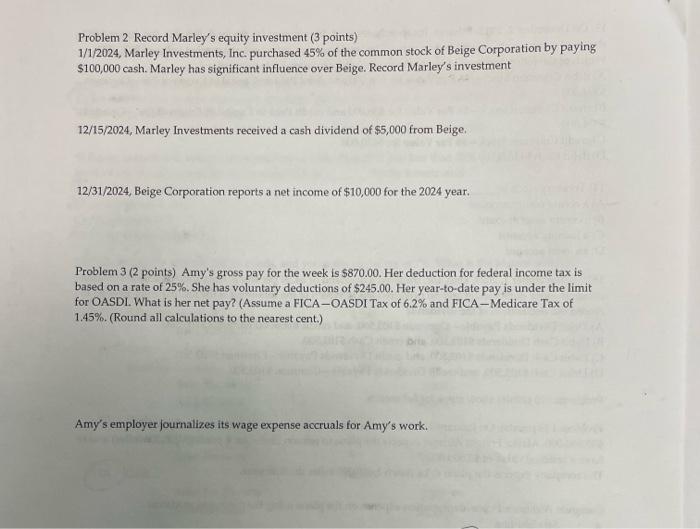

Problem 2 Record Marley's equity investment (3 points) 1/1/2024, Marley Investments, Inc. purchased 45% of the common stock of Beige Corporation by paying $100,000 cash.

Problem 2 Record Marley's equity investment (3 points) 1/1/2024, Marley Investments, Inc. purchased 45% of the common stock of Beige Corporation by paying $100,000 cash. Marley has significant influence over Beige. Record Marley's investment 12/15/2024, Marley Investments received a cash dividend of $5,000 from Beige. 12/31/2024, Beige Corporation reports a net income of $10,000 for the 2024 year. Problem 3 (2 points) Amy's gross pay for the week is $870.00. Her deduction for federal income tax is based on a rate of 25%. She has voluntary deductions of $245.00. Her year-to-date pay is under the limit for OASDI. What is her net pay? (Assume a FICA-OASDI Tax of 6.2% and FICA-Medicare Tax of 1.45%. (Round all calculations to the nearest cent.) D 062 bris Amy's employer journalizes its wage expense accruals for Amy's work. Ie sugare)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started